Printable New York Transfer-on-Death Deed Document

Form Preview Example

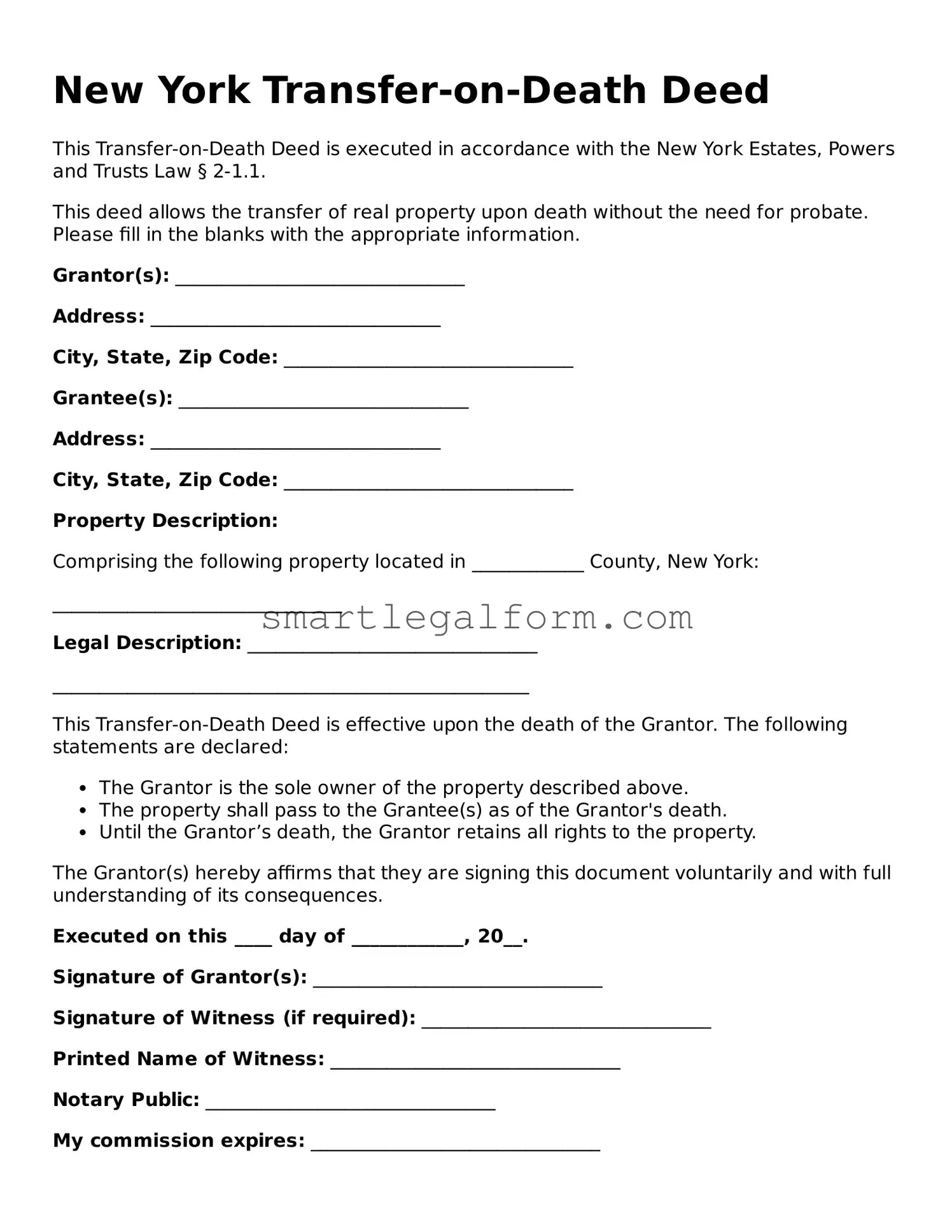

New York Transfer-on-Death Deed

This Transfer-on-Death Deed is executed in accordance with the New York Estates, Powers and Trusts Law § 2-1.1.

This deed allows the transfer of real property upon death without the need for probate. Please fill in the blanks with the appropriate information.

Grantor(s): _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

Grantee(s): _______________________________

Address: _______________________________

City, State, Zip Code: _______________________________

Property Description:

Comprising the following property located in ____________ County, New York:

_______________________________

Legal Description: _______________________________

___________________________________________________

This Transfer-on-Death Deed is effective upon the death of the Grantor. The following statements are declared:

- The Grantor is the sole owner of the property described above.

- The property shall pass to the Grantee(s) as of the Grantor's death.

- Until the Grantor’s death, the Grantor retains all rights to the property.

The Grantor(s) hereby affirms that they are signing this document voluntarily and with full understanding of its consequences.

Executed on this ____ day of ____________, 20__.

Signature of Grantor(s): _______________________________

Signature of Witness (if required): _______________________________

Printed Name of Witness: _______________________________

Notary Public: _______________________________

My commission expires: _______________________________

Common mistakes

Filling out a New York Transfer-on-Death Deed form can be a straightforward process, but many individuals encounter pitfalls that can lead to complications down the line. One common mistake is failing to include all required information. The form requires specific details about the property and the beneficiaries. Omitting even a single piece of essential information can render the deed invalid. Always double-check to ensure that names, addresses, and property descriptions are complete and accurate.

Another frequent error occurs when individuals do not properly sign and date the form. The Transfer-on-Death Deed must be signed by the owner in the presence of a notary public. If the signature is missing or the date is incorrect, the deed may not be legally recognized. It's crucial to follow these requirements closely to avoid any issues with the transfer of property after the owner's passing.

People often overlook the necessity of recording the deed with the county clerk's office. Even if the form is filled out correctly and signed, failing to record it can lead to significant challenges. Without proper recording, the deed may not be enforceable, and beneficiaries might face difficulties claiming the property. To ensure that the deed is effective, it must be filed in accordance with local regulations.

Lastly, many individuals misunderstand the implications of the Transfer-on-Death Deed. Some mistakenly believe that it bypasses all estate taxes or that it can be easily revoked without formal procedures. In reality, while the deed does allow for a straightforward transfer of property upon death, it does not eliminate tax responsibilities. Additionally, revoking or changing the deed typically requires filing a new document. Understanding these nuances is essential for anyone considering this option.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some important do's and don'ts:

- Do clearly identify the property you wish to transfer.

- Do include the names and addresses of all beneficiaries.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank.

- Don't forget to check local laws regarding the transfer of property.

- Don't submit the form without verifying all information is correct.

Other Transfer-on-Death Deed State Forms

Florida Transfer on Death Deed Form - Minimizes the need for legal proceedings post-death.

Tod in California - This option is particularly appealing for individuals who wish to avoid the time and expense of probate proceedings.

To further understand the specifics of a Utah Non-disclosure Agreement form, it is important to review samples and templates available online, such as those on smarttemplates.net, which can provide valuable insights into their proper usage and structure, ensuring that all parties can effectively protect their sensitive information.

Deed Upon Death Form - Future property sales or refinances remain unaffected, which can be an appealing feature for property owners.

Similar forms

- Will: A will is a legal document that outlines how a person's assets should be distributed upon their death. Like a Transfer-on-Death Deed, it allows for the transfer of property, but a will typically requires probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust is an arrangement where a trustee holds assets for the benefit of beneficiaries. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of property upon death, avoiding probate.

- Joint Tenancy: In a joint tenancy arrangement, two or more individuals own property together. Upon the death of one owner, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed works.

- Payable-on-Death Account: This type of bank account allows the account holder to designate a beneficiary who will receive the funds upon the account holder's death. Like a Transfer-on-Death Deed, it ensures a direct transfer without going through probate.

- Employee Handbook: The Employee Handbook serves as an essential document that outlines a company's policies and expectations for its employees. For further information, you can refer to the https://documentonline.org/blank-employee-handbook.

- Beneficiary Designation: Certain financial accounts, such as retirement accounts and life insurance policies, allow for beneficiary designations. This ensures that assets pass directly to the named beneficiary, similar to a Transfer-on-Death Deed.

- Life Estate: A life estate grants an individual the right to use property during their lifetime, with the property passing to another person upon their death. This is similar to a Transfer-on-Death Deed, as both facilitate the transfer of property after death.

- Transfer-on-Death Registration: This is often used for vehicles and allows the owner to designate a beneficiary who will receive the vehicle upon the owner's death, mirroring the direct transfer feature of a Transfer-on-Death Deed.