Printable New York Deed in Lieu of Foreclosure Document

Form Preview Example

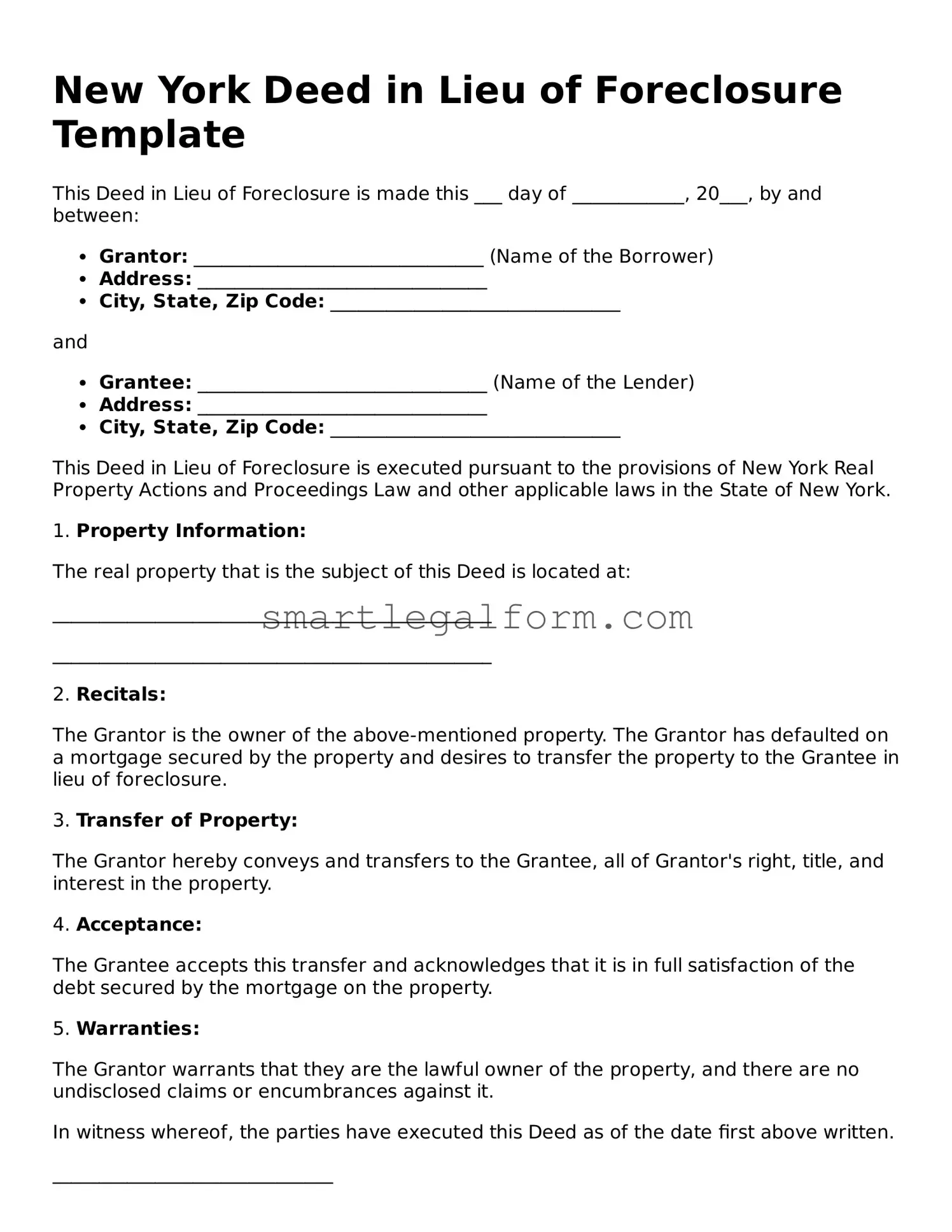

New York Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of ____________, 20___, by and between:

- Grantor: _______________________________ (Name of the Borrower)

- Address: _______________________________

- City, State, Zip Code: _______________________________

and

- Grantee: _______________________________ (Name of the Lender)

- Address: _______________________________

- City, State, Zip Code: _______________________________

This Deed in Lieu of Foreclosure is executed pursuant to the provisions of New York Real Property Actions and Proceedings Law and other applicable laws in the State of New York.

1. Property Information:

The real property that is the subject of this Deed is located at:

_______________________________________________

_______________________________________________

2. Recitals:

The Grantor is the owner of the above-mentioned property. The Grantor has defaulted on a mortgage secured by the property and desires to transfer the property to the Grantee in lieu of foreclosure.

3. Transfer of Property:

The Grantor hereby conveys and transfers to the Grantee, all of Grantor's right, title, and interest in the property.

4. Acceptance:

The Grantee accepts this transfer and acknowledges that it is in full satisfaction of the debt secured by the mortgage on the property.

5. Warranties:

The Grantor warrants that they are the lawful owner of the property, and there are no undisclosed claims or encumbrances against it.

In witness whereof, the parties have executed this Deed as of the date first above written.

______________________________

Grantor Signature

______________________________

Grantee Signature

______________________________

Witness Signature

______________________________

Witness Name (Printed)

______________________________

Date

Common mistakes

Filling out the New York Deed in Lieu of Foreclosure form can be a straightforward process, but many individuals make common mistakes that can complicate the situation. One frequent error is failing to provide accurate property information. It is essential to include the correct legal description of the property, as well as the address. Omitting or misrepresenting this information can lead to delays or even rejection of the deed.

Another mistake often encountered is not obtaining the necessary signatures. All parties involved in the property transfer must sign the form. This includes not only the borrower but also any co-owners or other individuals with a legal interest in the property. Neglecting to gather these signatures can invalidate the deed, resulting in the need to start the process over.

People frequently overlook the importance of understanding the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property to the lender, which can have significant consequences for the borrower’s credit and future borrowing ability. Failing to fully grasp these implications can lead to regrets later on. Consulting with a professional before submitting the form is advisable.

Finally, individuals may not follow the proper filing procedures after completing the form. Once the deed is signed, it must be recorded with the appropriate county clerk's office. Skipping this step means the deed is not legally recognized, leaving the borrower still liable for the property. Ensuring that all steps are followed correctly is crucial for a successful transaction.

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are some key do's and don'ts to keep in mind:

- Do ensure that you fully understand the implications of signing the deed.

- Do provide accurate and complete information on the form.

- Do consult with a legal advisor to clarify any uncertainties.

- Do keep copies of all documents for your records.

- Do communicate openly with your lender throughout the process.

- Don't rush through the form; take your time to review each section.

- Don't omit any required signatures or dates.

- Don't ignore any additional documents your lender may require.

- Don't forget to consider the tax implications of the deed in lieu of foreclosure.

By following these guidelines, you can navigate the process more smoothly and protect your interests effectively.

Other Deed in Lieu of Foreclosure State Forms

California Voluntary Foreclosure Deed - This form requires the lender's acceptance to finalize the property transfer.

When engaging in agreements that involve potential risks, it is essential to understand the implications of a Hold Harmless Agreement. These agreements safeguard parties by transferring liabilities and potential legal consequences from one entity to another. For those looking for detailed information or templates, TopTemplates.info offers a comprehensive resource on Michigan Hold Harmless Agreements tailored to ensure clarity and proper legal protection.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Each party should maintain copies of the signed Deed in Lieu for their records.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, it helps avoid foreclosure by settling the debt through a sale.

- General Power of Attorney: When needing to designate someone to manage important decisions, consider the General Power of Attorney form resources to ensure your interests are protected.

- Loan Modification Agreement: This agreement modifies the terms of an existing loan to make it more manageable for the borrower. Similar to a deed in lieu, it aims to prevent foreclosure by providing a solution that keeps the borrower in their home.

- Forbearance Agreement: This document allows the borrower to temporarily pause or reduce mortgage payments. It shares the goal of preventing foreclosure, offering a reprieve to the homeowner facing financial difficulties.

- Mortgage Release or Satisfaction: This document formally releases the borrower from their mortgage obligation. It is similar to a deed in lieu because it signifies the end of the borrower's responsibility for the loan, often following a foreclosure or settlement.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to restructure debts. While different in process, it serves a similar purpose of protecting the homeowner from losing their property.

- Repayment Plan: This plan outlines how a borrower can repay missed mortgage payments over time. Like a deed in lieu, it offers a way to resolve the debt while keeping the home, preventing foreclosure.