Attorney-Approved Vehicle Repayment Agreement Form

Form Preview Example

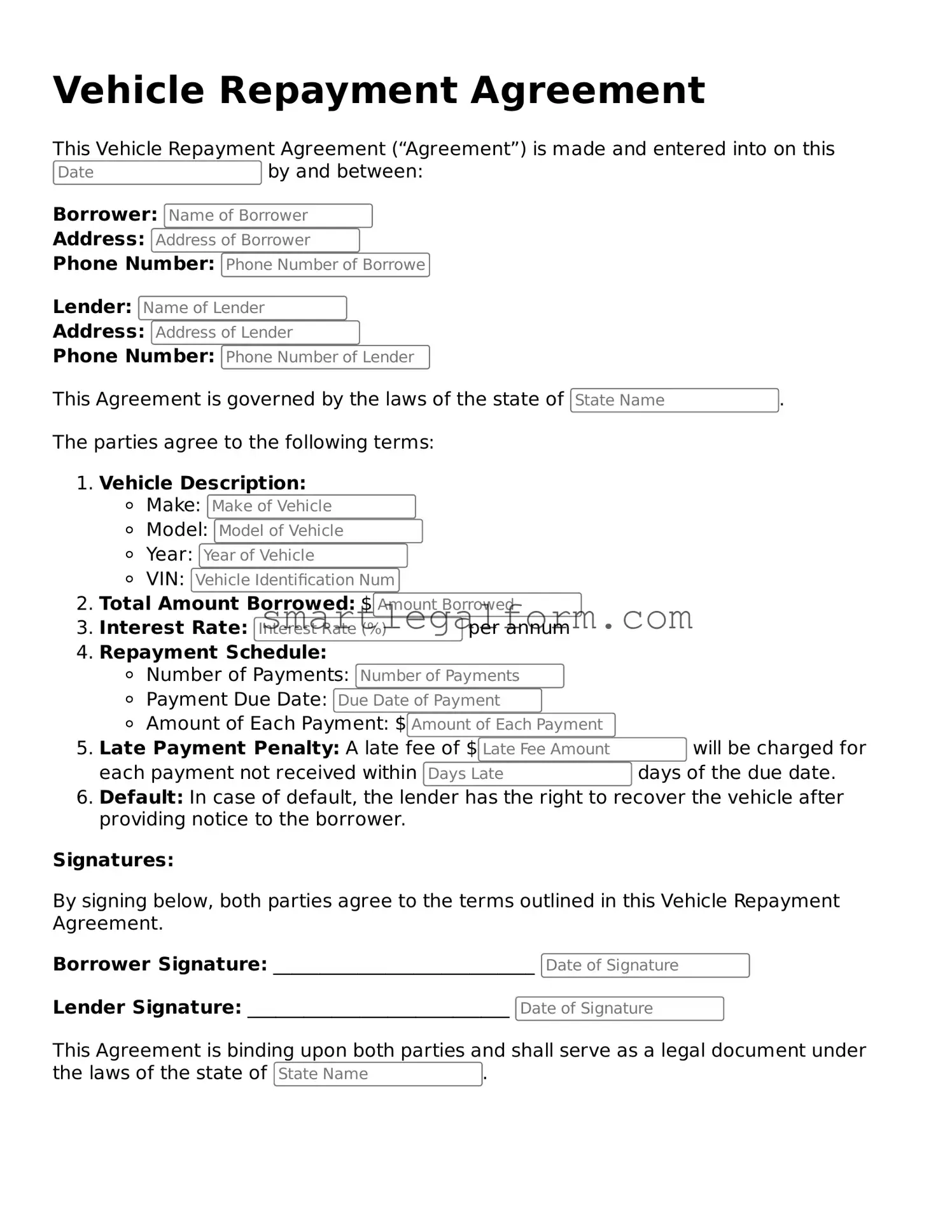

Vehicle Repayment Agreement

This Vehicle Repayment Agreement (“Agreement”) is made and entered into on this by and between:

Borrower:

Address:

Phone Number:

Lender:

Address:

Phone Number:

This Agreement is governed by the laws of the state of .

The parties agree to the following terms:

- Vehicle Description:

- Make:

- Model:

- Year:

- VIN:

- Total Amount Borrowed: $

- Interest Rate: per annum

- Repayment Schedule:

- Number of Payments:

- Payment Due Date:

- Amount of Each Payment: $

- Late Payment Penalty: A late fee of $ will be charged for each payment not received within days of the due date.

- Default: In case of default, the lender has the right to recover the vehicle after providing notice to the borrower.

Signatures:

By signing below, both parties agree to the terms outlined in this Vehicle Repayment Agreement.

Borrower Signature: ____________________________

Lender Signature: ____________________________

This Agreement is binding upon both parties and shall serve as a legal document under the laws of the state of .

Common mistakes

Completing a Vehicle Repayment Agreement form is an important step for individuals seeking to manage their vehicle loans responsibly. However, several common mistakes can lead to complications in the repayment process. Understanding these pitfalls can help ensure that the form is filled out accurately and completely.

One frequent error occurs when individuals fail to provide accurate personal information. This includes not only their name and address but also their contact details. Incomplete or incorrect information can delay communication and potentially lead to misunderstandings regarding the terms of the agreement.

Another mistake often made is neglecting to read the entire form before signing. Some individuals may rush through the process, overlooking crucial sections that outline the repayment terms. This can result in confusion later on, particularly if the borrower is unaware of specific obligations or deadlines.

Additionally, people sometimes forget to include necessary documentation. Supporting documents, such as proof of income or insurance information, are essential for validating the agreement. Omitting these can lead to delays in processing and may even result in the rejection of the application.

It is also common for individuals to miscalculate their monthly payments. When filling out the form, borrowers must ensure that they accurately reflect their financial situation. An incorrect payment amount can lead to missed payments, which can adversely affect credit scores and result in additional fees.

Lastly, some individuals may not fully understand the consequences of defaulting on the loan. This lack of awareness can lead to poor decision-making later. It is crucial to comprehend the potential repercussions, such as repossession of the vehicle or legal action, to make informed choices about repayment.

By being mindful of these common mistakes, individuals can better navigate the Vehicle Repayment Agreement process and establish a more positive relationship with their lender. Taking the time to ensure accuracy and understanding can significantly impact the overall experience of managing vehicle loans.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it's important to approach the process carefully. Here are some essential dos and don’ts to keep in mind:

- Do read the entire form before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all entries for errors before submitting.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use nicknames or abbreviations for names and addresses.

- Don't rush through the form; take your time to ensure accuracy.

- Don't forget to include any supporting documents if required.

- Don't submit the form without reviewing the terms and conditions.

Common Templates:

Consolation Bracket - The structure fosters an environment for teams to showcase their skills.

Ca Acknowledgement Form - This form helps to prevent fraud in the signing of important documents.

For businesses in Arizona, understanding the importance of a strategic Non-compete Agreement is vital to safeguarding proprietary information against potential competitors.

How to Write a Bill of Sale for Atv - The perfect solution for individual sellers looking to sell their ATV.

Similar forms

The Vehicle Repayment Agreement form shares similarities with several other documents in the realm of financial agreements and contracts. Here are ten documents that resemble it:

- Loan Agreement: This document outlines the terms of a loan, including the repayment schedule and interest rates, similar to how a Vehicle Repayment Agreement details payment terms for a vehicle loan.

- Lease Agreement: A lease agreement for a vehicle specifies the terms of leasing, including payments and responsibilities, much like a repayment agreement for a financed vehicle.

- Promissory Note: A promissory note is a written promise to pay a specific amount, which aligns with the commitment to repay outlined in the Vehicle Repayment Agreement.

- Power of Attorney: A crucial legal document that allows an individual to appoint someone else to make vital decisions on their behalf, ensuring that their affairs are managed according to their wishes. For more information, visit TopTemplates.info.

- Installment Sale Agreement: This document outlines the terms of purchasing an item in installments, akin to how a Vehicle Repayment Agreement functions for vehicle purchases.

- Security Agreement: A security agreement provides collateral for a loan, similar to how a vehicle may serve as collateral in a repayment agreement.

- Retail Installment Contract: This contract details the terms of a retail installment sale, closely mirroring the structure of a Vehicle Repayment Agreement.

- Credit Agreement: A credit agreement outlines the terms of credit extended to a borrower, reflecting the financial obligations found in a Vehicle Repayment Agreement.

- Debt Settlement Agreement: This document outlines terms for settling a debt, similar in purpose to negotiating repayment terms in a Vehicle Repayment Agreement.

- Personal Loan Agreement: This agreement specifies the terms for personal loans, much like the Vehicle Repayment Agreement does for vehicle loans.

- Mortgage Agreement: A mortgage agreement details the terms of borrowing for real estate, sharing similarities with the repayment terms found in vehicle financing agreements.