Printable Texas Deed in Lieu of Foreclosure Document

Form Preview Example

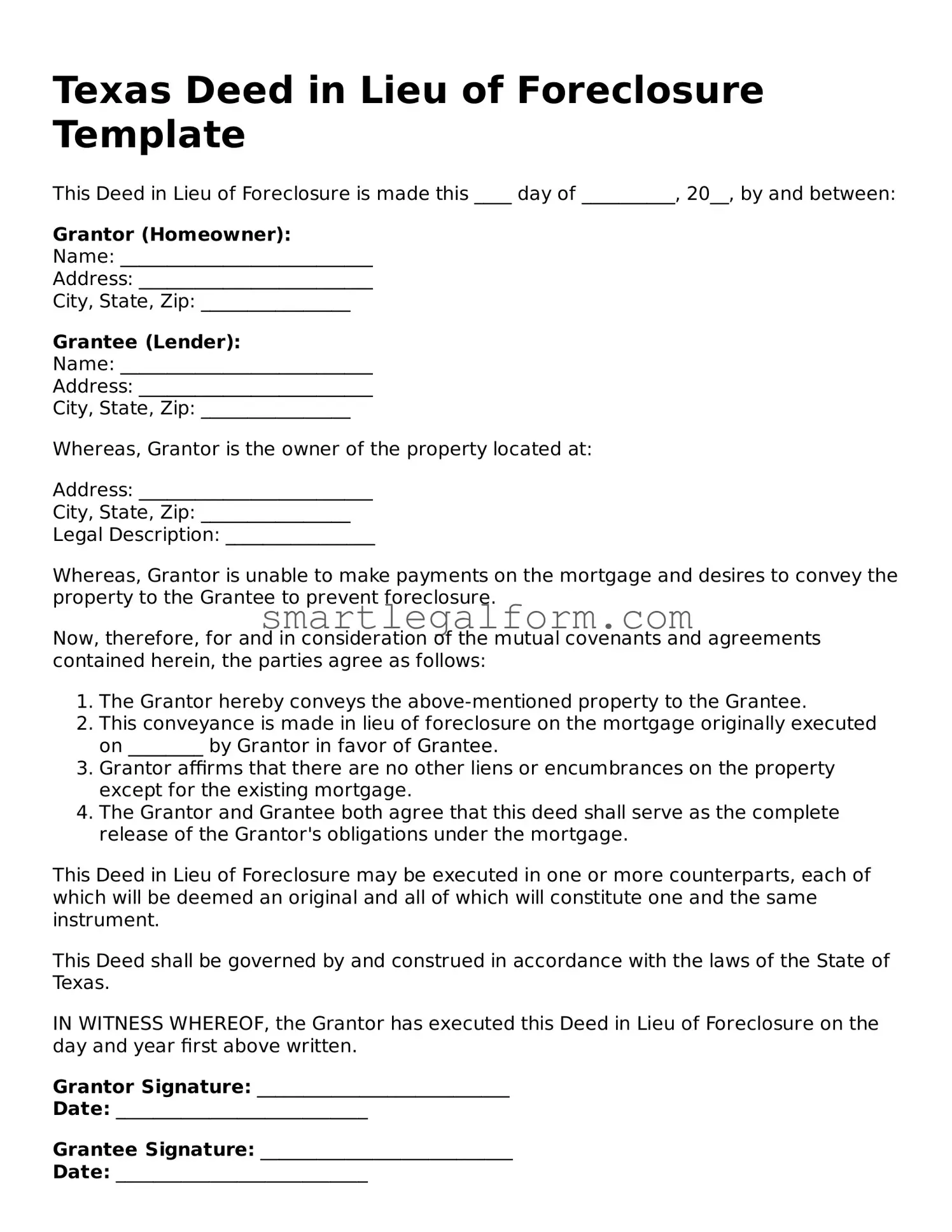

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20__, by and between:

Grantor (Homeowner):

Name: ___________________________

Address: _________________________

City, State, Zip: ________________

Grantee (Lender):

Name: ___________________________

Address: _________________________

City, State, Zip: ________________

Whereas, Grantor is the owner of the property located at:

Address: _________________________

City, State, Zip: ________________

Legal Description: ________________

Whereas, Grantor is unable to make payments on the mortgage and desires to convey the property to the Grantee to prevent foreclosure.

Now, therefore, for and in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

- The Grantor hereby conveys the above-mentioned property to the Grantee.

- This conveyance is made in lieu of foreclosure on the mortgage originally executed on ________ by Grantor in favor of Grantee.

- Grantor affirms that there are no other liens or encumbrances on the property except for the existing mortgage.

- The Grantor and Grantee both agree that this deed shall serve as the complete release of the Grantor's obligations under the mortgage.

This Deed in Lieu of Foreclosure may be executed in one or more counterparts, each of which will be deemed an original and all of which will constitute one and the same instrument.

This Deed shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on the day and year first above written.

Grantor Signature: ___________________________

Date: ___________________________

Grantee Signature: ___________________________

Date: ___________________________

Common mistakes

Filling out the Texas Deed in Lieu of Foreclosure form can be a straightforward process, but many people make common mistakes that can complicate matters. One major mistake is failing to provide accurate property information. It’s essential to include the correct legal description of the property. Omitting this detail can lead to delays or even rejection of the deed.

Another frequent error is not signing the document in the appropriate places. Both the grantor and grantee must sign the deed. If either party neglects to sign, the document may not be valid. This oversight can create unnecessary hurdles in the foreclosure process.

Many individuals also forget to have the deed notarized. In Texas, notarization is a critical step. Without it, the deed may not be enforceable. This step is often overlooked, leading to complications later on.

Some people fail to review the entire document before submission. It’s important to read through all the sections to ensure that everything is complete and correct. Missing a single detail can cause significant issues down the line.

Another common mistake is misunderstanding the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property, which means the homeowner is giving up their rights to it. Some individuals may not fully grasp this, leading to regret after the fact.

Additionally, people often neglect to inform their lender about their intention to execute a Deed in Lieu of Foreclosure. Communication with the lender is crucial. Failing to do so can result in misunderstandings or a lack of cooperation from the lender.

Another mistake involves not consulting with a legal professional. While it may seem like a simple form, legal advice can provide clarity and ensure that all aspects are handled correctly. Skipping this step can lead to avoidable errors.

Some individuals may also rush the process. Filling out the form in haste can lead to careless mistakes. Taking the time to complete the form carefully can prevent future complications.

Lastly, people often forget to keep copies of the completed deed. It’s essential to maintain a record of all documents submitted. This can be invaluable for future reference or if any disputes arise.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things to consider:

- Do provide accurate information about the property, including its legal description.

- Do sign the document in front of a notary public to ensure it is legally binding.

- Do keep copies of all documents for your records after submission.

- Don't rush through the form; take your time to review each section carefully.

- Don't leave any sections blank; fill out all required fields completely.

Other Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Mortgage - It is often easier and quicker than going through a full foreclosure process.

When considering the implications of a Durable Power of Attorney, it's essential to recognize its role in ensuring your affairs are managed according to your wishes. This document is vital for anyone looking to prepare for unforeseen circumstances, and for more resources and templates on how to create one, you can visit toptemplates.info/.

Deed in Lieu of Foreclosure Ny - Signing this document can sometimes lead to better outcomes than filing for bankruptcy or facing foreclosure.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Every state may handle Deeds in Lieu differently, so local laws should always be considered.

Similar forms

A Deed in Lieu of Foreclosure is a legal option for homeowners facing foreclosure. It allows them to transfer the property back to the lender, thereby avoiding the lengthy foreclosure process. Several other documents share similarities with this form. Here are ten of them:

- Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a short sale agreement involves the sale of a property for less than the amount owed on the mortgage. Both options aim to relieve the homeowner from financial burden while providing a solution for the lender.

- Loan Modification Agreement: This document alters the terms of an existing mortgage. Similar to a Deed in Lieu, it seeks to prevent foreclosure by making payments more manageable for the homeowner.

- Forbearance Agreement: A forbearance agreement allows homeowners to temporarily pause or reduce their mortgage payments. This document, like a Deed in Lieu, is designed to help avoid foreclosure.

- Repayment Plan: A repayment plan outlines how a homeowner can catch up on missed mortgage payments. Both this and a Deed in Lieu aim to provide alternatives to foreclosure.

- Quitclaim Deed: A quitclaim deed transfers ownership of a property without any warranties. Similar to a Deed in Lieu, it can be used to convey property back to the lender, though it may not involve a foreclosure situation.

- Hold Harmless Agreement - This legally binding document ensures that one party does not hold the other responsible for any liability or damage during a transaction. It emphasizes the need for clear communication and understanding, and information can be found at OnlineLawDocs.com.

- Property Settlement Agreement: Often used in divorce cases, this document divides property between parties. It shares similarities with a Deed in Lieu in that it involves the transfer of property rights.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. Like a Deed in Lieu, it provides a way for homeowners to manage overwhelming debt and protect their assets.

- Release of Lien: This document removes a lien from a property, often after debts are settled. It serves a similar purpose to a Deed in Lieu by clearing encumbrances from the property.

- Real Estate Purchase Agreement: This agreement outlines the terms of a property sale. In a Deed in Lieu scenario, the property is effectively sold back to the lender, making the two documents closely related.

- Deed of Trust: A deed of trust secures a loan with real property. While it functions differently, it is similar in that it involves property ownership and can lead to foreclosure if payments are not made.

Understanding these documents can help homeowners navigate their options when facing financial difficulties. Each serves a unique purpose but shares the common goal of providing solutions to avoid foreclosure.