Printable Ohio Deed Document

Form Preview Example

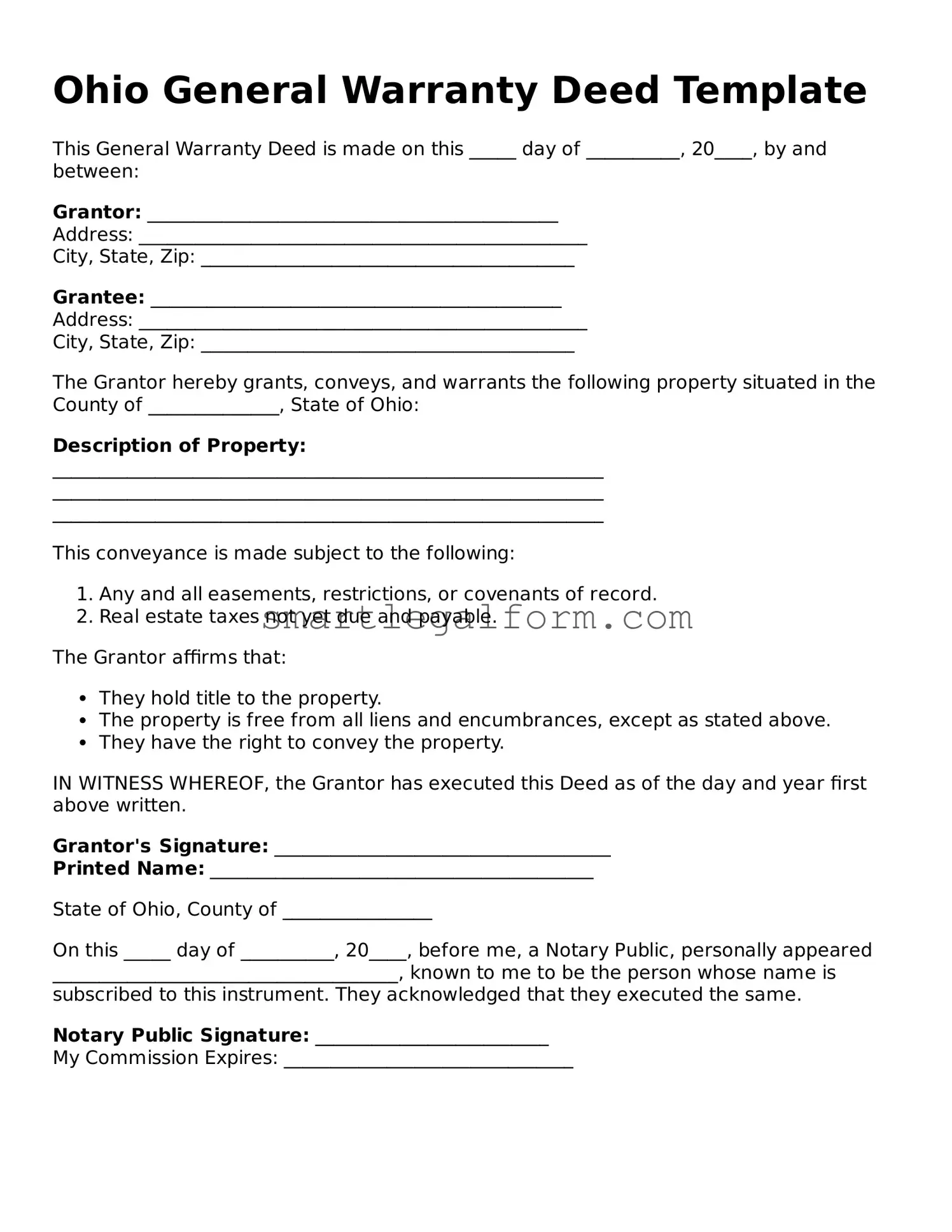

Ohio General Warranty Deed Template

This General Warranty Deed is made on this _____ day of __________, 20____, by and between:

Grantor: ____________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Grantee: ____________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

The Grantor hereby grants, conveys, and warrants the following property situated in the County of ______________, State of Ohio:

Description of Property:

___________________________________________________________

___________________________________________________________

___________________________________________________________

This conveyance is made subject to the following:

- Any and all easements, restrictions, or covenants of record.

- Real estate taxes not yet due and payable.

The Grantor affirms that:

- They hold title to the property.

- The property is free from all liens and encumbrances, except as stated above.

- They have the right to convey the property.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor's Signature: ____________________________________

Printed Name: _________________________________________

State of Ohio, County of ________________

On this _____ day of __________, 20____, before me, a Notary Public, personally appeared _____________________________________, known to me to be the person whose name is subscribed to this instrument. They acknowledged that they executed the same.

Notary Public Signature: _________________________

My Commission Expires: _______________________________

Common mistakes

When filling out the Ohio Deed form, many individuals inadvertently make mistakes that can lead to complications down the road. One common error is failing to include the correct legal description of the property. The legal description is crucial because it precisely identifies the property being transferred. Without it, the deed may be deemed invalid, leading to potential disputes or confusion about ownership.

Another frequent mistake is not having the deed properly signed and notarized. In Ohio, a deed must be signed by the grantor (the person transferring the property) and should ideally be notarized to ensure its authenticity. If these steps are overlooked, the deed may not be enforceable, which could create significant issues when trying to sell or transfer the property in the future.

People also often neglect to include the correct names of the parties involved. It is essential to ensure that the names of both the grantor and the grantee (the person receiving the property) are spelled correctly and match their legal identification. Any discrepancies can lead to legal challenges and may even result in the deed being rejected by the county recorder's office.

Lastly, many individuals overlook the importance of understanding and addressing any existing liens or encumbrances on the property. If there are outstanding mortgages or other claims against the property, these must be disclosed in the deed. Failing to do so can result in legal repercussions and financial liabilities for the new owner. Proper due diligence is essential to avoid these pitfalls and ensure a smooth transfer of property ownership.

Dos and Don'ts

When filling out the Ohio Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should and shouldn't do:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Do provide a complete legal description of the property being transferred.

- Do sign the deed in front of a notary public to validate the document.

- Do include the date of the transaction on the form.

- Do keep a copy of the completed deed for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use abbreviations or informal language in the legal description.

- Don't forget to check local regulations regarding additional requirements.

- Don't forget to pay any applicable transfer taxes.

- Don't submit the deed without ensuring it is properly notarized.

Other Deed State Forms

How to Get a Copy of My House Deed - An important step in the process of buying or selling a home.

Pennsylvania Deed Form - Deeds play a critical role in estate planning, allowing individuals to pass property to heirs smoothly.

How to Obtain a Deed to Your House - Deeds often require notarization to be legally binding.

Understanding the intricacies of a Michigan Hold Harmless Agreement is essential for businesses and individuals entering into contracts, as it effectively allocates risk and protects against unforeseen liabilities. For further insights and templates regarding this important legal document, you can visit TopTemplates.info, where you can find resources to help you draft your own agreement.

New York Warranty Deed Form - Facilitates a smooth transition of property ownership.

Similar forms

Title Transfer Document: Similar to a deed, this document formally transfers ownership of property from one party to another. Both serve to establish legal ownership and are recorded with the appropriate governmental authority.

Lease Agreement: While a lease agreement outlines the terms under which one party can use property owned by another, both documents are essential in defining rights and responsibilities related to property use.

Bill of Sale: This document transfers ownership of personal property, much like a deed does for real estate. Both documents require signatures and may need to be notarized for legal validity.

Employment Verification Form: This essential document confirms an individual's employment status and validates work history, including job titles and responsibilities, benefiting both job seekers and employers alike. For further details, you can refer to documentonline.org/blank-employment-verification.

Mortgage Agreement: A mortgage agreement is similar in that it involves the transfer of an interest in property. However, it also establishes the terms of a loan secured by the property, creating a lien.

Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters, including property transactions. Both documents empower individuals to manage property-related affairs.

Trust Agreement: A trust agreement creates a legal entity to hold property for the benefit of others. Like a deed, it specifies how property is to be managed and distributed.

Quitclaim Deed: This is a specific type of deed that transfers any interest the grantor has in the property without guaranteeing that interest is valid. It is similar to a standard deed but offers less protection to the grantee.

Warranty Deed: A warranty deed provides a guarantee that the grantor holds clear title to the property. Both documents serve to transfer ownership but differ in the level of assurance they provide.

Settlement Statement: Often used in real estate transactions, this document outlines the financial details of a property sale. It complements the deed by detailing the financial aspects of the ownership transfer.

Affidavit of Title: This document is a sworn statement confirming the ownership of property and the absence of liens. It is similar to a deed in that it relates to property ownership and may be used alongside it in transactions.