Printable New York Power of Attorney Document

Form Preview Example

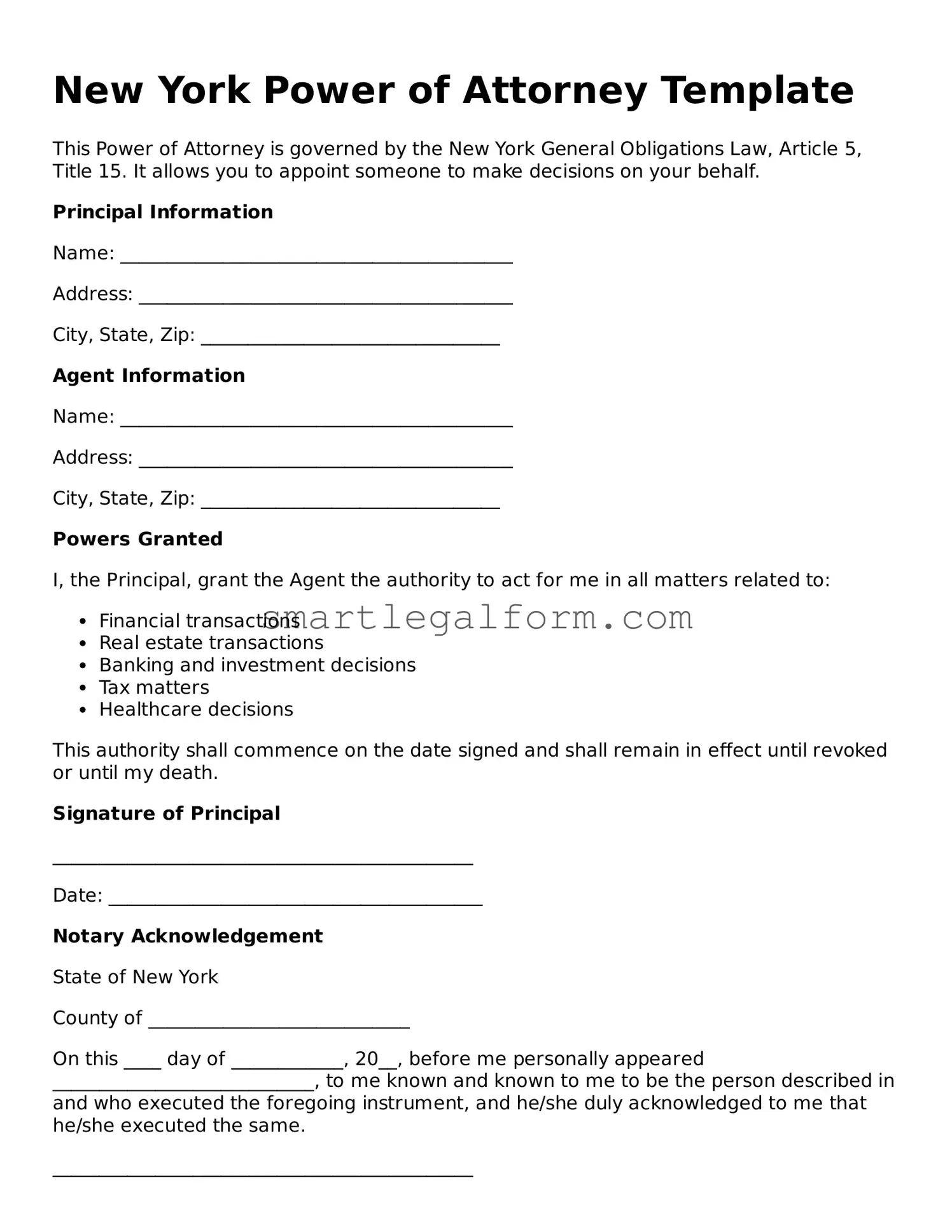

New York Power of Attorney Template

This Power of Attorney is governed by the New York General Obligations Law, Article 5, Title 15. It allows you to appoint someone to make decisions on your behalf.

Principal Information

Name: __________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Agent Information

Name: __________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

Powers Granted

I, the Principal, grant the Agent the authority to act for me in all matters related to:

- Financial transactions

- Real estate transactions

- Banking and investment decisions

- Tax matters

- Healthcare decisions

This authority shall commence on the date signed and shall remain in effect until revoked or until my death.

Signature of Principal

_____________________________________________

Date: ________________________________________

Notary Acknowledgement

State of New York

County of ____________________________

On this ____ day of ____________, 20__, before me personally appeared ____________________________, to me known and known to me to be the person described in and who executed the foregoing instrument, and he/she duly acknowledged to me that he/she executed the same.

_____________________________________________

Notary Public

My Commission Expires: ______________________

Common mistakes

Filling out a Power of Attorney form in New York can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to specify the powers being granted. It is crucial to clearly outline the specific authority the agent will have, whether it be managing financial affairs, making healthcare decisions, or handling real estate transactions. Without this clarity, the document may not serve its intended purpose.

Another mistake often encountered is neglecting to date the form properly. A Power of Attorney must be dated to be valid. If the date is missing or incorrectly filled out, it can lead to disputes regarding when the authority was granted. This oversight can create confusion and potentially invalidate the document.

Individuals sometimes overlook the importance of choosing the right agent. Selecting someone who lacks the necessary skills or trustworthiness can result in mismanagement of affairs. It is vital to choose an agent who understands the responsibilities involved and whom you trust implicitly to act in your best interests.

Additionally, many people fail to have the Power of Attorney form witnessed or notarized, which is a requirement in New York. Notarization adds a layer of legitimacy to the document and helps prevent potential challenges regarding its authenticity. Without proper witnessing or notarization, the form may not hold up in legal situations.

Another common error is not discussing the Power of Attorney with the designated agent beforehand. It is essential to have an open conversation about the responsibilities and expectations involved. This discussion ensures that both parties are on the same page and can help prevent misunderstandings in the future.

Lastly, individuals may neglect to review and update the Power of Attorney as circumstances change. Life events such as marriage, divorce, or the death of the agent can impact the effectiveness of the document. Regularly reviewing and updating the Power of Attorney ensures that it remains aligned with your current wishes and needs.

Dos and Don'ts

When filling out the New York Power of Attorney form, it's important to be thorough and careful. Here are some guidelines to help you navigate the process effectively.

- Do: Clearly identify the principal, the person granting the authority, and the agent, the person receiving the authority.

- Do: Specify the powers you are granting. Be as detailed as possible to avoid confusion.

- Do: Sign the form in the presence of a notary public. This step is crucial for the document to be legally valid.

- Do: Keep copies of the signed Power of Attorney for your records and provide copies to your agent and any relevant institutions.

- Don't: Leave any sections blank. Incomplete forms can lead to misunderstandings or legal issues.

- Don't: Use vague language. Clear and specific language helps ensure that your wishes are understood and followed.

- Don't: Forget to revoke any previous Power of Attorney documents if you are creating a new one. This prevents conflicts and confusion.

By following these guidelines, you can help ensure that your Power of Attorney is effective and reflects your intentions accurately.

Other Power of Attorney State Forms

Printable Power of Attorney Form Florida - Can simplify the process of managing a loved one's affairs.

Types of Power of Attorney in Pennsylvania - A properly executed Power of Attorney usually has no effect until you're incapacitated.

The Free And Invoice PDF form is a document designed to facilitate billing and payment processes between businesses and clients. It helps in clearly outlining goods or services provided, along with their respective costs. For those looking to access a template, you can visit https://documentonline.org/blank-free-and-invoice-pdf/ to streamline transactions and ensure transparency in financial exchanges.

Ca Power of Attorney Form - It is advisable to keep copies of the Power of Attorney for reference.

Illinois Power of Attorney for Property Form - This form can help family members make informed choices during emergencies.

Similar forms

The Power of Attorney (POA) form is a powerful legal document that allows one person to act on behalf of another. Several other documents share similar functions or purposes. Here’s a list of ten such documents, highlighting their similarities:

- Living Will: Like a POA, a living will allows individuals to express their wishes regarding medical treatment. However, it specifically focuses on end-of-life decisions, rather than granting general powers to another person.

- Healthcare Proxy: This document designates someone to make healthcare decisions on your behalf if you become unable to do so. Similar to a POA, it empowers another person but is limited to health-related matters.

- Durable Power of Attorney: This is a type of POA that remains effective even if the person becomes incapacitated. It provides continuity in decision-making, much like a standard POA.

- Financial Power of Attorney: This document specifically grants authority to manage financial matters. It is similar to a general POA but is focused solely on financial decisions.

- Trust Agreement: A trust allows a person to manage assets for the benefit of another. Both documents involve delegating authority, but a trust typically involves asset management rather than personal decision-making.

- Prenuptial Agreement: To safeguard financial interests, reviewing a thorough Prenuptial Agreement overview is crucial for couples planning marriage.

- Joint Tenancy Agreement: This agreement allows two or more people to own property together. While it’s not a power of attorney, it involves shared decision-making regarding property, similar to how a POA allows shared authority.

- Guardianship Document: This legal arrangement appoints someone to care for a minor or an incapacitated adult. It parallels a POA in that it assigns authority, but it is more focused on personal care and welfare.

- Representative Payee Agreement: This document allows someone to manage Social Security or other government benefits for another person. Like a POA, it designates authority but is specific to financial benefits.

- Executor Appointment: An executor is named in a will to manage the estate after someone passes away. This role involves decision-making authority, similar to that granted in a POA, but is limited to posthumous matters.

- Business Power of Attorney: This is a specialized form of POA that allows someone to make business decisions on behalf of a company. It shares the same fundamental principle of delegation but is tailored for business contexts.

Understanding these documents can help you navigate situations where you may need to delegate authority or make decisions on behalf of someone else. Each serves a unique purpose while sharing common elements with the Power of Attorney.