Printable Texas Prenuptial Agreement Document

Form Preview Example

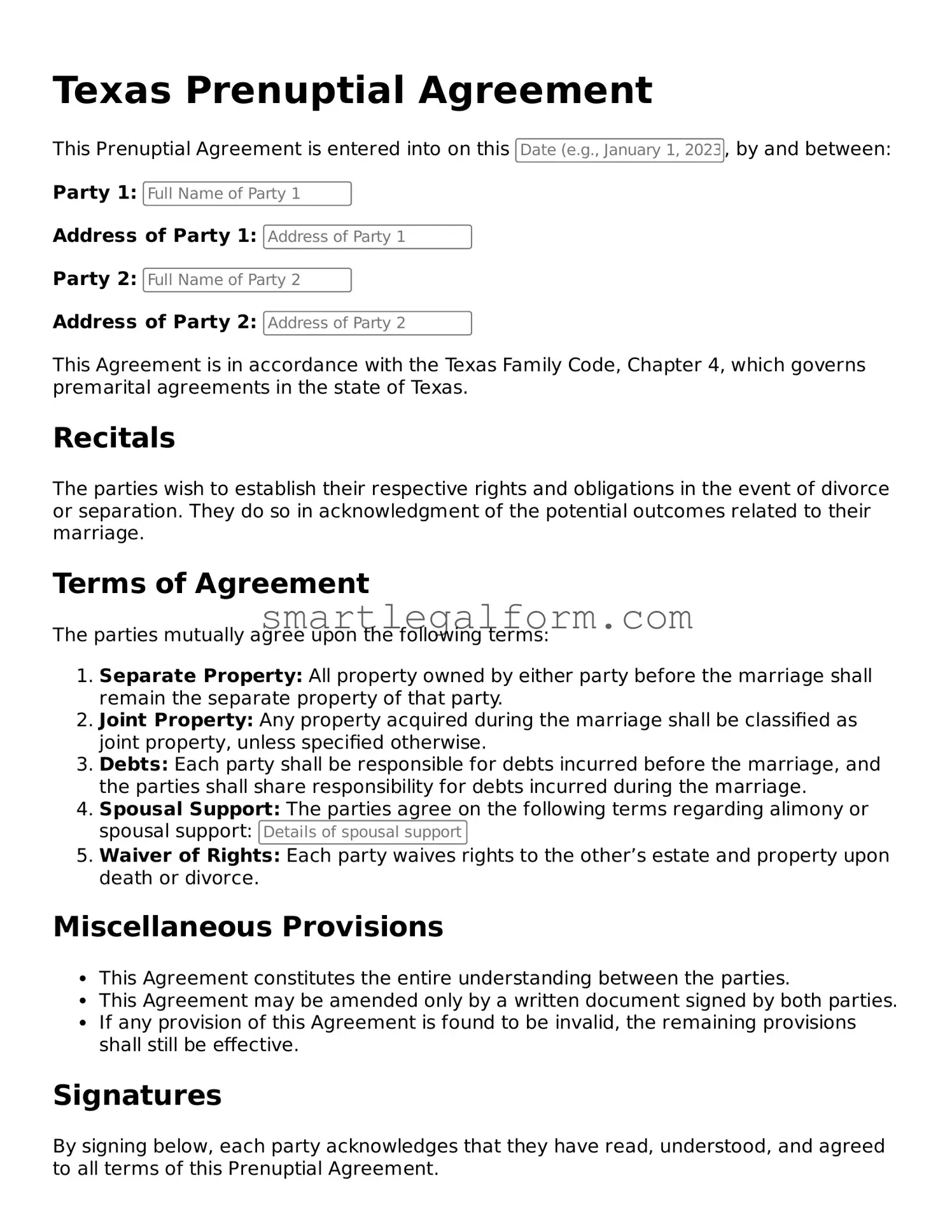

Texas Prenuptial Agreement

This Prenuptial Agreement is entered into on this , by and between:

Party 1:

Address of Party 1:

Party 2:

Address of Party 2:

This Agreement is in accordance with the Texas Family Code, Chapter 4, which governs premarital agreements in the state of Texas.

Recitals

The parties wish to establish their respective rights and obligations in the event of divorce or separation. They do so in acknowledgment of the potential outcomes related to their marriage.

Terms of Agreement

The parties mutually agree upon the following terms:

- Separate Property: All property owned by either party before the marriage shall remain the separate property of that party.

- Joint Property: Any property acquired during the marriage shall be classified as joint property, unless specified otherwise.

- Debts: Each party shall be responsible for debts incurred before the marriage, and the parties shall share responsibility for debts incurred during the marriage.

- Spousal Support: The parties agree on the following terms regarding alimony or spousal support:

- Waiver of Rights: Each party waives rights to the other’s estate and property upon death or divorce.

Miscellaneous Provisions

- This Agreement constitutes the entire understanding between the parties.

- This Agreement may be amended only by a written document signed by both parties.

- If any provision of this Agreement is found to be invalid, the remaining provisions shall still be effective.

Signatures

By signing below, each party acknowledges that they have read, understood, and agreed to all terms of this Prenuptial Agreement.

_____________________________

Signature of Party 1

_____________________________

Signature of Party 2

_____________________________

Date

This document aims to facilitate clear communication and mutual understanding between the parties regarding their financial rights and responsibilities.

Common mistakes

Filling out a prenuptial agreement can be a daunting task, especially in a state like Texas where the legal landscape can be complex. One common mistake people make is failing to fully disclose their assets and debts. Transparency is crucial in these agreements. If one party conceals significant financial information, it could lead to the agreement being challenged in court later on.

Another frequent error is using vague language. Clear and specific terms are essential to ensure that both parties understand their rights and responsibilities. Ambiguities can lead to misunderstandings and disputes down the line. It is vital to define terms precisely, so there is no room for misinterpretation.

People often neglect to consider future changes in circumstances. Life is unpredictable, and what may seem fair at the time of signing may not hold true in the future. It is wise to include provisions that address potential changes, such as the birth of children or significant shifts in income. This foresight can help avoid complications later.

Additionally, many individuals fail to seek independent legal advice. Each party should have their own attorney review the agreement. This step ensures that both sides fully understand the implications of the document. Without proper legal guidance, one may inadvertently agree to terms that are not in their best interest.

Another common pitfall is rushing the process. Prenuptial agreements require careful consideration and discussion. Taking the time to negotiate terms can lead to a more equitable outcome. Hasty decisions often result in overlooked details that could have significant consequences.

Moreover, some people overlook the importance of reviewing and updating the agreement periodically. As life evolves, so do financial situations and personal circumstances. Regularly revisiting the prenuptial agreement allows couples to adjust the terms as necessary, ensuring that the document remains relevant and fair.

Lastly, individuals sometimes fail to sign the agreement in a timely manner. Waiting until the last minute can create pressure and lead to mistakes. It is essential to finalize the prenuptial agreement well before the wedding date to allow both parties ample time to consider the terms and avoid any last-minute disputes.

Dos and Don'ts

When filling out the Texas Prenuptial Agreement form, it's important to approach the process with care. Here are some key dos and don'ts to consider:

- Do communicate openly with your partner about your intentions and expectations.

- Do ensure that both parties fully understand the terms of the agreement.

- Do consult with a legal professional to review the document before signing.

- Do keep copies of the signed agreement for your records.

- Don't rush the process; take your time to discuss and negotiate terms.

- Don't include any unfair or unreasonable terms that could lead to disputes.

- Don't forget to update the agreement if your circumstances change significantly.

- Don't sign the agreement without independent legal advice to ensure fairness.

Other Prenuptial Agreement State Forms

Florida Premarital Contract - A prenuptial agreement can prevent one partner from making significant financial decisions without the other’s input.

Ohio Premarital Contract - The prenup may include provisions for shared property acquired during marriage.

For those seeking to ensure their estate is managed according to their wishes, the Arizona Last Will and Testament process is vital. This document serves as a crucial tool for outlining asset distribution, providing clarity and security for both the individual and their family during a challenging time.

Pennsylvania Premarital Contract - This contract might discourage conflict about money management in marriage.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets will be divided in case of divorce or separation.

- Separation Agreement: This document is used when a couple decides to live apart. It covers issues like property division, child custody, and support, similar to what a prenuptial agreement addresses.

- Divorce Settlement Agreement: This is a final agreement made during divorce proceedings. It details how assets and debts will be divided, akin to the asset protection features in a prenuptial agreement.

- Co-habitation Agreement: Couples living together can use this document to outline financial responsibilities and property rights, similar to how a prenuptial agreement functions for married couples.

- Will: A will specifies how a person's assets will be distributed upon death. While not directly related to marriage, both documents address asset management and distribution.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. Like a prenuptial agreement, it can protect assets and dictate how they should be handled.

- Power of Attorney: This document allows someone to make decisions on behalf of another. While it focuses on decision-making, it can also include financial matters, similar to the financial planning aspect of a prenuptial agreement.

- Lease Agreement: To ensure a smooth rental experience, it’s important for both landlords and tenants to fully understand the TopTemplates.info which provides comprehensive resources on lease agreements in Georgia, capturing essential terms and conditions for the rental property.

- Business Partnership Agreement: For couples who own a business together, this agreement outlines how the business will be managed and what happens if one partner leaves, similar to asset division in a prenuptial agreement.

- Financial Disclosure Statement: This document details each party's financial situation, often used in conjunction with prenuptial agreements to ensure transparency about assets and debts.

- Child Support Agreement: This document outlines financial support for children after separation or divorce. Like a prenuptial agreement, it addresses financial responsibilities related to family matters.