Printable Ohio Transfer-on-Death Deed Document

Form Preview Example

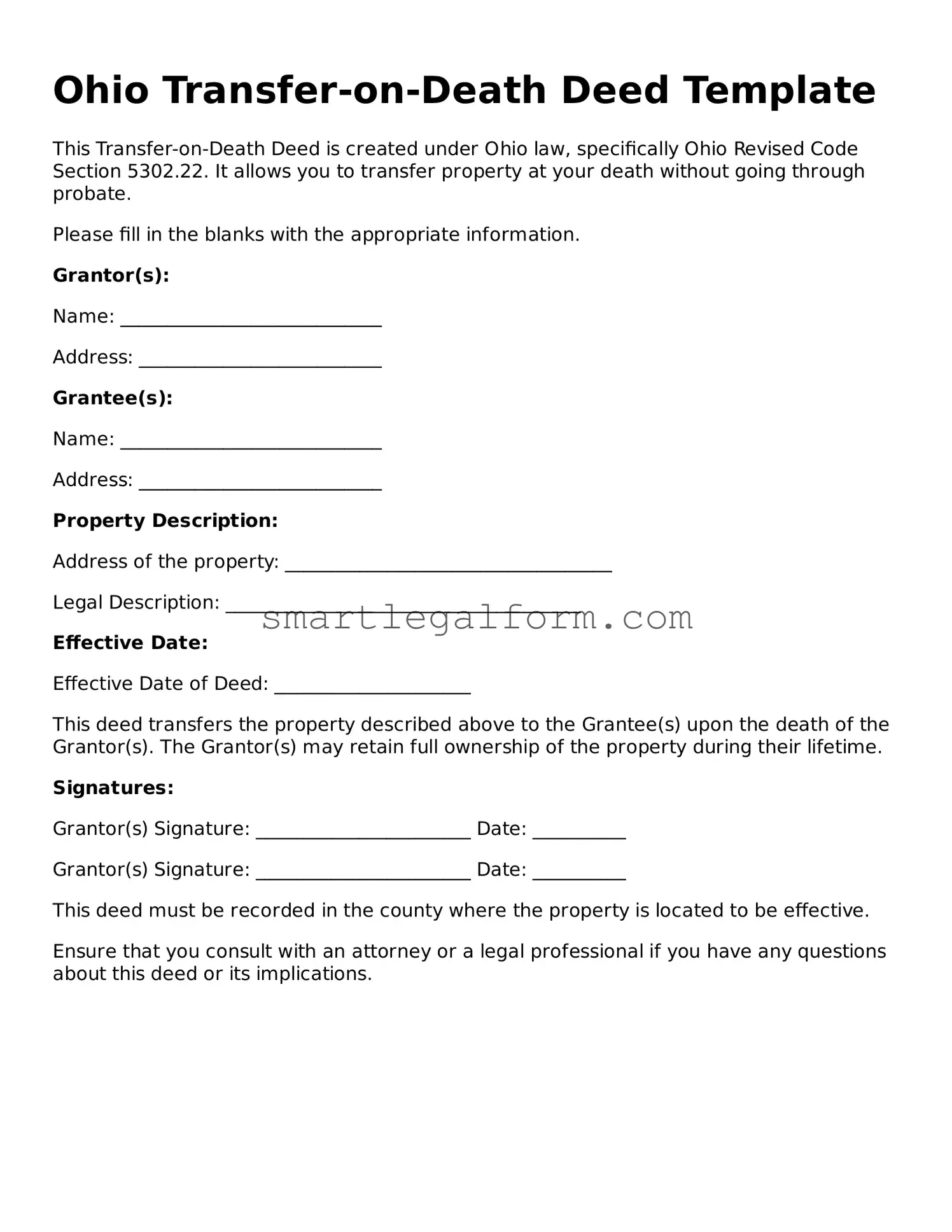

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created under Ohio law, specifically Ohio Revised Code Section 5302.22. It allows you to transfer property at your death without going through probate.

Please fill in the blanks with the appropriate information.

Grantor(s):

Name: ____________________________

Address: __________________________

Grantee(s):

Name: ____________________________

Address: __________________________

Property Description:

Address of the property: ___________________________________

Legal Description: ______________________________________

Effective Date:

Effective Date of Deed: _____________________

This deed transfers the property described above to the Grantee(s) upon the death of the Grantor(s). The Grantor(s) may retain full ownership of the property during their lifetime.

Signatures:

Grantor(s) Signature: _______________________ Date: __________

Grantor(s) Signature: _______________________ Date: __________

This deed must be recorded in the county where the property is located to be effective.

Ensure that you consult with an attorney or a legal professional if you have any questions about this deed or its implications.

Common mistakes

Filling out the Ohio Transfer-on-Death Deed form can be a straightforward process, but many people make common mistakes that can lead to complications. One frequent error is not including the correct legal description of the property. Instead of just the address, the legal description must accurately reflect the property boundaries as recorded in the county auditor's office. Missing this detail can create confusion about which property is being transferred.

Another mistake involves failing to sign the deed in the presence of a notary public. The law requires that the deed be notarized to ensure its validity. If the deed is not properly notarized, it may be considered invalid, which can lead to disputes among heirs or beneficiaries.

People often overlook the importance of naming beneficiaries clearly. Using vague terms, such as "my children," can cause misunderstandings. Instead, listing each beneficiary by name helps to avoid disputes later on. Clear identification ensures that everyone knows their rights and interests in the property.

Additionally, some individuals forget to record the deed with the county recorder's office. Even if the deed is filled out correctly and signed, it must be filed to be effective. Failing to record the deed means that it may not be enforceable against third parties, potentially leading to issues down the line.

Another common mistake is not updating the deed when circumstances change. Life events such as divorce, death, or changes in relationships can impact who should inherit the property. Regularly reviewing and updating the deed can prevent future complications.

People sometimes neglect to consider tax implications. Transferring property through a Transfer-on-Death Deed can have tax consequences that should be discussed with a financial advisor. Understanding these implications can help beneficiaries prepare for any potential tax liabilities.

Lastly, some individuals fail to communicate their intentions with their beneficiaries. Open discussions about the Transfer-on-Death Deed can provide clarity and help manage expectations. When everyone understands the plan, it reduces the likelihood of disputes and misunderstandings in the future.

Dos and Don'ts

When completing the Ohio Transfer-on-Death Deed form, it is essential to approach the task with care and attention to detail. Below are important guidelines to follow, as well as common pitfalls to avoid.

Things You Should Do:

- Ensure that all property details are accurate and clearly stated.

- Include the names and addresses of all beneficiaries.

- Sign the deed in the presence of a notary public.

- Keep a copy of the completed deed for your records.

- Consider consulting a legal professional if you have questions.

- File the deed with the appropriate county recorder’s office.

- Review the deed periodically to ensure it reflects your current wishes.

Things You Shouldn't Do:

- Do not leave any fields blank on the form.

- Avoid using outdated information about the property or beneficiaries.

- Do not sign the deed without a notary present.

- Refrain from making alterations or corrections without proper procedure.

- Do not forget to inform beneficiaries about the deed and its implications.

- Do not assume that verbal agreements about the deed are sufficient.

- Never delay filing the deed after it has been completed and signed.

By adhering to these guidelines, you can ensure a smoother process and help prevent potential complications in the future.

Other Transfer-on-Death Deed State Forms

Florida Transfer on Death Deed Form - Widely recognized by real estate professionals and attorneys.

Where Can I Get a Tod Form - Because the Transfer-on-Death Deed is revocable, it provides flexibility in changing one’s estate planning as circumstances change.

Tod in California - Property owners can use the Transfer-on-Death Deed to avoid potential disputes among heirs concerning property division.

Understanding the importance of a Georgia Hold Harmless Agreement is crucial for anyone engaged in activities that may involve risk or liability. This legal document not only safeguards one party from unforeseen damages but also fosters trust among participants. For those seeking templates or more information regarding these agreements, resources like TopTemplates.info can be invaluable.

Transfer on Death Instrument - The form typically requires the owner's signature and two witnesses or a notary to be legally valid.

Similar forms

The Transfer-on-Death Deed (TOD Deed) is a unique legal document that allows individuals to transfer property to beneficiaries upon their death, bypassing the probate process. However, it shares similarities with several other legal documents. Here’s a look at six documents that are comparable to the TOD Deed:

- Last Will and Testament: A will specifies how a person's assets should be distributed after death. Like the TOD Deed, it can designate beneficiaries, but it typically requires probate to validate the distribution.

- Living Trust: A living trust holds assets during a person's lifetime and allows for their distribution after death. Similar to a TOD Deed, it can avoid probate, making the transfer process quicker for beneficiaries.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries who will receive assets directly upon death, similar to how a TOD Deed operates for real estate.

- Joint Tenancy with Right of Survivorship: This ownership structure allows two or more people to own property together. When one owner passes away, the property automatically transfers to the surviving owner, akin to the transfer mechanism in a TOD Deed.

- Employment Verification Form: This document is essential for employers to confirm an individual's employment history and qualifications, as outlined in the https://documentonline.org/blank-employment-verification-form.

- Payable-on-Death (POD) Accounts: These bank accounts allow individuals to name a beneficiary who will receive the funds upon the account holder's death, functioning similarly to a TOD Deed in terms of direct transfer without probate.

- Transfer-on-Death Registration for Vehicles: This document allows vehicle owners to designate a beneficiary who will inherit the vehicle upon their death, paralleling the property transfer aspect of a TOD Deed.

Understanding these documents can help individuals make informed decisions about how they wish to manage and transfer their assets. Each serves a specific purpose and can be beneficial in different situations.