Printable Texas Motor Vehicle Power of Attorney Document

Form Preview Example

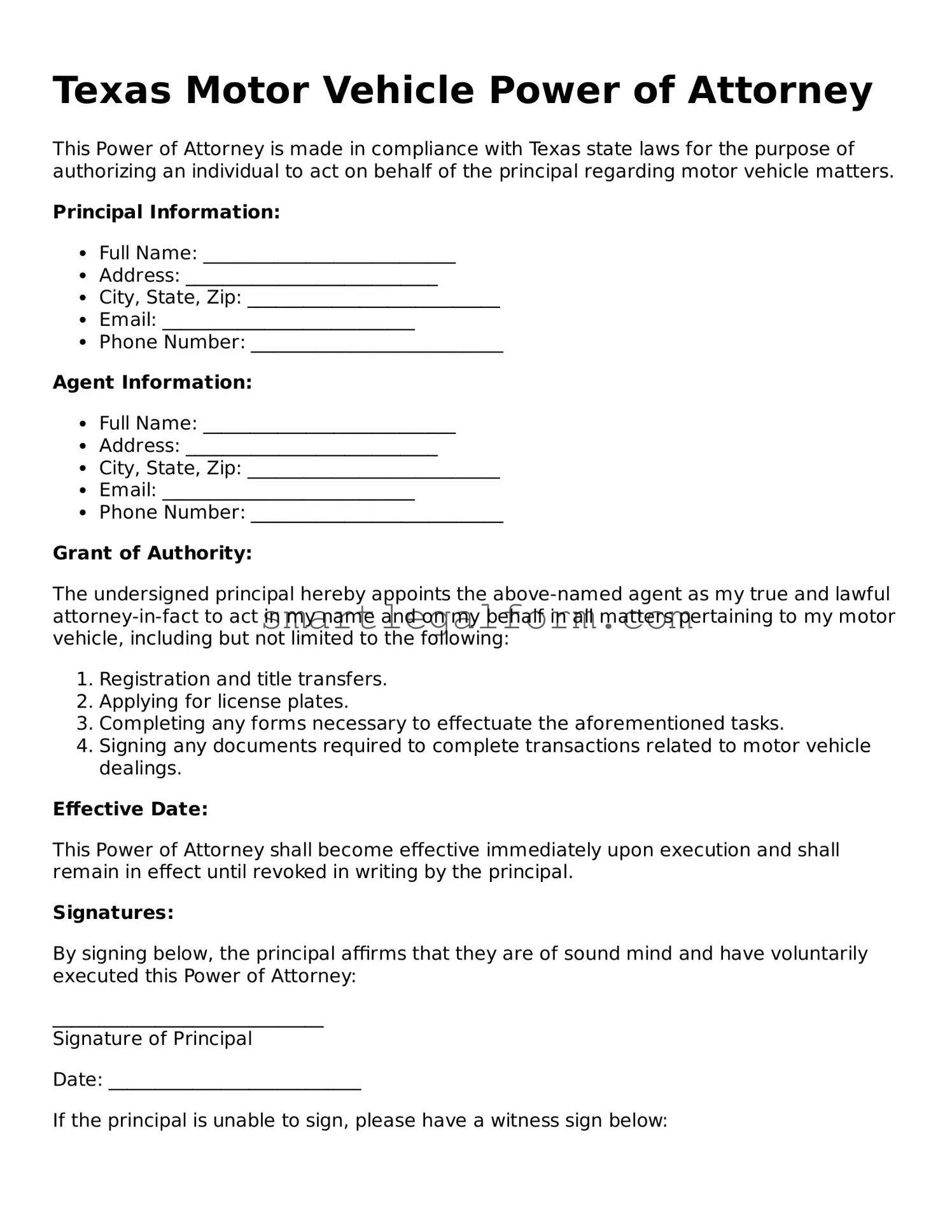

Texas Motor Vehicle Power of Attorney

This Power of Attorney is made in compliance with Texas state laws for the purpose of authorizing an individual to act on behalf of the principal regarding motor vehicle matters.

Principal Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

- Email: ___________________________

- Phone Number: ___________________________

Agent Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

- Email: ___________________________

- Phone Number: ___________________________

Grant of Authority:

The undersigned principal hereby appoints the above-named agent as my true and lawful attorney-in-fact to act in my name and on my behalf in all matters pertaining to my motor vehicle, including but not limited to the following:

- Registration and title transfers.

- Applying for license plates.

- Completing any forms necessary to effectuate the aforementioned tasks.

- Signing any documents required to complete transactions related to motor vehicle dealings.

Effective Date:

This Power of Attorney shall become effective immediately upon execution and shall remain in effect until revoked in writing by the principal.

Signatures:

By signing below, the principal affirms that they are of sound mind and have voluntarily executed this Power of Attorney:

_____________________________

Signature of Principal

Date: ___________________________

If the principal is unable to sign, please have a witness sign below:

_____________________________

Signature of Witness

Date: ___________________________

Common mistakes

When filling out the Texas Motor Vehicle Power of Attorney form, many individuals encounter common pitfalls that can lead to complications. One frequent mistake is failing to provide accurate vehicle information. This includes the vehicle identification number (VIN), make, model, and year. Inaccurate details can cause delays or even invalidate the power of attorney.

Another common error is neglecting to sign and date the form. The signature of the principal is crucial for the document to be legally binding. Without this essential step, the power of attorney may not hold up in legal situations. Additionally, forgetting to date the form can lead to confusion about its validity period.

People often overlook the importance of specifying the powers granted. The form allows for different types of authority, such as selling the vehicle or transferring title. If these powers are not clearly outlined, the agent may not have the authority to act as intended, leading to potential disputes.

Inadequate identification of the agent is another mistake that can undermine the effectiveness of the power of attorney. The agent’s full name and address must be clearly stated. Ambiguities in identifying the agent can create confusion and hinder the execution of the document.

Lastly, individuals sometimes fail to understand the implications of granting power of attorney. This form allows another person to act on their behalf regarding vehicle matters. It is essential to choose someone trustworthy, as this person will have significant authority over the vehicle transactions. Misjudging this can lead to unintended consequences.

Dos and Don'ts

When filling out the Texas Motor Vehicle Power of Attorney form, it’s important to get it right. Here are some things to keep in mind.

- Do ensure that you use the correct form for your specific needs.

- Do fill in all required fields completely and accurately.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces; if a section doesn’t apply, write "N/A."

- Don't forget to date the form before submitting it.

- Don't use white-out or any correction fluid on the form.

- Don't submit the form without confirming that all signatures are in place.

Following these guidelines will help ensure that your Power of Attorney form is valid and accepted without issues.

Other Motor Vehicle Power of Attorney State Forms

Hillsborough County Tag Office - It provides a solution for efficiently handling vehicle transactions when you are out of town.

How Long Does a Notarized Power of Attorney Last - Provide a designated representative with the capability to act on your behalf for vehicle issues.

Similar forms

- General Power of Attorney: This document allows one person to act on behalf of another in a broad range of matters, including financial and legal decisions. Like the Motor Vehicle Power of Attorney, it grants authority to manage specific tasks, but it covers a wider scope.

- Limited Power of Attorney: Similar to the Motor Vehicle Power of Attorney, this document grants authority for a specific purpose or for a limited time. It can be used for tasks like real estate transactions or handling bank accounts, focusing on defined actions.

- Durable Power of Attorney: This type remains in effect even if the principal becomes incapacitated. It shares the same principle as the Motor Vehicle Power of Attorney, allowing someone to make decisions on behalf of another, but extends beyond vehicle matters.

- Healthcare Power of Attorney: This document allows someone to make medical decisions on behalf of another person. While the Motor Vehicle Power of Attorney focuses on vehicle-related matters, both empower someone to act in the best interest of another.

- Financial Power of Attorney: This document is specifically designed for financial matters, enabling one person to manage another's financial affairs. Like the Motor Vehicle Power of Attorney, it provides authority but is tailored for broader financial responsibilities.

- Real Estate Power of Attorney: This allows someone to manage real estate transactions on behalf of another. Both documents grant specific authority, but the Real Estate Power of Attorney is focused on property-related decisions.

- Business Power of Attorney: This empowers someone to make decisions on behalf of a business entity. Similar to the Motor Vehicle Power of Attorney, it allows for delegation of authority, but it pertains to business operations and management.

- Tax Power of Attorney: This document allows someone to represent another in tax matters. While the Motor Vehicle Power of Attorney deals with vehicle transactions, both provide a means for someone to act on behalf of another in specific areas.

- Trustee Power of Attorney: This document allows a trustee to manage trust assets. Similar to the Motor Vehicle Power of Attorney, it grants authority to act, but is specifically for managing assets held in trust.

- Child Care Power of Attorney: This allows a parent to designate someone to make decisions regarding their child’s care. Like the Motor Vehicle Power of Attorney, it involves delegating authority to act on behalf of another, focusing on the welfare of a minor.