Printable New York Promissory Note Document

Form Preview Example

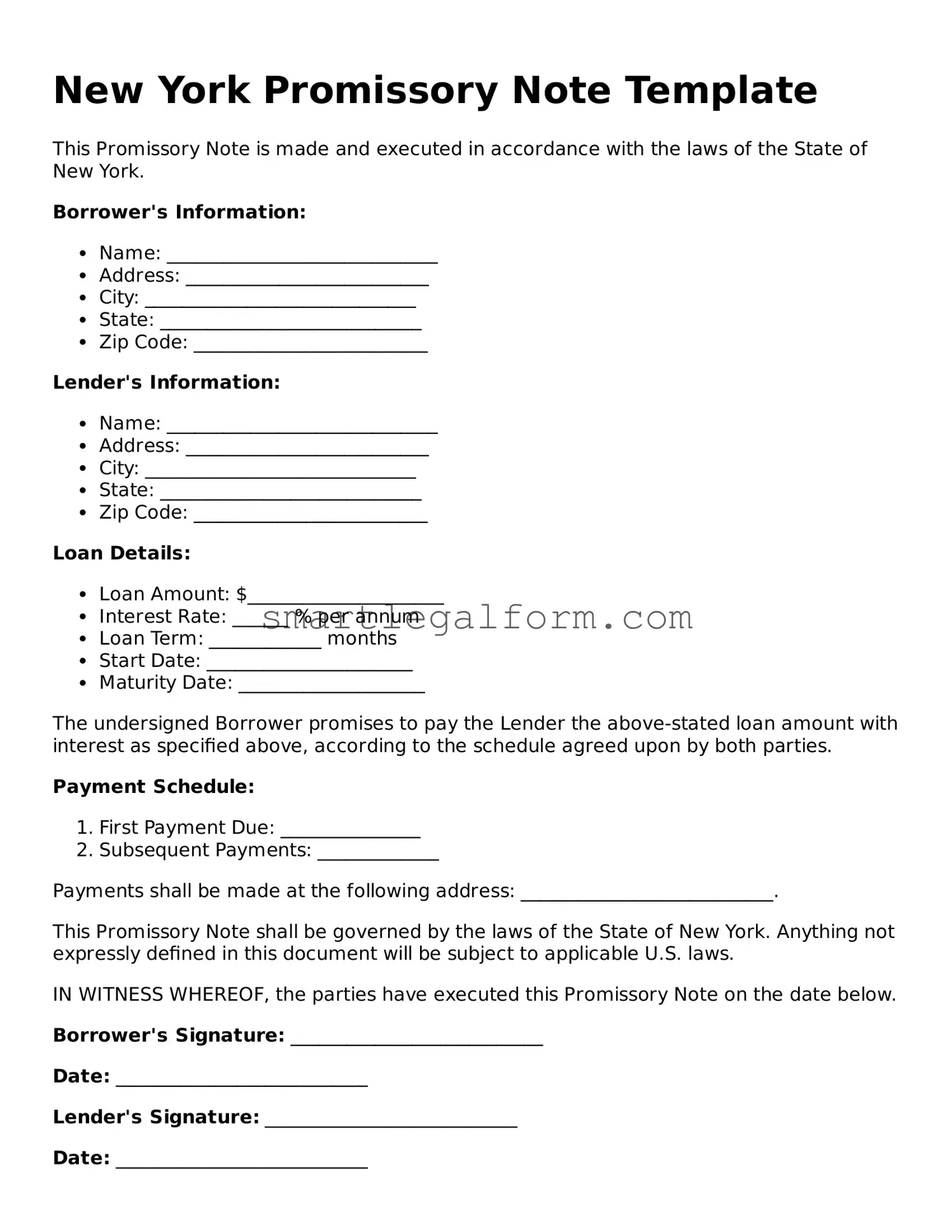

New York Promissory Note Template

This Promissory Note is made and executed in accordance with the laws of the State of New York.

Borrower's Information:

- Name: _____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- Zip Code: _________________________

Lender's Information:

- Name: _____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- Zip Code: _________________________

Loan Details:

- Loan Amount: $_____________________

- Interest Rate: ______ % per annum

- Loan Term: ____________ months

- Start Date: ______________________

- Maturity Date: ____________________

The undersigned Borrower promises to pay the Lender the above-stated loan amount with interest as specified above, according to the schedule agreed upon by both parties.

Payment Schedule:

- First Payment Due: _______________

- Subsequent Payments: _____________

Payments shall be made at the following address: ___________________________.

This Promissory Note shall be governed by the laws of the State of New York. Anything not expressly defined in this document will be subject to applicable U.S. laws.

IN WITNESS WHEREOF, the parties have executed this Promissory Note on the date below.

Borrower's Signature: ___________________________

Date: ___________________________

Lender's Signature: ___________________________

Date: ___________________________

Common mistakes

Filling out a New York Promissory Note form can be straightforward, but many people make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary parties. The form requires clear identification of both the borrower and the lender. Omitting one party’s name or using incorrect names can create confusion and legal issues down the line.

Another common mistake is neglecting to specify the repayment terms. The form should clearly outline how and when the borrower will repay the loan. This includes detailing the interest rate, payment schedule, and any grace periods. Without these specifics, misunderstandings may arise, potentially leading to disputes.

People often overlook the importance of signatures. Both the borrower and lender must sign the document for it to be legally binding. In some cases, individuals may assume that a verbal agreement suffices, but without signatures, the promissory note may not hold up in court.

Additionally, failing to date the document is another frequent oversight. The date of signing is crucial as it establishes the timeline for repayment. If the date is missing, it may create ambiguity regarding when the borrower is expected to start making payments.

Lastly, many individuals do not keep a copy of the signed promissory note. After the document is completed, it’s essential to retain a copy for personal records. This ensures that both parties have access to the agreed-upon terms and can refer back to them if any issues arise in the future.

Dos and Don'ts

When filling out the New York Promissory Note form, it is important to follow specific guidelines to ensure accuracy and legality. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do use clear and legible handwriting or type the information.

- Don't use abbreviations unless specified.

- Do include the full names and addresses of all parties involved.

- Don't forget to specify the loan amount clearly.

- Do state the interest rate, if applicable.

- Don't mix different currencies or formats for the amount.

- Do sign and date the document in the appropriate places.

- Don't overlook the need for witnesses or notarization, if required.

Following these guidelines will help ensure that the Promissory Note is completed correctly and is legally binding.

Other Promissory Note State Forms

Ohio Promissory Note Requirements - This note should clearly specify the due date of the final payment.

Understanding the key components of a Marital Separation Agreement for financial accountability is crucial for couples considering this arrangement. This document can significantly aid in the organization of essential matters such as asset distribution and child support. By clearly defining these aspects, individuals can facilitate a more amicable separation process and ensure both parties are adequately protected throughout the transition.

Promissory Note Template Illinois - This document outlines the terms under which a borrower agrees to repay a loan.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of borrowing money, including the loan amount, interest rate, and repayment schedule.

- Mortgage: A mortgage is a secured loan for purchasing real estate. It includes a promissory note as part of the documentation, detailing the borrower's promise to repay the loan.

- Installment Agreement: This document allows for the repayment of a debt in scheduled installments. Similar to a promissory note, it specifies payment amounts and due dates.

- IOU (I Owe You): An informal acknowledgment of a debt, an IOU serves a similar purpose as a promissory note but lacks the detailed terms and conditions.

- Security Agreement: This document outlines the collateral for a loan. While a promissory note states the borrower's promise to pay, a security agreement specifies what is at stake if the borrower defaults.

- Notice to Quit: The California Notice to Quit form is essential for landlords looking to legally initiate eviction proceedings. It serves as a formal notification to tenants, providing them with an opportunity to resolve lease violations or vacate the property. For more information on this important document, visit TopTemplates.info.

- Personal Guarantee: This is a promise made by an individual to repay a loan if the primary borrower defaults. It functions similarly to a promissory note by establishing liability.

- Credit Agreement: This document governs the terms of credit extended to a borrower. It includes repayment terms, much like a promissory note, but typically covers a broader range of conditions.

- Lease Agreement: In some cases, lease agreements can contain clauses similar to promissory notes, particularly when they involve payment terms for leasing property or equipment.

- Debt Settlement Agreement: This document outlines the terms under which a debtor will repay a portion of their debt. It shares similarities with a promissory note in that it establishes repayment terms.