Printable Texas Gift Deed Document

Form Preview Example

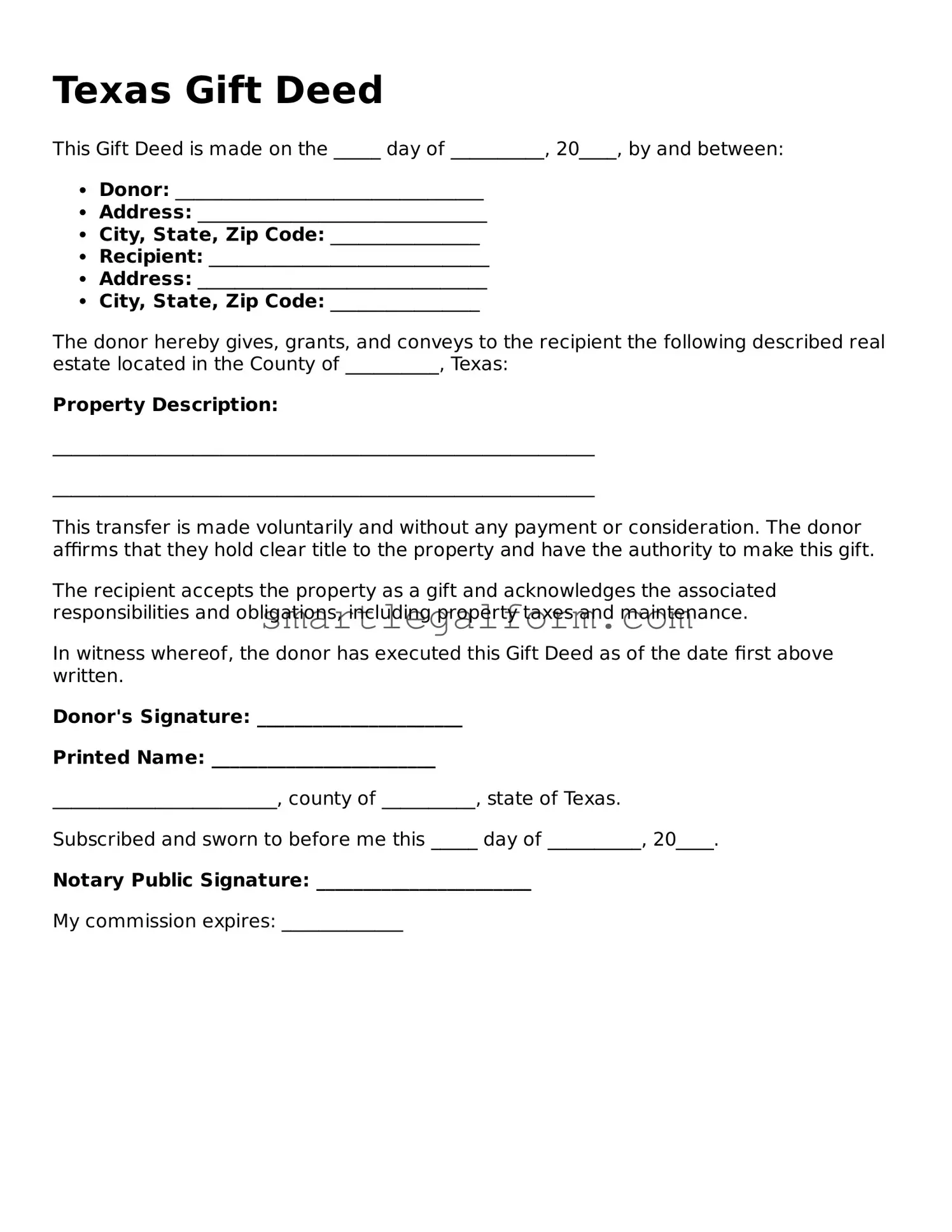

Texas Gift Deed

This Gift Deed is made on the _____ day of __________, 20____, by and between:

- Donor: _________________________________

- Address: _______________________________

- City, State, Zip Code: ________________

- Recipient: ______________________________

- Address: _______________________________

- City, State, Zip Code: ________________

The donor hereby gives, grants, and conveys to the recipient the following described real estate located in the County of __________, Texas:

Property Description:

__________________________________________________________

__________________________________________________________

This transfer is made voluntarily and without any payment or consideration. The donor affirms that they hold clear title to the property and have the authority to make this gift.

The recipient accepts the property as a gift and acknowledges the associated responsibilities and obligations, including property taxes and maintenance.

In witness whereof, the donor has executed this Gift Deed as of the date first above written.

Donor's Signature: ______________________

Printed Name: ________________________

________________________, county of __________, state of Texas.

Subscribed and sworn to before me this _____ day of __________, 20____.

Notary Public Signature: _______________________

My commission expires: _____________

Common mistakes

Filling out the Texas Gift Deed form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is not providing complete information about the property. It’s essential to include the full legal description of the property being gifted. Without this, the deed may not be valid, and the transfer could be challenged later.

Another mistake is failing to identify the grantor and grantee correctly. The grantor is the person giving the gift, while the grantee is the recipient. If names are misspelled or if the wrong names are used, it can create confusion. Always double-check names against official documents to ensure accuracy.

Some individuals overlook the requirement for notarization. A Gift Deed must be signed in front of a notary public to be legally binding. Skipping this step can render the deed ineffective. It’s a simple process that should not be neglected.

Additionally, people often forget to include a statement of consideration. While a gift typically involves no exchange of money, the deed should still mention that the property is being given as a gift. This clarity helps establish the intent behind the transfer and can prevent misunderstandings later on.

Another common issue arises when the deed is not filed with the county clerk’s office. After completing the form, it’s crucial to record the deed to make the transfer official. Failing to file can lead to disputes over ownership in the future.

Lastly, many individuals do not seek legal advice when needed. While it may seem like a simple transaction, consulting with a legal professional can provide valuable insights. They can help ensure that all aspects of the Gift Deed are completed correctly, reducing the risk of future problems.

Dos and Don'ts

When filling out the Texas Gift Deed form, it’s important to ensure accuracy and clarity. Here are some essential do's and don'ts to keep in mind:

- Do ensure that all parties involved are clearly identified, including the giver and the recipient.

- Do provide a detailed description of the property being gifted, including its address and any relevant legal descriptions.

- Do sign the document in front of a notary public to ensure its validity.

- Do keep a copy of the completed form for your records after it has been filed.

- Don't leave any sections blank; incomplete forms can lead to delays or rejections.

- Don't use ambiguous language; be specific about the terms of the gift.

- Don't forget to check local laws regarding property gifts, as regulations can vary.

- Don't rush the process; take your time to review the form before submitting it.

Other Gift Deed State Forms

How to Add Someone to House Title in California - Gifts made during a person's lifetime can impact their estate planning.

Before entering into any agreement, it is essential to understand the implications of a Georgia Hold Harmless Agreement, as it can significantly impact your legal responsibilities. This document is vital for maintaining clarity and protecting interests, especially in situations involving potential risks. For more guidance and templates related to this legal form, refer to TopTemplates.info.

Similar forms

Quitclaim Deed: This document transfers ownership of property without any warranties. Like a Gift Deed, it is often used to transfer property between family members or friends.

Warranty Deed: This deed provides a guarantee that the grantor holds clear title to the property. Similar to a Gift Deed, it conveys ownership but includes assurances about the title's validity.

Transfer on Death Deed: This allows property to pass directly to a beneficiary upon the owner’s death. It shares the intent of a Gift Deed to transfer property without going through probate.

Deed of Trust: This document secures a loan with real property. While it serves a different purpose, it involves the transfer of interest in property, similar to a Gift Deed.

- Employee Handbook: For clarity on workplace policies, the informative Employee Handbook guidelines serve to educate employees about their rights and responsibilities.

Lease Agreement: This document grants temporary use of property in exchange for rent. Although it does not transfer ownership, it establishes rights to use the property, akin to the rights conveyed in a Gift Deed.

Bill of Sale: This document transfers ownership of personal property. Like a Gift Deed, it formalizes the transfer of ownership, though it typically pertains to movable items rather than real estate.

Power of Attorney: This document allows one person to act on another's behalf. It can facilitate the transfer of property, similar to how a Gift Deed is executed by one party for another.

Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it involves a sale, it shares the goal of transferring property ownership, much like a Gift Deed.

Affidavit of Heirship: This document establishes the heirs of a deceased person. It can be used to transfer property after death, similar to the intentions behind a Gift Deed.

Joint Tenancy Agreement: This agreement allows two or more individuals to hold property together. It reflects a shared ownership similar to the intent of a Gift Deed when property is given to family members.