Free Profit And Loss Form

Form Preview Example

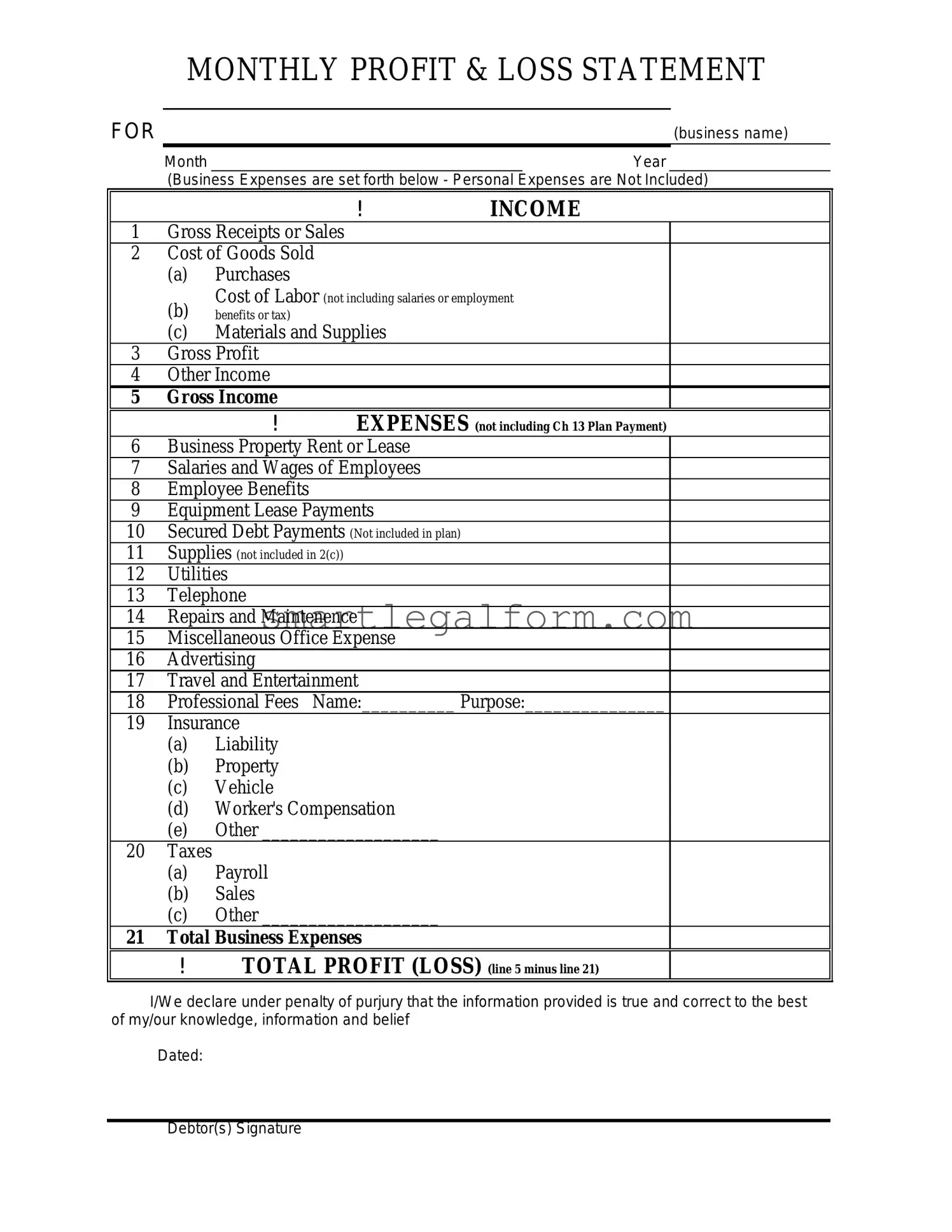

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Common mistakes

Filling out a Profit and Loss form can be a bit tricky, and many people make common mistakes that can lead to inaccurate financial reporting. One frequent error is failing to categorize expenses correctly. When expenses are misclassified, it can distort the overall picture of a business's financial health. For example, mixing personal expenses with business expenses can create confusion and lead to incorrect conclusions.

Another mistake is not keeping track of all income sources. Some individuals may only report income from primary sales, overlooking other revenue streams such as investments or side projects. This oversight can result in an incomplete financial statement, which might affect decision-making and tax obligations.

Many people also underestimate their expenses. They might forget to include recurring costs like subscriptions or utilities. By underreporting expenses, the Profit and Loss statement may show a misleadingly high profit, which can have implications for budgeting and planning.

Inaccurate data entry is another common issue. Simple typos or transposing numbers can lead to significant discrepancies. It's essential to double-check figures to ensure they accurately reflect the financial activity. This diligence helps maintain the integrity of the financial report.

Some individuals fail to update their Profit and Loss form regularly. Without timely updates, the financial information becomes stale and unhelpful for making informed decisions. Regularly reviewing and updating the form allows for better tracking of financial performance over time.

Lastly, not seeking help when needed can be a mistake. If someone is unsure about how to fill out the form correctly, consulting with a financial advisor or accountant can be beneficial. They can provide guidance and ensure that the form is completed accurately, which can save time and trouble in the long run.

Dos and Don'ts

When filling out the Profit and Loss form, attention to detail is crucial. Here are some important do's and don'ts to keep in mind:

- Do ensure all income sources are accurately reported.

- Do categorize expenses correctly to reflect your business operations.

- Do keep supporting documentation for all entries.

- Do review the form for any errors before submission.

- Don't omit any income, even if it seems minor.

- Don't mix personal expenses with business expenses.

- Don't wait until the last minute to gather your financial information.

Following these guidelines can help you submit a clear and accurate Profit and Loss form, making the process smoother for everyone involved.

Other PDF Documents

Daily Security Guard Log Book Sample - Provide a summary of actions taken during each security tour.

Shower Sheets for Cna - Utilization of this form assists in maintaining high care standards.

Aia Statement of Qualifications - Contractors can use the form to demonstrate their project efficiencies.

Similar forms

- Income Statement: This document provides a summary of revenues, expenses, and profits over a specific period, similar to the Profit and Loss form.

- Balance Sheet: While it focuses on assets, liabilities, and equity at a specific point in time, it complements the Profit and Loss form by showing the financial position of a business.

- Cash Flow Statement: This document tracks the flow of cash in and out of a business, highlighting operational, investing, and financing activities, much like the Profit and Loss form tracks income and expenses.

- Statement of Retained Earnings: This document outlines changes in retained earnings over a period, linking to the Profit and Loss form by reflecting net income or loss.

- Budget Report: This report compares actual income and expenses to projected figures, similar to the Profit and Loss form in assessing financial performance.

- Sales Report: This document details sales revenue and trends, providing insights that align with the income aspect of the Profit and Loss form.

- Expense Report: This outlines specific expenses incurred over a period, which is a crucial part of the Profit and Loss form.

- Tax Return: This document summarizes income and expenses for tax purposes, similar to the Profit and Loss form in detailing financial performance.

- Financial Forecast: This predictive document estimates future revenues and expenses, akin to the Profit and Loss form in projecting financial outcomes.

- Operating Statement: This provides an overview of operational performance, focusing on income and expenses, closely resembling the structure of the Profit and Loss form.