Free Payroll Check Form

Form Preview Example

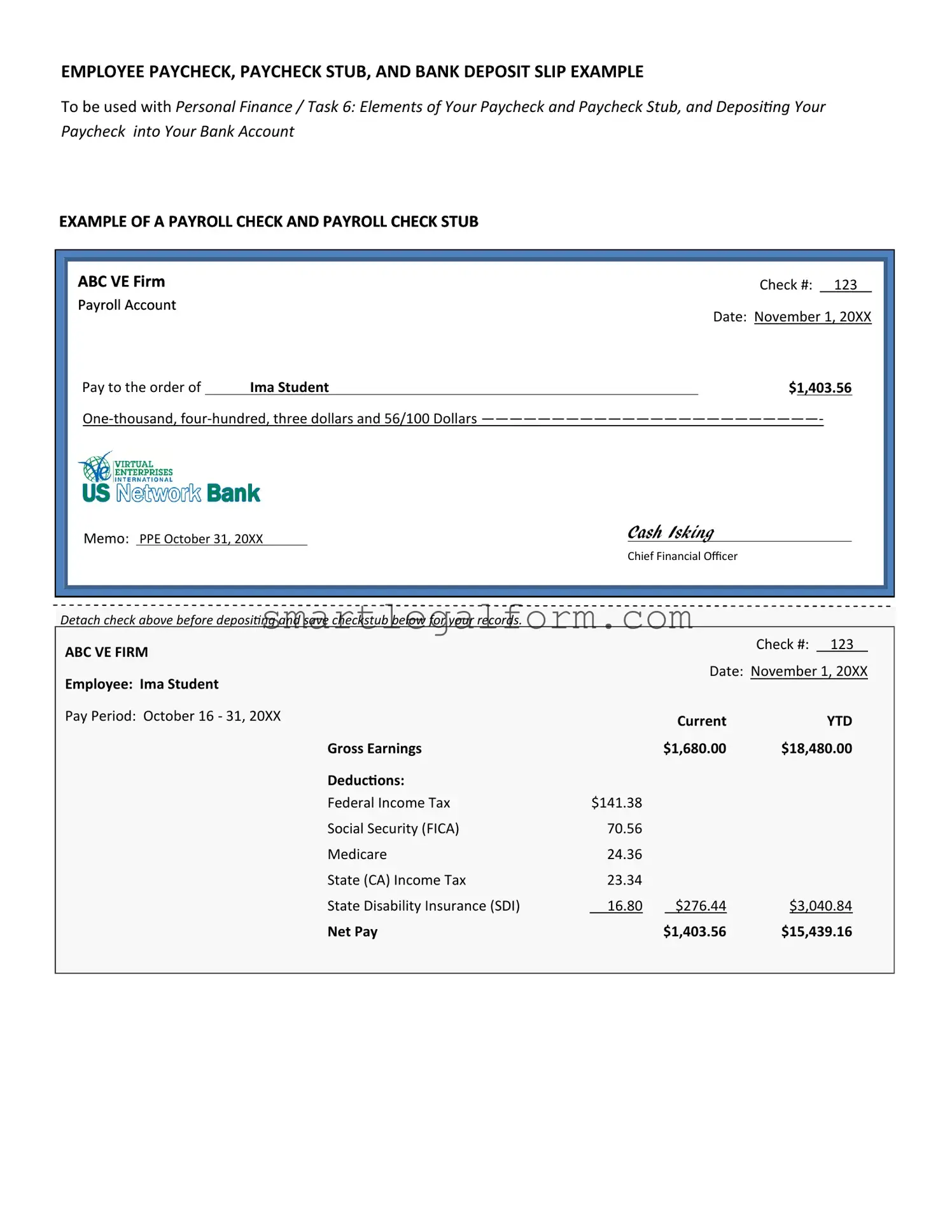

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Common mistakes

Filling out a Payroll Check form can seem straightforward, but many people make common mistakes that can lead to delays or errors in payment. Understanding these pitfalls can help ensure that employees receive their paychecks on time and without complications.

One frequent mistake is inaccurate personal information. Employees often forget to double-check their name, address, or Social Security number. Even a small typo can cause significant issues, including delays in processing or incorrect tax withholdings. Always verify that the information matches official documents.

Another common error involves incorrect payment amounts. Some individuals may miscalculate their hours worked or forget to include overtime. It's essential to keep accurate records of hours and pay rates to avoid discrepancies. A simple math error can lead to underpayment or overpayment, both of which can create problems down the line.

People sometimes neglect to sign the form. A missing signature can halt the entire payroll process. It’s a simple step, but one that can easily be overlooked in a rush. Always ensure that the form is signed before submission to prevent unnecessary delays.

Additionally, many individuals fail to submit the form on time. Payroll deadlines are strict, and late submissions can result in missing pay periods. Staying organized and aware of deadlines is crucial to ensuring timely payment. Set reminders if necessary to keep track of when forms are due.

Another mistake is not keeping a copy of the submitted form. This can lead to confusion if there are questions or issues later. Retaining a copy provides a reference point for both employees and payroll staff, making it easier to resolve any discrepancies that may arise.

Lastly, some employees forget to review tax withholding options. Choosing the wrong withholding status can affect take-home pay and tax obligations. It’s vital to understand the implications of these choices and to adjust them as necessary to avoid surprises during tax season.

By being mindful of these common mistakes, employees can streamline the payroll process and ensure they receive their pay accurately and on time. Attention to detail is key in this essential task.

Dos and Don'ts

When filling out the Payroll Check form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below are some important do's and don'ts to keep in mind.

- Do double-check all employee information for accuracy.

- Do ensure that the correct pay period is indicated on the form.

- Don't leave any fields blank; each section must be completed.

- Don't use incorrect or outdated tax information.

Other PDF Documents

How to Fix Written Mistake on Car Title When Selling - This form applies to the state of Illinois and adheres to local mechanics' lien statutes.

For those navigating the complexities of mobile home transactions, understanding the significance of the essential Mobile Home Bill of Sale is crucial. This document not only facilitates the transfer process but also protects the rights of both the buyer and seller, ensuring that all pertinent information is accurately recorded. For additional insights and guidance, you may refer to this key Mobile Home Bill of Sale resource.

Bbb File a Complaint - Delivery was significantly delayed without notice.

Similar forms

The Payroll Check form is an important document in the payroll process, but it shares similarities with several other documents. Here’s a look at nine documents that are similar to the Payroll Check form, along with explanations of how they relate:

- Pay Stub: A pay stub accompanies a paycheck and details the employee's earnings, deductions, and net pay. Like the Payroll Check form, it provides essential information about compensation.

- W-2 Form: This tax form summarizes an employee's annual wages and the taxes withheld. Both documents are crucial for reporting income and ensuring compliance with tax obligations.

-

Power of Attorney Form: Essential for appointing someone to make decisions on your behalf, this legal document can cover various aspects like financial and health-related matters. For more information, visit TopTemplates.info.

- Direct Deposit Authorization Form: This document allows an employee to authorize their employer to deposit their paycheck directly into their bank account. It streamlines the payment process, similar to the Payroll Check form.

- Time Sheet: A time sheet records the hours worked by an employee. It is essential for calculating pay, just as the Payroll Check form is necessary for issuing payment.

- Payroll Register: This report summarizes all payroll transactions for a specific period. It provides an overview of payroll expenses, akin to the information contained in the Payroll Check form.

- Employee Information Form: This form collects essential details about an employee, such as personal information and tax withholding preferences. Both documents are vital for accurate payroll processing.

- Payroll Deduction Authorization Form: This document allows employees to authorize deductions from their paychecks for benefits or other purposes. It is similar in function to the Payroll Check form, as it impacts the final amount received.

- Expense Reimbursement Form: Employees use this form to request reimbursement for work-related expenses. Both documents involve financial transactions related to employee compensation.

- Employment Contract: This agreement outlines the terms of employment, including salary. It is foundational for understanding pay, much like the Payroll Check form provides clarity on payment issued.