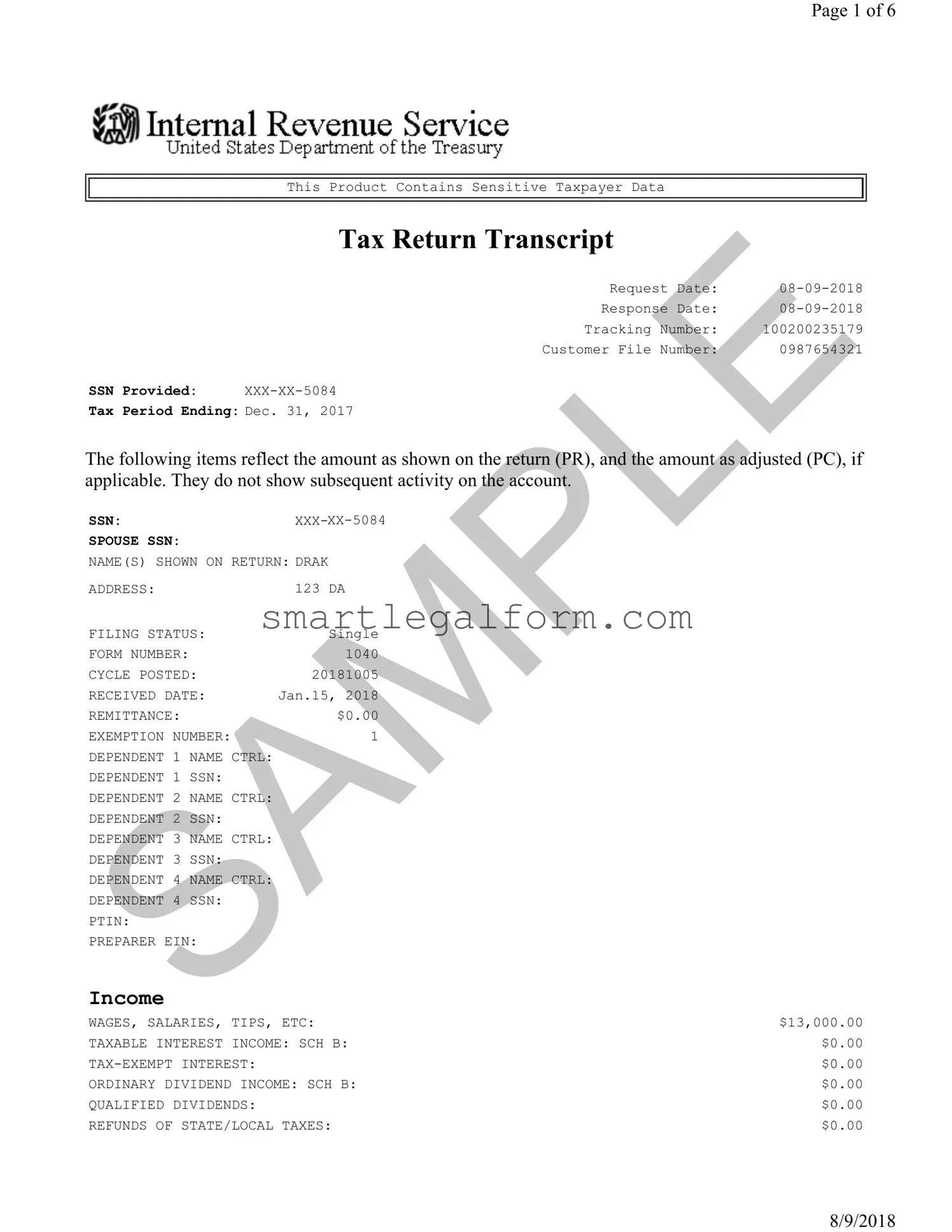

Free Sample Tax Return Transcript Form

Form Preview Example

Page 1 of 6

This Product Contains Sensitive Taxpayer Data

Tax Return Transcript

|

Request Date: |

|

|

Response Date: |

|

|

Tracking Number: |

100200235179 |

|

Customer File Number: |

0987654321 |

SSN Provided: |

|

Tax Period Ending: Dec. 31, 2017

The following items reflect the amount as shown on the return (PR), and the amount as adjusted (PC), if applicable. They do not show subsequent activity on the account.

SSN: |

|

|

SPOUSE SSN: |

|

|

NAME(S) SHOWN ON RETURN: DRAK |

||

ADDRESS: |

|

123 DA |

FILING STATUS: |

Single |

|

FORM NUMBER: |

|

1040 |

CYCLE POSTED: |

20181005 |

|

RECEIVED DATE: |

Jan.15, 2018 |

|

REMITTANCE: |

|

$0.00 |

EXEMPTION NUMBER: |

1 |

|

DEPENDENT 1 |

N ME CTRL: |

|

DEPENDENT 1 |

SSN: |

|

DEPENDENT 2 |

N ME CTRL: |

|

DEPENDENT 2 |

SSN: |

|

DEPENDENT 3 |

N ME CTRL: |

|

DEPENDENT 3 |

N: |

|

DEPENDENT 4 |

N ME CTRL: |

|

DEPENDENT 4 |

N: |

|

PTIN: |

|

|

PREPARER EIN: |

|

|

Income

WAGES, SALARIES, TIPS, ETC: |

$13,000.00 |

TAXABLE INTEREST INCOME: SCH B: |

$0.00 |

$0.00 |

|

ORDINARY DIVIDEND INCOME: SCH B: |

$0.00 |

QUALIFIED DIVIDENDS: |

$0.00 |

REFUNDS OF STATE/LOCAL TAXES: |

$0.00 |

8/9/2018

Page 2 of 6

ALIMONY RECEIVED: |

|

$0.00 |

BUSINESS INCOME OR LOSS (Schedule C): |

|

$2,500.00 |

BUSINESS INCOME OR LOSS: SCH C PER COMPUTER: |

|

$2,500.00 |

CAPITAL GAIN OR LOSS: (Schedule D): |

|

$0.00 |

CAPITAL GAINS OR LOSS: SCH D PER COMPUTER: |

|

$0.00 |

OTHER GAINS OR LOSSES (Form 4797): |

|

$0.00 |

TOTAL IRA DISTRIBUTIONS: |

|

$0.00 |

TAXABLE IRA DISTRIBUTIONS: |

|

$0.00 |

TOTAL PENSIONS AND ANNUITIES: |

|

$0.00 |

SAMPLE |

$0.00 |

|

TAXABLE PENSION/ANNUITY AMOUNT: |

|

|

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E): |

|

$0.00 |

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E) PER COMPUTER: |

|

$0.00 |

RENT/ROYALTY INCOME/LOSS PER COMPUTER: |

|

$0.00 |

ESTATE/TRUST INCOME/LOSS PER COMPUTER: |

|

$0.00 |

|

$0.00 |

|

FARM INCOME OR LOSS (Schedule F): |

|

$0.00 |

FARM INCOME OR LOSS (Schedule F) PER COMPUTER: |

|

$0.00 |

UNEMPLOYMENT COMPENSATION: |

|

$0.00 |

TOTAL SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS PER COM UTER: |

|

$0.00 |

OTHER INCOME: |

|

$0.00 |

SCHEDULE EIC SE INCOME PER COMPUTER: |

|

$2,323.00 |

SCHEDULE EIC EARNED INCOME PER COMPUTER: |

$15,323.00 |

|

SCH EIC DISQUALIFIED INC COMPUTER: |

|

$0.00 |

TOTAL INCOME: |

$15,500.00 |

|

TOTAL INCOME PER COMPUTER: |

$15,500.00 |

|

Adjustments to Income

EDUCATOR EXPENSES: |

|

$0.00 |

||

EDUCATOR EXPENSES PER CO PUTER: |

$0.00 |

|||

RESERVIST AND OTHER |

BUSINESS EXPENSE: |

$0.00 |

||

HEALTH |

VINGS |

CCT |

DEDUCTION: |

$0.00 |

HEALTH S VINGS |

CCT |

DEDUCTION PER CO PTR: |

$0.00 |

|

MOVING EXPENSES: F3903: |

$0.00 |

|||

SELF EMPLOYMENT T X DEDUCTION: |

$177.00 |

|||

SELF EMPLOYMENT T X DEDUCTION PER COMPUTER: |

$177.00 |

|||

ELF EMPLOYMENT T X DEDUCTION VERIFIED: |

$0.00 |

|||

KEOGH/ EP CONTRIBUTION DEDUCTION: |

$0.00 |

|||

$0.00 |

||||

EARLY WITHDRAWAL OF |

AVINGS PENALTY: |

$0.00 |

||

ALIMONY PAID |

N: |

|

|

|

ALIMONY PAID: |

|

|

$0.00 |

|

IRA DEDUCTION: |

|

|

$0.00 |

|

IRA DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION VERIFIED: |

$0.00 |

|||

TUITION AND FEES DEDUCTION: |

$0.00 |

|||

TUITION AND FEES DEDUCTION PER COMPUTER: |

$0.00 |

|||

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION: |

$0.00 |

|||

8/9/2018

Page 3 of 6

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

OTHER ADJUSTMENTS: |

|

|

$0.00 |

||

ARCHER MSA DEDUCTION: |

|

$0.00 |

|||

ARCHER MSA DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TOTAL ADJUSTMENTS: |

|

|

$177.00 |

||

TOTAL ADJUSTMENTS PER COMPUTER: |

|

$177.00 |

|||

ADJUSTED GROSS INCOME: |

$15,323.00 |

||||

ADJUSTED GROSS INCOME PER COMPUTER: |

$15,323.00 |

||||

SAMPLE |

|

||||

Tax and Credits |

|

|

|||

|

|

NO |

|||

BLIND: |

|

|

|

|

NO |

SPOUSE |

|

|

NO |

||

SPOUSE BLIND: |

|

|

NO |

||

STANDARD DEDUCTION PER COMPUTER: |

|

$4,850.00 |

|||

ADDITIONAL STANDARD DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TAX TABLE INCOME PER COMPUTER: |

$10,473.00 |

||||

EXEMPTION AMOUNT PER COMPUTER: |

|

$3,100.00 |

|||

TAXABLE INCOME: |

|

|

$7,373.00 |

||

TAXABLE INCOME PER COMPUTER: |

|

$7,373.00 |

|||

TOTAL POSITIVE INCOME PER COMPUTER: |

$15,500.00 |

||||

TENTATIVE TAX: |

|

|

$749.00 |

||

TENTATIVE TAX PER COMPUTER: |

|

$749.00 |

|||

FORM 8814 ADDITIONAL TAX AMOUNT: |

|

$0.00 |

|||

TAX ON INCOME LESS SOC SEC INCOME PER COM UTER: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE MINIMUM TAX: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE INI UM TAX PER CO UTER: |

|

$0.00 |

|||

FOREIGN TAX CREDIT: |

|

$0.00 |

|||

FOREIGN TAX CREDIT PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION TAX PER CO PUTER: |

|

$0.00 |

|||

EXCESS ADVANCE PREMIUM TAX CREDIT REPAY ENT OUNT: |

|

$0.00 |

|||

EXCESS |

DV NCE PREMIUM T X CREDIT REP Y ENT VERIFIED A OUNT: |

|

$0.00 |

||

CHILD & DEPENDENT C RE CREDIT: |

|

$0.00 |

|||

CHILD & DEPENDENT C RE CREDIT PER COMPUTER: |

|

$0.00 |

|||

CREDIT FOR ELDERLY |

ND DIS BLED: |

|

$0.00 |

||

CREDIT FOR ELDERLY |

ND DIS BLED PER COMPUTER: |

|

$0.00 |

||

EDUCATION CREDIT: |

|

|

$0.00 |

||

EDUCATION CREDIT PER COMPUTER: |

|

$0.00 |

|||

GRO EDUC TION CREDIT PER COMPUTER: |

|

$0.00 |

|||

RETIREMENT |

AVINGS CNTRB CREDIT: |

|

$0.00 |

||

RETIREMENT |

AVINGS CNTRB CREDIT PER COMPUTER: |

|

$0.00 |

||

PRIM RET |

|

AV CNTRB: F8880 LN6A: |

|

$0.00 |

|

EC RET |

AV CNTRB: F8880 LN6B: |

|

$0.00 |

||

TOTAL RETIREMENT |

AVINGS CONTRIBUTION: F8880 CMPTR: |

|

$0.00 |

||

RESIDENTIAL ENERGY CREDIT: |

|

$0.00 |

|||

RESIDENTIAL ENERGY CREDIT PER COMPUTER: |

|

$0.00 |

|||

CHILD TAX CREDIT: |

|

|

$0.00 |

||

CHILD TAX CREDIT PER COMPUTER: |

|

$0.00 |

|||

ADOPTION CREDIT: F8839: |

|

$0.00 |

|||

ADOPTION CREDIT PER COMPUTER: |

|

$0.00 |

|||

8/9/2018

Page 4 of 6

FORM 8396 MORTGAGE CERTIFICATE CREDIT: |

$0.00 |

|

FORM 8396 MORTGAGE CERTIFICATE CREDIT PER COMPUTER: |

$0.00 |

|

F3800, F8801 AND OTHER CREDIT AMOUNT: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS PER COMPUTER: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801 PER COMPUTER: |

$0.00 |

|

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT AMOUNT: |

$0.00 |

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

SAMPLE |

$0.00 |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT AMOUNT: |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

OTHER CREDITS: |

$0.00 |

|

TOTAL CREDITS: |

$0.00 |

|

TOTAL CREDITS PER COMPUTER: |

$0.00 |

|

INCOME TAX AFTER CREDITS PER COMPUTER: |

$749.00 |

|

Other Taxes

SE TAX: |

|

$354.00 |

SE TAX PER COMPUTER: |

|

$354.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS: |

|

$0.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNRE ORTED TI |

ER COM UTER: |

$0.00 |

TAX ON QUALIFIED PLANS F5329 (PR): |

|

$0.00 |

TAX ON QUALIFIED PLANS F5329 PER COM UTER: |

|

$0.00 |

IRAF TAX PER COMPUTER: |

|

$0.00 |

TP TAX FIGURES (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

IMF TOTAL TAX (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

OTHER TAXES PER COMPUTER: |

|

$0.00 |

UNPAID FICA ON REPORTED TIPS: |

|

$0.00 |

OTHER TAXES: |

|

$0.00 |

RECAPTURE TAX: F8611: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES PER CO PUTER: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY VERIFIED: |

|

$0.00 |

HEALTH COVER GE REC PTURE: F8885: |

|

$0.00 |

RECAPTURE T XES: |

|

$0.00 |

TOTAL SSESSMENT PER COMPUTER: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES PER COMPUTER: |

|

$1,103.00 |

Payments

FEDERAL INCOME TAX WITHHELD: |

$1,000.00 |

|

HEALTH CARE: INDIVIDUAL RESPONSIBILITY: |

$0.00 |

|

HEALTH CARE |

0 |

|

E TIMATED TAX |

PAYMENT : |

$0.00 |

OTHER PAYMENT CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT PER COMPUTER: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT VERIFIED: |

$0.00 |

|

EARNED INCOME CREDIT: |

$0.00 |

|

EARNED INCOME CREDIT PER COMPUTER: |

$0.00 |

|

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY: |

$0.00 |

|

8/9/2018

Page 5 of 6

SCHEDULE 8812 |

NONTAXABLE COMBAT PAY: |

$0.00 |

EXCESS SOCIAL |

SECURITY & RRTA TAX WITHHELD: |

$0.00 |

SCHEDULE 8812 |

TOT SS/MEDICARE WITHHELD: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT PER COMPUTER: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT VERIFIED: |

$0.00 |

AMOUNT PAID WITH FORM 4868: |

$0.00 |

|

FORM 2439 REGULATED INVESTMENT COMPANY CREDIT: |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS: |

$0.00 |

|

SAMPLE |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS PER COMPUTER: |

||

HEALTH COVERAGE TX CR: F8885: |

$0.00 |

|

PREMIUM TAX CREDIT AMOUNT: |

$0.00 |

|

PREMIUM TAX CREDIT VERIFIED AMOUNT: |

$0.00 |

|

PRIMARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

|

SECONDARY NAP |

FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNT: |

$0.00 |

|

FORM 5405 TOTAL HOMEBUYERS CREDIT REPAYMENT PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER (2): |

$0.00 |

|

FORM 2439 AND |

OTHER CREDITS: |

$0.00 |

TOTAL PAYMENTS: |

$1,000.00 |

|

TOTAL PAYMENTS PER COMPUTER: |

$1,000.00 |

|

Refund or Amount Owed

AMOUNT YOU OWE: |

$103.00 |

APPLIED TO NEXT YEAR'S ESTIMATED TAX: |

$0.00 |

ESTIMATED TAX PENALTY: |

$0.00 |

TAX ON INCOME LESS STATE REFUND PER CO UTER: |

$0.00 |

BAL DUE/OVER PYMT USING TP FIG PER CO PUTER: |

$103.00 |

BAL DUE/OVER PYMT USING CO PUTER FIGURES: |

$103.00 |

FORM 8888 TOTAL REFUND PER CO PUTER: |

$0.00 |

Third Party Designee

THIRD P RTY DESIGNEE ID NU BER: |

|

AUTHORIZ TION INDIC TOR: |

0 |

THIRD RTY DESIGNEE N ME: |

|

Schedule

OCIAL |

ECURITY NUMBER: |

|

EMPLOYER |

ID NUMBER: |

|

BU INE |

NAME: |

|

DE CRIPTION OF BU INE /PROFESSION: |

DRAK |

|

NAICS CODE: |

000000 |

|

ACCT MTHD: |

|

|

FIR T TIME CHEDULE C FILED: |

N |

|

TATUTORY EMPLOYEE IND: |

N |

|

INCOME

GROSS RECEIPTS OR SALES: |

$2,700.00 |

RETURNS AND ALLOWANCES: |

$0.00 |

NET GROSS RECEIPTS: |

$0.00 |

COST OF GOODS SOLD: |

$0.00 |

SCHEDULE C FORM 1099 REQUIRED: |

NONE |

8/9/2018

Page 6 of 6

SCHEDULE C FORM 1099 FILED: |

NONE |

OTHER INCOME: |

$0.00 |

EXPENSES

CAR AND TRUCK EXPENSES: |

$0.00 |

DEPRECIATION: |

$0.00 |

INSURANCE (OTHER THAN HEALTH): |

$0.00 |

MORTGAGE INTEREST: |

$0.00 |

LEGAL AND PROFESSIONAL SERVICES: |

$0.00 |

SAMPLE |

$0.00 |

REPAIRS AND MAINTENANCE: |

|

TRAVEL: |

$0.00 |

MEALS AND ENTERTAINMENT: |

$0.00 |

WAGES: |

$0.00 |

OTHER EXPENSES: |

$0.00 |

TOTAL EXPENSES: |

$200.00 |

EXP FOR BUSINESS USE OF HOME: |

$0.00 |

SCH C NET PROFIT OR LOSS PER COMPUTER: |

$2,500.00 |

AT RISK CD: |

|

OFFICE EXPENSE AMOUNT: |

$0.00 |

UTILITIES EXPENSE AMOUNT: |

$0.00 |

COST OF GOODS SOLD

INVENTORY |

AT |

BEGINNING OF |

YEAR: |

$0.00 |

INVENTORY |

AT |

END OF YEAR: |

|

$0.00 |

Schedule

SSN OF |

|

NET FARM PROFIT/LOSS: SCH F: |

$0.00 |

CONSERVATION RESERVE PROGRAM PAY ENTS: |

$0.00 |

NET NONFARM PROFIT/LOSS: |

$2,500.00 |

TOTAL SE INCOME: |

$2,500.00 |

SE QUARTERS COVERED: |

4 |

TOTAL SE TAX PER COMPUTER: |

$353.12 |

SE INCOME COMPUTER VERIFIED: |

$0.00 |

SE INCOME PER COMPUTER: |

$2,308.00 |

TOTAL NET E RNINGS PER CO PUTER: |

$2,308.00 |

LONG FORM ONLY

TENTATIVE |

CHURCH RNINGS: |

$0.00 |

|

TOTAL SOC |

SEC & RR W GES: |

$0.00 |

|

E |

T X |

COMPUTER: |

$286.19 |

E MEDIC RE INCOME PER COMPUTER: |

$2,308.00 |

||

E MEDICARE TAX PER COMPUTER: |

$66.93 |

||

E FARM OPTION METHOD U ED: |

0 |

||

E OPTIONAL METHOD INCOME: |

$0.00 |

||

Form 8863 - Education Credits (Hope and Lifetime Learning Credits)

PART III - ALLOWABLE EDUCATION CREDITS

GROSS EDUCATION CR PER COMPUTER: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT PER COMPUTER: |

$0.00 |

|

|

|

This Product Contains Sensitive Taxpayer Data |

|

|

|

|

|

|

8/9/2018

Common mistakes

Filling out the Sample Tax Return Transcript form can be a daunting task, and mistakes are common. One frequent error occurs when individuals fail to double-check their Social Security Numbers (SSNs). Even a single incorrect digit can lead to significant delays or complications with tax processing. It is crucial to ensure that the SSN provided matches the one issued by the Social Security Administration.

Another common mistake is neglecting to verify the tax period ending date. Many people may overlook this detail, which can lead to confusion about which tax year the transcript pertains to. Always confirm that the date aligns with the tax year you are referencing to avoid any discrepancies.

Some individuals mistakenly leave out dependent information or fail to include all dependents. This can affect eligibility for various credits and deductions. It is essential to accurately list all dependents, including their names and Social Security Numbers, to ensure that you receive the appropriate benefits.

Many people also overlook the importance of checking income figures. Errors in reporting wages, salaries, or other income can result in incorrect tax calculations. It is advisable to cross-reference these figures with your W-2s or other income statements to ensure accuracy.

Another area where mistakes often occur is in the adjustments to income section. Individuals sometimes forget to include deductions they are eligible for, such as educator expenses or student loan interest. Missing these deductions can lead to a higher tax liability than necessary, so it is important to review all potential adjustments carefully.

Failing to sign and date the form is a frequent oversight. Without a signature, the form may be considered invalid, delaying processing and potentially resulting in penalties. Always ensure that you have signed and dated the form before submission.

Some individuals may also neglect to provide the necessary third-party designee information. This section allows someone else to discuss the tax return with the IRS on your behalf. If you intend for someone to assist you, ensure that their information is filled out correctly.

Lastly, not keeping a copy of the completed form for personal records is a mistake that can lead to future complications. Having a copy can be invaluable for reference in case of audits or inquiries. Always retain a copy of your tax return transcript for your records.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check your Social Security Number (SSN) for accuracy.

- Do ensure that all income sources are reported, including wages, business income, and any other earnings.

- Do keep your tax documents organized and accessible for reference while filling out the form.

- Do sign and date the form before submitting it to avoid delays.

- Do use clear and legible handwriting or type the information to ensure readability.

- Don't leave any required fields blank; this could result in processing delays.

- Don't provide false information or omit important details, as this can lead to legal issues.

- Don't forget to include any adjustments to income that may apply to your situation.

- Don't submit the form without reviewing it for errors or inconsistencies.

By following these guidelines, you can help ensure that your tax return is processed smoothly and accurately.

Other PDF Documents

Credit Application Form - Provide company details to assess your creditworthiness.

Owner Operator Lease Agreement - The agreement starts when both parties provide their signatures.

Fedex Informed Delivery - People can choose where they are most comfortable receiving their packages, considering options available.

Similar forms

- Tax Return Transcript: This document provides a summary of a taxpayer's return information, including income, deductions, and credits. Similar to the Sample Tax Return Transcript, it does not show any subsequent account activity.

- Account Transcript: This document includes a record of all transactions on a taxpayer's account. It details payments, adjustments, and any changes made after the tax return was filed, unlike the Sample Tax Return Transcript.

- Wage and Income Transcript: This transcript shows all income reported to the IRS, including wages, dividends, and interest. It is similar to the Sample Tax Return Transcript in that it summarizes income information but does not include deductions or credits.

- Record of Account Transcript: This combines information from both the tax return and account transcripts. It provides a complete view of a taxpayer's account, including the return filed and any adjustments made, similar to the Sample Tax Return Transcript's summary nature.

- Verification of Non-filing Letter: This document confirms that the IRS has no record of a tax return for a specific year. While it does not summarize income or deductions like the Sample Tax Return Transcript, it serves as proof of non-filing status.

- Form 4506-T: This form is used to request various types of tax return transcripts from the IRS. It is similar in purpose to the Sample Tax Return Transcript, as it allows individuals to obtain important tax information.