Printable Texas RV Bill of Sale Document

Form Preview Example

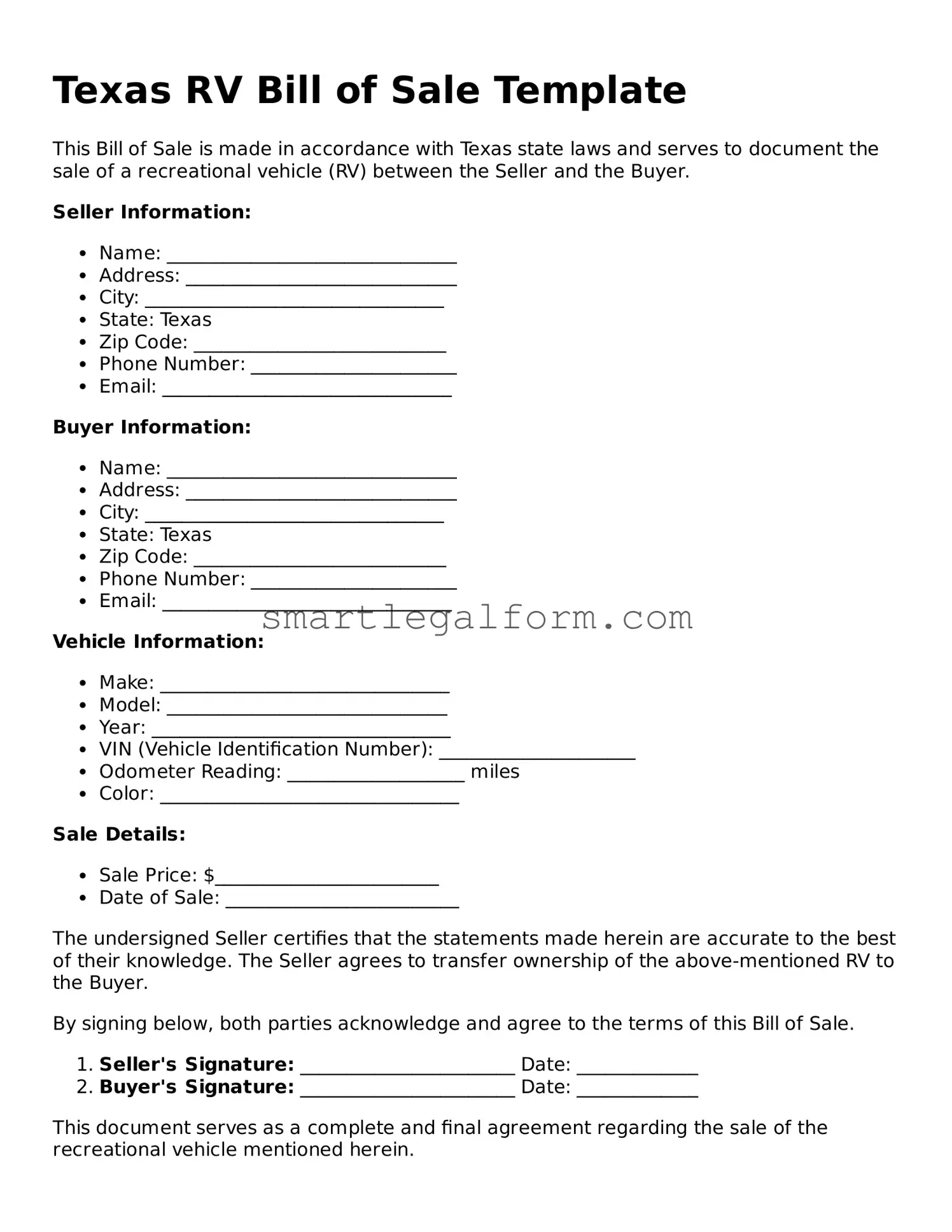

Texas RV Bill of Sale Template

This Bill of Sale is made in accordance with Texas state laws and serves to document the sale of a recreational vehicle (RV) between the Seller and the Buyer.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: Texas

- Zip Code: ___________________________

- Phone Number: ______________________

- Email: _______________________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: Texas

- Zip Code: ___________________________

- Phone Number: ______________________

- Email: _______________________________

Vehicle Information:

- Make: _______________________________

- Model: ______________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): _____________________

- Odometer Reading: ___________________ miles

- Color: ________________________________

Sale Details:

- Sale Price: $________________________

- Date of Sale: _________________________

The undersigned Seller certifies that the statements made herein are accurate to the best of their knowledge. The Seller agrees to transfer ownership of the above-mentioned RV to the Buyer.

By signing below, both parties acknowledge and agree to the terms of this Bill of Sale.

- Seller's Signature: _______________________ Date: _____________

- Buyer's Signature: _______________________ Date: _____________

This document serves as a complete and final agreement regarding the sale of the recreational vehicle mentioned herein.

Common mistakes

When completing the Texas RV Bill of Sale form, individuals often overlook important details that can lead to complications. One common mistake is failing to provide accurate vehicle identification information. This includes the RV's VIN (Vehicle Identification Number), make, model, and year. Incomplete or incorrect information can create issues when registering the vehicle.

Another frequent error is neglecting to include the sale price. The form requires a clear statement of the amount paid for the RV. Omitting this detail can result in problems during the title transfer process and may lead to complications with tax authorities.

Many people also forget to sign the form. Both the seller and buyer must provide their signatures to validate the transaction. Without these signatures, the bill of sale may not be recognized as a legal document.

Additionally, some individuals do not date the form. A date is essential for establishing when the sale took place. This information is crucial for both parties, especially in case of future disputes or for tax purposes.

Another mistake involves not providing accurate contact information for both the buyer and seller. Including full names, addresses, and phone numbers is important. This information helps in case there are any follow-up questions or issues regarding the sale.

People sometimes forget to check for any liens on the RV. If the vehicle has an outstanding loan or lien, it must be cleared before the sale. Failing to address this can lead to legal complications for the buyer.

Some individuals fail to make copies of the completed bill of sale. Keeping a copy for personal records is a good practice. This ensures that both parties have proof of the transaction should any questions arise later.

Finally, not reviewing the entire form before submission is a common oversight. Taking the time to double-check all entries can prevent mistakes and ensure that the form is filled out correctly. This simple step can save both parties from future headaches.

Dos and Don'ts

When completing the Texas RV Bill of Sale form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid.

- Do provide accurate information about the RV, including make, model, year, and Vehicle Identification Number (VIN).

- Do include the sale price clearly to avoid any misunderstandings.

- Do have both the buyer and seller sign the form to validate the transaction.

- Do date the form to establish when the sale took place.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any sections blank; fill out all required fields completely.

- Don't use incorrect or outdated information that could lead to legal issues.

- Don't sign the form without verifying all details are accurate.

- Don't forget to check local regulations regarding additional documentation that may be required.

Other RV Bill of Sale State Forms

Bill of Sale for Trailers - Can help with title transfer after the sale is completed.

Florida Trailer Bill of Sale - Protects both the seller's and buyer's interests.

Similar forms

- Car Bill of Sale: This document serves a similar purpose for automobiles. It transfers ownership from the seller to the buyer and includes details like the vehicle's make, model, and VIN.

- Boat Bill of Sale: Just like the RV Bill of Sale, this document is used for boats. It outlines the sale terms, including the boat's specifications and the parties involved.

- Motorcycle Bill of Sale: This document is specifically for motorcycles. It includes information about the motorcycle's condition, mileage, and the buyer and seller's details.

- Trailer Bill of Sale: Similar to the RV Bill of Sale, this document is used for trailers. It details the trailer's specifications and serves as proof of ownership transfer.

- Aircraft Bill of Sale: This document is for the sale of aircraft. It includes vital information such as the aircraft's registration number and the parties involved in the transaction.

- Mobile Home Bill of Sale: This document facilitates the sale of mobile homes. It outlines the terms of sale and includes details about the mobile home itself.

- Equipment Bill of Sale: Used for heavy machinery and equipment, this document transfers ownership and details the equipment's specifications and condition.

- Pet Bill of Sale: This document is used when transferring ownership of a pet. It includes details about the pet and any agreements regarding its care and ownership.