Printable Pennsylvania Transfer-on-Death Deed Document

Form Preview Example

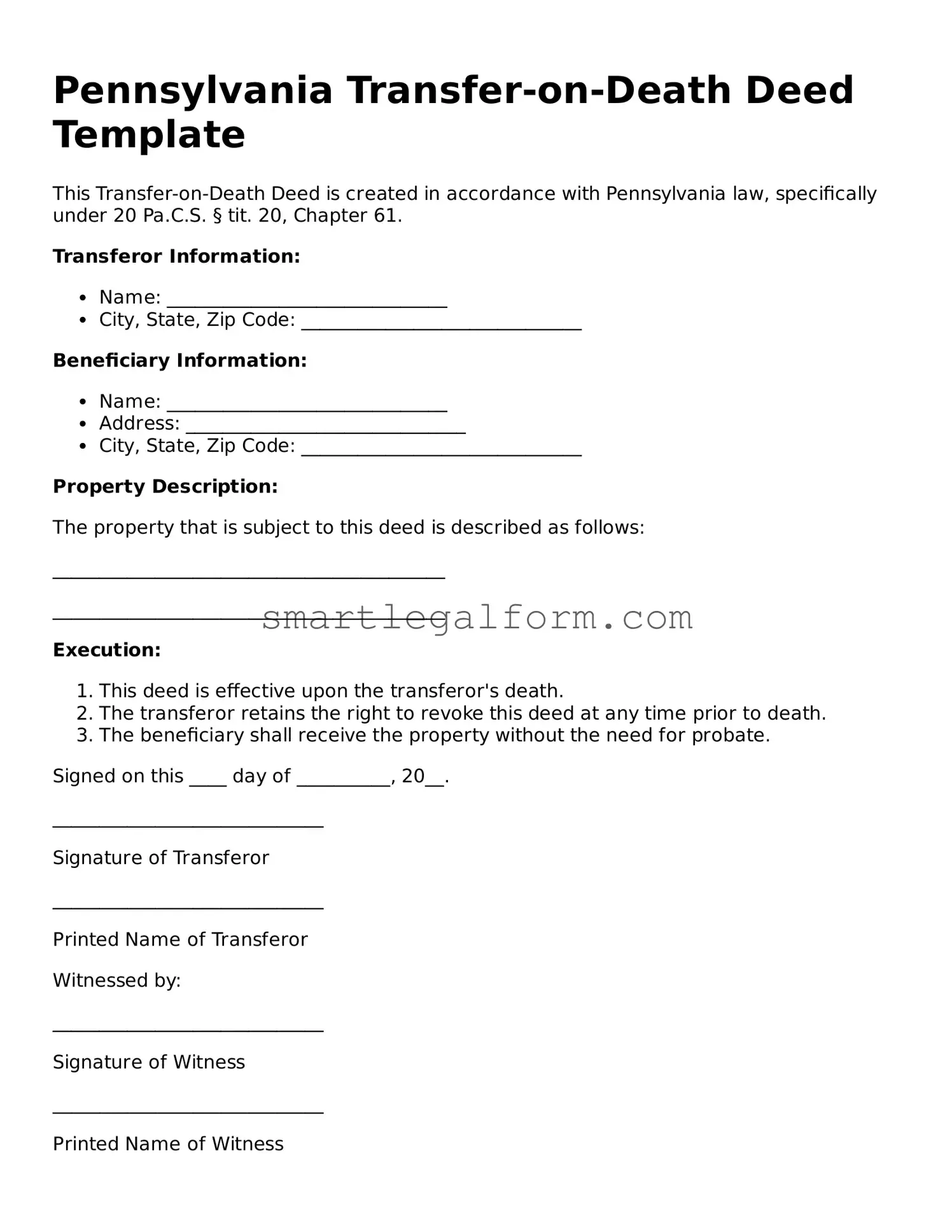

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with Pennsylvania law, specifically under 20 Pa.C.S. § tit. 20, Chapter 61.

Transferor Information:

- Name: ______________________________

- City, State, Zip Code: ______________________________

Beneficiary Information:

- Name: ______________________________

- Address: ______________________________

- City, State, Zip Code: ______________________________

Property Description:

The property that is subject to this deed is described as follows:

__________________________________________

__________________________________________

Execution:

- This deed is effective upon the transferor's death.

- The transferor retains the right to revoke this deed at any time prior to death.

- The beneficiary shall receive the property without the need for probate.

Signed on this ____ day of __________, 20__.

_____________________________

Signature of Transferor

_____________________________

Printed Name of Transferor

Witnessed by:

_____________________________

Signature of Witness

_____________________________

Printed Name of Witness

This deed must be recorded with the county recorder's office in the county where the property is located. Ensure compliance with local regulations and recording requirements.

Common mistakes

Filling out the Pennsylvania Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications later on. One prevalent error is failing to properly identify the property. The deed must clearly describe the property being transferred, including the correct address and legal description. Omitting this information or providing incorrect details can result in disputes or challenges to the transfer.

Another frequent mistake involves the designation of beneficiaries. Individuals often list beneficiaries without considering the implications of their choices. For instance, failing to specify whether the beneficiaries will take the property equally or in specific shares can create confusion. Additionally, if a beneficiary predeceases the property owner, the deed may not account for what happens next, leading to unintended consequences.

People sometimes neglect to sign the deed in the presence of a notary public. In Pennsylvania, the law requires that the Transfer-on-Death Deed be notarized to be valid. Without proper notarization, the deed may not be enforceable, which can ultimately thwart the intended transfer of property upon the owner’s death.

Moreover, individuals may overlook the necessity of recording the deed with the appropriate county office. Even if the deed is correctly filled out and notarized, failing to file it can render the transfer ineffective. Recording the deed ensures that it is part of the public record, which protects the rights of the beneficiaries and clarifies ownership.

Another common error is not updating the deed when personal circumstances change. Life events such as marriage, divorce, or the birth of children can impact beneficiary designations. If the deed is not revised to reflect these changes, it may lead to unintended heirs receiving the property or, conversely, intended heirs being excluded.

Lastly, individuals often do not seek legal advice before completing the deed. While it is possible to fill out the form independently, consulting with a legal professional can help avoid pitfalls and ensure that all aspects of the transfer are appropriately handled. A legal advisor can provide guidance on how to address specific situations and ensure that the deed aligns with the individual’s overall estate planning goals.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure everything is completed correctly. Here are some dos and don'ts to keep in mind:

- Do ensure that the property description is accurate and complete.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do file the completed deed with the county recorder of deeds.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't forget to check for any local regulations that may apply.

- Don't use outdated forms; always use the latest version.

- Don't rush through the process; take your time to review everything carefully.

Other Transfer-on-Death Deed State Forms

Transfer on Death Instrument - This deed serves as an alternative to more complex estate planning methods like trusts.

Where Can I Get a Tod Form - A Transfer-on-Death Deed does not impact the owner's ability to get loans or other encumbrances on the property while alive.

Deed Upon Death Form - This deed can contribute to a comprehensive estate plan, serving alongside wills and other estate documents.

In order to properly safeguard yourself from potential liabilities, it is advisable to utilize a Hold Harmless Agreement form, especially in states like Florida, where these agreements are common. By accessing resources provided by TopTemplates.info, you can gain insights on how to draft and implement such agreements effectively, thereby minimizing legal risks associated with your activities.

Tod in California - It allows you to maintain control over your property while providing for beneficiaries in the future.

Similar forms

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to express their wishes regarding the transfer of property, although a will typically requires probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust is an arrangement where a person places their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of property to beneficiaries without going through probate, providing a streamlined process for asset distribution.

- Employment Verification Form: This form is essential for confirming an individual's employment history and can be found at https://documentonline.org/blank-employment-verification-form/, serving as a crucial tool in the hiring process for both employers and candidates.

- Joint Tenancy: Joint tenancy is a form of ownership where two or more individuals hold title to property together. Upon the death of one owner, the property automatically transfers to the surviving owner(s). This is akin to a Transfer-on-Death Deed, which also facilitates the transfer of property outside of probate.

- Beneficiary Designation: Certain financial accounts and insurance policies allow individuals to name beneficiaries who will receive the assets upon their death. This process mirrors the Transfer-on-Death Deed, as both methods enable a direct transfer of property without the need for probate.

- Payable-on-Death (POD) Accounts: A POD account allows individuals to designate a beneficiary who will receive the funds in the account upon their death. Like a Transfer-on-Death Deed, it provides a straightforward way to transfer assets directly to a named individual, bypassing the probate process.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for their stocks or bonds. Similar to a Transfer-on-Death Deed, it ensures that the securities pass directly to the beneficiary upon the owner's death, avoiding probate.

- Life Estate Deed: A life estate deed allows a person to retain the right to use a property during their lifetime while designating another person to inherit the property after their death. This is similar to a Transfer-on-Death Deed in that it establishes a clear plan for property transfer upon death, although it involves different rights during the owner's lifetime.