Printable New York Loan Agreement Document

Form Preview Example

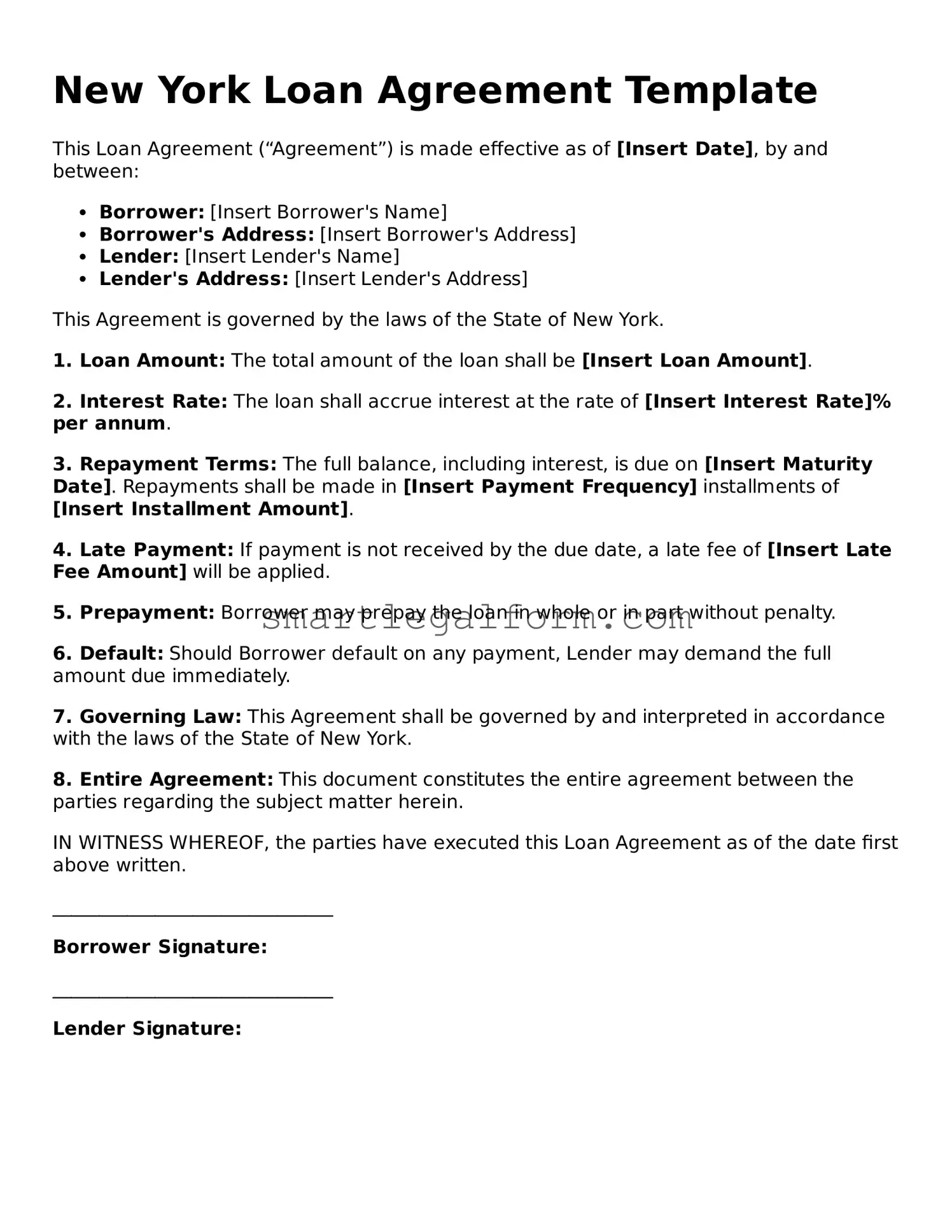

New York Loan Agreement Template

This Loan Agreement (“Agreement”) is made effective as of [Insert Date], by and between:

- Borrower: [Insert Borrower's Name]

- Borrower's Address: [Insert Borrower's Address]

- Lender: [Insert Lender's Name]

- Lender's Address: [Insert Lender's Address]

This Agreement is governed by the laws of the State of New York.

1. Loan Amount: The total amount of the loan shall be [Insert Loan Amount].

2. Interest Rate: The loan shall accrue interest at the rate of [Insert Interest Rate]% per annum.

3. Repayment Terms: The full balance, including interest, is due on [Insert Maturity Date]. Repayments shall be made in [Insert Payment Frequency] installments of [Insert Installment Amount].

4. Late Payment: If payment is not received by the due date, a late fee of [Insert Late Fee Amount] will be applied.

5. Prepayment: Borrower may prepay the loan in whole or in part without penalty.

6. Default: Should Borrower default on any payment, Lender may demand the full amount due immediately.

7. Governing Law: This Agreement shall be governed by and interpreted in accordance with the laws of the State of New York.

8. Entire Agreement: This document constitutes the entire agreement between the parties regarding the subject matter herein.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

______________________________

Borrower Signature:

______________________________

Lender Signature:

Common mistakes

Filling out the New York Loan Agreement form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is not providing complete personal information. Borrowers often forget to include their full name, address, or contact details. Incomplete information can hinder communication and may result in the application being rejected.

Another mistake is failing to read the terms and conditions carefully. Many individuals skim through the agreement, missing critical details about interest rates, repayment terms, or fees. This oversight can lead to unexpected financial burdens down the line. It’s essential to understand what you are agreeing to before signing.

Inaccurate financial information is also a common pitfall. Borrowers sometimes misreport their income or existing debts. This can distort the lender's assessment of your ability to repay the loan. Always double-check your financial details to ensure accuracy.

People often neglect to sign the form in the appropriate places. Missing signatures can cause significant delays in processing your loan application. Take a moment to review the document to ensure you have signed where required.

Another mistake is not providing the necessary documentation. Lenders typically require proof of income, identification, and other supporting documents. Failing to include these can result in a denial of your application. Gather all required documents before you start filling out the form.

Some individuals overlook the importance of the loan purpose. The form usually asks for a brief explanation of why you need the loan. Providing vague or unclear reasons can raise red flags for lenders. Be specific and honest about your intentions.

Additionally, people often ignore the deadlines associated with the loan application process. Submitting the form late can jeopardize your chances of approval. Keep track of any deadlines and ensure you submit your application on time.

Lastly, many borrowers fail to ask questions. If something is unclear, it’s crucial to seek clarification from the lender. Ignoring uncertainties can lead to misunderstandings that may affect your loan. Don’t hesitate to reach out for assistance if you need it.

Dos and Don'ts

When filling out the New York Loan Agreement form, it's crucial to approach the task with care. Here’s a list of things to do and avoid:

- Do read the entire form carefully. Understanding each section ensures you provide accurate information.

- Do double-check your personal information. Typos in names, addresses, or Social Security numbers can lead to complications.

- Do provide all required documentation. Missing documents can delay the processing of your loan.

- Do ask questions if something is unclear. Contacting a representative can clarify any doubts you may have.

- Do keep a copy of the completed form. Having a record can be helpful for future reference.

- Don't rush through the form. Taking your time helps avoid mistakes.

- Don't leave any sections blank. Incomplete forms may be rejected or delayed.

- Don't provide false information. Misrepresentation can lead to legal consequences.

- Don't forget to review the terms. Understanding the agreement's terms is essential before signing.

- Don't hesitate to seek legal advice if needed. Consulting a professional can provide peace of mind.

Other Loan Agreement State Forms

Promissory Note Template California - Loan Agreements can help prevent misunderstandings between parties.

For those looking to establish their business in Arizona, understanding the significance of the Articles of Incorporation form is vital. This essential document lays down the foundational details required to formalize a corporation in the state. For more information, you can refer to our guide on "navigating the Articles of Incorporation process" at azformsonline.com.

Promissory Note Template Illinois - The form might feature a clause about third-party rights.

Similar forms

Promissory Note: A promissory note is a written promise to pay a specific amount of money at a designated time. Like a loan agreement, it outlines the terms of repayment and the interest rate, but it is generally simpler and focuses solely on the borrower's commitment to repay.

Mortgage Agreement: This document secures a loan with real property. Similar to a loan agreement, it details the terms of the loan, but it also includes provisions regarding the collateral and the rights of the lender in case of default.

Credit Agreement: A credit agreement governs the terms under which credit is extended to a borrower. It shares similarities with a loan agreement in outlining the amount, interest rate, and repayment schedule, but it often includes revolving credit features.

Lease Agreement: Although primarily used for rental arrangements, a lease agreement can resemble a loan agreement in that it specifies payment terms for the use of property. Both documents outline obligations and rights of the parties involved.

Secured Loan Agreement: This type of agreement involves a loan backed by collateral. It is similar to a standard loan agreement but includes additional terms regarding the collateral and the lender's rights in the event of default.

Non-disclosure Agreement: A Utah Non-disclosure Agreement form is essential for protecting confidential information shared during business dealings. It helps maintain privacy and secured interests, especially in development phases. For more details, visit smarttemplates.net.

Personal Loan Agreement: A personal loan agreement is a contract between a borrower and a lender for personal loans. It details the loan amount, interest rate, and repayment terms, much like a standard loan agreement, but is often less formal.

Business Loan Agreement: This document is tailored for business financing. It shares key elements with a loan agreement, such as repayment terms and interest rates, but it also includes specific clauses relevant to business operations and financial health.