Printable Pennsylvania Last Will and Testament Document

Form Preview Example

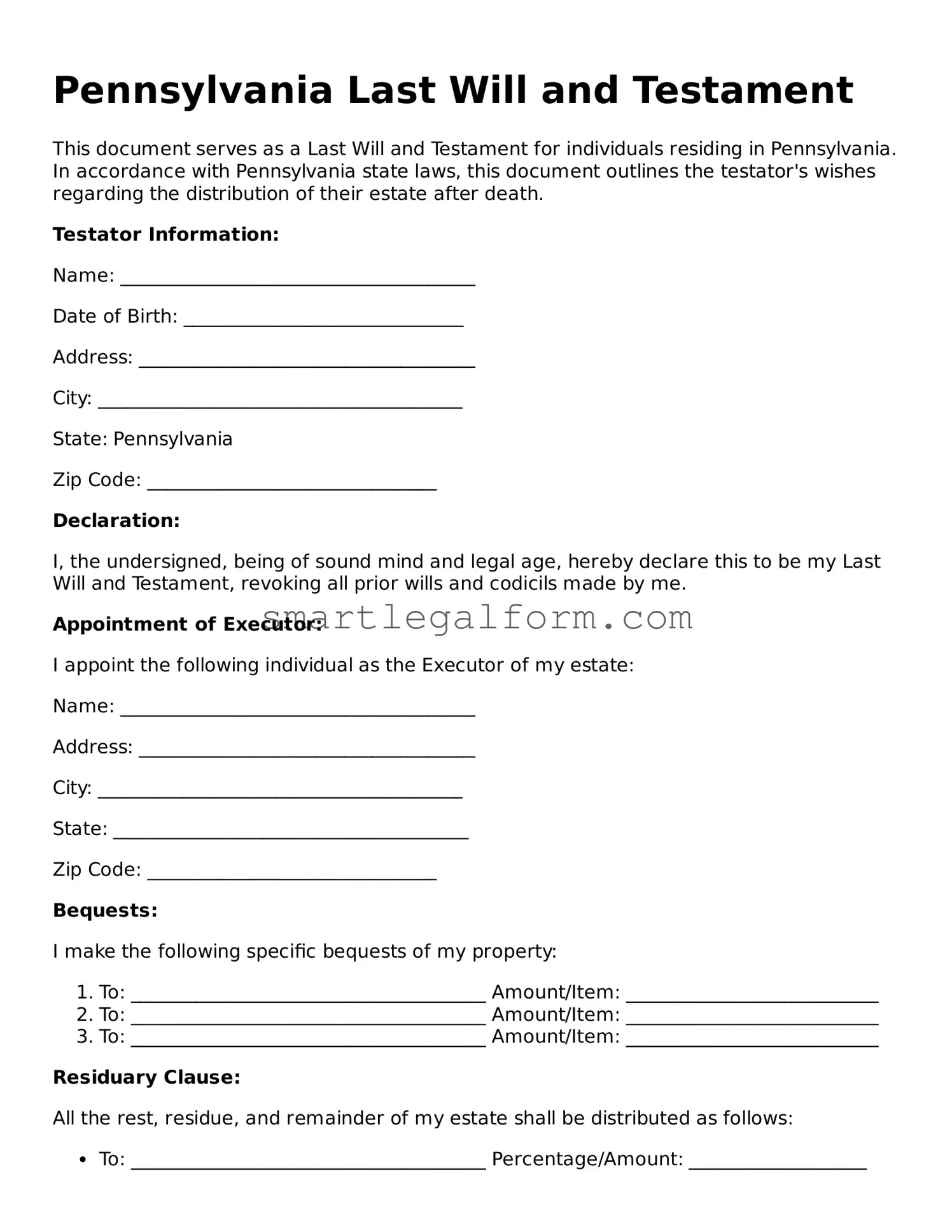

Pennsylvania Last Will and Testament

This document serves as a Last Will and Testament for individuals residing in Pennsylvania. In accordance with Pennsylvania state laws, this document outlines the testator's wishes regarding the distribution of their estate after death.

Testator Information:

Name: ______________________________________

Date of Birth: ______________________________

Address: ____________________________________

City: _______________________________________

State: Pennsylvania

Zip Code: _______________________________

Declaration:

I, the undersigned, being of sound mind and legal age, hereby declare this to be my Last Will and Testament, revoking all prior wills and codicils made by me.

Appointment of Executor:

I appoint the following individual as the Executor of my estate:

Name: ______________________________________

Address: ____________________________________

City: _______________________________________

State: ______________________________________

Zip Code: _______________________________

Bequests:

I make the following specific bequests of my property:

- To: ______________________________________ Amount/Item: ___________________________

- To: ______________________________________ Amount/Item: ___________________________

- To: ______________________________________ Amount/Item: ___________________________

Residuary Clause:

All the rest, residue, and remainder of my estate shall be distributed as follows:

- To: ______________________________________ Percentage/Amount: ___________________

- To: ______________________________________ Percentage/Amount: ___________________

Governing Law:

This Will is governed by the laws of the Commonwealth of Pennsylvania.

Witnesses:

This instrument was signed in our presence by the above-named testator, who is of sound mind and legal age, and who declared it to be their Last Will and Testament. We, the undersigned witnesses, do hereby affirm that we are not named as beneficiaries, and we witnessed the testator's signing of this document.

Witness 1:

Name: ______________________________________

Address: ____________________________________

Signature: _________________________________

Date: _______________________________________

Witness 2:

Name: ______________________________________

Address: ____________________________________

Signature: _________________________________

Date: _______________________________________

Testator's Signature:

Signature: _________________________________

Date: _______________________________________

Common mistakes

Filling out a Last Will and Testament form in Pennsylvania is a significant step in estate planning. However, many individuals make common mistakes that can lead to complications later on. Understanding these pitfalls can help ensure that your intentions are clearly expressed and legally binding.

One frequent mistake is failing to properly identify the testator. The testator is the person making the will. If the name is misspelled or incomplete, it can create confusion about the individual’s identity. This may result in challenges to the will's validity, potentially delaying the distribution of assets.

Another common error is neglecting to name an executor. The executor is responsible for carrying out the terms of the will. Without a designated executor, the court may need to appoint someone, which can lead to delays and disputes among family members. It is essential to choose someone trustworthy and capable of handling the responsibilities involved.

Many people also overlook the importance of signatures. In Pennsylvania, a will must be signed by the testator and, ideally, by two witnesses. If the will lacks the proper signatures, it may not be considered valid. Additionally, witnesses should not be beneficiaries of the will to avoid conflicts of interest.

Another mistake involves vague language. When individuals use ambiguous terms or fail to specify the distribution of assets clearly, it can lead to misunderstandings. Clear and precise language helps ensure that the testator's wishes are honored without confusion or misinterpretation.

Individuals often forget to update their wills after significant life events, such as marriage, divorce, or the birth of a child. These changes can affect how assets are distributed and who is named as beneficiaries. Regularly reviewing and updating the will is crucial to reflect current circumstances.

Finally, some people fail to consider the tax implications of their estate. Understanding potential estate taxes and how they may affect the distribution of assets is vital. Seeking advice from a financial professional can help navigate these complexities and ensure that beneficiaries receive their intended inheritance.

Dos and Don'ts

When filling out the Pennsylvania Last Will and Testament form, it's important to follow certain guidelines to ensure your document is valid and reflects your wishes. Here are some things you should and shouldn't do:

- Do clearly identify yourself at the beginning of the document.

- Do specify your beneficiaries and what they will receive.

- Do sign the will in the presence of two witnesses.

- Do keep your will in a safe place and inform someone of its location.

- Don't use ambiguous language that could lead to confusion.

- Don't forget to date the will.

- Don't leave out any important details about your assets.

- Don't attempt to make changes without following proper procedures.

Other Last Will and Testament State Forms

Do You Need a Lawyer to Do a Will - Clarifies which items are to be sold to pay off debts.

Will Template Texas - Some individuals opt to include a no-contest clause to discourage any challenges to their Last Will.

For those navigating their separation, a well-prepared legal framework is vital. The important aspects of a Marital Separation Agreement can significantly aid in defining roles and responsibilities during this transitional phase, ultimately fostering mutual understanding and cooperation.

Free Will Kit Ohio - Can include provisions for dependents or minor children.

Similar forms

- Living Will: A living will outlines an individual's preferences for medical treatment in case they become incapacitated. Like a Last Will and Testament, it is a legal document that reflects personal wishes, but it focuses on healthcare decisions rather than asset distribution.

- Power of Attorney: This document allows someone to make financial or legal decisions on behalf of another person. Similar to a Last Will, it involves the delegation of authority but is effective during the individual's lifetime, rather than after death.

- Trust Document: A trust document establishes a legal entity to hold and manage assets for beneficiaries. While a Last Will specifies how assets are distributed after death, a trust can provide for ongoing management and distribution during and after the grantor's lifetime.

- Healthcare Proxy: A healthcare proxy designates an individual to make medical decisions on behalf of someone else. Like a Last Will, it is a crucial document for ensuring that personal wishes are honored, particularly in medical situations.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes without creating an entirely new Last Will and Testament, thus maintaining the original document's validity while updating specific provisions.

- Notice to Quit: The TopTemplates.info provides essential information on the California Notice to Quit form, which is crucial for landlords in the eviction process. Understanding this document ensures proper communication and legal compliance when addressing lease violations.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes, funeral arrangements, or asset distribution. While not legally binding like a Last Will, it can complement a will by offering clarity and additional context.

- Beneficiary Designation Forms: These forms are used to specify who will receive assets such as life insurance or retirement accounts. Similar to a Last Will, they direct the distribution of assets but operate outside of the probate process.

- Joint Tenancy Agreement: This agreement allows two or more individuals to own property together, with rights of survivorship. Like a Last Will, it determines how property will be transferred upon death, but it does so immediately and without going through probate.

- Family Trust: A family trust is designed to manage family assets and provide for family members. Similar to a Last Will, it ensures that assets are distributed according to the grantor's wishes, often with more flexibility and control over timing and conditions.

- Declaration of Trust: This document outlines the terms and conditions under which a trust operates. It serves a similar purpose to a Last Will by detailing how assets are to be managed and distributed, but it can be effective during the grantor's lifetime.