Printable New York Deed Document

Form Preview Example

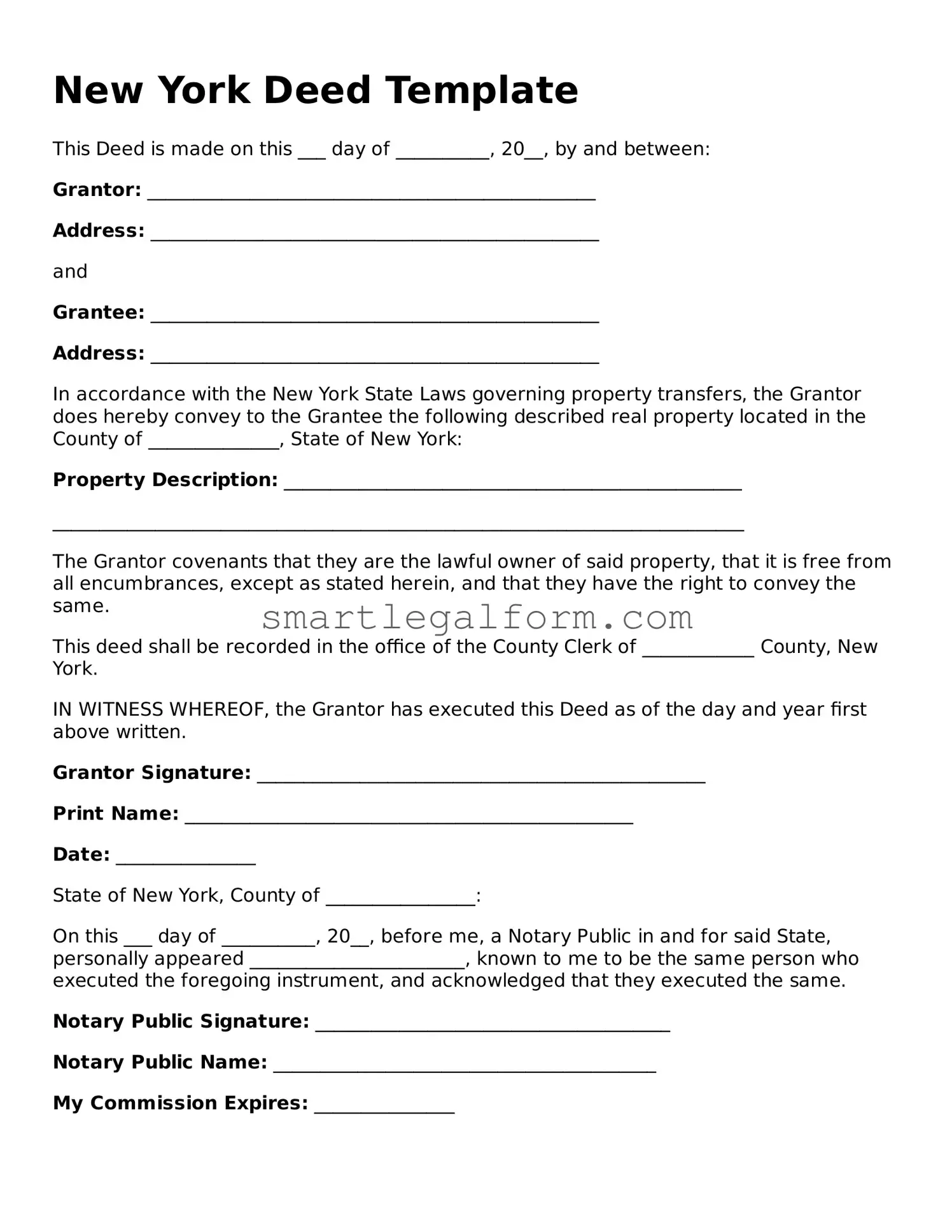

New York Deed Template

This Deed is made on this ___ day of __________, 20__, by and between:

Grantor: ________________________________________________

Address: ________________________________________________

and

Grantee: ________________________________________________

Address: ________________________________________________

In accordance with the New York State Laws governing property transfers, the Grantor does hereby convey to the Grantee the following described real property located in the County of ______________, State of New York:

Property Description: _________________________________________________

__________________________________________________________________________

The Grantor covenants that they are the lawful owner of said property, that it is free from all encumbrances, except as stated herein, and that they have the right to convey the same.

This deed shall be recorded in the office of the County Clerk of ____________ County, New York.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor Signature: ________________________________________________

Print Name: ________________________________________________

Date: _______________

State of New York, County of ________________:

On this ___ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared _______________________, known to me to be the same person who executed the foregoing instrument, and acknowledged that they executed the same.

Notary Public Signature: ______________________________________

Notary Public Name: _________________________________________

My Commission Expires: _______________

Common mistakes

Filling out a New York Deed form can seem straightforward, but many individuals make common mistakes that can lead to significant issues down the line. One frequent error is the omission of essential information. For instance, failing to include the full names of both the grantor and grantee can render the deed invalid. It is crucial to ensure that all parties are clearly identified to avoid complications in property transfer.

Another common mistake is incorrect legal descriptions of the property. The deed must include a precise description of the property being transferred, often found in previous deeds or surveys. A vague or inaccurate description can lead to disputes over property boundaries and ownership.

People often overlook the requirement for notarization. In New York, a deed must be signed in the presence of a notary public. Without this step, the deed may not be recognized as valid. It is essential to ensure that the signature is properly notarized to uphold the legality of the document.

Additionally, many individuals fail to consider the implications of the transfer tax. New York imposes a tax on the transfer of real property, and neglecting to account for this can result in unexpected financial burdens. It is advisable to consult with a tax professional to understand any obligations that may arise from the transaction.

Another mistake involves the failure to record the deed promptly. Once the deed is executed, it should be filed with the county clerk’s office as soon as possible. Delaying this step can lead to complications, especially if there are disputes over ownership or if the property is sold again in the future.

People also sometimes neglect to check for existing liens or encumbrances on the property. Before transferring ownership, it is vital to conduct a title search to uncover any potential issues that could affect the transaction. Ignoring this step can result in inherited debts or legal troubles.

Moreover, individuals may not fully understand the implications of the type of deed they are using. There are various types of deeds, such as warranty deeds and quitclaim deeds, each serving different purposes. Choosing the wrong type can impact the rights and responsibilities of the parties involved.

Another mistake is failing to include any necessary disclosures. In New York, sellers are often required to disclose certain conditions or defects related to the property. Omitting this information can lead to legal disputes and potential liability issues.

Finally, many people do not seek legal advice when completing a deed form. While it is possible to fill out the form independently, consulting with a real estate attorney can help ensure that all legal requirements are met and that the transaction proceeds smoothly. A professional can provide valuable insights that might be overlooked by someone unfamiliar with the process.

Dos and Don'ts

When filling out the New York Deed form, it's essential to approach the task with care and attention to detail. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do ensure that all information is accurate and complete.

- Do use clear and legible handwriting or type the information.

- Do include the correct legal description of the property.

- Do sign the deed in front of a notary public.

- Do check for any specific requirements that may apply to your situation.

- Don't leave any sections blank; if a section doesn't apply, write "N/A."

- Don't use abbreviations that could lead to confusion.

- Don't forget to include the names of all parties involved.

- Don't rush the process; take your time to review everything before submission.

By following these guidelines, you can help ensure that your deed is properly filled out and accepted without unnecessary delays.

Other Deed State Forms

Ohio General Warranty Deed - Trusts may utilize deed forms for property management and distribution purposes.

In order to effectively navigate the complexities of legal agreements, it is essential to understand the importance of a Hold Harmless Agreement, especially in Texas. This document helps clarify the responsibilities and liabilities of each party, ensuring that everyone involved is on the same page about what risks they are assuming. For more detailed information on how to create a Texas Hold Harmless Agreement, you can refer to TopTemplates.info, which provides valuable resources to guide you through the process.

Broward County Real Estate Records - Is often accompanied by a title search for verification.

How to Obtain a Deed to Your House - A deed creates a permanent record of property ownership.

Pennsylvania Deed Form - A property deed serves as proof of ownership and can be used in disputes over property rights.

Similar forms

Bill of Sale: This document transfers ownership of personal property from one party to another. Like a deed, it serves as proof of the transaction and outlines the details of the sale.

Lease Agreement: A lease agreement establishes a temporary arrangement for the use of property. Similar to a deed, it defines the rights and responsibilities of both the landlord and tenant.

Quitclaim Deed: This type of deed transfers interest in a property without guaranteeing that the title is clear. It is often used between family members and serves as a simpler alternative to a warranty deed.

Warranty Deed: A warranty deed provides a guarantee that the grantor holds clear title to the property. This document offers more protection to the buyer compared to a quitclaim deed.

Power of Attorney: This document allows one person to act on behalf of another in legal matters. Like a deed, it formalizes the authority granted and can be used in property transactions.

Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. It is similar to a deed in that it outlines the management and transfer of property.

Mortgage Agreement: This document secures a loan with property as collateral. It functions similarly to a deed by detailing the rights and obligations of both the borrower and lender.

Deed of Trust: A deed of trust involves three parties: the borrower, lender, and trustee. It serves as a security instrument for a loan, much like a mortgage, and outlines the terms of the property transfer.

- Employment Verification Form: This document is essential for confirming an individual's employment status and may include details like job titles, dates of employment, and responsibilities. For further information, you can refer to documentonline.org/blank-employment-verification.

Affidavit of Title: This document is a sworn statement confirming the ownership of property and the absence of liens. It is similar to a deed in that it provides evidence of ownership during a transaction.