Attorney-Approved Release of Promissory Note Form

Form Preview Example

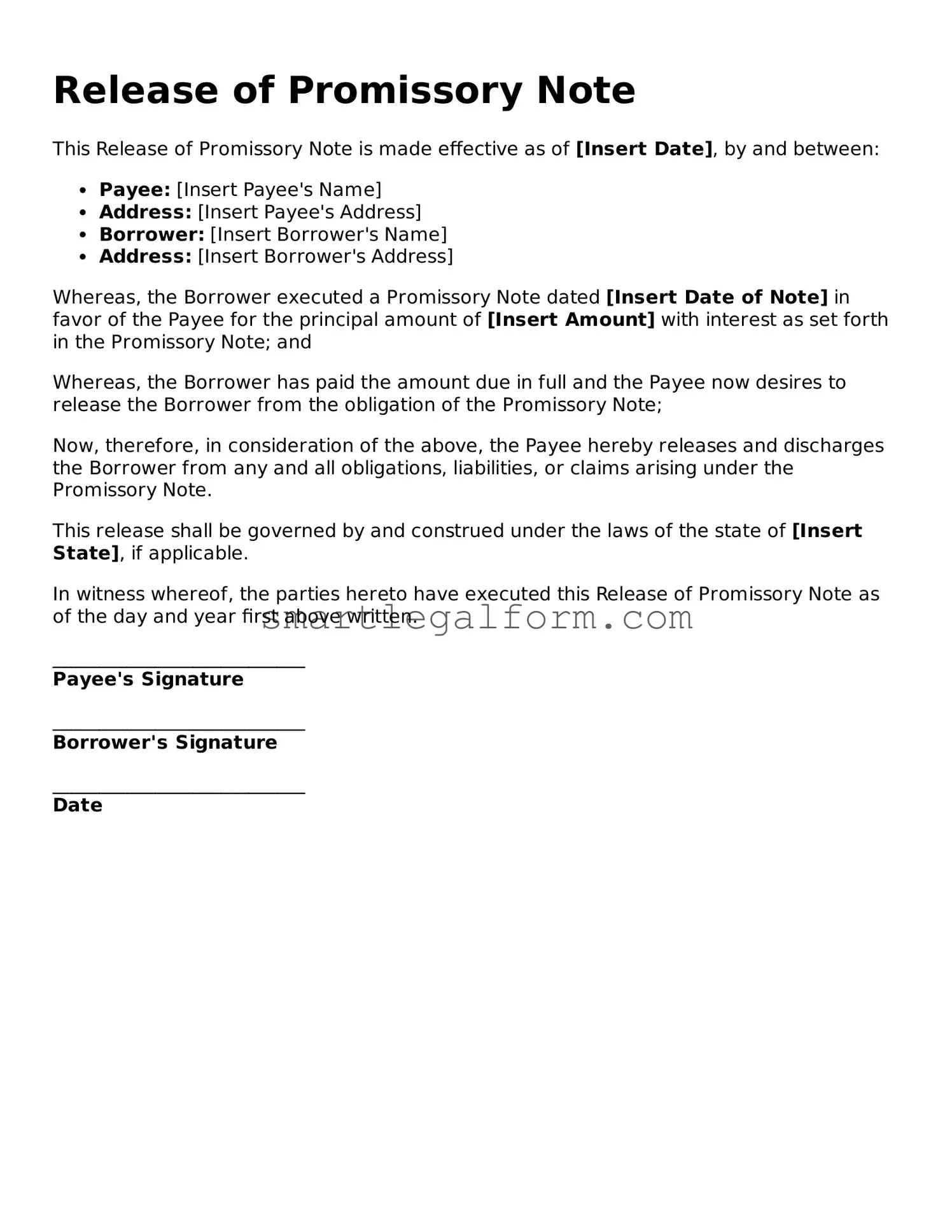

Release of Promissory Note

This Release of Promissory Note is made effective as of [Insert Date], by and between:

- Payee: [Insert Payee's Name]

- Address: [Insert Payee's Address]

- Borrower: [Insert Borrower's Name]

- Address: [Insert Borrower's Address]

Whereas, the Borrower executed a Promissory Note dated [Insert Date of Note] in favor of the Payee for the principal amount of [Insert Amount] with interest as set forth in the Promissory Note; and

Whereas, the Borrower has paid the amount due in full and the Payee now desires to release the Borrower from the obligation of the Promissory Note;

Now, therefore, in consideration of the above, the Payee hereby releases and discharges the Borrower from any and all obligations, liabilities, or claims arising under the Promissory Note.

This release shall be governed by and construed under the laws of the state of [Insert State], if applicable.

In witness whereof, the parties hereto have executed this Release of Promissory Note as of the day and year first above written.

___________________________

Payee's Signature

___________________________

Borrower's Signature

___________________________

Date

Common mistakes

Filling out a Release of Promissory Note form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to include all necessary parties. When multiple individuals or entities are involved, it is crucial to ensure that every party who has a stake in the note is named. Omitting a party can result in disputes later on.

Another mistake often made is not providing accurate details about the promissory note itself. This includes the note's date, amount, and any specific terms or conditions. Inaccuracies can create confusion and may invalidate the release. Always double-check these details to ensure they match the original note.

Additionally, people sometimes neglect to sign the form correctly. Each required signature must be present, and they should be dated appropriately. A missing signature or an incorrect date can delay the release process and complicate matters further.

Moreover, individuals may overlook the need for notarization. Depending on the jurisdiction, notarizing the form might be necessary to ensure its legal validity. Failing to have the document notarized can lead to challenges in enforcing the release.

Finally, misunderstanding the implications of the release can lead to serious issues. Some individuals may believe that signing the release absolves them of all obligations related to the promissory note. However, it is essential to understand what rights are being relinquished and to consult with a professional if there is any uncertainty.

Dos and Don'ts

When filling out the Release of Promissory Note form, there are important considerations to keep in mind. Here are seven things you should and shouldn't do:

- Do double-check all personal information for accuracy.

- Do ensure that the date of release is clearly stated.

- Do include the original promissory note number for reference.

- Do sign the form in the presence of a witness or notary, if required.

- Don't leave any sections of the form blank unless specifically instructed.

- Don't use incorrect or outdated forms; always use the most current version.

- Don't forget to keep a copy of the completed form for your records.

More Types of Release of Promissory Note Forms:

How to Write a Promissory Note Example - The document is essential for accountability in car financing agreements.

When engaging in financial transactions, utilizing a California Promissory Note form is crucial for establishing clear terms and conditions. This document not only enforces the borrower's commitment to repay the specified amount but also protects the lender's interests by detailing repayment schedules and interest rates. To explore further options and resources related to this essential legal tool, you can refer to All California Forms.

Similar forms

Release of Mortgage: This document formally releases a borrower from their mortgage obligations, similar to how a Release of Promissory Note frees the borrower from the debt associated with the note.

- Promissory Note Form: For clear financial dealings, refer to our detailed Promissory Note documentation to understand the obligations of both borrowers and lenders.

Debt Settlement Agreement: In a debt settlement agreement, a creditor agrees to accept a reduced amount as full payment. This is comparable to the release of a promissory note, which signifies that the debt has been resolved.

Loan Satisfaction Letter: This letter confirms that a loan has been paid in full. Like the Release of Promissory Note, it serves as proof that the borrower has fulfilled their obligation.

Deed of Reconveyance: This document transfers property ownership back to the borrower after a loan is paid off. It parallels the release of a promissory note by indicating that the borrower no longer owes anything.

Cancellation of Lease: A cancellation of lease document terminates a rental agreement. This is similar to the release of a promissory note, as both signify the end of financial obligations.

Settlement Agreement: This document outlines the terms of a settlement between parties, often resolving disputes. It resembles the release of a promissory note by documenting the conclusion of a financial obligation.

Discharge of Bankruptcy: This legal document releases a debtor from personal liability for certain debts. It is akin to a release of a promissory note in that it signifies the elimination of debt responsibilities.

Quitclaim Deed: A quitclaim deed transfers interest in a property without guaranteeing that the title is clear. This is similar to the release of a promissory note, as both involve the relinquishment of claims.

Termination Agreement: This document ends a contractual relationship between parties. Like the release of a promissory note, it signifies that no further obligations exist between the parties.