Attorney-Approved Transfer-on-Death Deed Form

Transfer-on-Death Deed for Particular US States

Form Preview Example

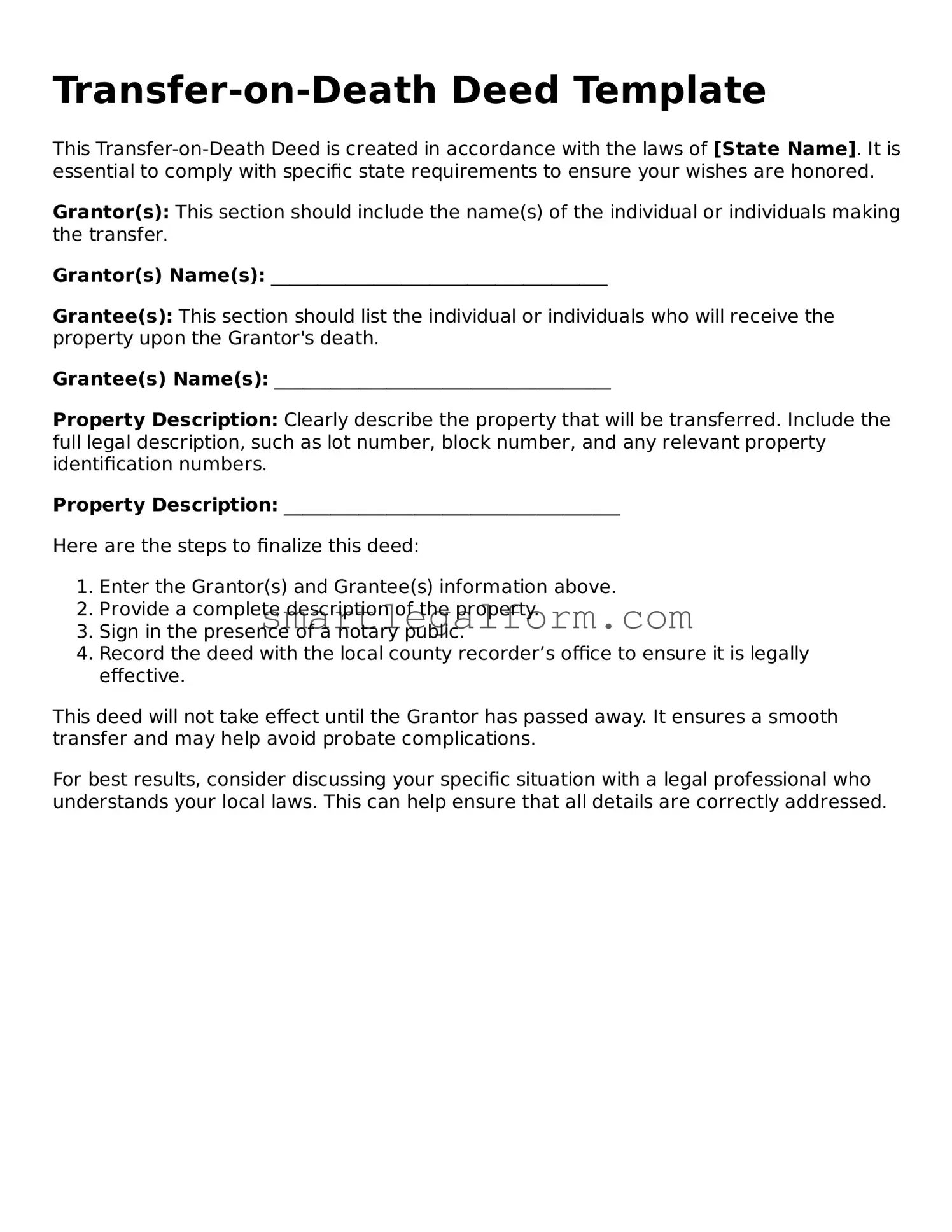

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of [State Name]. It is essential to comply with specific state requirements to ensure your wishes are honored.

Grantor(s): This section should include the name(s) of the individual or individuals making the transfer.

Grantor(s) Name(s): ____________________________________

Grantee(s): This section should list the individual or individuals who will receive the property upon the Grantor's death.

Grantee(s) Name(s): ____________________________________

Property Description: Clearly describe the property that will be transferred. Include the full legal description, such as lot number, block number, and any relevant property identification numbers.

Property Description: ____________________________________

Here are the steps to finalize this deed:

- Enter the Grantor(s) and Grantee(s) information above.

- Provide a complete description of the property.

- Sign in the presence of a notary public.

- Record the deed with the local county recorder’s office to ensure it is legally effective.

This deed will not take effect until the Grantor has passed away. It ensures a smooth transfer and may help avoid probate complications.

For best results, consider discussing your specific situation with a legal professional who understands your local laws. This can help ensure that all details are correctly addressed.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed form can seem straightforward, but many individuals make critical mistakes that can lead to complications down the road. One common error is failing to properly identify the property. It's essential to provide a clear and complete description of the property being transferred. Omitting details or using vague language can result in confusion or even disputes among heirs.

Another frequent mistake involves not signing the deed correctly. Each state has specific requirements for signatures, and overlooking these can render the document invalid. Ensure that all necessary parties sign the deed in the presence of a notary, if required by state law. A signature that is missing or improperly executed can lead to delays or legal challenges.

Many people also neglect to record the TOD deed with the appropriate county office. Simply completing the form does not finalize the transfer. Without proper recording, the deed may not be recognized, and the intended beneficiaries could face difficulties claiming the property. Always check local regulations to understand the recording process.

Another mistake is failing to consider the implications of the deed on other estate planning documents. A TOD deed can interact with wills and trusts in unexpected ways. For example, if a will contradicts the TOD deed, it may create confusion about the intended distribution of assets. It’s advisable to review all estate planning documents to ensure consistency.

People often overlook the importance of communicating their intentions to beneficiaries. If the intended recipients are unaware of the deed or its implications, they may not know how to claim the property upon the owner’s death. Open discussions can prevent misunderstandings and ensure that everyone is on the same page.

Lastly, many individuals fail to update the TOD deed after significant life changes, such as marriage, divorce, or the death of a beneficiary. Life events can alter one’s intentions regarding property transfer. Regularly reviewing and updating the deed is crucial to reflect current wishes and avoid complications later on.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's important to follow certain guidelines. Here are some dos and don'ts to keep in mind:

- Do ensure that you have the correct legal description of the property.

- Do clearly identify the beneficiaries who will receive the property.

- Don't forget to sign the deed in front of a notary public.

- Don't use vague language that could lead to confusion about the property or beneficiaries.

More Types of Transfer-on-Death Deed Forms:

What Is a Deed in Lieu of Foreclosure - It may be possible for homeowners to negotiate terms with their lender during this process.

Lady Bird Deed Form Michigan - This type of deed is often easier and less costly than other estate planning methods.

The Employment Verification form is a crucial document used by employers to confirm the employment status of an individual. This form serves as a means of validating a person's work history, including job titles, dates of employment, and responsibilities. For more information on how to properly complete this form, you can visit https://documentonline.org/blank-employment-verification/. Understanding its purpose can benefit both job seekers and employers alike.

Deed of Gift Property - Gift Deeds are often straightforward documents, but their significance can extend beyond mere legal formality.

Similar forms

The Transfer-on-Death Deed (TOD) form shares similarities with several other legal documents. Each document serves a unique purpose but has comparable features regarding the transfer of assets. Below are six documents that are similar to the TOD form:

- Will: A will outlines how a person's assets will be distributed after their death. Like a TOD deed, it allows for the transfer of property but requires probate, while a TOD deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies distribution after death. Both documents help avoid probate, but a living trust typically requires more management.

- Hold Harmless Agreement: This document is essential in Texas, as it releases one party from legal and financial responsibility in case of accidents, ensuring that all participants are aware of their responsibilities. For more information, visit TopTemplates.info.

- Beneficiary Designation: This document names individuals who will receive specific assets, such as life insurance or retirement accounts. Similar to a TOD deed, it allows direct transfer upon death without going through probate.

- Transfer-on-Death Account: This type of account allows the account holder to designate beneficiaries. Like the TOD deed, it ensures that the assets pass directly to the beneficiaries upon death.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows co-owners to automatically inherit the property upon the death of one owner. Both documents facilitate a smooth transfer of ownership outside of probate.

- Payable-on-Death (POD) Accounts: These accounts allow the account holder to designate a beneficiary who will receive the funds upon the holder's death. Similar to the TOD deed, it bypasses probate and ensures a direct transfer to the beneficiary.