Printable Texas Deed Document

Form Preview Example

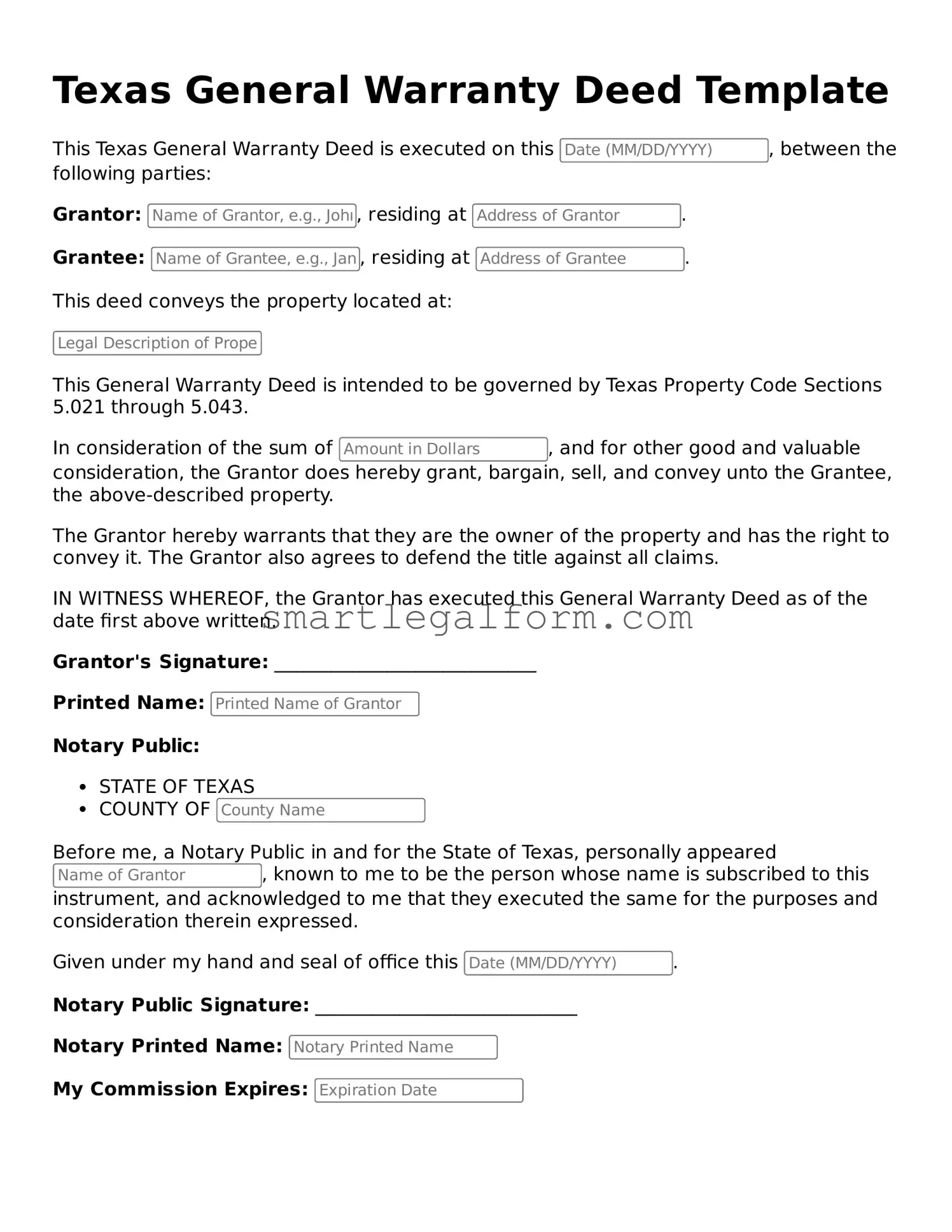

Texas General Warranty Deed Template

This Texas General Warranty Deed is executed on this , between the following parties:

Grantor: , residing at .

Grantee: , residing at .

This deed conveys the property located at:

This General Warranty Deed is intended to be governed by Texas Property Code Sections 5.021 through 5.043.

In consideration of the sum of , and for other good and valuable consideration, the Grantor does hereby grant, bargain, sell, and convey unto the Grantee, the above-described property.

The Grantor hereby warrants that they are the owner of the property and has the right to convey it. The Grantor also agrees to defend the title against all claims.

IN WITNESS WHEREOF, the Grantor has executed this General Warranty Deed as of the date first above written.

Grantor's Signature: ____________________________

Printed Name:

Notary Public:

- STATE OF TEXAS

- COUNTY OF

Before me, a Notary Public in and for the State of Texas, personally appeared , known to me to be the person whose name is subscribed to this instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this .

Notary Public Signature: ____________________________

Notary Printed Name:

My Commission Expires:

Common mistakes

Filling out a Texas Deed form can be a straightforward process, but mistakes often occur that can lead to complications. One common error is failing to include the correct legal description of the property. This description must be precise and should match what is recorded in the county records. Omitting or inaccurately describing the property can result in legal disputes down the line.

Another frequent mistake is not including all necessary parties. The grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. If a spouse is involved in the transaction, their name should also be included to avoid any claims of ownership later.

Many people overlook the importance of signing the deed. A deed is not valid unless it is signed by the grantor. Additionally, signatures must be notarized. Without notarization, the deed may be rejected by the county clerk's office.

Incorrectly filling out the date can also create problems. The date on the deed should reflect the actual date of the transaction. If the date is left blank or filled in incorrectly, it can lead to confusion regarding when ownership was transferred.

Another mistake is neglecting to check for any liens or encumbrances on the property. Before completing the deed, it’s essential to ensure that there are no outstanding debts associated with the property that could affect the transfer. Ignoring this step can lead to unexpected financial liabilities for the grantee.

People sometimes forget to include a statement of consideration. This statement outlines the amount paid for the property, even if it’s a nominal amount. Failing to provide this information can raise questions about the legitimacy of the transaction.

Inaccurate or incomplete information about the property’s boundaries can also be problematic. The deed must reflect the exact boundaries as per the survey or plat map. Errors in this area can lead to disputes with neighbors or issues with property taxes.

Another common oversight is not recording the deed promptly. Once the deed is signed and notarized, it should be filed with the county clerk's office without delay. Delays can complicate the transfer process and may affect the rights of the new owner.

Finally, many individuals do not keep a copy of the recorded deed for their records. It’s crucial to retain a copy of the final document for future reference. Having a copy can help resolve any disputes or questions that may arise regarding property ownership.

Dos and Don'ts

When filling out the Texas Deed form, it’s essential to ensure accuracy and completeness. Here’s a helpful list of things to do and avoid:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Do provide a clear and accurate description of the property being transferred.

- Do include the date of the transaction to establish a clear timeline.

- Do sign the deed in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use white-out or correction fluid on the form; it may invalidate the document.

- Don't forget to include any necessary attachments, such as a legal description of the property.

- Don't assume that the deed will be filed automatically; you must submit it to the appropriate county office.

- Don't rush through the process; take your time to ensure everything is accurate.

Other Deed State Forms

Ohio General Warranty Deed - Not all property transfers require a deed, but it is a best practice for real estate transactions.

Pennsylvania Deed Form - A deed should describe the property being transferred in enough detail to avoid confusion.

When considering a legal strategy, understanding the importance of a General Power of Attorney for financial management is crucial. This document empowers an appointed agent to act on behalf of the principal, making it vital for estate planning and decision-making processes.

Broward County Real Estate Records - Strategic tool in real estate investment planning.

How to Get a Copy of My House Deed - Used in various real estate transactions, including sales and donations.

Similar forms

The Deed form is a crucial document in various legal and property transactions. It shares similarities with several other important documents. Below is a list of nine documents that are comparable to the Deed form, along with explanations of their similarities.

- Title Deed: Like the Deed form, a Title Deed serves to transfer ownership of property. It provides proof of ownership and outlines the rights of the owner.

- Lease Agreement: A Lease Agreement, similar to a Deed, establishes the terms under which one party can use property owned by another. Both documents are legally binding and protect the interests of the involved parties.

- Bill of Sale: This document transfers ownership of personal property, much like a Deed does for real estate. Both documents require signatures to validate the transfer.

- Power of Attorney: A Power of Attorney grants someone the authority to act on another's behalf, similar to how a Deed allows one to transfer property rights. Both require clear intent and consent.

- Trust Agreement: A Trust Agreement, like a Deed, involves the transfer of property rights. It establishes a fiduciary relationship, ensuring that the property is managed according to the trustor's wishes.

- Mortgage Agreement: This document outlines the terms of a loan secured by real estate, similar to a Deed which also involves property. Both documents are critical in real estate transactions and often recorded with the county.

- Last Will and Testament: A legal document that outlines how a person's estate should be distributed after death, ensuring their final wishes are honored and providing clarity for estate management. For more details, visit TopTemplates.info.

- Quitclaim Deed: A Quitclaim Deed is a specific type of Deed that transfers interest in property without guaranteeing the title. It is similar in function to a standard Deed but is often used in situations where the parties know each other.

- Warranty Deed: A Warranty Deed provides a guarantee that the property title is clear, akin to a standard Deed. Both documents serve to protect the buyer from future claims against the property.

- Real Estate Purchase Agreement: This agreement outlines the terms of a property sale, similar to a Deed. It details the rights and responsibilities of both the buyer and seller before the transfer of ownership occurs.