Printable New York Operating Agreement Document

Form Preview Example

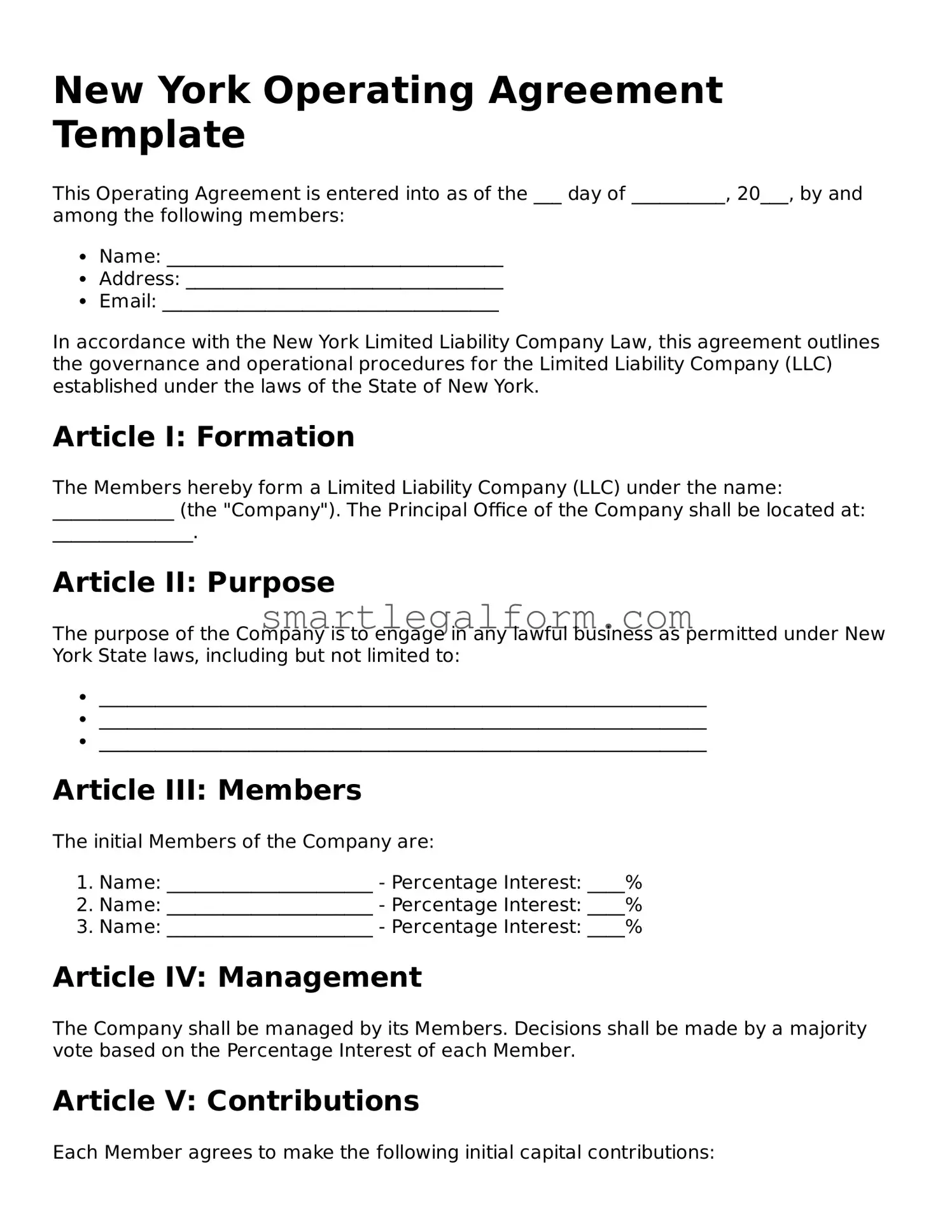

New York Operating Agreement Template

This Operating Agreement is entered into as of the ___ day of __________, 20___, by and among the following members:

- Name: ____________________________________

- Address: __________________________________

- Email: ____________________________________

In accordance with the New York Limited Liability Company Law, this agreement outlines the governance and operational procedures for the Limited Liability Company (LLC) established under the laws of the State of New York.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the name: _____________ (the "Company"). The Principal Office of the Company shall be located at: _______________.

Article II: Purpose

The purpose of the Company is to engage in any lawful business as permitted under New York State laws, including but not limited to:

- _________________________________________________________________

- _________________________________________________________________

- _________________________________________________________________

Article III: Members

The initial Members of the Company are:

- Name: ______________________ - Percentage Interest: ____%

- Name: ______________________ - Percentage Interest: ____%

- Name: ______________________ - Percentage Interest: ____%

Article IV: Management

The Company shall be managed by its Members. Decisions shall be made by a majority vote based on the Percentage Interest of each Member.

Article V: Contributions

Each Member agrees to make the following initial capital contributions:

- Name: ______________________ - Contribution: $______________

- Name: ______________________ - Contribution: $______________

- Name: ______________________ - Contribution: $______________

Article VI: Fiscal Matters

The fiscal year of the Company will end on the 31st day of December each year. Financial records will be maintained by the designated member and made available for inspection by any Member upon reasonable request.

Article VII: Indemnification

To the fullest extent permitted by law, the Company shall indemnify any Member for liabilities incurred in connection with the Company, provided that such Member acted in good faith and in a manner they reasonably believed to be in the best interest of the Company.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members of the Company.

Article IX: Miscellaneous

This Agreement constitutes the entire agreement among the Members and supersedes any prior agreements or understandings, whether written or oral.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

- ____________________________________ (Signature of Member)

- ____________________________________ (Signature of Member)

- ____________________________________ (Signature of Member)

Date: _____________________________

Common mistakes

Filling out the New York Operating Agreement form can be a straightforward process, but many individuals encounter pitfalls that can lead to complications down the road. One common mistake is failing to specify the purpose of the limited liability company (LLC). Without a clear statement of purpose, the agreement may lack essential context, which could lead to misunderstandings among members.

Another frequent error involves neglecting to identify all members of the LLC. Omitting a member can create disputes later, especially when decisions need to be made or profits distributed. Each member's contributions and roles should be clearly outlined to prevent confusion and ensure that everyone is on the same page.

Additionally, some individuals overlook the importance of defining the management structure. Whether the LLC is member-managed or manager-managed should be explicitly stated. This clarity helps in establishing who has authority in decision-making processes, which is crucial for smooth operations.

Many people also forget to include provisions for adding new members. Life circumstances change, and businesses evolve. By not addressing how new members can join, the agreement may become outdated or difficult to amend, leading to potential conflicts in the future.

Furthermore, failing to address the distribution of profits and losses is a significant oversight. It is essential to clarify how profits will be shared among members. Without this information, members may have differing expectations, which could result in disputes over financial matters.

Another mistake involves not including a process for resolving disputes. Every business faces challenges, and having a clear method for conflict resolution can save time and resources. Without such a provision, disagreements may escalate, leading to costly legal battles.

People often forget to review and update the Operating Agreement regularly. As businesses grow and change, so too should the terms of the agreement. An outdated document can lead to misalignment between members and the current state of the business.

In some cases, individuals do not seek legal advice when drafting the Operating Agreement. While templates can provide a starting point, consulting with a professional can help ensure that the agreement meets all legal requirements and adequately protects the interests of all members.

Another common oversight is not considering tax implications. The structure of the LLC can affect how members are taxed. It is vital to understand these implications and to include provisions that reflect the chosen tax treatment.

Lastly, many people fail to sign and date the agreement properly. An unsigned or improperly dated document may not hold up in legal situations. Ensuring that all members sign and date the agreement is a crucial step in solidifying the document's validity.

Dos and Don'ts

When filling out the New York Operating Agreement form, attention to detail is crucial. Here are ten essential do's and don'ts to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Do provide accurate information regarding the members of the LLC.

- Do specify the management structure clearly, whether it is member-managed or manager-managed.

- Do include the purpose of the LLC in the agreement.

- Do ensure that all members sign the agreement to validate it.

- Don't leave any sections blank; if a section is not applicable, indicate that clearly.

- Don't use vague language; be specific in your descriptions and provisions.

- Don't forget to date the agreement upon completion.

- Don't overlook the need for legal review, especially if the LLC has multiple members.

- Don't rush through the process; take your time to ensure accuracy and completeness.

By following these guidelines, individuals can create a clear and effective Operating Agreement that meets the requirements of New York law and serves the interests of the LLC members.

Other Operating Agreement State Forms

California Llc Operating Agreement - This document can outline how disputes will be resolved, such as through mediation or arbitration processes.

Operating Agreement Llc Ohio - The Operating Agreement helps secure investors by outlining governance.

Florida Operating Agreement Template - It is crucial for multi-member LLCs to have an Operating Agreement in place.

Llc Operating Agreement Sample - The Operating Agreement can establish guidelines for audits and financial reports.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for a corporation's internal management. They detail the roles of directors and officers, meeting protocols, and voting procedures, ensuring that all members understand their responsibilities.

- Partnership Agreement: This document governs the relationships between partners in a business. Like an Operating Agreement, it specifies each partner's contributions, profit-sharing ratios, and procedures for resolving disputes, thereby promoting clarity and cooperation.

- Shareholder Agreement: Designed for corporations, this agreement sets the terms between shareholders. It covers aspects such as the transfer of shares, voting rights, and how decisions are made, paralleling the governance structure established in an Operating Agreement.

- LLC Membership Certificate: While not a governance document, this certificate confirms a member's ownership interest in an LLC. It complements the Operating Agreement by providing official recognition of membership, which can be important for legal and financial purposes.

- Business Plan: Although primarily focused on strategy and goals, a business plan often includes operational guidelines. This can overlap with an Operating Agreement in terms of outlining how the business will function and the roles of its members.

- Non-Disclosure Agreement (NDA): While primarily concerned with confidentiality, an NDA can be similar in that it establishes expectations and responsibilities among parties. It protects sensitive information, much like an Operating Agreement protects the interests of the LLC members.