Printable Pennsylvania Articles of Incorporation Document

Form Preview Example

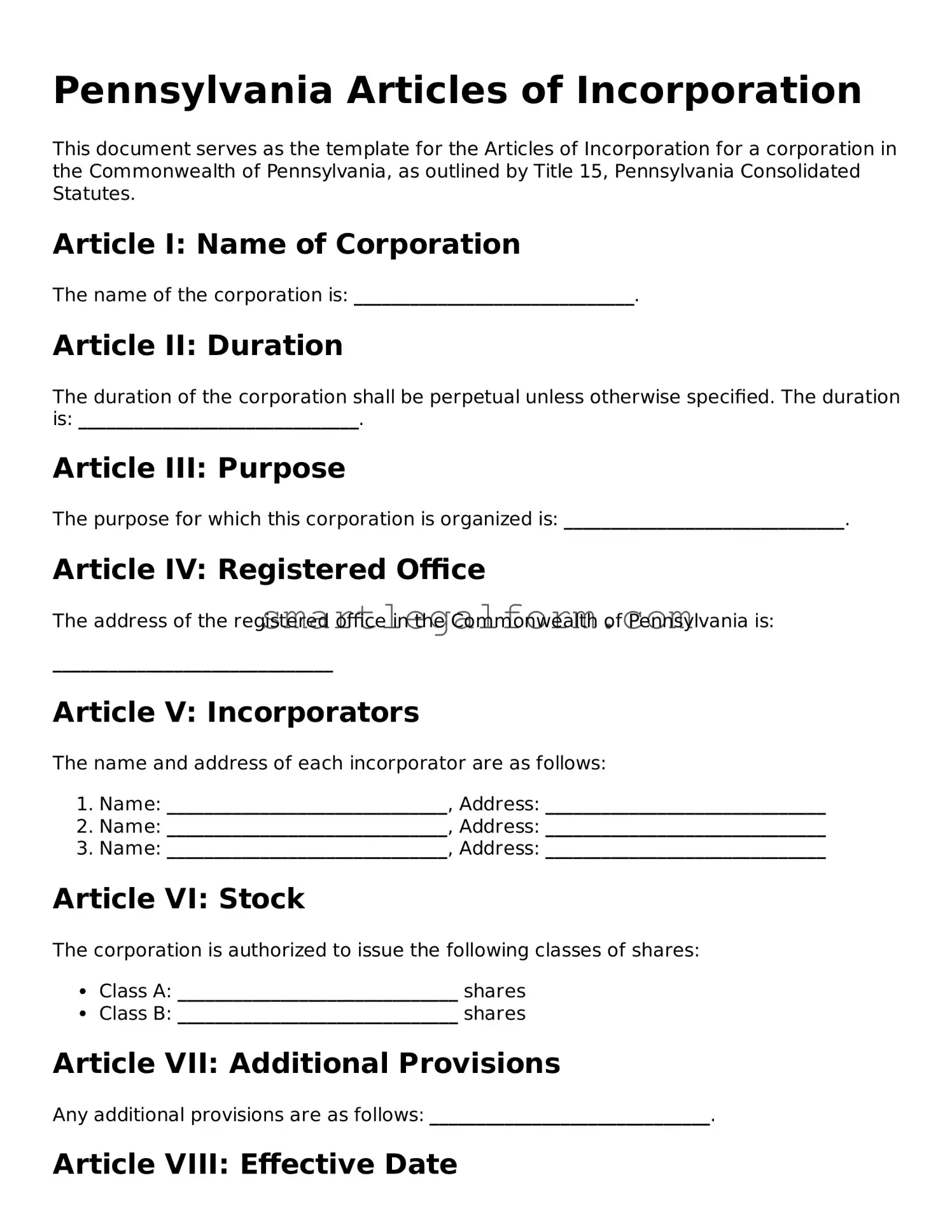

Pennsylvania Articles of Incorporation

This document serves as the template for the Articles of Incorporation for a corporation in the Commonwealth of Pennsylvania, as outlined by Title 15, Pennsylvania Consolidated Statutes.

Article I: Name of Corporation

The name of the corporation is: ______________________________.

Article II: Duration

The duration of the corporation shall be perpetual unless otherwise specified. The duration is: ______________________________.

Article III: Purpose

The purpose for which this corporation is organized is: ______________________________.

Article IV: Registered Office

The address of the registered office in the Commonwealth of Pennsylvania is:

______________________________

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name: ______________________________, Address: ______________________________

- Name: ______________________________, Address: ______________________________

- Name: ______________________________, Address: ______________________________

Article VI: Stock

The corporation is authorized to issue the following classes of shares:

- Class A: ______________________________ shares

- Class B: ______________________________ shares

Article VII: Additional Provisions

Any additional provisions are as follows: ______________________________.

Article VIII: Effective Date

This document shall be effective upon filing with the Department of State or at a later date specified as: ______________________________.

Incorporator Signatures

We, the undersigned incorporators, hereby declare that the information provided above is accurate.

Signature: ______________________________ Date: ______________________________

Signature: ______________________________ Date: ______________________________

This document is to be filed with the Pennsylvania Department of State to complete the incorporation process.

Common mistakes

Filing the Pennsylvania Articles of Incorporation form is a crucial step in establishing a business entity. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide a clear and specific name for the corporation. The name must be distinguishable from other registered entities in Pennsylvania. Omitting this detail can result in rejection of the application.

Another common mistake is neglecting to include the correct number of shares the corporation is authorized to issue. This information is essential for determining ownership and investment opportunities. If the number of shares is left blank or inaccurately stated, it may cause issues during the incorporation process.

People often overlook the requirement to list the registered office address. This address must be a physical location in Pennsylvania, not a P.O. Box. Providing an incorrect or incomplete address can hinder the corporation's ability to receive important legal documents.

Additionally, many applicants forget to include the names and addresses of the initial directors. This information is necessary for the corporation's governance structure. Failing to provide this detail can result in delays as the state may require additional information before proceeding.

Another mistake involves the signature of the incorporator. The form must be signed by an individual who is authorized to file on behalf of the corporation. If the signature is missing or not properly executed, the application will be deemed incomplete.

Finally, applicants sometimes neglect to review the filing fee requirements. Each submission must include the correct payment. Failing to include the appropriate fee can lead to processing delays or rejection of the application altogether. Ensuring all details are accurate and complete is vital for a smooth incorporation process.

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things to do and not to do:

- Do provide a clear and concise name for your corporation that complies with Pennsylvania naming requirements.

- Do include the registered office address in Pennsylvania where the corporation will maintain its records.

- Do specify the purpose of the corporation in a straightforward manner.

- Do ensure that the incorporators sign the form, as their signatures are necessary for validation.

- Don't use a name that is already in use or too similar to an existing corporation.

- Don't leave any required sections blank; all parts of the form must be completed to avoid delays.

Other Articles of Incorporation State Forms

Sunbiz Articles of Incorporation - Can include provisions for management and governance structure.

The importance of obtaining a Marriage Certificate cannot be overstated, as it acts as a key document for legal recognition and various administrative processes. For those looking for templates and guidance on this vital form, resources like TopTemplates.info can be incredibly helpful in ensuring everything is completed correctly.

The Articles of Incorporation - Clarity in purpose can assist in legal proceedings and tax matters.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for a corporation's operation. Like the Articles of Incorporation, they are foundational documents that govern the organization but focus more on management and governance rather than formation.

- Certificate of Incorporation: This document is often synonymous with the Articles of Incorporation. It serves the same purpose of formally establishing a corporation in the eyes of the state, detailing essential information about the business.

- Operating Agreement: Similar to bylaws, an operating agreement is used primarily by LLCs. It lays out the management structure and operational guidelines, similar to how the Articles of Incorporation define the corporate structure.

Bill of Sale: This legal document serves as proof of a transaction between a buyer and a seller. In Florida, it captures essential details such as the buyer's and seller's information, a description of the item sold, and the agreed price. For a template, you can refer to documentonline.org/blank-florida-bill-of-sale.

- Partnership Agreement: This document governs the relationship between partners in a business. Like the Articles of Incorporation, it establishes key roles and responsibilities, though it applies to partnerships rather than corporations.

- Business Plan: A business plan outlines the strategy for running a business. While it is not a legal document like the Articles of Incorporation, both serve as critical frameworks for establishing a business's goals and operational guidelines.

- Shareholder Agreement: This document governs the rights and responsibilities of shareholders. Similar to the Articles of Incorporation, it is essential for defining ownership and control within a corporation.

- Tax Registration Forms: These forms, required by the IRS and state tax authorities, register a business for tax purposes. They are similar to the Articles of Incorporation in that they formalize the business's existence and compliance with legal requirements.

- Annual Reports: Corporations are often required to file annual reports with the state. These documents provide updated information about the corporation, similar to how the Articles of Incorporation provide foundational details upon formation.

- Certificate of Good Standing: This document certifies that a corporation is compliant with state regulations. Like the Articles of Incorporation, it serves to validate the corporation's legal status and operational integrity.