Attorney-Approved Quitclaim Deed Form

Quitclaim Deed for Particular US States

Form Preview Example

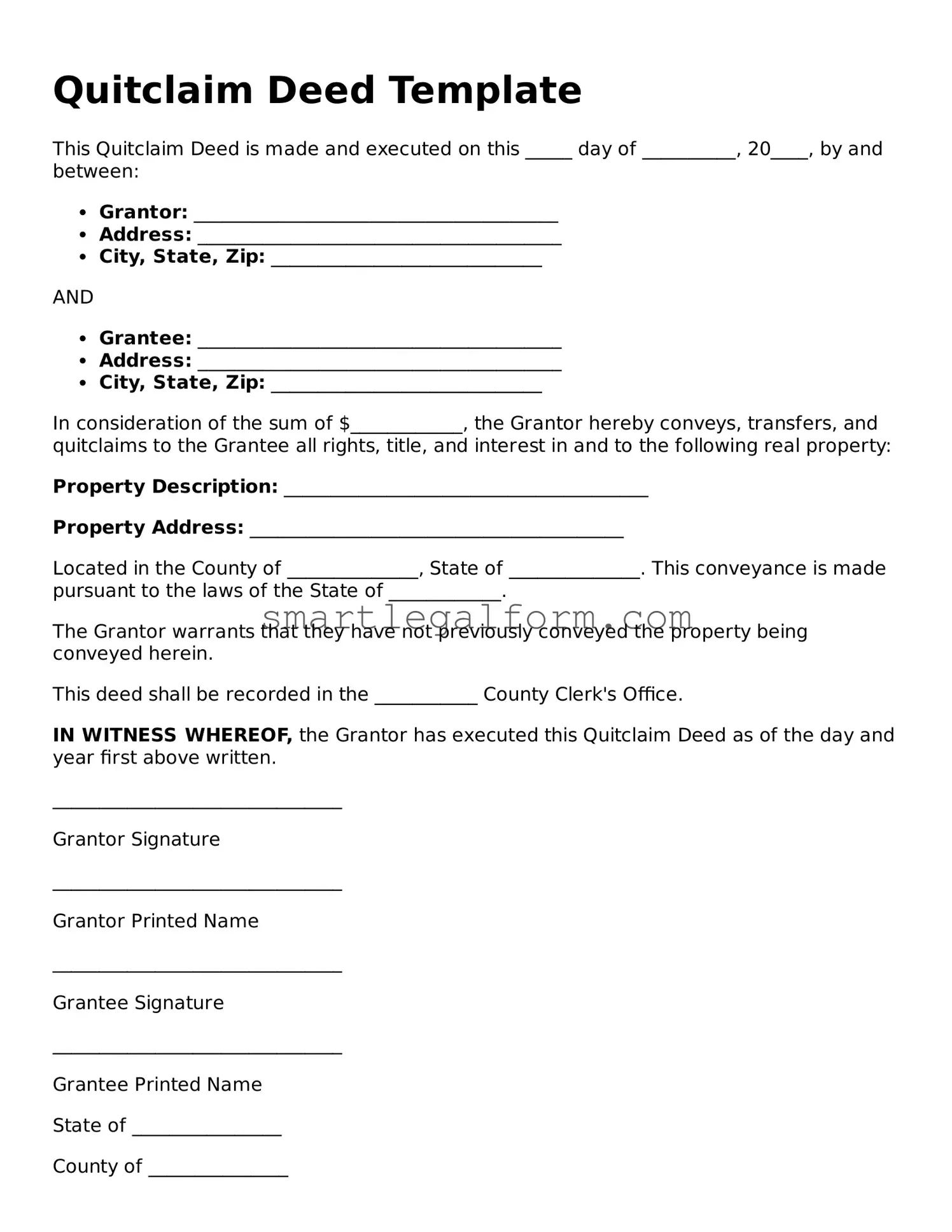

Quitclaim Deed Template

This Quitclaim Deed is made and executed on this _____ day of __________, 20____, by and between:

- Grantor: _______________________________________

- Address: _______________________________________

- City, State, Zip: _____________________________

AND

- Grantee: _______________________________________

- Address: _______________________________________

- City, State, Zip: _____________________________

In consideration of the sum of $____________, the Grantor hereby conveys, transfers, and quitclaims to the Grantee all rights, title, and interest in and to the following real property:

Property Description: _______________________________________

Property Address: ________________________________________

Located in the County of ______________, State of ______________. This conveyance is made pursuant to the laws of the State of ____________.

The Grantor warrants that they have not previously conveyed the property being conveyed herein.

This deed shall be recorded in the ___________ County Clerk's Office.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_______________________________

Grantor Signature

_______________________________

Grantor Printed Name

_______________________________

Grantee Signature

_______________________________

Grantee Printed Name

State of ________________

County of _______________

On this _____ day of __________, 20____, before me, a Notary Public, personally appeared ______________________________________, known or identified to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same.

Witness my hand and official seal.

___________________________

Notary Public Signature

Commission Number: ________________

My Commission Expires: _______________

Common mistakes

Filling out a Quitclaim Deed form can seem straightforward, but many individuals make common mistakes that can lead to complications later. One frequent error is not providing the correct legal description of the property. This description should be detailed and accurate, as it identifies the specific piece of real estate being transferred. Omitting or incorrectly describing the property can result in disputes or confusion over ownership.

Another mistake involves the names of the parties involved. It is essential to ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match the names on their legal documents. Any discrepancies can create issues in the future, particularly if the deed is challenged.

People often overlook the need for signatures. The Quitclaim Deed must be signed by the grantor, and in some cases, it may require notarization. Failing to include a signature or not having the document notarized can render the deed invalid. Additionally, the date of the signing should also be included, as this provides important context for the transfer.

Another common error is neglecting to check local laws regarding the recording of the deed. Each jurisdiction has its own requirements for how and where a Quitclaim Deed must be filed. Not adhering to these regulations can lead to the deed being unrecorded, which may affect the grantee's rights to the property.

Some individuals also forget to include any necessary consideration, or payment, even if it is nominal. While Quitclaim Deeds often involve no money changing hands, stating a consideration amount is still important for legal purposes. This can prevent misunderstandings about the nature of the transfer.

Additionally, people sometimes fail to provide clear instructions for the handling of the deed after completion. Once the Quitclaim Deed is signed and notarized, it should be filed with the appropriate local government office. Not doing so can leave the transfer unrecognized, which may lead to complications regarding ownership.

Lastly, many overlook the importance of seeking legal advice. While it may seem unnecessary, consulting with a legal professional can help ensure that all aspects of the Quitclaim Deed are properly addressed. This step can prevent costly mistakes and provide peace of mind throughout the property transfer process.

Dos and Don'ts

When filling out a Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should and shouldn't do.

- Do: Clearly identify the property being transferred, including the legal description.

- Do: Include the names of all parties involved in the transaction.

- Do: Sign the form in the presence of a notary public.

- Do: Check for any state-specific requirements before submission.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any fields blank; incomplete forms may be rejected.

- Don't: Use vague language when describing the property.

- Don't: Forget to date the document.

- Don't: Alter the form after it has been signed and notarized.

- Don't: Assume that the form will be accepted without verification; confirm with local authorities.

More Types of Quitclaim Deed Forms:

What Is a Deed in Lieu of Foreclosure - It is essential to communicate openly with the lender during this process.

Does California Have a Transfer on Death Deed - By using a Transfer-on-Death Deed, property owners avoid the delays commonly associated with probate.

A Marriage Certificate form is an official document that proves the legal union between two individuals. It serves as an essential record for personal identification, legal, and financial purposes. Obtaining this form is a necessary step for newlyweds to validate their marriage in the eyes of the law, and resources such as TopTemplates.info can help in providing the necessary templates for this process.

Deed of Gift Property - The recipient does not typically provide anything in return for the property, emphasizing the voluntary nature of the gift.

Similar forms

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it offers protection to the buyer against any future claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership of property. It assures the buyer that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property between family members or in a divorce settlement. Like a quitclaim deed, it does not provide any warranties about the property title.

- Living Will: To ensure your healthcare preferences are respected, consider creating a detailed Living Will document for Arizona residents outlining your medical treatment wishes.

- Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a quitclaim deed, both documents facilitate the transfer of property rights.

- Life Estate Deed: A life estate deed allows a person to retain ownership of a property during their lifetime, with the property passing to another party upon their death. This deed, like a quitclaim deed, can transfer property rights without warranties.

- Transfer on Death Deed: This deed allows property owners to designate a beneficiary who will receive the property upon the owner's death. It functions similarly to a quitclaim deed in that it transfers property rights without going through probate, but it provides a clear transfer of ownership upon death.