Printable Texas Loan Agreement Document

Form Preview Example

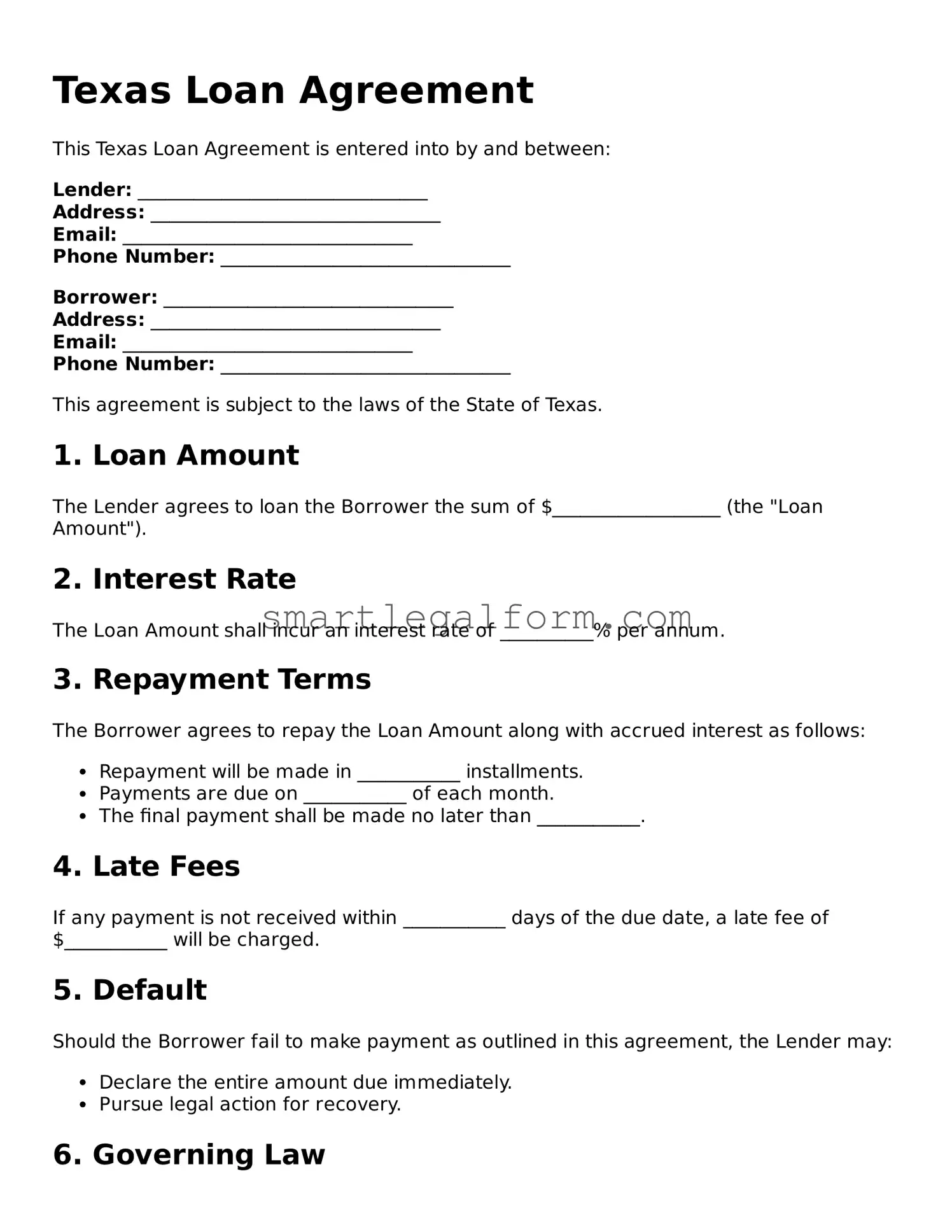

Texas Loan Agreement

This Texas Loan Agreement is entered into by and between:

Lender: _______________________________

Address: _______________________________

Email: _______________________________

Phone Number: _______________________________

Borrower: _______________________________

Address: _______________________________

Email: _______________________________

Phone Number: _______________________________

This agreement is subject to the laws of the State of Texas.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of $__________________ (the "Loan Amount").

2. Interest Rate

The Loan Amount shall incur an interest rate of __________% per annum.

3. Repayment Terms

The Borrower agrees to repay the Loan Amount along with accrued interest as follows:

- Repayment will be made in ___________ installments.

- Payments are due on ___________ of each month.

- The final payment shall be made no later than ___________.

4. Late Fees

If any payment is not received within ___________ days of the due date, a late fee of $___________ will be charged.

5. Default

Should the Borrower fail to make payment as outlined in this agreement, the Lender may:

- Declare the entire amount due immediately.

- Pursue legal action for recovery.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

7. Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Lender Signature: _______________________________

Date: _______________________________

Borrower Signature: _______________________________

Date: _______________________________

Common mistakes

When filling out the Texas Loan Agreement form, individuals often overlook critical details that can lead to complications later on. One common mistake is failing to provide complete personal information. Borrowers must ensure that their name, address, and contact details are accurate and up-to-date. Incomplete information can delay the loan process and may even result in the rejection of the application.

Another frequent error involves misunderstanding the terms of the loan. Many people do not take the time to read through the agreement thoroughly. This oversight can lead to confusion about interest rates, repayment schedules, and penalties for late payments. Understanding these terms is essential to avoid unexpected financial burdens in the future.

Additionally, some individuals neglect to specify the loan amount clearly. It is crucial to indicate the exact amount being borrowed to prevent any ambiguity. Inaccurate figures can lead to disputes between the lender and borrower, potentially resulting in legal issues down the line.

Moreover, failing to sign the document is a mistake that can invalidate the agreement. A signature signifies that both parties agree to the terms outlined in the loan agreement. Without it, the document holds no legal weight, leaving the borrower unprotected.

Another common pitfall is overlooking the inclusion of collateral, when applicable. If the loan is secured by an asset, it is important to detail this in the agreement. Omitting this information can create uncertainty about what the lender may claim in the event of default.

Finally, many borrowers do not keep a copy of the signed agreement for their records. Retaining a copy is vital for future reference, especially in case of disputes or misunderstandings. A well-organized filing system can help ensure that all parties have access to the necessary documentation when needed.

Dos and Don'ts

When filling out the Texas Loan Agreement form, attention to detail is crucial. Here are five things you should and shouldn't do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Double-check all numbers and dates for accuracy.

- Do: Sign and date the form in the designated areas.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the form without understanding each section.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Forget to review the terms and conditions before signing.

- Don't: Ignore any instructions provided with the form.

Other Loan Agreement State Forms

Promissory Note Template California - The form can be used for various loan types, adapting to each case.

Creating a Texas Last Will and Testament is crucial for ensuring that your final wishes regarding the distribution of your assets are respected. It not only provides a clear framework for your estate but also eliminates potential disputes among family members. For guidance on drafting this important document, you can visit TopTemplates.info.

Promissory Note Template New York - Borrowers often need to provide credit history as part of the agreement.

Promissory Note Template Florida Pdf - The agreement may outline the repercussions of illegal activities linked to the loan proceeds.

Promissory Note Template Illinois - It may specify limits on the use of loan funds.

Similar forms

Promissory Note: This document outlines a borrower's promise to repay a loan. Like a Loan Agreement, it specifies the amount borrowed, interest rates, and repayment terms.

Mortgage Agreement: A mortgage secures a loan with real property. Similar to a Loan Agreement, it includes details about the loan amount and terms, but also describes the collateral involved.

Security Agreement: This document establishes a security interest in personal property. It parallels a Loan Agreement by detailing the obligations of the borrower and the rights of the lender.

- General Power of Attorney: For delegating decision-making authority, refer to the comprehensive General Power of Attorney form guide to understand its legal implications and applications.

Lease Agreement: A lease outlines terms for renting property. While it focuses on rental arrangements, it shares similarities with a Loan Agreement in that it specifies payment terms and duration.

Credit Agreement: This document governs the terms of a credit facility. Like a Loan Agreement, it details the amount available, interest rates, and repayment conditions.

Partnership Agreement: This document governs the terms of a business partnership. It resembles a Loan Agreement in that it outlines contributions, profit sharing, and obligations among partners.