Printable Texas Bill of Sale Document

Form Preview Example

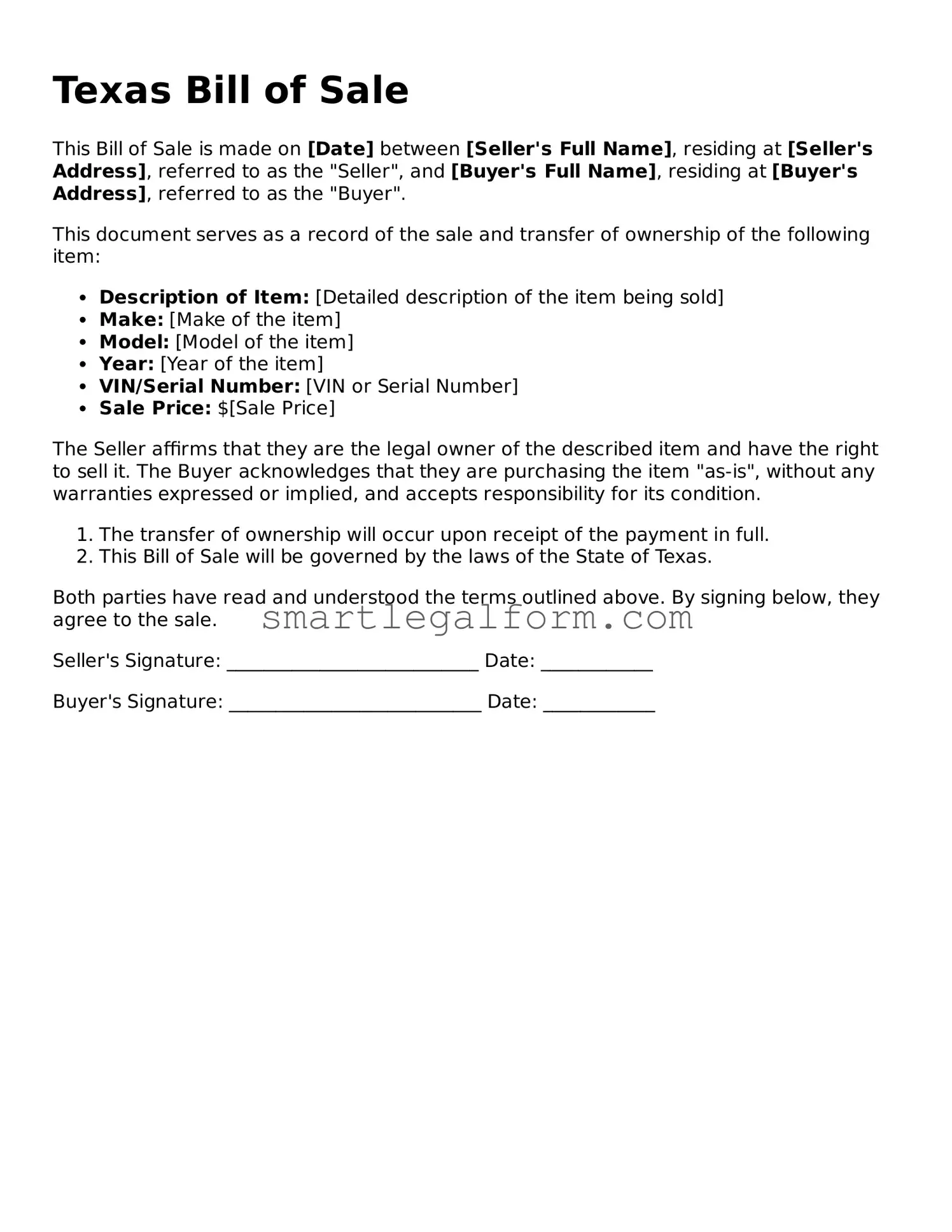

Texas Bill of Sale

This Bill of Sale is made on [Date] between [Seller's Full Name], residing at [Seller's Address], referred to as the "Seller", and [Buyer's Full Name], residing at [Buyer's Address], referred to as the "Buyer".

This document serves as a record of the sale and transfer of ownership of the following item:

- Description of Item: [Detailed description of the item being sold]

- Make: [Make of the item]

- Model: [Model of the item]

- Year: [Year of the item]

- VIN/Serial Number: [VIN or Serial Number]

- Sale Price: $[Sale Price]

The Seller affirms that they are the legal owner of the described item and have the right to sell it. The Buyer acknowledges that they are purchasing the item "as-is", without any warranties expressed or implied, and accepts responsibility for its condition.

- The transfer of ownership will occur upon receipt of the payment in full.

- This Bill of Sale will be governed by the laws of the State of Texas.

Both parties have read and understood the terms outlined above. By signing below, they agree to the sale.

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

Common mistakes

When filling out the Texas Bill of Sale form, individuals often overlook important details that can lead to complications later on. One common mistake is failing to include all necessary information about the buyer and seller. Each party's full name, address, and contact information should be clearly stated. Omitting any of these details can create confusion and may affect the validity of the document.

Another frequent error is neglecting to provide a thorough description of the item being sold. It is essential to include specific details such as the make, model, year, and Vehicle Identification Number (VIN) for vehicles. For other items, include any relevant serial numbers or distinguishing features. A vague description can lead to disputes regarding what was actually sold.

People also often forget to indicate the sale price clearly. The amount should be written in both numeric and written form to avoid misunderstandings. If the price is not clearly stated, it may raise questions about the terms of the sale later on.

Additionally, many individuals fail to sign the form. Both the buyer and seller must sign the Bill of Sale for it to be legally binding. Without signatures, the document lacks the necessary authority and may not be enforceable in the event of a dispute.

Another mistake is not dating the Bill of Sale. Including the date of the transaction is crucial. It establishes when the sale occurred, which can be important for legal and tax purposes. Without a date, the document may lack clarity regarding the timeline of the transaction.

Some people mistakenly assume that a notary signature is not necessary. While it is not always required, having the Bill of Sale notarized adds an extra layer of protection and authenticity. It can be especially beneficial in cases involving significant transactions or disputes.

Furthermore, individuals sometimes forget to keep a copy of the completed Bill of Sale for their records. It is essential to retain a copy for future reference, especially if questions arise about the transaction. Having documentation can help resolve any potential issues.

People may also neglect to check for any specific state requirements that apply to their transaction. Different types of sales may have unique regulations, and failing to comply with these can lead to legal challenges down the road. Researching state laws before completing the form is advisable.

Lastly, many individuals do not review the completed Bill of Sale for errors before submitting it. Typos or incorrect information can invalidate the document or lead to misunderstandings. Taking the time to carefully review the form can prevent unnecessary complications in the future.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it’s important to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the buyer and seller.

- Do include a clear description of the item being sold.

- Do specify the sale price of the item.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any required fields blank.

- Don't use vague terms to describe the item; be specific.

- Don't forget to include any applicable taxes or fees.

- Don't rush through the process; take your time to ensure accuracy.

- Don't alter the form after it has been signed by both parties.

Other Bill of Sale State Forms

Dealer Bill of Sale Template - This document is crucial for high-value items, providing proof of ownership and transaction history.

Bill of Sale Transfer - Serves as confirmation of the completion of a sale process.

Ohio Bill of Sale Word Template - The importance of a Bill of Sale can be seen in its ability to safeguard the interests of both parties.

Selling a Car Privately for Cash - The Bill of Sale should be retained by both parties for future reference and verification.

Similar forms

- Purchase Agreement: This document outlines the terms and conditions of a sale between a buyer and a seller. Like a Bill of Sale, it confirms the transaction and can include details such as price, payment terms, and descriptions of the item being sold.

- Lease Agreement: A lease agreement allows one party to use property owned by another for a specified time in exchange for payment. Similar to a Bill of Sale, it provides legal recognition of the transfer of rights, though it does not transfer ownership.

- Gift Deed: This document formalizes the transfer of property or assets as a gift. While a Bill of Sale typically involves a sale, a gift deed also serves to document the transfer of ownership without any exchange of money.

- Warranty Deed: A warranty deed is used to transfer real estate and guarantees that the seller holds clear title to the property. Like a Bill of Sale, it is a legal instrument that establishes ownership and protects the buyer's rights.

- Quitclaim Deed: This document transfers whatever interest the seller has in a property without any warranties. Similar to a Bill of Sale, it conveys ownership but does not guarantee the quality of the title being transferred.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a future date. While it does not transfer ownership like a Bill of Sale, it is often used in conjunction with sales transactions to outline payment terms.

- Contract for Deed: This is a type of real estate sales agreement where the buyer makes payments to the seller over time. Ownership is transferred only after the final payment, making it similar to a Bill of Sale in that it documents the sale process.

- Title Transfer Form: This form is used to officially transfer the title of a vehicle or property from one person to another. Like a Bill of Sale, it serves as proof of the change in ownership.

- Sales Receipt: A sales receipt is a document that acknowledges the payment for goods or services. It is similar to a Bill of Sale in that it provides proof of the transaction and details about what was purchased.

- Inventory List: An inventory list details items owned by a person or business. While it does not serve as a legal transfer document like a Bill of Sale, it can accompany such a document to provide a comprehensive overview of the items involved in a sale.