Printable Ohio Deed in Lieu of Foreclosure Document

Form Preview Example

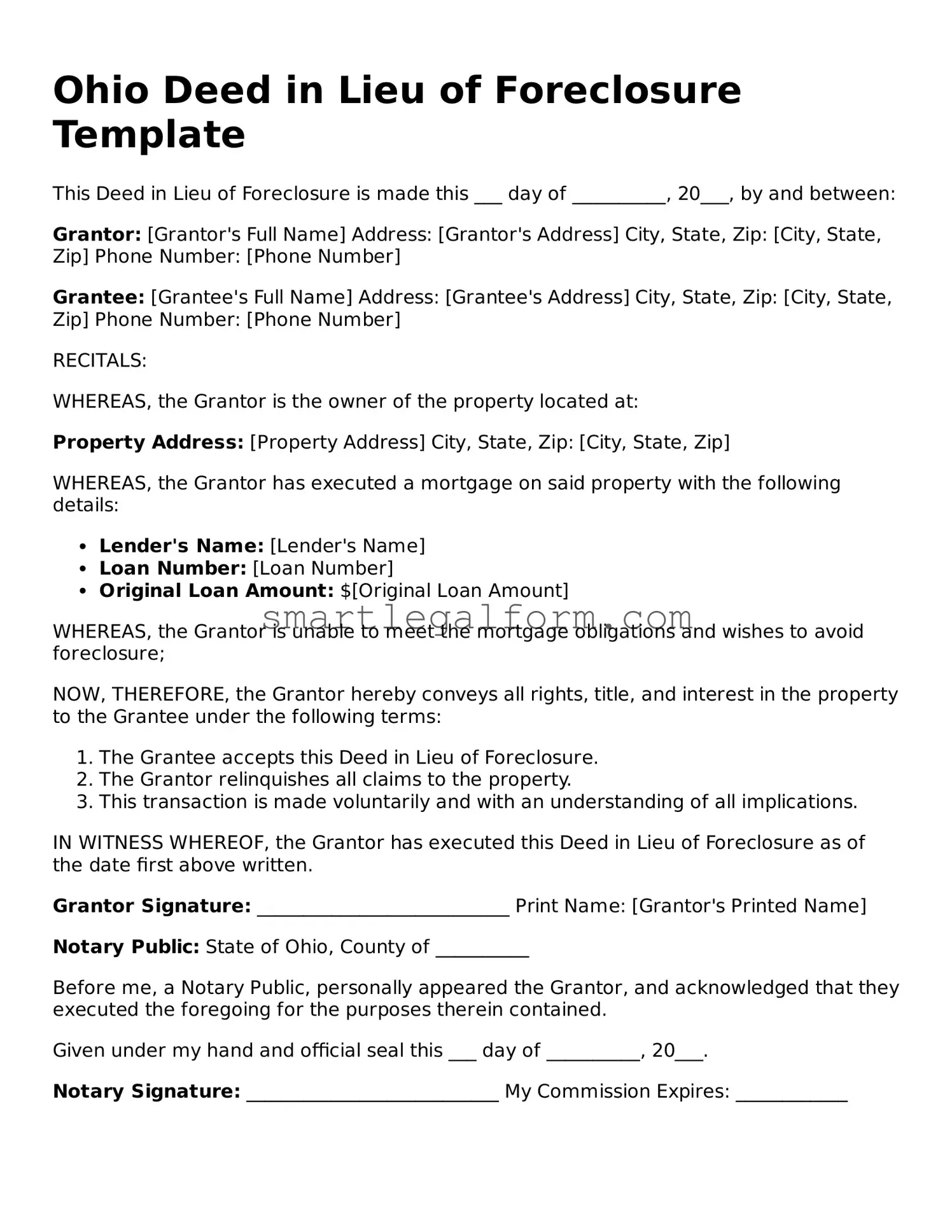

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___, by and between:

Grantor: [Grantor's Full Name] Address: [Grantor's Address] City, State, Zip: [City, State, Zip] Phone Number: [Phone Number]

Grantee: [Grantee's Full Name] Address: [Grantee's Address] City, State, Zip: [City, State, Zip] Phone Number: [Phone Number]

RECITALS:

WHEREAS, the Grantor is the owner of the property located at:

Property Address: [Property Address] City, State, Zip: [City, State, Zip]

WHEREAS, the Grantor has executed a mortgage on said property with the following details:

- Lender's Name: [Lender's Name]

- Loan Number: [Loan Number]

- Original Loan Amount: $[Original Loan Amount]

WHEREAS, the Grantor is unable to meet the mortgage obligations and wishes to avoid foreclosure;

NOW, THEREFORE, the Grantor hereby conveys all rights, title, and interest in the property to the Grantee under the following terms:

- The Grantee accepts this Deed in Lieu of Foreclosure.

- The Grantor relinquishes all claims to the property.

- This transaction is made voluntarily and with an understanding of all implications.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ___________________________ Print Name: [Grantor's Printed Name]

Notary Public: State of Ohio, County of __________

Before me, a Notary Public, personally appeared the Grantor, and acknowledged that they executed the foregoing for the purposes therein contained.

Given under my hand and official seal this ___ day of __________, 20___.

Notary Signature: ___________________________ My Commission Expires: ____________

Common mistakes

Filling out the Ohio Deed in Lieu of Foreclosure form can be a complex process. Many individuals make mistakes that can lead to delays or complications. Here are seven common errors to avoid.

One frequent mistake is not providing accurate property information. Ensure that the property address, parcel number, and legal description are correct. Inaccurate details can cause confusion and may result in the deed being rejected.

Another common error is failing to sign the document properly. All parties involved must sign the deed. If anyone forgets to sign, it may render the document invalid. Double-check that every required signature is present.

People often overlook the need for witnesses or notarization. In Ohio, a deed typically requires notarization. Not having a notary present during the signing process can lead to issues when you submit the deed.

Some individuals neglect to review the terms of the deed before signing. It’s crucial to understand what you are agreeing to. Misunderstandings about the terms can lead to disputes later on.

Another mistake involves not consulting with a professional. While it may seem straightforward, legal documents can have long-term implications. Seeking advice from a real estate attorney or a qualified professional can help avoid pitfalls.

People sometimes fail to keep copies of the completed document. Always make sure to retain a copy for your records. This can be important for future reference or if questions arise regarding the deed.

Lastly, not submitting the deed promptly can be a significant error. Once completed, the deed should be filed with the appropriate county office without delay. Delaying this step can complicate the foreclosure process.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it's important to take certain precautions to ensure the process goes smoothly. Here are six things to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Don't rush through the form. Take your time to understand each section before filling it out.

- Do consult with a legal professional if you have any questions or uncertainties about the form.

- Don't forget to sign and date the form. An unsigned form may be considered invalid.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't submit the form without verifying that you have met all necessary requirements for a deed in lieu of foreclosure.

By following these guidelines, you can help ensure that your submission is handled properly and efficiently.

Other Deed in Lieu of Foreclosure State Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Before signing, homeowners should review all terms carefully to avoid hidden pitfalls.

Understanding the importance of a Hold Harmless Agreement in California can significantly benefit both parties involved, as it clarifies the responsibilities and liabilities related to potential risks. For comprehensive information and templates, you can visit TopTemplates.info, which provides valuable resources to ensure that you create a well-structured and effective agreement that caters to your specific needs.

California Voluntary Foreclosure Deed - This deed serves as an official document finalizing the transfer of ownership.

Similar forms

The Deed in Lieu of Foreclosure is a specific legal document used in real estate transactions, particularly when a borrower wants to avoid foreclosure. It can be helpful to understand other documents that serve similar purposes in real estate and financial contexts. Here are six documents that share similarities with the Deed in Lieu of Foreclosure:

- Loan Modification Agreement: This document changes the terms of an existing loan. Borrowers may use it to make their payments more manageable and avoid foreclosure.

- Short Sale Agreement: In a short sale, a lender agrees to accept less than the full amount owed on a mortgage. This allows the homeowner to sell the property and avoid foreclosure.

- Forbearance Agreement: This document allows a borrower to temporarily reduce or suspend mortgage payments. It provides relief for homeowners facing financial difficulties.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. It gives borrowers time to reorganize their debts and possibly keep their homes.

- Quitclaim Deed: This document transfers ownership of a property without any warranties. It can be used to transfer property to a lender in certain situations, similar to a Deed in Lieu of Foreclosure.

- Non-disclosure Agreement: A California Non-disclosure Agreement (NDA) is essential for protecting confidential information and establishing a secure relationship between parties. For further details, visit OnlineLawDocs.com.

- Repayment Plan: A repayment plan outlines how a borrower will pay back missed mortgage payments. It is an option for those who want to catch up and avoid foreclosure.

Each of these documents serves a unique purpose, yet they all aim to provide alternatives to foreclosure, allowing homeowners to navigate financial challenges more effectively.