Printable New York Quitclaim Deed Document

Form Preview Example

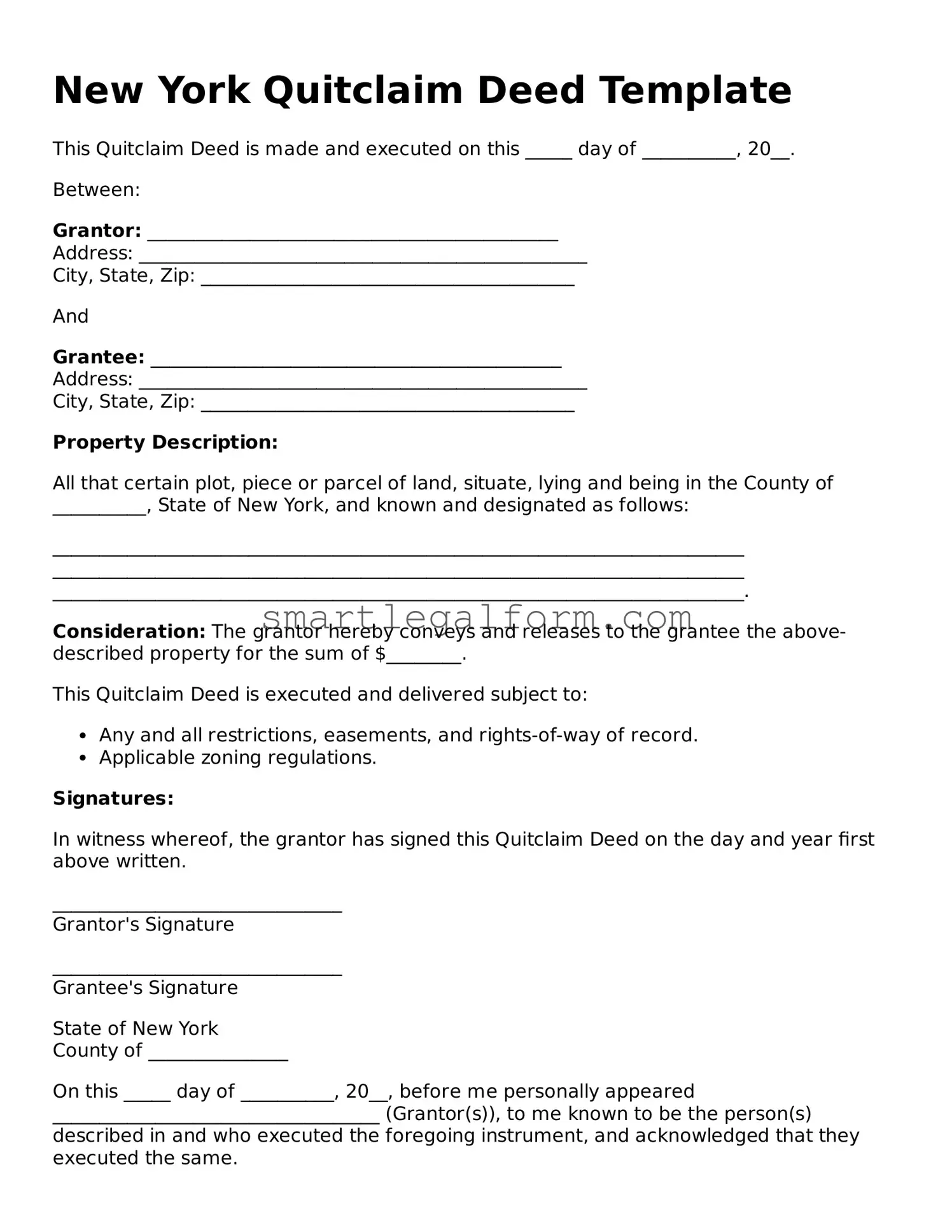

New York Quitclaim Deed Template

This Quitclaim Deed is made and executed on this _____ day of __________, 20__.

Between:

Grantor: ____________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

And

Grantee: ____________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Property Description:

All that certain plot, piece or parcel of land, situate, lying and being in the County of __________, State of New York, and known and designated as follows:

__________________________________________________________________________

__________________________________________________________________________

__________________________________________________________________________.

Consideration: The grantor hereby conveys and releases to the grantee the above-described property for the sum of $________.

This Quitclaim Deed is executed and delivered subject to:

- Any and all restrictions, easements, and rights-of-way of record.

- Applicable zoning regulations.

Signatures:

In witness whereof, the grantor has signed this Quitclaim Deed on the day and year first above written.

_______________________________

Grantor's Signature

_______________________________

Grantee's Signature

State of New York

County of _______________

On this _____ day of __________, 20__, before me personally appeared ___________________________________ (Grantor(s)), to me known to be the person(s) described in and who executed the foregoing instrument, and acknowledged that they executed the same.

_______________________________

Notary Public

My Commission Expires: _______________

Common mistakes

When completing a New York Quitclaim Deed form, individuals often make several common mistakes that can lead to complications. One frequent error is failing to include the correct names of the grantor and grantee. It is essential to ensure that the names match exactly as they appear on legal documents. Any discrepancies can result in delays or even the rejection of the deed.

Another common mistake is neglecting to provide a complete legal description of the property. This description should be detailed enough to identify the property clearly. Omitting key details or using vague language can create confusion and may affect the validity of the deed.

People sometimes forget to include the date of execution. While it may seem minor, the date is crucial for establishing the timeline of ownership transfer. Without it, the deed may be considered incomplete, leading to potential legal disputes in the future.

Additionally, some individuals overlook the requirement for notarization. A Quitclaim Deed must be signed in the presence of a notary public. Failing to have the document notarized can render it invalid, preventing the transfer of property ownership.

Another mistake involves not checking for outstanding liens or mortgages on the property. A Quitclaim Deed does not clear any existing financial obligations. If these issues are not addressed beforehand, the grantee may inherit unwanted debts along with the property.

People also tend to underestimate the importance of filing the deed with the appropriate county clerk’s office. Even if the deed is correctly filled out, it must be properly recorded to be effective. Failing to file can result in the deed being unenforceable.

Lastly, individuals often ignore the implications of tax consequences. Transferring property through a Quitclaim Deed can trigger tax liabilities. Consulting with a tax professional before completing the deed can help avoid unexpected financial burdens.

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it is important to follow specific guidelines to ensure the document is completed correctly. Here are nine things you should and shouldn't do:

- Do provide accurate property descriptions. Ensure that the legal description of the property is clear and precise.

- Don't leave any required fields blank. All necessary information must be filled out to avoid delays.

- Do include the names of all grantors and grantees. This ensures that all parties are properly identified.

- Don't use abbreviations or shorthand. Write out names and addresses fully to prevent confusion.

- Do sign the deed in front of a notary public. A notarized signature is essential for the document's validity.

- Don't forget to check for errors. Review the form for any mistakes before submission.

- Do file the completed deed with the appropriate county clerk's office. This step is crucial for official record-keeping.

- Don't assume the deed will be automatically recorded. Follow up to confirm that it has been filed correctly.

- Do keep a copy of the filed deed for your records. This serves as proof of the transfer of property.

Other Quitclaim Deed State Forms

How Do I File a Quit Claim Deed - A quitclaim deed transfers ownership interest in a property without guarantees.

When engaging in the sale of personal property in Florida, it is crucial to utilize a Bill of Sale to formalize the transaction and avoid any potential disputes. This legal document not only serves as proof of the sale but also captures vital details such as the parties involved and the specifics of the item sold. For those seeking a reliable template, you can find one at https://documentonline.org/blank-florida-bill-of-sale, which can assist in ensuring all necessary information is accurately documented.

How Much Does a Deed Cost - Can provide peace of mind in informal agreements.

Pennsylvania Quit Claim Deed Pdf - This type of deed is commonly used in estate planning and asset protection strategies.

Similar forms

- Warranty Deed: This document transfers ownership of property and guarantees that the seller has clear title to the property. Unlike a quitclaim deed, a warranty deed provides legal protection against claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property ownership. It assures the buyer that the property has not been sold to anyone else and that there are no undisclosed liens.

- Special Warranty Deed: This type of deed transfers property with a limited warranty. It guarantees that the seller has not caused any title issues during their ownership but does not cover problems that existed before.

- Deed of Trust: This document secures a loan by transferring the property title to a trustee until the borrower repays the loan. It is similar in that it involves property ownership but serves a different purpose related to financing.

- Marital Separation Agreement: For couples navigating separation, the comprehensive Marital Separation Agreement resources help clarify their rights and obligations effectively.

- Mortgage: A mortgage is a loan secured by real estate. While it does not transfer ownership like a quitclaim deed, it is related to property rights and can affect ownership if the loan is not repaid.

- Lease Agreement: This document allows a tenant to use a property owned by another party for a specified time. It does not transfer ownership but does create a legal interest in the property for the duration of the lease.

- Affidavit of Title: This document is a sworn statement confirming the ownership of a property and that there are no liens or claims against it. It is similar to a quitclaim deed in that it deals with property title but does not transfer ownership.