Printable Ohio Promissory Note Document

Form Preview Example

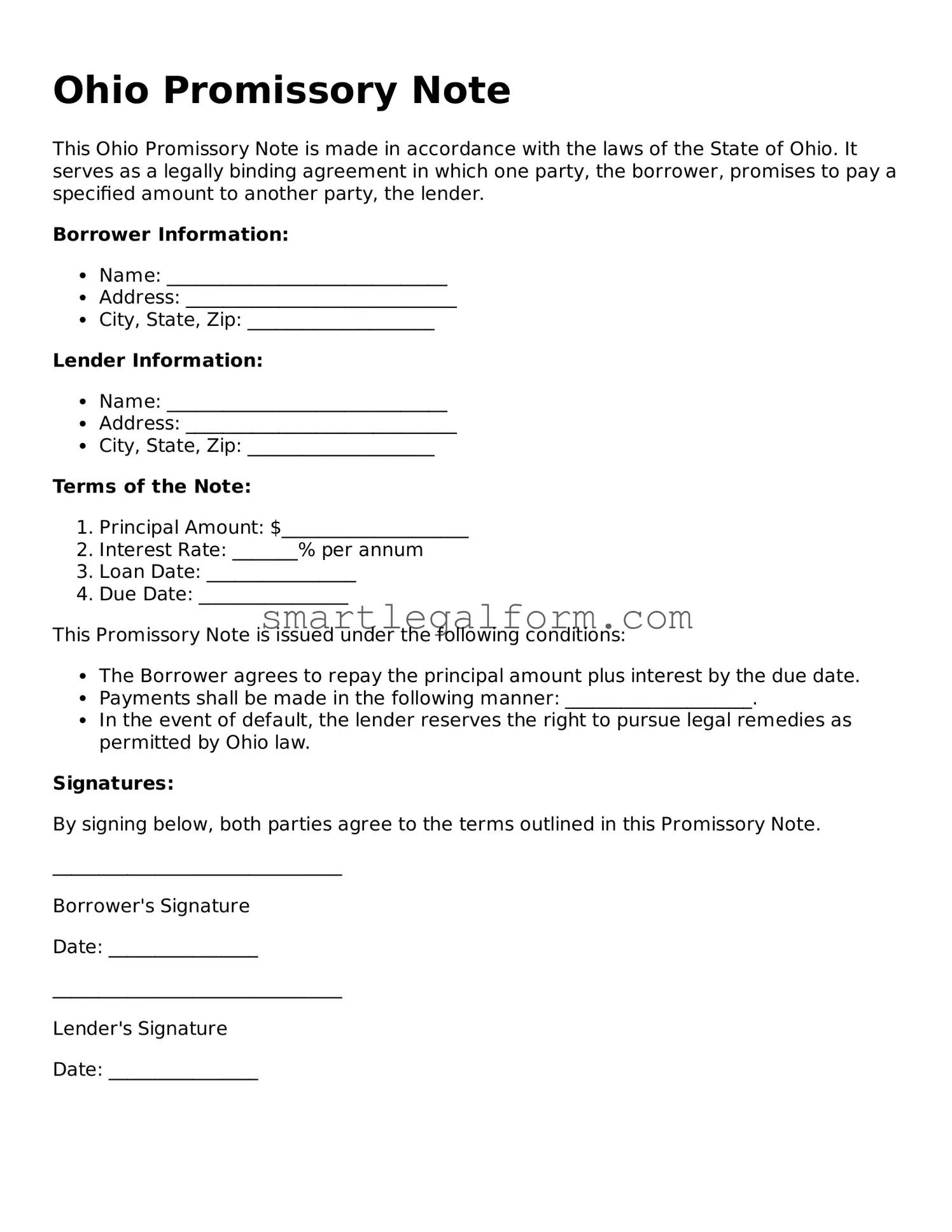

Ohio Promissory Note

This Ohio Promissory Note is made in accordance with the laws of the State of Ohio. It serves as a legally binding agreement in which one party, the borrower, promises to pay a specified amount to another party, the lender.

Borrower Information:

- Name: ______________________________

- Address: _____________________________

- City, State, Zip: ____________________

Lender Information:

- Name: ______________________________

- Address: _____________________________

- City, State, Zip: ____________________

Terms of the Note:

- Principal Amount: $____________________

- Interest Rate: _______% per annum

- Loan Date: ________________

- Due Date: ________________

This Promissory Note is issued under the following conditions:

- The Borrower agrees to repay the principal amount plus interest by the due date.

- Payments shall be made in the following manner: ____________________.

- In the event of default, the lender reserves the right to pursue legal remedies as permitted by Ohio law.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_______________________________

Borrower's Signature

Date: ________________

_______________________________

Lender's Signature

Date: ________________

Common mistakes

Filling out the Ohio Promissory Note form can be straightforward, but there are common mistakes that people often make. One frequent error is failing to include the correct date. The date is crucial as it establishes when the agreement takes effect. Without this information, the note may lack validity.

Another mistake is neglecting to clearly state the amount being borrowed. This figure should be written both in numbers and words to avoid any confusion. If the amount is not specified correctly, it could lead to disputes down the line.

People also sometimes forget to include the names of both the borrower and the lender. Each party’s full legal name should be used to ensure clarity. Omitting this detail can create complications regarding who is responsible for the repayment.

Additionally, not specifying the interest rate can lead to misunderstandings. If the loan is to be repaid with interest, it’s essential to state the rate clearly. Leaving this out may result in the loan being considered interest-free, which may not be the intention.

Another common oversight is failing to include the repayment schedule. The form should detail when payments are due and how they should be made. Without this information, the borrower may not know when to pay, and the lender may not know when to expect payments.

People often overlook the importance of signatures. Both parties must sign the document to make it legally binding. A lack of signatures could render the note unenforceable in a court of law.

Furthermore, not having a witness or notary can be a mistake. While not always required, having a witness or notary can add an extra layer of legitimacy to the document. This can be particularly important if disputes arise in the future.

Another error involves not keeping copies of the signed note. Both the borrower and lender should retain a copy for their records. This helps both parties remember the terms of the agreement and provides proof if any issues arise later.

Lastly, failing to read the entire document before signing can lead to serious issues. It’s vital to ensure that all terms are understood and agreed upon. Rushing through the process may result in agreeing to unfavorable terms.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it's important to be careful and thorough. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the borrower and lender.

- Do clearly state the loan amount and interest rate.

- Do specify the repayment terms, including due dates.

- Don’t leave any fields blank; fill out all required sections.

- Don’t use vague language; be clear and specific.

- Don’t forget to sign and date the document.

- Don’t overlook the need for witnesses or notarization if required.

Other Promissory Note State Forms

Personal Loan Promissory Note - Promissory notes can enhance financial literacy by outlining responsibilities and repayment plans.

The California Notice to Quit form is a critical document that landlords must use to initiate the eviction process for tenants who have violated their lease terms. This form serves as a formal warning, giving tenants the opportunity to rectify the issue or vacate the property within a specified period. For further information on this topic, you can visit https://toptemplates.info/. Understanding this form and its proper use is essential for both landlords and tenants to safeguard their rights and ensure a legal and fair resolution to tenancy disputes.

Promissory Note California - This document outlines the terms of a loan between a borrower and a lender.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it often includes more detailed conditions and obligations for both parties.

- Mortgage: A mortgage is a specific type of loan secured by real property. It shares similarities with a promissory note in that it involves a promise to repay borrowed money, but it also includes collateral, which is the property itself.

- Security Agreement: This document establishes a security interest in personal property. Similar to a promissory note, it involves a borrower’s promise to repay a loan, but it provides the lender with rights to specific assets if the borrower defaults.

- Power of Attorney for a Child: This legal document allows a parent or guardian to designate someone else to make necessary decisions regarding their child's welfare in their absence. It is crucial for scenarios like extended travel or health issues, ensuring the child's needs are met. To create this authorization, you can download and submit the form.

- Installment Agreement: An installment agreement outlines a repayment plan for a debt. It is similar to a promissory note in that it specifies the amount owed and the payment schedule, but it typically covers a broader range of debts beyond loans.

- Letter of Credit: A letter of credit is a financial document from a bank guaranteeing a buyer's payment to a seller. Like a promissory note, it involves a promise to pay, but it is used primarily in international trade transactions.

- Debt Acknowledgment: This document confirms that a debt exists and outlines the amount owed. While a promissory note includes a promise to pay, a debt acknowledgment simply recognizes the debt without detailing repayment terms.