Attorney-Approved Owner Financing Contract Form

Form Preview Example

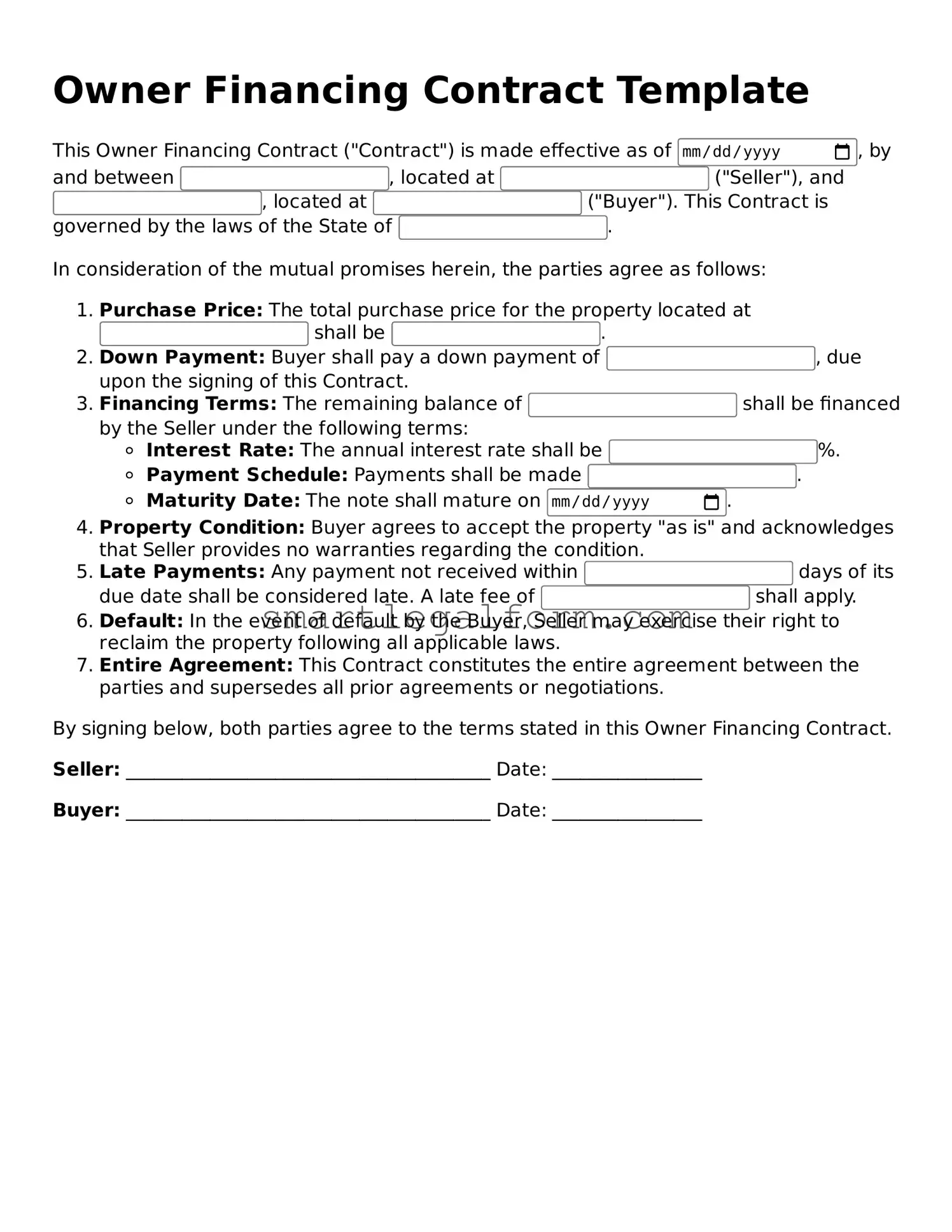

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is made effective as of , by and between , located at ("Seller"), and , located at ("Buyer"). This Contract is governed by the laws of the State of .

In consideration of the mutual promises herein, the parties agree as follows:

- Purchase Price: The total purchase price for the property located at shall be .

- Down Payment: Buyer shall pay a down payment of , due upon the signing of this Contract.

- Financing Terms: The remaining balance of shall be financed by the Seller under the following terms:

- Interest Rate: The annual interest rate shall be %.

- Payment Schedule: Payments shall be made .

- Maturity Date: The note shall mature on .

- Property Condition: Buyer agrees to accept the property "as is" and acknowledges that Seller provides no warranties regarding the condition.

- Late Payments: Any payment not received within days of its due date shall be considered late. A late fee of shall apply.

- Default: In the event of default by the Buyer, Seller may exercise their right to reclaim the property following all applicable laws.

- Entire Agreement: This Contract constitutes the entire agreement between the parties and supersedes all prior agreements or negotiations.

By signing below, both parties agree to the terms stated in this Owner Financing Contract.

Seller: _______________________________________ Date: ________________

Buyer: _______________________________________ Date: ________________

Common mistakes

Filling out an Owner Financing Contract form can be a complex process. Many individuals make mistakes that can lead to misunderstandings or legal complications. One common error is failing to clearly define the terms of the financing arrangement. This includes the interest rate, payment schedule, and duration of the loan. Without precise details, both parties may have differing expectations, which can result in disputes down the line.

Another frequent mistake involves neglecting to include necessary contingencies. Contingencies are conditions that must be met for the contract to remain valid. For instance, a buyer may want to include a contingency that allows them to conduct a home inspection before finalizing the sale. Omitting these important clauses can leave one party vulnerable if unexpected issues arise.

People often overlook the importance of accurate property descriptions. A vague or incorrect description can lead to confusion about what is being financed. This mistake can complicate the transaction and potentially lead to legal issues if the property is misidentified. Clear and specific language is essential to ensure that both parties understand exactly what is included in the agreement.

Lastly, many individuals fail to seek legal advice before signing the contract. While it may seem like a straightforward transaction, the nuances of owner financing can be complex. Consulting with a legal professional can help identify potential pitfalls and ensure that the contract is fair and enforceable. Ignoring this step may lead to significant challenges in the future.

Dos and Don'ts

When filling out an Owner Financing Contract form, it is crucial to approach the task with care. Here are seven important dos and don’ts to keep in mind:

- Do read the entire contract thoroughly before filling it out. Understanding every section helps prevent mistakes.

- Do provide accurate information. Ensure that all details, including names, addresses, and financial terms, are correct.

- Do consult a legal expert if you have questions. Getting professional advice can clarify complex terms.

- Do keep a copy of the completed contract for your records. This will be useful for future reference.

- Don't rush through the form. Taking your time reduces the risk of errors.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't ignore state-specific regulations. Each state may have unique requirements that must be followed.

More Types of Owner Financing Contract Forms:

Purchase Agreement Addendum - The form provides a structured way to negotiate changes after the initial agreement.

The Texas Real Estate Purchase Agreement is a legally binding document used in real estate transactions within Texas. This form outlines the terms and conditions agreed upon by both the buyer and seller, and for those seeking a template, it can be found at documentonline.org/blank-texas-real-estate-purchase-agreement. Understanding its components is crucial for anyone involved in property sales in the state.

Similar forms

-

Purchase Agreement: This document outlines the terms of the sale between the buyer and seller. It details the purchase price, payment terms, and conditions of the sale, similar to how an Owner Financing Contract specifies payment arrangements and responsibilities.

-

Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. Like the Owner Financing Contract, it establishes the borrower's obligation to repay the loan, including interest rates and payment schedules.

- Real Estate Purchase Agreement: This document is essential for anyone looking to navigate the complexities of buying or selling property in New York. It outlines the terms and conditions under which a piece of real estate will be sold and purchased, detailing everything from the price to the responsibilities of both parties. For more information on this topic, you can refer to the NY PDF Forms.

-

Deed of Trust: This document secures the loan by transferring the property title to a trustee until the borrower repays the loan. Similar to the Owner Financing Contract, it provides security for the lender in case of default.

-

Lease Purchase Agreement: This agreement allows a tenant to rent a property with the option to buy it later. It shares similarities with the Owner Financing Contract in that both documents facilitate a path to ownership while detailing payment terms.

-

Real Estate Option Agreement: This agreement gives a buyer the right, but not the obligation, to purchase a property at a set price within a specific time frame. Like the Owner Financing Contract, it outlines terms and conditions that protect both parties in the transaction.