Printable Pennsylvania Quitclaim Deed Document

Form Preview Example

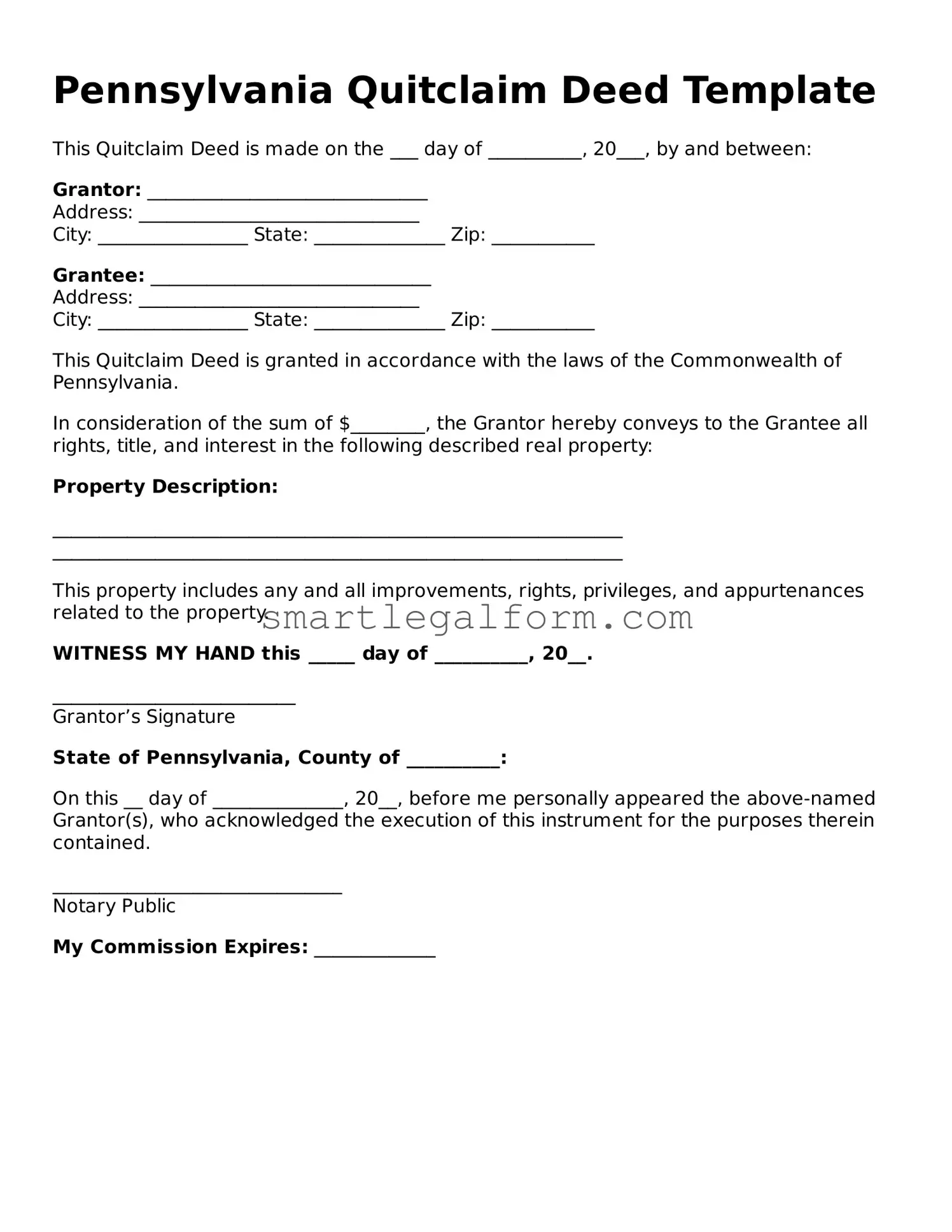

Pennsylvania Quitclaim Deed Template

This Quitclaim Deed is made on the ___ day of __________, 20___, by and between:

Grantor: ______________________________

Address: ______________________________

City: ________________ State: ______________ Zip: ___________

Grantee: ______________________________

Address: ______________________________

City: ________________ State: ______________ Zip: ___________

This Quitclaim Deed is granted in accordance with the laws of the Commonwealth of Pennsylvania.

In consideration of the sum of $________, the Grantor hereby conveys to the Grantee all rights, title, and interest in the following described real property:

Property Description:

_____________________________________________________________

_____________________________________________________________

This property includes any and all improvements, rights, privileges, and appurtenances related to the property.

WITNESS MY HAND this _____ day of __________, 20__.

__________________________

Grantor’s Signature

State of Pennsylvania, County of __________:

On this __ day of ______________, 20__, before me personally appeared the above-named Grantor(s), who acknowledged the execution of this instrument for the purposes therein contained.

_______________________________

Notary Public

My Commission Expires: _____________

Common mistakes

Filling out a Pennsylvania Quitclaim Deed form can seem straightforward, but many people make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure a smooth transfer of property ownership.

One frequent mistake is not providing complete information about the grantor and grantee. The form requires full names and addresses. Omitting any details can cause delays or even invalidate the deed. It’s essential to double-check that all names are spelled correctly and that addresses are accurate.

Another common error is failing to include a proper legal description of the property. This description should be specific and can often be found in previous deeds or tax records. Without this information, the deed may not clearly identify the property being transferred, leading to confusion or disputes later.

People also often overlook the need for signatures. Both the grantor and grantee must sign the Quitclaim Deed. If either party neglects to sign, the document cannot be legally recognized. Furthermore, signatures should be notarized to add an extra layer of authenticity.

Additionally, many individuals forget to check for any outstanding liens or mortgages on the property. If there are existing debts tied to the property, these can complicate the transfer process. It’s advisable to conduct a title search to ensure there are no hidden surprises.

Another mistake is not filing the deed with the appropriate county office. After completing the form, it must be recorded to be effective. Failing to file can leave the deed unenforceable, meaning the transfer of ownership might not be recognized by the state.

Some people also neglect to consider tax implications. Transferring property can have financial consequences, including transfer taxes. It’s wise to consult with a tax professional to understand any potential liabilities before completing the deed.

Lastly, many individuals do not seek legal advice when necessary. While the Quitclaim Deed form is accessible, the implications of transferring property can be complex. Consulting with a legal expert can provide clarity and help avoid costly mistakes.

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, attention to detail is crucial. This document serves as a legal instrument to transfer property ownership, and ensuring accuracy can prevent future disputes. Here are some essential dos and don'ts to keep in mind:

- Do provide the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do include a complete description of the property. This typically includes the address and any relevant parcel numbers.

- Do sign the form in the presence of a notary public to ensure its validity.

- Do check for any outstanding liens or mortgages on the property before completing the deed.

- Don't use abbreviations or informal names. Clarity is essential for legal documents.

- Don't forget to file the completed deed with the appropriate county office. Failing to do so can leave the transfer unrecorded.

By following these guidelines, individuals can navigate the process of completing a Quitclaim Deed with greater confidence and accuracy. Each step plays a vital role in ensuring a smooth transfer of property rights.

Other Quitclaim Deed State Forms

How Do I File a Quit Claim Deed - Grantors in a quitclaim deed will not be liable for any future claims.

Quitclaim Deed Ohio - A Quitclaim Deed is often used to clear up title issues.

To ensure a clear and complete transaction, it is important to use the appropriate documentation, such as the https://documentonline.org/blank-florida-motor-vehicle-bill-of-sale, which outlines the necessary details for transferring ownership of a motor vehicle in Florida.

How Much Does a Deed Cost - The deed's effectiveness begins upon signing and recording.

Is a Quit Claim Deed Legally Binding - This form provides no recourse for the grantee after the transfer.

Similar forms

- Warranty Deed: This document guarantees that the seller has a clear title to the property and the right to sell it. Unlike a quitclaim deed, a warranty deed provides more protection to the buyer by ensuring that they will not face claims against the property.

- Non-compete Agreement: To protect business interests, consider the comprehensive Non-compete Agreement details that outline employee restrictions after leaving a position.

- Grant Deed: A grant deed also transfers ownership of property but includes assurances that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This offers more security compared to a quitclaim deed.

- Deed of Trust: This document is used to secure a loan with real property as collateral. It involves three parties: the borrower, the lender, and a trustee. While a quitclaim deed transfers ownership, a deed of trust creates a security interest in the property.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified period in exchange for rent. While it does not transfer ownership, it provides rights to use the property, similar to how a quitclaim deed transfers ownership rights.