Printable Pennsylvania Deed in Lieu of Foreclosure Document

Form Preview Example

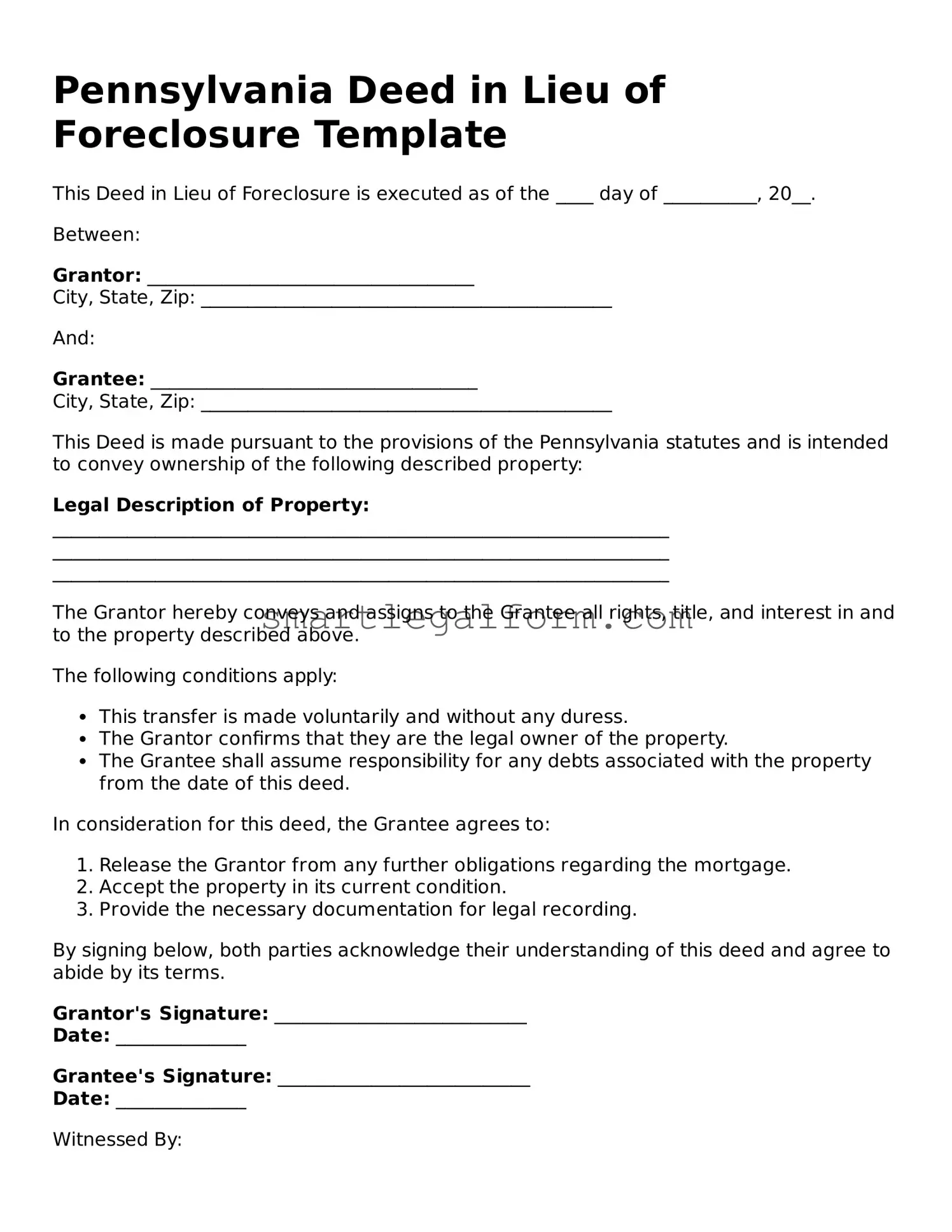

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed as of the ____ day of __________, 20__.

Between:

Grantor: ___________________________________

And:

Grantee: ___________________________________

This Deed is made pursuant to the provisions of the Pennsylvania statutes and is intended to convey ownership of the following described property:

Legal Description of Property:

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

The Grantor hereby conveys and assigns to the Grantee all rights, title, and interest in and to the property described above.

The following conditions apply:

- This transfer is made voluntarily and without any duress.

- The Grantor confirms that they are the legal owner of the property.

- The Grantee shall assume responsibility for any debts associated with the property from the date of this deed.

In consideration for this deed, the Grantee agrees to:

- Release the Grantor from any further obligations regarding the mortgage.

- Accept the property in its current condition.

- Provide the necessary documentation for legal recording.

By signing below, both parties acknowledge their understanding of this deed and agree to abide by its terms.

Grantor's Signature: ___________________________

Date: ______________

Grantee's Signature: ___________________________

Date: ______________

Witnessed By:

____________________________________

Date: ______________

Notary Public:

____________________________________

My Commission Expires: ______________

Common mistakes

Filling out the Pennsylvania Deed in Lieu of Foreclosure form can be a complicated process, and mistakes can lead to significant delays or complications. One common error is failing to provide accurate property descriptions. A precise description is essential, as it identifies the property being transferred. If the description is vague or incorrect, it may result in legal disputes or the rejection of the deed.

Another frequent mistake involves not including all necessary signatures. All parties involved in the transaction must sign the document. If even one signature is missing, the deed may not be considered valid. This oversight can prolong the foreclosure process, causing unnecessary stress for all parties involved.

People often overlook the importance of having the deed notarized. A notary public must witness the signing of the deed to ensure that the signatures are authentic. Without this notarization, the deed may be deemed invalid, and the intended transfer of property will not occur.

Additionally, many individuals fail to understand the implications of the deed itself. They may not realize that by signing the deed in lieu of foreclosure, they are relinquishing their ownership rights to the property. It is crucial for individuals to fully comprehend the consequences of this action, as it can impact their credit and future housing options.

Another common mistake is neglecting to check for outstanding liens or mortgages on the property. If there are existing debts tied to the property, these may need to be addressed before the deed can be accepted. Ignoring this step can lead to complications and may hinder the process of transferring ownership.

People sometimes forget to provide a clear statement of intent. The form should clearly indicate that the transfer is being made voluntarily and in lieu of foreclosure. Without this clarity, the intent behind the deed may be misinterpreted, causing confusion or legal challenges later on.

Inadequate communication with the lender is another issue that arises frequently. It is vital to keep the lender informed throughout the process. Failure to do so can result in misunderstandings about the status of the property and may lead to unexpected consequences.

Moreover, individuals may underestimate the importance of reviewing the entire document before submission. Skimming through the form can lead to overlooked errors or incomplete sections. A thorough review is essential to ensure that all information is accurate and complete.

Lastly, some individuals may not seek legal advice when filling out the deed. Consulting with a legal professional can provide valuable insights and help avoid potential pitfalls. Without proper guidance, individuals may inadvertently make mistakes that could have been easily avoided.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is important to approach the process with care. Below is a list of things you should and shouldn't do to ensure the form is completed accurately.

- Do provide accurate information about the property and the parties involved.

- Do ensure that the deed is signed by all necessary parties.

- Do have the deed notarized to validate the signatures.

- Do keep a copy of the completed form for your records.

- Do consult with a legal advisor if you have any questions or concerns.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't submit the form without reviewing it for errors.

- Don't rush the process; take your time to understand each part of the form.

- Don't forget to check local regulations that may affect the deed.

- Don't ignore the implications of transferring the property; understand your rights and responsibilities.

Other Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Mortgage - In this arrangement, the lender usually agrees to forgive the remaining mortgage debt.

California Voluntary Foreclosure Deed - Borrowers are encouraged to understand all terms associated with a Deed in Lieu.

To better understand the essential components and implications of a Michigan Hold Harmless Agreement, you can visit TopTemplates.info, where detailed explanations and templates are available, making it easier for individuals and businesses to navigate the legal landscape and protect themselves effectively.

Foreclosure Vs Deed in Lieu - This document signifies the homeowner's intention to relinquish their interest in the property to the mortgage lender.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - A Deed in Lieu may also include potential relocation assistance for the homeowner.

Similar forms

- Mortgage Release: This document releases the borrower from the mortgage obligation, similar to a deed in lieu, which transfers property ownership to the lender to avoid foreclosure.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Like a deed in lieu, it helps the homeowner avoid foreclosure.

- Employment Verification Form: The Employment Verification form is a crucial document used by employers to confirm the employment status of an individual. This form serves as a means of validating a person's work history, including job titles, dates of employment, and responsibilities. Understanding its purpose can benefit both job seekers and employers alike. For more information, visit https://documentonline.org/blank-employment-verification/.

- Loan Modification Agreement: This document changes the terms of the original loan, potentially making it more manageable for the borrower. Both aim to prevent foreclosure but take different approaches.

- Forebearance Agreement: This agreement allows the borrower to temporarily pause mortgage payments. It offers a way to avoid foreclosure, similar to how a deed in lieu allows for a smoother exit from a mortgage.

- Quitclaim Deed: This document transfers ownership of property without warranties. It can be used to relinquish property rights, akin to a deed in lieu where the borrower hands over the property to the lender.

- Settlement Agreement: This document outlines the terms for settling a debt. It shares similarities with a deed in lieu, as both provide a resolution to outstanding mortgage obligations.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and may lead to a discharge of debts. Both options offer relief from financial burdens, although through different legal processes.

- Property Transfer Agreement: This agreement facilitates the transfer of property ownership. Like a deed in lieu, it involves the voluntary transfer of property to settle debts.