Printable Texas Last Will and Testament Document

Form Preview Example

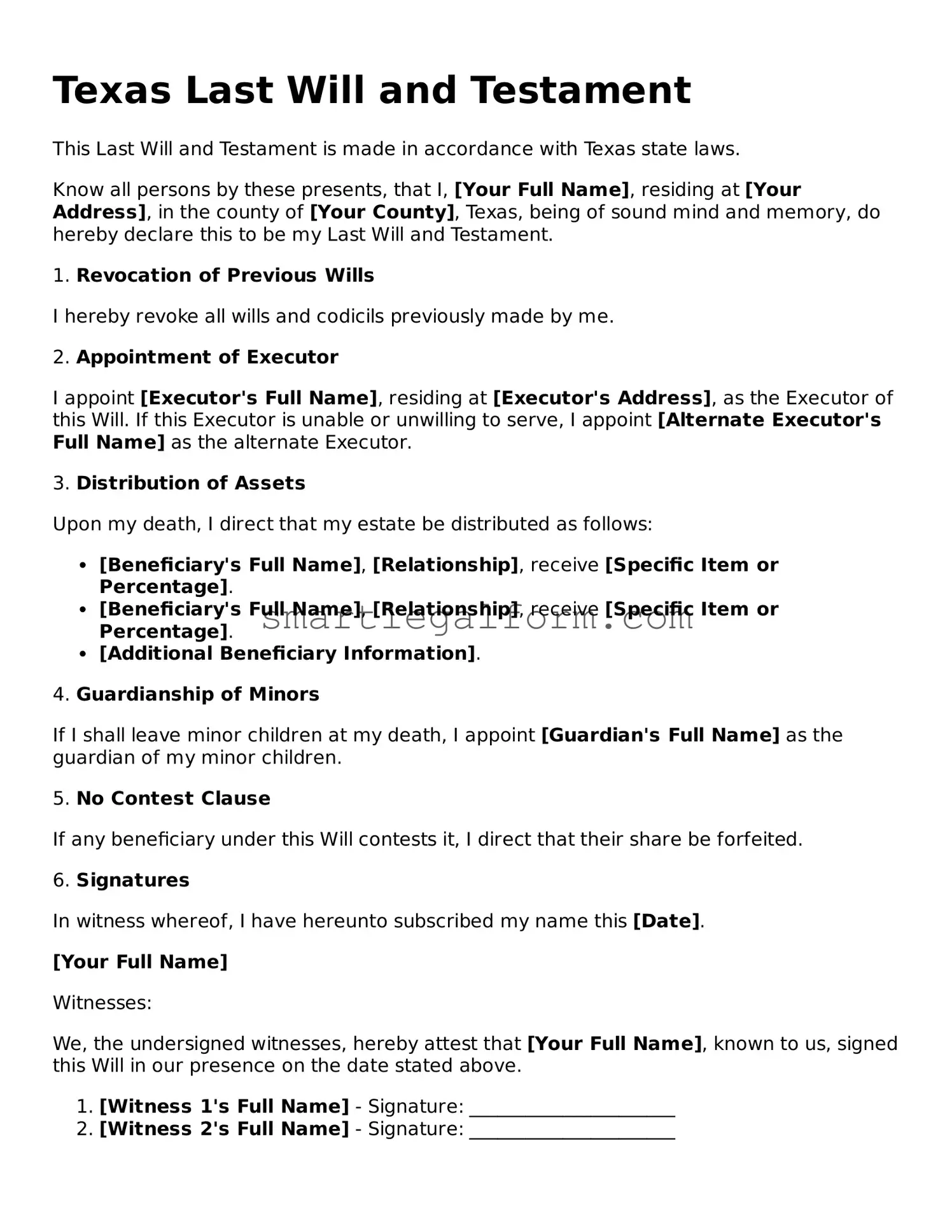

Texas Last Will and Testament

This Last Will and Testament is made in accordance with Texas state laws.

Know all persons by these presents, that I, [Your Full Name], residing at [Your Address], in the county of [Your County], Texas, being of sound mind and memory, do hereby declare this to be my Last Will and Testament.

1. Revocation of Previous Wills

I hereby revoke all wills and codicils previously made by me.

2. Appointment of Executor

I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If this Executor is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

3. Distribution of Assets

Upon my death, I direct that my estate be distributed as follows:

- [Beneficiary's Full Name], [Relationship], receive [Specific Item or Percentage].

- [Beneficiary's Full Name], [Relationship], receive [Specific Item or Percentage].

- [Additional Beneficiary Information].

4. Guardianship of Minors

If I shall leave minor children at my death, I appoint [Guardian's Full Name] as the guardian of my minor children.

5. No Contest Clause

If any beneficiary under this Will contests it, I direct that their share be forfeited.

6. Signatures

In witness whereof, I have hereunto subscribed my name this [Date].

[Your Full Name]

Witnesses:

We, the undersigned witnesses, hereby attest that [Your Full Name], known to us, signed this Will in our presence on the date stated above.

- [Witness 1's Full Name] - Signature: ______________________

- [Witness 2's Full Name] - Signature: ______________________

This document is intended to reflect my wishes concerning the distribution of my property and care of my dependents after my passing.

Common mistakes

Creating a Last Will and Testament is a crucial step in planning for the future, but many people make common mistakes when filling out the Texas form. One frequent error is failing to properly identify beneficiaries. It is essential to clearly state who will inherit your assets. Vague language or incomplete names can lead to confusion and disputes among loved ones after your passing.

Another mistake is neglecting to sign the document in front of the required witnesses. In Texas, a will must be signed by you and at least two witnesses who are not beneficiaries. If this step is overlooked, the will may not be considered valid, which can create significant complications for your estate.

People often forget to update their wills after significant life events. Major changes, such as marriage, divorce, or the birth of a child, can impact your wishes regarding asset distribution. Failing to revise your will to reflect these changes can lead to unintended consequences, leaving loved ones unprotected or assets distributed contrary to your intentions.

Additionally, some individuals mistakenly believe that a handwritten will is automatically valid. While Texas does recognize holographic wills, they must meet specific criteria to be enforceable. If the will is not entirely in your handwriting or lacks the necessary signatures, it may be challenged in court.

Lastly, many people overlook the importance of including a self-proving affidavit. This document can streamline the probate process by confirming the validity of the will without requiring witnesses to testify. Not including this affidavit can prolong the probate process, causing unnecessary delays and costs for your loved ones.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it’s important to be mindful of certain practices. Here’s a list of things you should and shouldn't do:

- Do ensure you are of sound mind and at least 18 years old when creating your will.

- Do clearly state your wishes regarding the distribution of your assets.

- Do sign your will in the presence of at least two witnesses who are not beneficiaries.

- Do keep your will in a safe place and inform your executor where it can be found.

- Do review and update your will periodically, especially after major life events.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date your will; this helps establish its validity.

- Don't attempt to write your will without understanding Texas laws regarding wills.

- Don't leave your will in a place where it can be easily lost or destroyed.

- Don't neglect to consider potential tax implications for your heirs.

Other Last Will and Testament State Forms

Can I Create My Own Will - May stipulate how to handle conflicts that arise from ambiguous language in the will.

For those looking to establish a solid foundation for their business, understanding the importance of an "Arizona Operating Agreement" is key. This critical document provides a clear framework for managing an LLC and delineating member roles, which is vital for successful operations. Learn more about the necessity of this form by visiting creating an effective Operating Agreement.

Free Will Kit Ohio - May incorporate conditions or stipulations for certain inheritances.

Free Last Will and Testament Forms - Clearly states intentions regarding digital legacy, such as social media accounts.

Similar forms

- Living Will: A living will outlines a person's preferences regarding medical treatment in case they become incapacitated. Like a Last Will and Testament, it expresses individual wishes but focuses on healthcare decisions rather than asset distribution.

Durable Power of Attorney: In California, a durable power of attorney enables an individual to appoint someone to handle decisions on their behalf during incapacitation. This form remains valid despite the individual’s inability to act and can encompass financial, personal, and health-related matters, making it essential for comprehensive planning, as discussed on TopTemplates.info.

- Durable Power of Attorney: This document designates someone to make financial or legal decisions on behalf of an individual if they are unable to do so. Similar to a Last Will, it ensures that a person's interests are managed according to their wishes.

- Revocable Trust: A revocable trust allows an individual to place assets into a trust during their lifetime, which can be managed and altered as needed. Upon death, the assets are distributed according to the trust's terms, similar to how a will distributes assets.

- Advance Healthcare Directive: This document combines a living will and a durable power of attorney for healthcare, specifying medical preferences and appointing a healthcare proxy. It ensures that medical decisions align with a person's wishes, akin to how a will addresses final wishes.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to designate who will receive assets upon death. Like a will, they determine the distribution of assets but operate outside of probate.

- Letter of Instruction: A letter of instruction provides guidance to heirs regarding personal wishes, funeral arrangements, and asset distribution. While not legally binding, it complements a will by offering additional context.

- Codicil: A codicil is an amendment or addition to an existing will. It allows individuals to change specific provisions without creating a new will, maintaining the original document's validity while updating it.

- Estate Plan: An estate plan encompasses various legal documents, including wills, trusts, and powers of attorney. It provides a comprehensive strategy for managing and distributing a person's assets, similar to the objectives of a Last Will and Testament.

- Trustee Appointment Document: This document appoints a trustee to manage a trust's assets. It outlines responsibilities and powers, ensuring that the trust is administered according to the deceased's wishes, much like a will governs the distribution of an estate.