Printable New York Real Estate Purchase Agreement Document

Form Preview Example

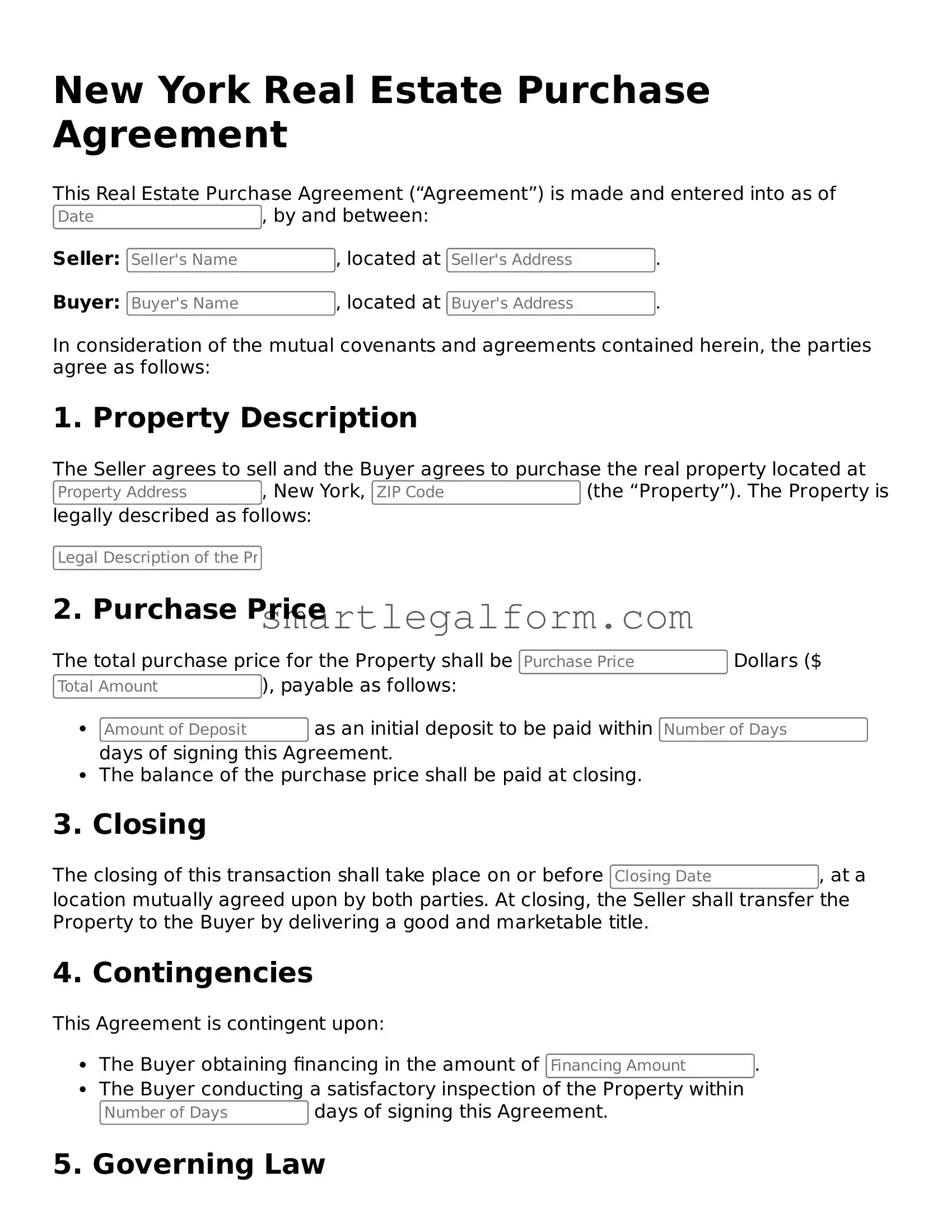

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made and entered into as of , by and between:

Seller: , located at .

Buyer: , located at .

In consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

1. Property Description

The Seller agrees to sell and the Buyer agrees to purchase the real property located at , New York, (the “Property”). The Property is legally described as follows:

2. Purchase Price

The total purchase price for the Property shall be Dollars ($), payable as follows:

- as an initial deposit to be paid within days of signing this Agreement.

- The balance of the purchase price shall be paid at closing.

3. Closing

The closing of this transaction shall take place on or before , at a location mutually agreed upon by both parties. At closing, the Seller shall transfer the Property to the Buyer by delivering a good and marketable title.

4. Contingencies

This Agreement is contingent upon:

- The Buyer obtaining financing in the amount of .

- The Buyer conducting a satisfactory inspection of the Property within days of signing this Agreement.

5. Governing Law

This Agreement shall be governed by the laws of the State of New York.

6. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement as of the day and year first written above.

Seller's Signature: ________________________________

Buyer's Signature: ________________________________

Common mistakes

Filling out the New York Real Estate Purchase Agreement can be a daunting task. Many people, whether first-time buyers or seasoned investors, often overlook critical details that can lead to complications down the road. One common mistake is not clearly identifying all parties involved in the transaction. It’s essential to ensure that names are spelled correctly and that all buyers and sellers are included. Missing a party can create legal headaches later.

Another frequent error is neglecting to specify the purchase price. While it may seem straightforward, ambiguity in this section can lead to disputes. Make sure to write the price clearly and double-check that it matches any verbal agreements made. This small step can prevent misunderstandings during the closing process.

People often forget to include contingencies in the agreement. Contingencies are conditions that must be met for the sale to proceed. For example, a buyer might want to include a home inspection contingency. Without these clauses, you may find yourself in a position where you have committed to a purchase without the necessary protections in place.

Inaccurate property descriptions are another pitfall. The property must be described precisely, including the address and any relevant details. If the description is vague or incorrect, it could lead to legal disputes over what was actually purchased. Always verify that the property details match public records.

Moreover, many overlook the importance of deadlines. Timelines for inspections, financing, and closing are critical components of the agreement. Missing a deadline can jeopardize the entire transaction. Keep a close eye on these dates and ensure that they are clearly outlined in the agreement.

Another mistake involves the earnest money deposit. Buyers often forget to specify the amount and the terms regarding this deposit. This money shows the seller that the buyer is serious about the purchase. Clearly stating how much will be deposited and under what conditions it may be returned is crucial.

Finally, failing to consult with a legal professional can be a significant oversight. Even if you feel confident in your understanding of the agreement, having an expert review the document can help catch mistakes you might have missed. Their guidance can provide peace of mind and ensure that your interests are protected throughout the process.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here are some key do's and don'ts:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about the property and parties involved.

- Do consult with a real estate attorney if you have any questions or concerns.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't ignore deadlines for submitting the agreement.

Other Real Estate Purchase Agreement State Forms

Real Estate Purchase Offer Template - Buyers are often encouraged to conduct due diligence before signing.

Real Estate Sales Agreement Pa - Common provisions include warranties and representations regarding the property's condition.

Free Florida Purchase and Sale Agreement - Details any warranties or guarantees offered by the seller.

When entering into various agreements, it is crucial to understand the implications of liability, particularly in situations encompassed by a Michigan Hold Harmless Agreement. This document not only clarifies the responsibilities of each party involved but also serves to protect businesses and individuals from unforeseen legal repercussions. For more information and access to templates that can help in drafting such agreements, visit TopTemplates.info.

Trec Real Estate - The purchase agreement can also address any lease agreements if the property is currently rented.

Similar forms

- Lease Agreement: Like a Real Estate Purchase Agreement, a lease agreement outlines the terms under which a tenant can occupy a property. Both documents specify the duration of the agreement, payment terms, and responsibilities of each party.

- Sales Contract: A sales contract for personal property shares similarities with a Real Estate Purchase Agreement. Both documents detail the sale terms, including price, payment methods, and any contingencies that must be met before the transaction is completed.

- General Power of Attorney: When appointing someone to manage your affairs, refer to our detailed understanding of General Power of Attorney to ensure all legal aspects are properly addressed.

- Listing Agreement: A listing agreement is used when a property owner hires a real estate agent to sell their property. This document, like a Real Estate Purchase Agreement, includes terms regarding commission, marketing strategies, and the responsibilities of the agent.

- Option Agreement: An option agreement gives a buyer the right to purchase a property at a later date, similar to the contingencies found in a Real Estate Purchase Agreement. Both documents set terms for the sale, including price and timeframes.