Free Stock Transfer Ledger Form

Form Preview Example

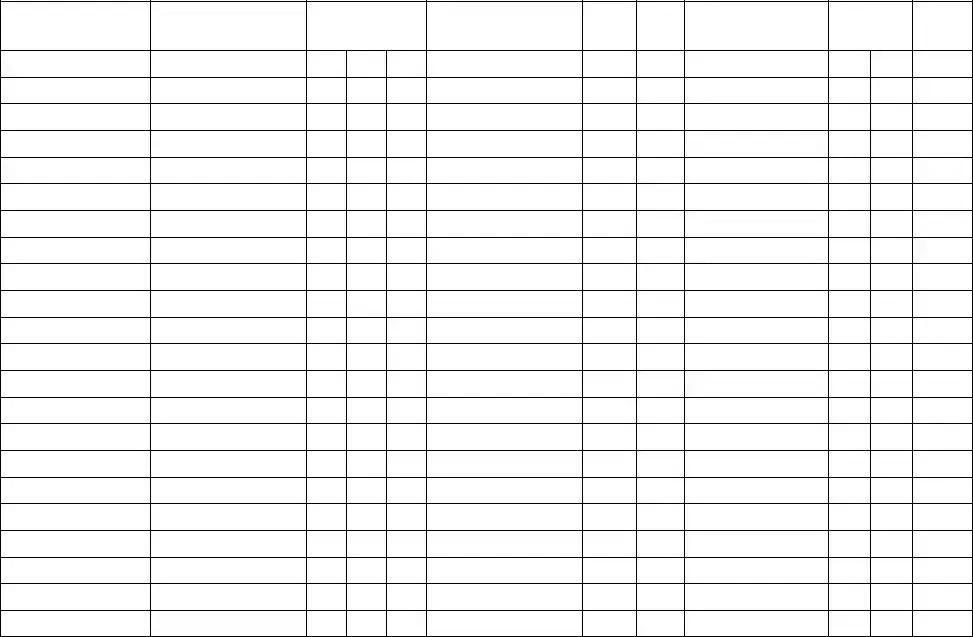

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Common mistakes

Filling out the Stock Transfer Ledger form requires attention to detail. One common mistake is failing to enter the corporation's name correctly. This information is crucial as it identifies the entity involved in the stock transfer. Omitting or misspelling the name can lead to confusion and potential legal issues.

Another frequent error occurs in the section for the name of the stockholder. Some individuals neglect to provide the full legal name, which can create discrepancies in ownership records. It is essential to ensure that the name matches the one registered with the corporation.

People often overlook the place of residence of the stockholder. This detail is important for record-keeping and may be required for tax purposes. Incomplete or inaccurate addresses can complicate future communications regarding the stockholder’s shares.

When it comes to the certificates issued, individuals may forget to include the certificate numbers. Each certificate represents a specific quantity of shares, and failing to provide these numbers can lead to difficulties in tracking ownership and verifying the transfer.

The date of issuance for the shares is another area where mistakes frequently occur. Some people may leave this field blank or input the wrong date. This information is vital for establishing the timeline of ownership and the validity of the shares.

In the section regarding shares transferred, individuals sometimes fail to specify from whom the shares were transferred. This detail is essential for maintaining accurate records and understanding the chain of ownership. Without this information, the transfer may be questioned.

Additionally, the amount paid for the shares can be incorrectly filled out. Some individuals might leave this blank or provide an inaccurate figure. This information is necessary for financial records and may affect tax implications for both the buyer and seller.

Another common error involves the date of transfer. Some people forget to include this critical piece of information, which can lead to confusion regarding when the ownership officially changed hands. Accurate dates are essential for legal and financial documentation.

Finally, individuals often neglect to indicate the certificates surrendered when transferring shares. This step is vital for ensuring that the old certificates are properly accounted for and that the new ownership is reflected in the records. Missing this detail can result in duplicate shares being issued or confusion in ownership records.

Dos and Don'ts

When completing the Stock Transfer Ledger form, attention to detail is crucial. Here are five essential dos and don’ts to keep in mind:

- Do ensure that the corporation’s name is accurately entered at the top of the form.

- Don’t leave any fields blank; incomplete information can lead to processing delays.

- Do verify that the certificate numbers are correct and correspond to the issued shares.

- Don’t forget to include the date of transfer, as it is important for record-keeping.

- Do double-check the number of shares held after the transfer to ensure accuracy.

By following these guidelines, you can help ensure that the Stock Transfer Ledger is filled out correctly and efficiently.

Other PDF Documents

Dekalb County Water New Service - Filling out this form is the first step to getting water service in your home or business.

When engaging in activities that involve potential risks, it is essential to understand the implications of a Hold Harmless Agreement. Specifically, in Texas, these agreements serve as vital legal protections, ensuring that parties involved are clear about their responsibilities and liabilities. For those seeking to delve deeper into the specifics of such agreements, resources like TopTemplates.info can provide invaluable guidance and templates to navigate the legal nuances effectively.

4 Point Inspection Form - Photos are required to accompany the form, providing visual evidence of the property's condition.

Similar forms

The Stock Transfer Ledger form serves a critical role in tracking the ownership and transfer of stock shares within a corporation. It bears similarities to several other important documents used in corporate governance and stock management. Below are four documents that share characteristics with the Stock Transfer Ledger form:

- Shareholder Register: Like the Stock Transfer Ledger, the Shareholder Register maintains a record of all shareholders, including their names and addresses. It also tracks the number of shares owned by each shareholder, ensuring accurate representation of ownership within the corporation.

- Stock Certificate: A Stock Certificate serves as tangible proof of ownership of shares in a corporation. Similar to the Stock Transfer Ledger, it includes essential details such as the shareholder's name, the number of shares, and the certificate number, facilitating the identification of ownership and transfer records.

- FedEx Bill of Lading: The FedEx Bill of Lading serves as an essential shipping document, similar to other forms in corporate management, ensuring clarity in agreements while providing a link to more information: https://documentonline.org/blank-fedex-bill-of-lading.

- Stock Transfer Agreement: This document outlines the terms and conditions under which shares are transferred from one party to another. It complements the Stock Transfer Ledger by providing a legal framework for the transfer process, ensuring that all parties understand their rights and obligations during the transaction.

- Annual Report: The Annual Report includes comprehensive information about the corporation’s financial performance and operations. While it differs in focus, it often summarizes stockholder information and may reference changes in stock ownership, linking it back to the records maintained in the Stock Transfer Ledger.