Printable Texas Operating Agreement Document

Form Preview Example

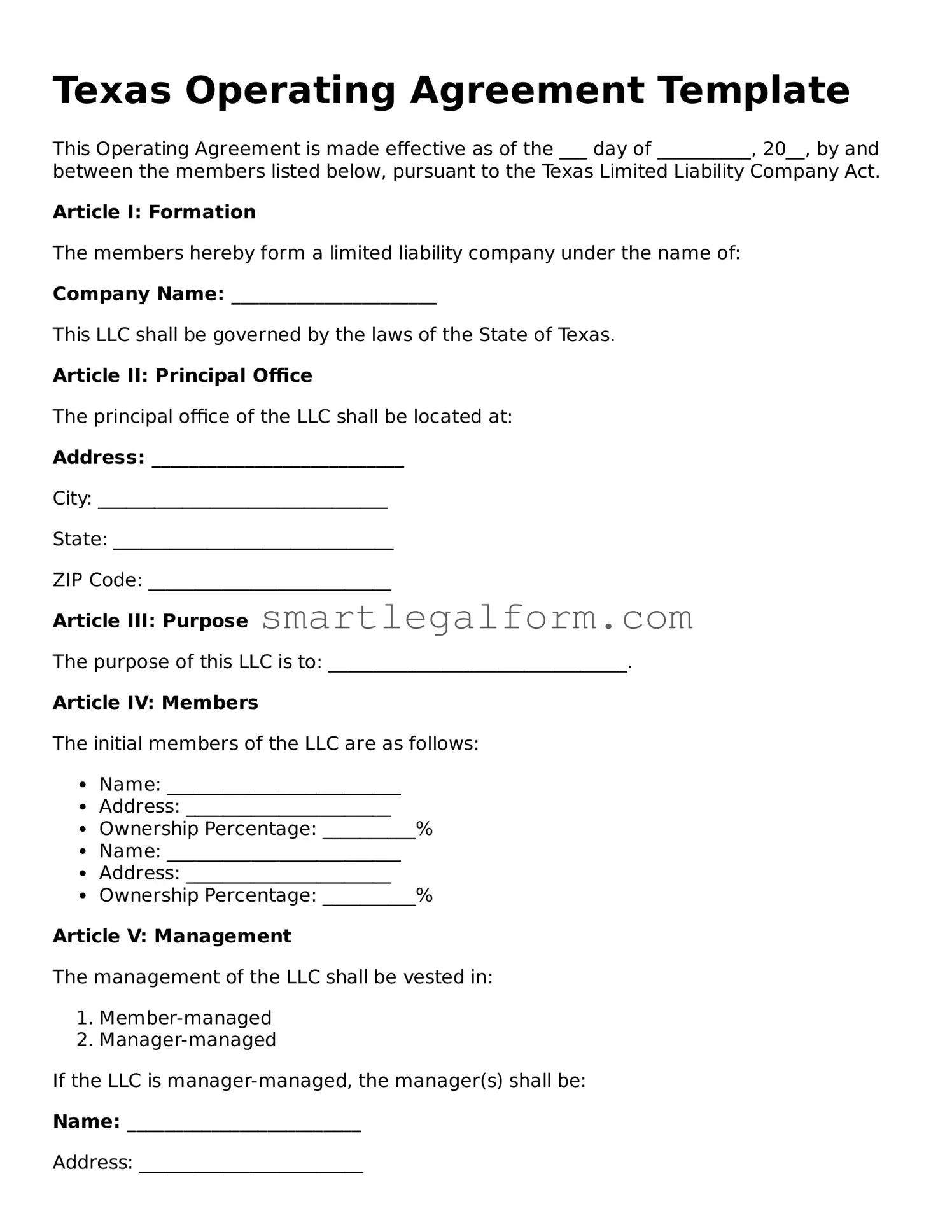

Texas Operating Agreement Template

This Operating Agreement is made effective as of the ___ day of __________, 20__, by and between the members listed below, pursuant to the Texas Limited Liability Company Act.

Article I: Formation

The members hereby form a limited liability company under the name of:

Company Name: ______________________

This LLC shall be governed by the laws of the State of Texas.

Article II: Principal Office

The principal office of the LLC shall be located at:

Address: ___________________________

City: _______________________________

State: ______________________________

ZIP Code: __________________________

Article III: Purpose

The purpose of this LLC is to: ________________________________.

Article IV: Members

The initial members of the LLC are as follows:

- Name: _________________________

- Address: ______________________

- Ownership Percentage: __________%

- Name: _________________________

- Address: ______________________

- Ownership Percentage: __________%

Article V: Management

The management of the LLC shall be vested in:

- Member-managed

- Manager-managed

If the LLC is manager-managed, the manager(s) shall be:

Name: _________________________

Address: ________________________

Article VI: Capital Contributions

The members shall make the following initial capital contributions:

- Name: _________________________ - Amount: $__________

- Name: _________________________ - Amount: $__________

Article VII: Distributions

Distributions shall be made to the members as follows:

- In proportion to ownership percentage

- As determined by members' agreement

Article VIII: Indemnification

The LLC shall indemnify each member and manager to the fullest extent permitted by Texas law for actions taken on behalf of the LLC.

Article IX: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members.

In witness whereof, the members have executed this Operating Agreement as of the day and year first above written.

Member Signature: ______________________

Member Name: __________________________

Date: _________________________________

Member Signature: ______________________

Member Name: __________________________

Date: _________________________________

Common mistakes

When filling out the Texas Operating Agreement form, many individuals encounter common pitfalls. One frequent mistake is failing to provide accurate information about the members of the LLC. Each member's name, address, and ownership percentage must be clearly stated. Omitting or misspelling this information can lead to confusion and potential legal issues down the line.

Another common error is neglecting to outline the management structure of the LLC. The form should specify whether the company will be managed by its members or by appointed managers. This detail is crucial, as it sets the expectations for decision-making and operational control. Without clarity on management roles, disputes may arise among members.

People often overlook the importance of including provisions for profit and loss distribution. The Operating Agreement should clearly state how profits and losses will be allocated among members. If this section is vague or missing, it can lead to disagreements and dissatisfaction among members regarding their financial interests.

Additionally, many individuals fail to address the procedures for adding or removing members. An effective Operating Agreement should outline how new members can be admitted and the process for removing existing members. Without these guidelines, the LLC may face challenges in maintaining its structure and membership integrity.

Another mistake is not considering the dispute resolution process. Including a section on how disputes will be handled can save time and resources in the future. Whether through mediation, arbitration, or litigation, having a clear plan can help members resolve conflicts amicably.

Lastly, individuals sometimes neglect to review and update the Operating Agreement regularly. As the business evolves, so too should the agreement. Regular reviews ensure that the document remains relevant and reflects the current needs and goals of the LLC. Failing to keep the agreement updated can lead to misunderstandings and complications as the business grows.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it is essential to approach the task with care and attention to detail. Below is a list of things to consider doing and avoiding during this process.

- Do read the instructions carefully before starting.

- Do provide accurate and complete information about the business and its members.

- Do consult with a legal professional if you have questions.

- Do ensure that all members sign the agreement to validate it.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank, as this can lead to delays or issues.

By following these guidelines, you can help ensure that your Texas Operating Agreement is filled out correctly and effectively serves its purpose.

Other Operating Agreement State Forms

Ny Llc Operating Agreement Template - This agreement is often required by banks for business accounts.

Operating Agreement Llc Ohio - It may include guidelines for employing people within the company.

California Llc Operating Agreement - Members can use the Operating Agreement to outline their rights to transfer ownership interests, clarifying procedures and restrictions.

An Agreement to Operate a Business in the Name of an Established Company - Having an Operating Agreement can help ensure a consistent approach to business decisions.

Similar forms

The Operating Agreement is a crucial document for limited liability companies (LLCs), outlining the management structure and operational guidelines. However, several other documents serve similar purposes in various business contexts. Here’s a look at seven documents that share similarities with the Operating Agreement:

- Partnership Agreement: This document outlines the terms and conditions of a partnership, detailing each partner's responsibilities, profit-sharing, and decision-making processes, much like an Operating Agreement does for LLCs.

- Bylaws: Corporations use bylaws to govern their internal management. They specify the roles of directors and officers, meeting protocols, and voting rights, similar to how an Operating Agreement defines roles within an LLC.

- Shareholder Agreement: This agreement between shareholders addresses ownership rights, share transfers, and governance issues. It parallels the Operating Agreement by establishing rules for managing a corporation's affairs.

- Joint Venture Agreement: In a joint venture, parties collaborate on a specific project. This agreement outlines contributions, profit-sharing, and management responsibilities, akin to the guidelines provided in an Operating Agreement.

- LLC Formation Documents: When forming an LLC, initial documents like Articles of Organization are filed. While these establish the entity, the Operating Agreement details how it will operate, providing a deeper layer of governance.

- Franchise Agreement: This document governs the relationship between a franchisor and franchisee. It outlines operational guidelines and responsibilities, similar to the way an Operating Agreement defines the relationship among LLC members.

- Employment Agreement: This document sets the terms of employment for individuals within a company. It specifies roles and responsibilities, akin to how an Operating Agreement delineates member roles in an LLC.

Each of these documents plays a vital role in defining relationships and operational procedures within their respective business structures, just as the Operating Agreement does for LLCs.