Free Netspend Dispute Form

Form Preview Example

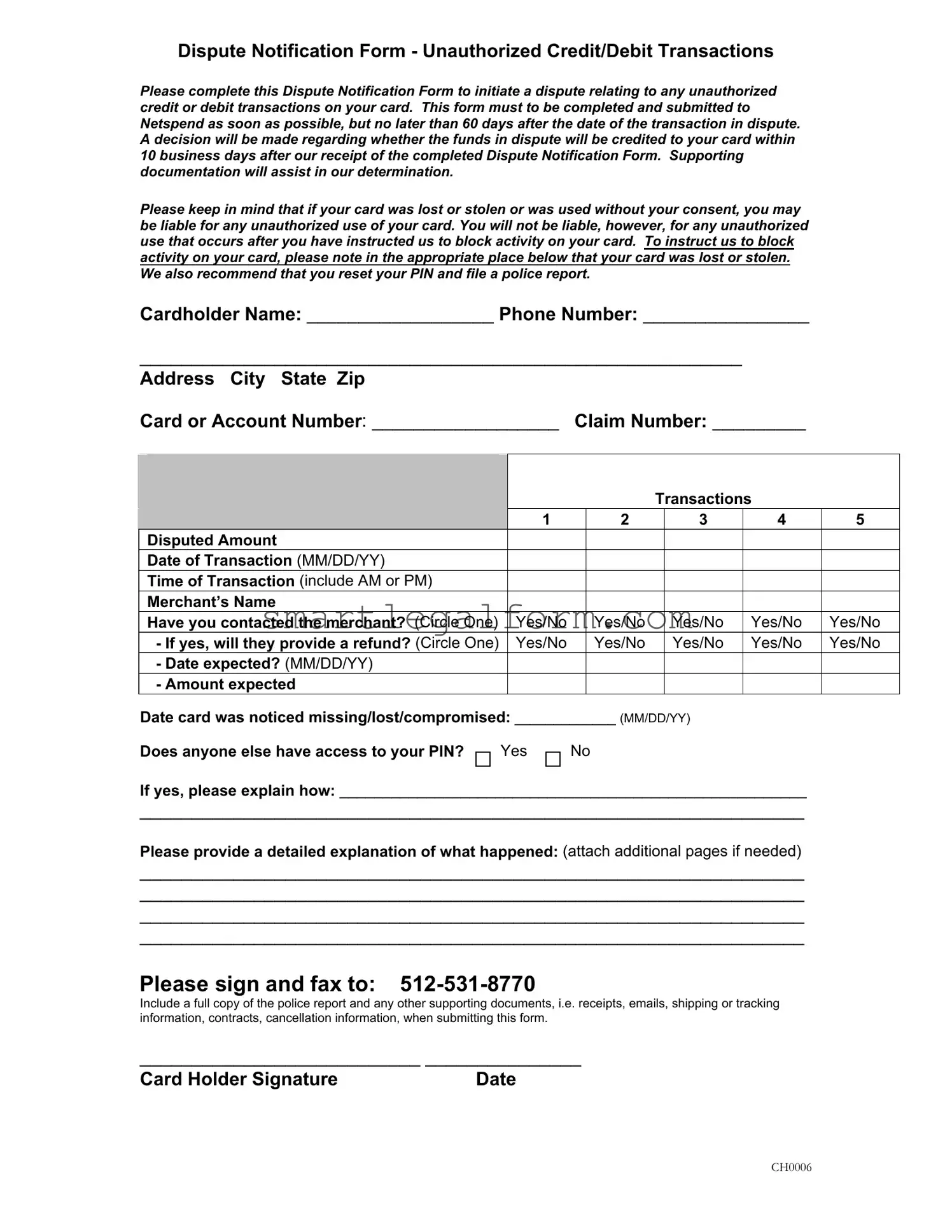

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Common mistakes

Filling out the Netspend Dispute Notification Form can be straightforward, but many people make common mistakes that can delay their claims. One frequent error is failing to submit the form within the required time frame. It's crucial to complete and send the form within 60 days of the disputed transaction. If you miss this deadline, your dispute may not be considered, leading to frustration and financial loss.

Another mistake involves not providing complete information about the disputed transactions. Each transaction requires specific details such as the date, time, merchant name, and amount. Omitting any of this information can hinder the processing of your dispute. Ensure that you fill in all required fields accurately to avoid unnecessary delays.

Some individuals overlook the importance of contacting the merchant before filing a dispute. The form asks whether you have reached out to the merchant and if they will provide a refund. If you haven't made this effort, it may reflect poorly on your case. Merchants often resolve issues directly, so this step can be beneficial.

Additionally, people sometimes forget to include supporting documentation. The form requests that you attach any relevant documents, such as police reports, receipts, or emails. These materials can strengthen your case and help Netspend make a quicker decision. Without them, your dispute may lack the necessary support to be resolved favorably.

Another common issue is not indicating whether the card was lost or stolen. If your card was compromised, you must specify this on the form. This information is vital for Netspend to understand the context of your dispute. Failing to mention this could lead to confusion about your liability for unauthorized transactions.

Lastly, some people neglect to provide a detailed explanation of what happened. The form includes a section for you to describe the situation surrounding the dispute. This narrative is important for Netspend to grasp the full picture. A clear and concise explanation can significantly enhance the chances of a successful resolution.

Dos and Don'ts

When filling out the Netspend Dispute form, it's important to follow certain guidelines to ensure your dispute is processed smoothly. Here’s a list of things you should and shouldn’t do:

- Do fill out the form completely and accurately.

- Do submit the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do include supporting documentation, such as receipts or police reports.

- Do clearly explain the details of the transaction you are disputing.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; incomplete forms may delay processing.

- Don't forget to sign and date the form before submission.

- Don't submit the form without verifying that all information is correct.

- Don't hesitate to reach out to customer service if you have questions about the process.

By following these guidelines, you can help ensure that your dispute is handled efficiently and effectively. Remember, taking the time to fill out the form correctly can make a significant difference in the outcome of your dispute.

Other PDF Documents

Dr Excuse Note for Work - Essential for anyone needing to substantiate their health-related time away from obligations.

A Florida Durable Power of Attorney form is a powerful legal document that allows an individual, known as the principal, to designate another person, called the agent, to manage their financial matters. This authorization remains in force even if the principal becomes incapacitated, ensuring continuous management of their affairs. For more information and resources regarding this important document, you can visit TopTemplates.info, which provides essential guidance on estate planning and safeguarding one’s financial future.

Where Can I Get the Disability Forms - The DE 2501 can be crucial for individuals facing temporary disabilities affecting their income.

Similar forms

The Netspend Dispute form serves a specific purpose in handling unauthorized transactions, but it shares similarities with various other documents used in financial and legal contexts. Here’s a list of ten documents that are similar to the Netspend Dispute form, highlighting how they align in function and structure:

- Credit Card Dispute Form: Like the Netspend form, this document allows cardholders to report unauthorized charges. It requires details about the transaction and the cardholder’s information.

- Fraud Report Form: This form is designed for reporting fraudulent activity. It collects personal details and specifics about the fraudulent transactions, similar to the Netspend form's requirements.

- Chargeback Request Form: Used by consumers to formally request a chargeback from their bank. It details the transaction in question and reasons for the dispute, paralleling the structure of the Netspend form.

- Identity Theft Report: This document is used to report identity theft to authorities. It requires personal information and details about the theft, akin to the information needed on the Netspend form.

- Bank Dispute Resolution Form: Banks provide this form for customers to dispute transactions. It collects similar information about the transaction and the nature of the dispute.

- Consumer Complaint Form: This form allows consumers to file complaints about financial institutions. It gathers personal information and details about the complaint, much like the Netspend form.

- Merchant Dispute Form: Used by merchants to dispute chargebacks or claims made by customers. It requires transaction details and reasons for the dispute, reflecting the structure of the Netspend form.

- Quitclaim Deed Form: For simple property transfers, utilize our informative Quitclaim Deed guidance to understand legal implications and ensure compliance.

- Insurance Claim Form: When filing a claim for lost or stolen property, this form collects details about the incident and the claimant’s information, similar to how the Netspend form operates.

- Refund Request Form: This document is used by consumers to request refunds for unauthorized transactions. It requires transaction details and the reason for the refund, mirroring the Netspend form.

- Transaction Verification Form: This form is used to verify disputed transactions. It collects similar details about the transaction and the account holder, resembling the Netspend dispute process.

Understanding these similarities can help individuals navigate the complexities of financial disputes more effectively. Each document serves its purpose, yet they share a common goal: to protect consumers and ensure fair handling of unauthorized transactions.