Printable Pennsylvania Promissory Note Document

Form Preview Example

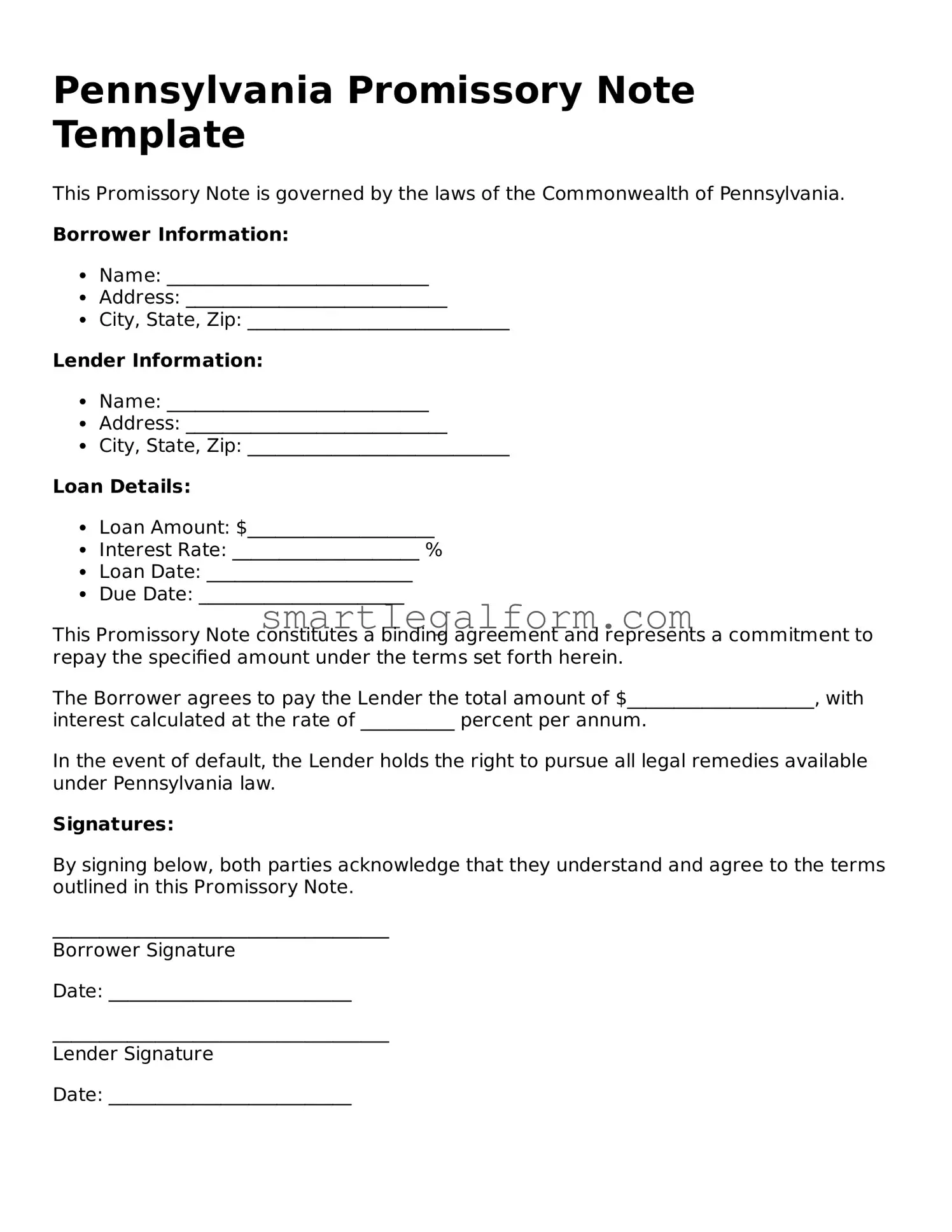

Pennsylvania Promissory Note Template

This Promissory Note is governed by the laws of the Commonwealth of Pennsylvania.

Borrower Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Lender Information:

- Name: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

Loan Details:

- Loan Amount: $____________________

- Interest Rate: ____________________ %

- Loan Date: ______________________

- Due Date: ______________________

This Promissory Note constitutes a binding agreement and represents a commitment to repay the specified amount under the terms set forth herein.

The Borrower agrees to pay the Lender the total amount of $____________________, with interest calculated at the rate of __________ percent per annum.

In the event of default, the Lender holds the right to pursue all legal remedies available under Pennsylvania law.

Signatures:

By signing below, both parties acknowledge that they understand and agree to the terms outlined in this Promissory Note.

____________________________________

Borrower Signature

Date: __________________________

____________________________________

Lender Signature

Date: __________________________

Common mistakes

Filling out a Pennsylvania Promissory Note can seem straightforward, but many people stumble over common mistakes. One frequent error is not including all necessary details. The form requires specific information, such as the names of the borrower and lender, the amount borrowed, and the repayment terms. Omitting any of these details can lead to confusion or disputes later on.

Another common mistake is failing to specify the interest rate. While some may think it’s unnecessary, the interest rate is a crucial component of the agreement. Without it, the document may not be enforceable, and the lender could face difficulties in collecting the owed amount. Always ensure that the interest rate is clearly stated, even if it’s zero percent.

People also often neglect to date the document properly. A promissory note should be signed and dated by both parties to establish a clear timeline for the agreement. If the date is missing, it may lead to ambiguity about when the loan was initiated, which can complicate matters if a dispute arises.

In addition, many individuals forget to include the payment schedule. Whether the borrower will make monthly payments, a lump sum payment, or another arrangement should be clearly outlined. This helps prevent misunderstandings and ensures that both parties are on the same page regarding expectations.

Another mistake is not having the document witnessed or notarized. While not always required, having a witness or a notary can add an extra layer of protection. This can be particularly important if the agreement is ever challenged in court. A signature from a neutral third party can lend credibility to the document.

Finally, people sometimes fail to keep copies of the signed note. After filling out the form, it’s essential for both the borrower and the lender to retain a copy for their records. Without a copy, either party may find it challenging to prove the terms of the agreement if issues arise down the line.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it is essential to approach the task with care. Below are some important dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and amounts.

- Do clearly specify the repayment terms, including interest rates and payment schedules.

- Do sign and date the document in the appropriate sections to validate it legally.

- Do keep a copy of the completed form for your records and future reference.

- Don't leave any sections blank. Unfilled areas can lead to confusion or disputes later.

- Don't use ambiguous language. Be clear and precise in your wording to avoid misunderstandings.

- Don't forget to have witnesses or a notary public sign the document if required.

- Don't rush through the process. Take your time to ensure everything is correct and legally binding.

Other Promissory Note State Forms

Texas Promissory Note Template - This note can be transferred to another lender or sold on the secondary market.

Florida Promissory Note Template - Borrowers use promissory notes to formalize the terms of their debt obligations.

Promissory Note Template Illinois - A promissory note can be integrated with other financial documents for clarity.

When considering the legal implications of employment, understanding a comprehensive Non-compete Agreement form is vital. This document serves to restrict employees from joining competitors or launching similar ventures for a designated duration post-employment. For further insights, explore our complete guide to Non-compete Agreements to navigate these crucial regulations effectively.

Ohio Promissory Note Requirements - A Promissory Note is a written promise to pay a specified amount of money to a designated person at a certain time.

Similar forms

-

Loan Agreement: Similar to a Promissory Note, a Loan Agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often includes more detailed provisions regarding the responsibilities of both the lender and borrower.

-

Installment Agreement: This document specifies a repayment plan for a loan that is paid back in installments. Like a Promissory Note, it includes the total amount owed and the payment schedule, but it may also detail the consequences of missed payments.

-

Mortgage: A Mortgage is a specific type of loan agreement used to finance the purchase of real estate. It includes a Promissory Note as part of the documentation, detailing the borrower's promise to repay the loan while also securing the property as collateral.

- Power of Attorney: The California Power of Attorney form enables an individual to designate someone else to handle decisions on their behalf, covering various financial, legal, and health-related matters. This document is essential for managing affairs if one is unable to do so personally, further highlighted by resources like TopTemplates.info.

-

Personal Guarantee: This document involves an individual agreeing to be responsible for a debt if the primary borrower defaults. It resembles a Promissory Note in that it represents a commitment to pay, but it shifts the liability to a different party.

-

Credit Agreement: This document outlines the terms under which credit is extended to a borrower. It shares similarities with a Promissory Note by detailing the repayment terms and interest, but it may also include provisions for credit limits and fees associated with the account.