Printable Texas Transfer-on-Death Deed Document

Form Preview Example

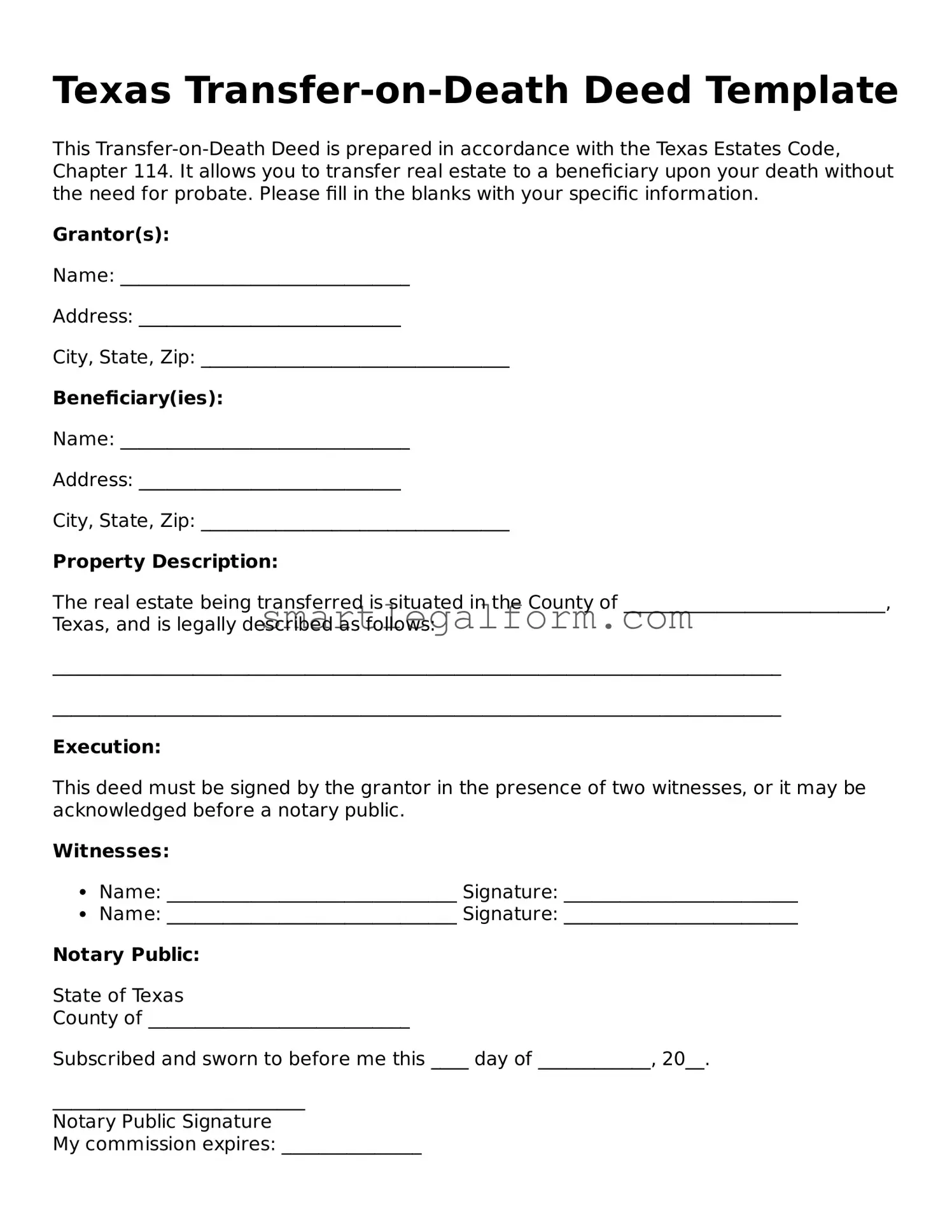

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is prepared in accordance with the Texas Estates Code, Chapter 114. It allows you to transfer real estate to a beneficiary upon your death without the need for probate. Please fill in the blanks with your specific information.

Grantor(s):

Name: _______________________________

Address: ____________________________

City, State, Zip: _________________________________

Beneficiary(ies):

Name: _______________________________

Address: ____________________________

City, State, Zip: _________________________________

Property Description:

The real estate being transferred is situated in the County of ____________________________, Texas, and is legally described as follows:

______________________________________________________________________________

______________________________________________________________________________

Execution:

This deed must be signed by the grantor in the presence of two witnesses, or it may be acknowledged before a notary public.

Witnesses:

- Name: _______________________________ Signature: _________________________

- Name: _______________________________ Signature: _________________________

Notary Public:

State of Texas

County of ____________________________

Subscribed and sworn to before me this ____ day of ____________, 20__.

___________________________

Notary Public Signature

My commission expires: _______________

Recording Information:

This document must be recorded in the county where the property is located to be effective. Please check with your local county clerk's office for further instructions.

It is advisable to seek legal counsel to ensure that this deed meets all requirements and accurately reflects your intentions.

Common mistakes

When filling out the Texas Transfer-on-Death Deed form, many people overlook critical details that can lead to complications down the line. One common mistake is not including the full legal name of the beneficiary. It's essential to ensure that the name matches exactly as it appears on legal documents. Any discrepancies can cause confusion and may even invalidate the deed.

Another frequent error involves failing to properly describe the property. A vague or incomplete description can create issues for the beneficiary when they attempt to claim the property. It’s important to include the property’s address and a legal description, which can usually be found on the property deed.

Some individuals neglect to sign the deed in front of a notary public. A signature without notarization can render the document ineffective. Ensuring that the deed is signed correctly and notarized is a crucial step in making it legally binding.

In addition, people often forget to provide the date of execution. Omitting the date can lead to disputes regarding the timing of the transfer. Always include the date to clarify when the deed was completed.

Many also fail to consider the implications of multiple beneficiaries. If you list more than one beneficiary but do not specify how the property will be divided, it could lead to misunderstandings or conflicts among heirs. Clearly outline how the property should be divided to avoid potential disputes.

Another mistake is neglecting to record the deed with the county clerk's office. A Transfer-on-Death Deed must be filed to be effective. If you skip this step, the deed may not hold up when the time comes for the beneficiary to claim the property.

Some individuals mistakenly believe that once the deed is signed, it cannot be revoked. In reality, you can revoke or change a Transfer-on-Death Deed at any time before your death. Keeping your estate plan flexible is key to addressing any changes in your circumstances or intentions.

Additionally, people often misunderstand the impact of existing debts on the property. If the property has liens or mortgages, beneficiaries may inherit these debts. It’s vital to discuss these financial obligations with an estate planning professional to ensure that your loved ones are not burdened with unexpected liabilities.

Another common oversight is not discussing the deed with the beneficiaries. Open communication can prevent confusion and ensure that everyone understands the intentions behind the deed. Having these conversations can also help clarify any questions or concerns before they arise.

Lastly, many individuals do not seek professional assistance when needed. While it may seem straightforward, the nuances of estate planning can be complex. Consulting with an expert can provide peace of mind and help avoid these common pitfalls.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it's important to approach the process with care. Here are some guidelines to help you navigate it effectively.

- Do ensure that you are the legal owner of the property you wish to transfer.

- Do clearly identify the beneficiaries you want to inherit the property.

- Do provide accurate and complete property descriptions to avoid confusion.

- Do sign the deed in front of a notary public to validate it.

- Do file the deed with the county clerk's office where the property is located.

- Don't use vague language when describing the property.

- Don't forget to include all required information on the form.

- Don't neglect to inform your beneficiaries about the deed and its implications.

- Don't assume that verbal agreements regarding the property are sufficient.

By following these dos and don'ts, you can help ensure that your Transfer-on-Death Deed is filled out correctly and serves its intended purpose.

Other Transfer-on-Death Deed State Forms

Where Can I Get a Tod Form - Potential tax implications should be discussed with a financial advisor when using a Transfer-on-Death Deed as part of estate planning.

Transfer on Death Deed Form Ohio - With this deed, you can express your intentions clearly and legally, safeguarding your wishes.

For those navigating commercial real estate in California, understanding the nuances of a Commercial Lease Agreement is crucial. This resource can help you familiarize yourself with the necessary terms and conditions, ensuring a smoother leasing process. Explore more about the requirements by visiting the important California Commercial Lease Agreement details.

Transfer on Death Instrument - This form can be particularly beneficial for individuals looking to maintain control over their property while alive.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but typically requires probate.

- Living Trust: A living trust holds assets during a person's lifetime and allows for a smooth transfer to beneficiaries upon death. Both documents help avoid probate, but a trust can manage assets while the person is still alive.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, like retirement accounts or insurance policies. Similar to a Transfer-on-Death Deed, it directly transfers assets without going through probate.

- Joint Tenancy: This ownership arrangement allows two or more people to own property together. When one owner passes away, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed works.

- Power of Attorney for a Child: Grant another adult the ability to make decisions on behalf of your child with the necessary insights on Power of Attorney for a Child provisions to ensure proper care when you're unavailable.

- Payable-on-Death (POD) Accounts: A POD account allows bank account holders to name beneficiaries who will receive the funds upon the account holder's death. This process bypasses probate, just like a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks and bonds. Upon death, the securities transfer directly to the beneficiaries, mirroring the Transfer-on-Death Deed's purpose.

- Life Estate Deed: This deed allows someone to live in a property for their lifetime while designating who will receive the property after their death. It shares the goal of ensuring a smooth transfer of property, though it involves different ownership rights.