Printable Texas Promissory Note Document

Form Preview Example

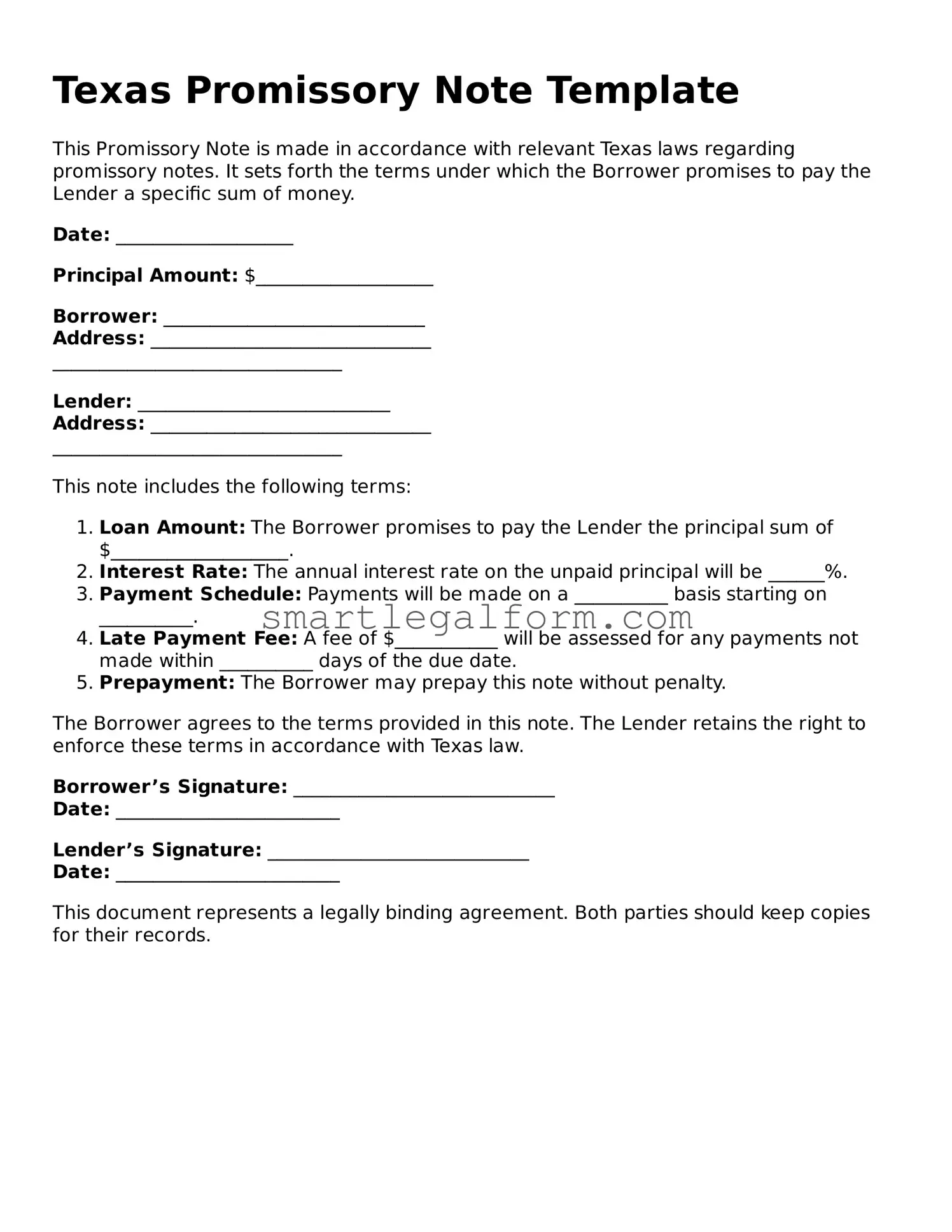

Texas Promissory Note Template

This Promissory Note is made in accordance with relevant Texas laws regarding promissory notes. It sets forth the terms under which the Borrower promises to pay the Lender a specific sum of money.

Date: ___________________

Principal Amount: $___________________

Borrower: ____________________________

Address: ______________________________

_______________________________

Lender: ___________________________

Address: ______________________________

_______________________________

This note includes the following terms:

- Loan Amount: The Borrower promises to pay the Lender the principal sum of $___________________.

- Interest Rate: The annual interest rate on the unpaid principal will be ______%.

- Payment Schedule: Payments will be made on a __________ basis starting on __________.

- Late Payment Fee: A fee of $___________ will be assessed for any payments not made within __________ days of the due date.

- Prepayment: The Borrower may prepay this note without penalty.

The Borrower agrees to the terms provided in this note. The Lender retains the right to enforce these terms in accordance with Texas law.

Borrower’s Signature: ____________________________

Date: ________________________

Lender’s Signature: ____________________________

Date: ________________________

This document represents a legally binding agreement. Both parties should keep copies for their records.

Common mistakes

Filling out a Texas Promissory Note form can be straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary parties. A promissory note typically requires the names and addresses of both the borrower and the lender. Omitting this information can create confusion and make the document unenforceable.

Another mistake often made is neglecting to specify the interest rate. It’s crucial to clearly state whether the loan will bear interest, and if so, at what rate. Leaving this section blank can lead to misunderstandings and disputes later on. Without a defined interest rate, the terms of repayment may become ambiguous.

People sometimes overlook the importance of the repayment schedule. A vague or incomplete repayment plan can cause issues. It’s essential to outline when payments are due, how much each payment will be, and the total duration of the loan. Clear terms help both parties understand their obligations and avoid potential conflicts.

Additionally, some individuals forget to sign the document. A promissory note is not valid without the signatures of both the borrower and the lender. This simple oversight can render the entire agreement ineffective. Always double-check that all required signatures are present before finalizing the document.

Lastly, failing to keep a copy of the signed promissory note is a common mistake. After signing, both parties should retain a copy for their records. This ensures that everyone has access to the terms of the agreement and can refer back to it if needed. Keeping a record helps prevent disputes and protects the rights of both parties involved.

Dos and Don'ts

When filling out the Texas Promissory Note form, it’s important to follow certain guidelines to ensure the document is valid and effective. Here’s a helpful list of what to do and what to avoid.

- Do provide accurate information about the borrower and lender, including full names and addresses.

- Do clearly state the loan amount to avoid any confusion in the future.

- Do specify the interest rate, if applicable, and ensure it complies with Texas laws.

- Do include a repayment schedule, detailing when payments are due.

- Do have both parties sign the document in the presence of a witness or notary.

- Don’t leave any sections blank, as this can lead to misunderstandings later.

- Don’t use vague language; be clear and precise in your wording.

Following these guidelines will help create a clear and enforceable Promissory Note. Always double-check your work for accuracy before finalizing the document.

Other Promissory Note State Forms

Personal Loan Promissory Note - Both parties should keep copies of the promissory note for their records.

Florida Promissory Note Template - Many financial institutions require promissory notes for loans exceeding a certain amount.

The Florida Motor Vehicle Power of Attorney form is a legal document. It allows a vehicle owner to authorize another person to make decisions regarding their motor vehicle in Florida. This includes handling matters like registration, title transfer, and other related transactions on the owner’s behalf, which can be easily managed through resources like toptemplates.info.

Create a Promissory Note - Having a promissory note can provide peace of mind for both borrowers and lenders.

Promissory Note Template Illinois - For significant loans, legal consultation is often recommended before finalizing the note.

Similar forms

-

Loan Agreement: A loan agreement outlines the terms under which a borrower agrees to repay borrowed funds. Like a promissory note, it specifies the amount borrowed, interest rates, and repayment schedule. However, a loan agreement may also include additional terms regarding collateral and default conditions.

- Independent Contractor Agreement: To clarify the terms of work and responsibilities, refer to the comprehensive Independent Contractor Agreement resources that enhance understanding of the professional relationship between businesses and contractors.

-

Credit Agreement: This document is used when a lender extends credit to a borrower. Similar to a promissory note, it details the credit amount, repayment terms, and interest rates. Credit agreements often encompass a broader range of terms, including fees and conditions for credit limit adjustments.

-

Mortgage Note: A mortgage note is a specific type of promissory note secured by real estate. It includes the borrower's promise to repay the loan amount, along with details about the property being used as collateral. Both documents serve to formalize the borrower's obligation to repay.

-

Personal Guarantee: This document involves a personal commitment from an individual to repay a debt if the primary borrower defaults. While it shares similarities with a promissory note in that it establishes a financial obligation, it typically does not include the same level of detail regarding payment terms.

-

Installment Agreement: An installment agreement allows a borrower to repay a debt in scheduled payments over time. Like a promissory note, it specifies the total amount owed and the payment schedule. However, it may also address late fees and other terms related to the payment process.