Attorney-Approved Promissory Note Form

Promissory Note for Particular US States

Promissory Note Form Types

Form Preview Example

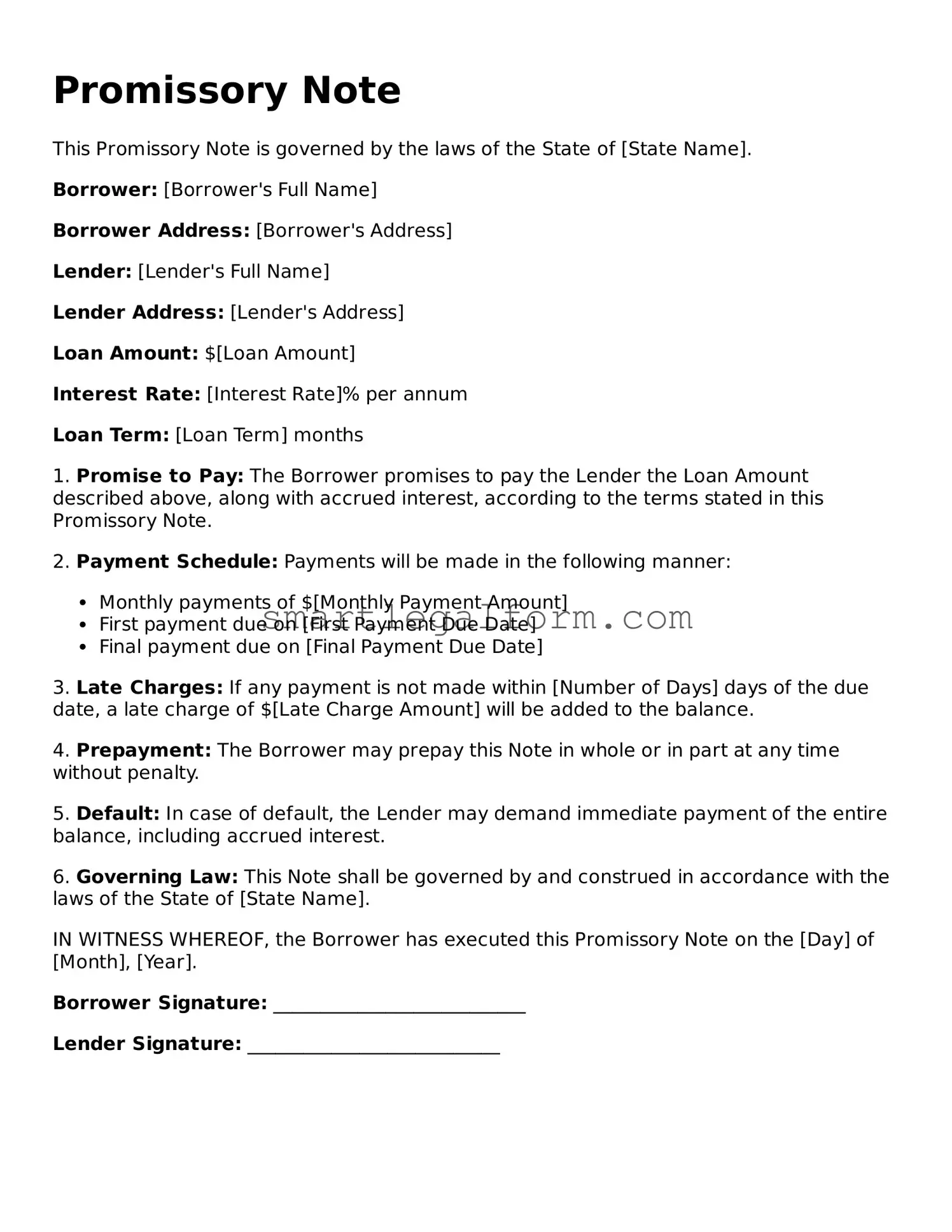

Promissory Note

This Promissory Note is governed by the laws of the State of [State Name].

Borrower: [Borrower's Full Name]

Borrower Address: [Borrower's Address]

Lender: [Lender's Full Name]

Lender Address: [Lender's Address]

Loan Amount: $[Loan Amount]

Interest Rate: [Interest Rate]% per annum

Loan Term: [Loan Term] months

1. Promise to Pay: The Borrower promises to pay the Lender the Loan Amount described above, along with accrued interest, according to the terms stated in this Promissory Note.

2. Payment Schedule: Payments will be made in the following manner:

- Monthly payments of $[Monthly Payment Amount]

- First payment due on [First Payment Due Date]

- Final payment due on [Final Payment Due Date]

3. Late Charges: If any payment is not made within [Number of Days] days of the due date, a late charge of $[Late Charge Amount] will be added to the balance.

4. Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

5. Default: In case of default, the Lender may demand immediate payment of the entire balance, including accrued interest.

6. Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of [State Name].

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note on the [Day] of [Month], [Year].

Borrower Signature: ___________________________

Lender Signature: ___________________________

Common mistakes

Filling out a Promissory Note form can seem straightforward, but several common mistakes often lead to complications down the line. One significant error is failing to include all necessary parties. A Promissory Note should clearly identify both the borrower and the lender. Omitting one of these parties can create confusion and lead to enforcement issues later on.

Another frequent mistake is neglecting to specify the loan amount. It’s crucial to write down the exact amount being borrowed. Leaving this blank or writing an incorrect figure can result in disputes about the terms of the agreement. Always double-check this detail to ensure clarity.

Additionally, people often overlook the importance of including the interest rate. Whether the loan is interest-free or carries a specific rate, this information must be explicitly stated. Not doing so can lead to misunderstandings and potential legal challenges in the future.

Another common error involves the repayment terms. Some individuals fail to define how and when payments will be made. It’s essential to outline the payment schedule, including due dates and the method of payment. This clarity helps prevent missed payments and the associated penalties.

Furthermore, many forget to include a late payment clause. This clause serves as a warning about the consequences of late payments. Without it, borrowers may not feel the urgency to pay on time, which can lead to financial strain for the lender.

Lastly, signatures are often overlooked. Both parties must sign the Promissory Note for it to be legally binding. Failing to do so can render the document unenforceable. Always ensure that both the borrower and lender have signed and dated the form.

Dos and Don'ts

When filling out a Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

Things You Should Do:

- Read the entire form carefully before starting to fill it out.

- Provide accurate and complete information about both parties involved.

- Clearly state the loan amount, interest rate, and repayment terms.

- Sign and date the document in the appropriate places.

- Keep a copy of the signed Promissory Note for your records.

Things You Shouldn't Do:

- Do not leave any sections of the form blank.

- Avoid using vague language or unclear terms.

- Do not sign the document without understanding all the terms.

- Refrain from altering the form or using incorrect information.

- Do not forget to check for any local laws that may apply to your Promissory Note.

Common Templates:

Photo Booth Rental Contract Template - Specify if there are any age restrictions for booth usage.

For those considering a separation, understanding the importance of a marital separation agreement is crucial. This document not only helps couples delineate their legal obligations but also facilitates communication during a stressful time. For more information, you can refer to the resources available at guidelines for a comprehensive Marital Separation Agreement.

Day to Day Lease Agreement - Specify any restrictions or allowances for guests in the rental property.

Loi Meaning in Job - The form can include any contingencies that need to be addressed before the official hire.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including repayment details and interest rates. However, it typically includes more comprehensive clauses regarding the rights and responsibilities of both parties.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. It includes terms for repayment and details about the property being financed, similar to how a promissory note specifies repayment terms.

- Installment Agreement: This document allows for the payment of a debt in installments over time. It shares similarities with a promissory note in that it outlines the payment schedule and the total amount owed.

- Secured Note: A secured note is backed by collateral, just like a promissory note. The main difference is that a secured note explicitly states what asset is being used as collateral for the loan.

- Personal Guarantee: This document involves a third party agreeing to pay a debt if the borrower defaults. It resembles a promissory note in that it establishes a financial obligation, though it involves an additional party.

- Debt Acknowledgment: A debt acknowledgment confirms that a borrower owes money to a lender. While it may not outline repayment terms as explicitly as a promissory note, it serves to recognize the debt.

-

Notice to Quit: This important document serves as a formal warning to tenants, providing them the opportunity to correct lease violations. For more information, visit TopTemplates.info.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. Similar to a promissory note, it details the amount borrowed and the repayment terms but often includes additional conditions and covenants.