Printable Ohio Power of Attorney Document

Form Preview Example

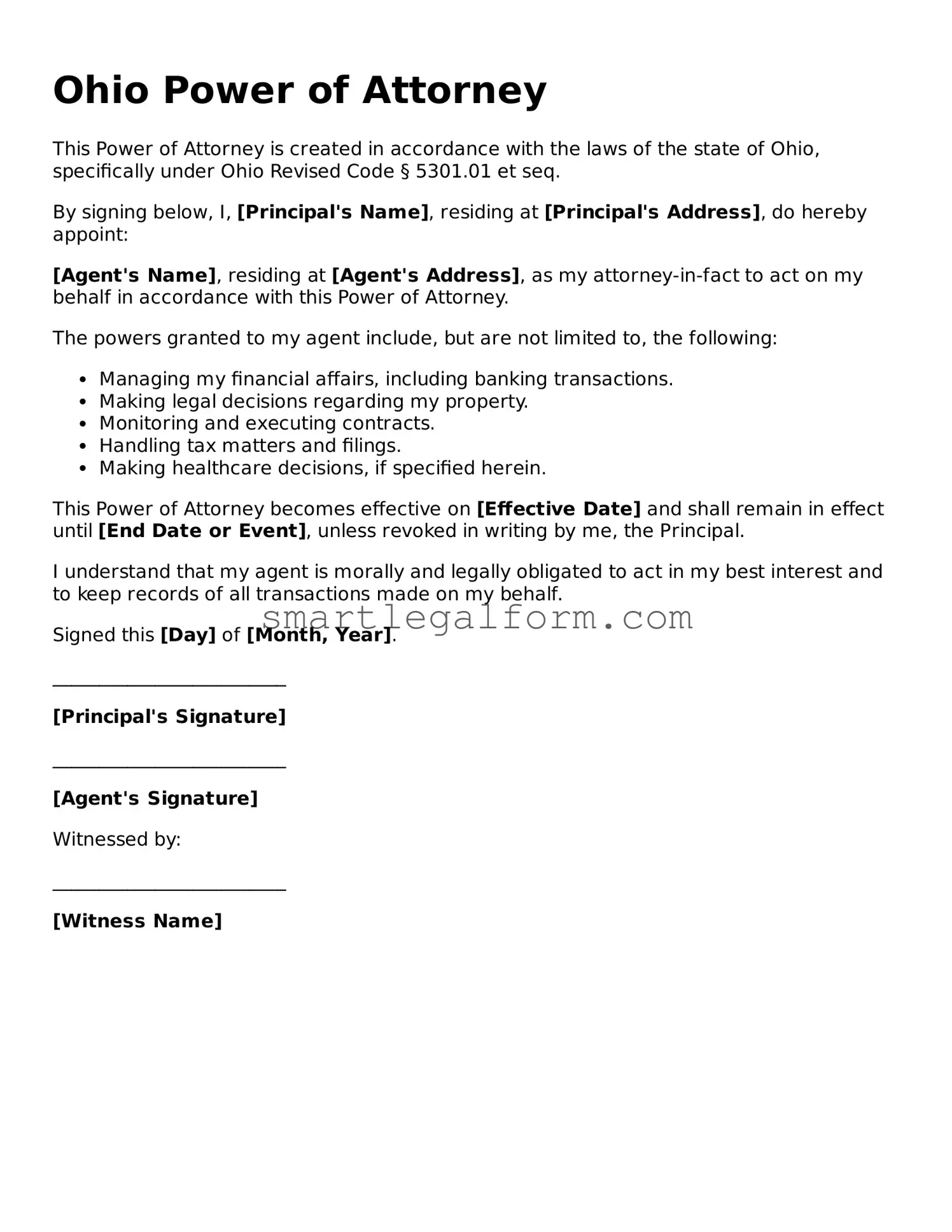

Ohio Power of Attorney

This Power of Attorney is created in accordance with the laws of the state of Ohio, specifically under Ohio Revised Code § 5301.01 et seq.

By signing below, I, [Principal's Name], residing at [Principal's Address], do hereby appoint:

[Agent's Name], residing at [Agent's Address], as my attorney-in-fact to act on my behalf in accordance with this Power of Attorney.

The powers granted to my agent include, but are not limited to, the following:

- Managing my financial affairs, including banking transactions.

- Making legal decisions regarding my property.

- Monitoring and executing contracts.

- Handling tax matters and filings.

- Making healthcare decisions, if specified herein.

This Power of Attorney becomes effective on [Effective Date] and shall remain in effect until [End Date or Event], unless revoked in writing by me, the Principal.

I understand that my agent is morally and legally obligated to act in my best interest and to keep records of all transactions made on my behalf.

Signed this [Day] of [Month, Year].

_________________________

[Principal's Signature]

_________________________

[Agent's Signature]

Witnessed by:

_________________________

[Witness Name]

Common mistakes

Filling out a Power of Attorney (POA) form in Ohio can be a straightforward process, but mistakes can lead to significant issues. One common error is failing to specify the powers granted. The form allows individuals to outline specific powers, but many leave this section blank or too vague. This can create confusion about what the agent is authorized to do.

Another frequent mistake is not signing the document correctly. In Ohio, the principal must sign the POA in the presence of a notary public. If this step is overlooked, the form may not be considered valid. Additionally, some individuals may forget to have the agent sign the document, which is also required for it to be effective.

People often neglect to date the Power of Attorney. A date is essential as it indicates when the document becomes effective. Without a date, there could be disputes about the timing of the authority granted. This oversight can complicate matters when the agent attempts to act on behalf of the principal.

Another mistake involves not discussing the POA with the chosen agent. It's crucial to have a conversation with the person you intend to appoint. If the agent is unaware of their responsibilities or unwilling to accept them, it can lead to complications down the line. Clear communication can prevent misunderstandings.

Some individuals also forget to consider alternate agents. If the primary agent is unable or unwilling to act, having a backup can ensure that the principal's wishes are still carried out. Failing to designate an alternate can leave the principal's affairs unaddressed in critical situations.

Moreover, individuals sometimes overlook the importance of updating the Power of Attorney. Life changes, such as marriage, divorce, or the death of an agent, may necessitate a revision of the document. Keeping the POA current is vital to ensure it reflects the principal's current wishes and circumstances.

Lastly, people often fail to distribute copies of the signed Power of Attorney. After completing the form, it's important to share copies with the agent and any relevant institutions, such as banks or healthcare providers. Without these copies, the agent may face challenges when trying to exercise their authority.

Dos and Don'ts

When filling out the Ohio Power of Attorney form, it's important to follow certain guidelines to ensure the document is valid and meets your needs. Here are some things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do clearly identify the person you are granting power to.

- Do specify the powers you are granting in detail.

- Do sign the form in the presence of a notary public.

- Don't leave any sections blank; fill in all required information.

- Don't use vague language that could lead to confusion.

- Don't forget to provide copies to the agent and relevant parties.

Other Power of Attorney State Forms

Ny Power of Attorney - This legal instrument can ease the burden on family during difficult times.

Having a well-structured Loan Agreement form is crucial for both borrowers and lenders, and resources like TopTemplates.info provide valuable templates to ensure that all necessary terms and conditions are clearly defined, avoiding potential misunderstandings and safeguarding the interests of all parties involved.

Texas Durable Power of Attorney Free Pdf - Choosing a trustworthy agent is crucial, as they will have significant control over your affairs.

Ca Power of Attorney Form - A Power of Attorney can be critical in real estate transactions.

Printable Power of Attorney Form Florida - Can be tailored for specific tasks or broad authority.

Similar forms

- Living Will: A Living Will outlines a person's preferences regarding medical treatment in the event they become unable to communicate. Like a Power of Attorney, it allows individuals to express their wishes, but it specifically focuses on healthcare decisions rather than financial or legal matters.

- Healthcare Proxy: This document designates someone to make medical decisions on behalf of an individual if they are incapacitated. Similar to a Power of Attorney, it grants authority to another person, but it is limited to healthcare-related decisions.

- Durable Power of Attorney: This form is a specific type of Power of Attorney that remains effective even if the principal becomes incapacitated. Both documents allow for the delegation of authority, but the Durable Power of Attorney specifically addresses the issue of incapacity.

- Financial Power of Attorney: This document allows a designated individual to manage financial matters on behalf of another person. It is similar to a general Power of Attorney but focuses solely on financial transactions and obligations.

-

Bill of Sale: A Bill of Sale is essential for documenting the sale of personal property between a buyer and a seller. In Florida, this form includes important details such as the buyer's and seller's information, the description of the item sold, and the price. For more information on the Bill of Sale form, visit https://documentonline.org/blank-florida-bill-of-sale.

- Trust Agreement: A Trust Agreement establishes a legal entity to hold assets for the benefit of a third party. While a Power of Attorney grants authority to act on someone's behalf, a Trust Agreement involves the management and distribution of assets, often with a long-term perspective.