Attorney-Approved Promissory Note for a Car Form

Form Preview Example

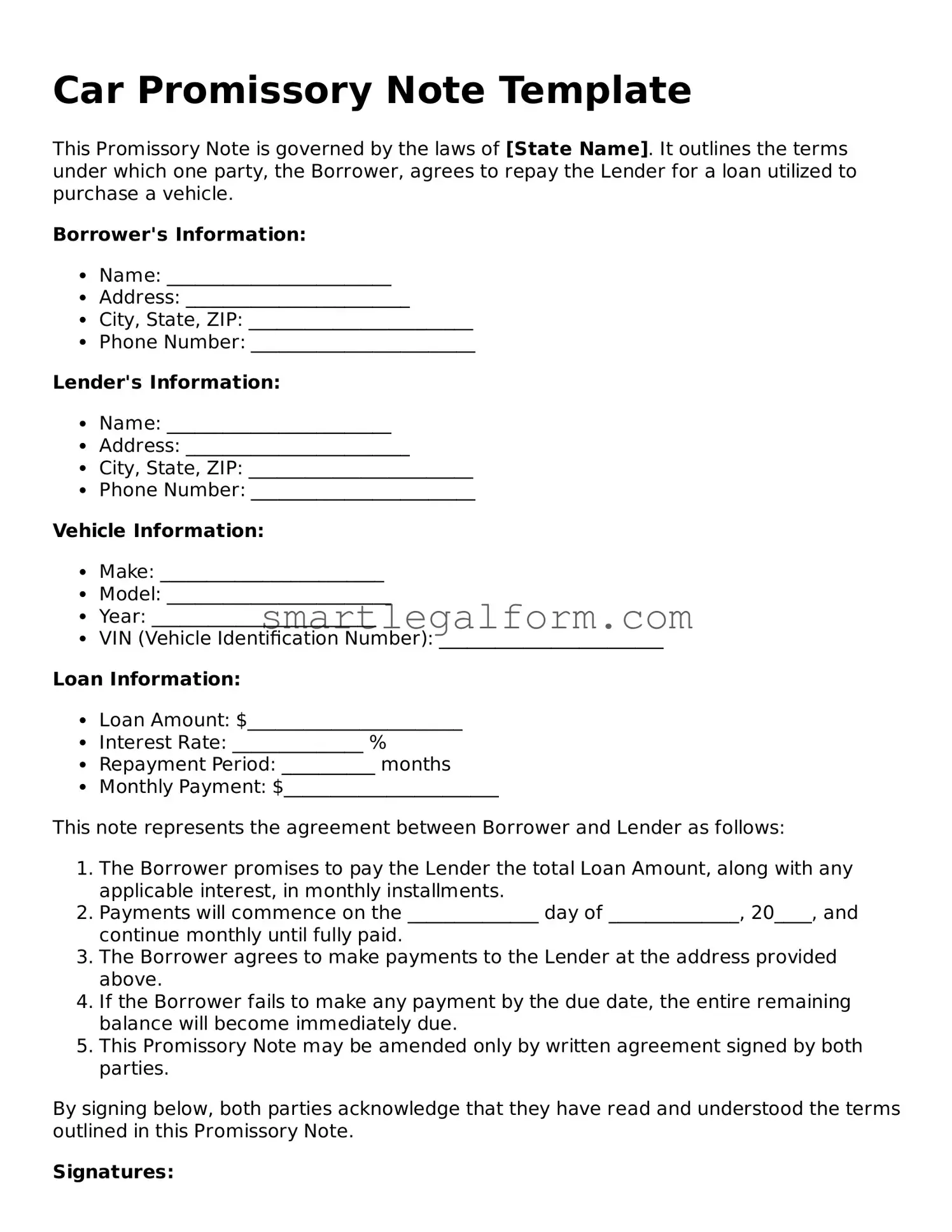

Car Promissory Note Template

This Promissory Note is governed by the laws of [State Name]. It outlines the terms under which one party, the Borrower, agrees to repay the Lender for a loan utilized to purchase a vehicle.

Borrower's Information:

- Name: ________________________

- Address: ________________________

- City, State, ZIP: ________________________

- Phone Number: ________________________

Lender's Information:

- Name: ________________________

- Address: ________________________

- City, State, ZIP: ________________________

- Phone Number: ________________________

Vehicle Information:

- Make: ________________________

- Model: ________________________

- Year: ________________________

- VIN (Vehicle Identification Number): ________________________

Loan Information:

- Loan Amount: $_______________________

- Interest Rate: ______________ %

- Repayment Period: __________ months

- Monthly Payment: $_______________________

This note represents the agreement between Borrower and Lender as follows:

- The Borrower promises to pay the Lender the total Loan Amount, along with any applicable interest, in monthly installments.

- Payments will commence on the ______________ day of ______________, 20____, and continue monthly until fully paid.

- The Borrower agrees to make payments to the Lender at the address provided above.

- If the Borrower fails to make any payment by the due date, the entire remaining balance will become immediately due.

- This Promissory Note may be amended only by written agreement signed by both parties.

By signing below, both parties acknowledge that they have read and understood the terms outlined in this Promissory Note.

Signatures:

Borrower's Signature: ________________________ Date: ________________

Lender's Signature: ________________________ Date: ________________

Witness Signature: ________________________ Date: ________________

Common mistakes

When completing the Promissory Note for a Car form, individuals often overlook critical details that can lead to complications. One common mistake is failing to provide accurate personal information. This includes the borrower's name, address, and contact details. Inaccuracies can result in delays or miscommunication, potentially jeopardizing the agreement.

Another frequent error is neglecting to specify the loan amount clearly. The total amount borrowed should be explicitly stated to avoid confusion. If the amount is incorrect or ambiguous, it can lead to disputes later on regarding repayment obligations.

Many individuals also forget to outline the interest rate. The form should include the agreed-upon interest rate, whether it is fixed or variable. Without this information, the terms of repayment may become unclear, leading to misunderstandings between the borrower and lender.

Additionally, some borrowers fail to include the repayment schedule. It is essential to detail when payments are due, the frequency of payments, and the total duration of the loan. Omitting this information can create uncertainty about when and how much the borrower needs to pay.

Another mistake involves not signing the document. A promissory note is not legally binding without the appropriate signatures. Both the borrower and lender must sign the form to validate the agreement. Failure to do so can render the note unenforceable.

Lastly, individuals sometimes overlook the importance of keeping a copy of the completed form. After filling out the Promissory Note for a Car, retaining a copy is crucial for both parties. This ensures that everyone has access to the agreed-upon terms, which can be vital in case of future disputes.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it is important to follow certain guidelines to ensure accuracy and clarity. Here are ten things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your name and address.

- Do clearly state the loan amount you are borrowing.

- Do include the interest rate, if applicable.

- Do specify the repayment schedule, including due dates.

- Don't leave any sections blank; fill in all required fields.

- Don't use unclear or vague language in the note.

- Don't forget to sign and date the document.

- Don't use correction fluid on the form; if you make a mistake, cross it out neatly and initial it.

- Don't ignore any state-specific requirements that may apply.

More Types of Promissory Note for a Car Forms:

Release of Promissory Note - Can be beneficial for both parties during tax filings or other financial disclosures.

To facilitate the creation and management of this financial instrument, individuals can access resources such as All New York Forms, which provides templates and guidance for drafting a New York Promissory Note, thereby ensuring that all necessary details are accurately captured and legally binding.

Similar forms

- Loan Agreement: Similar to a Promissory Note for a Car, a loan agreement outlines the terms of borrowing money. It specifies the amount borrowed, interest rates, repayment schedule, and consequences of defaulting on the loan. Both documents serve as a record of the borrower’s commitment to repay the lender.

- Promissory Note Form: For those looking to formalize borrowing agreements, our essential Promissory Note documentation guide provides all necessary details to facilitate clear and enforceable terms.

- Lease Agreement: A lease agreement is used when renting a vehicle rather than purchasing it. Like a promissory note, it details the terms of use, payment obligations, and duration of the agreement. Both documents establish a formal relationship between the parties involved and set expectations for payment.

- Security Agreement: This document is often used in conjunction with a promissory note when the car serves as collateral for the loan. A security agreement defines the lender’s rights to the vehicle in the event of non-payment. Similar to a promissory note, it provides legal protections for the lender.

- Installment Sale Agreement: An installment sale agreement allows a buyer to purchase a vehicle through a series of payments over time. This document, like a promissory note, includes payment terms, interest rates, and the consequences of failing to meet obligations. Both agreements facilitate the transfer of ownership while outlining the financial responsibilities of the buyer.