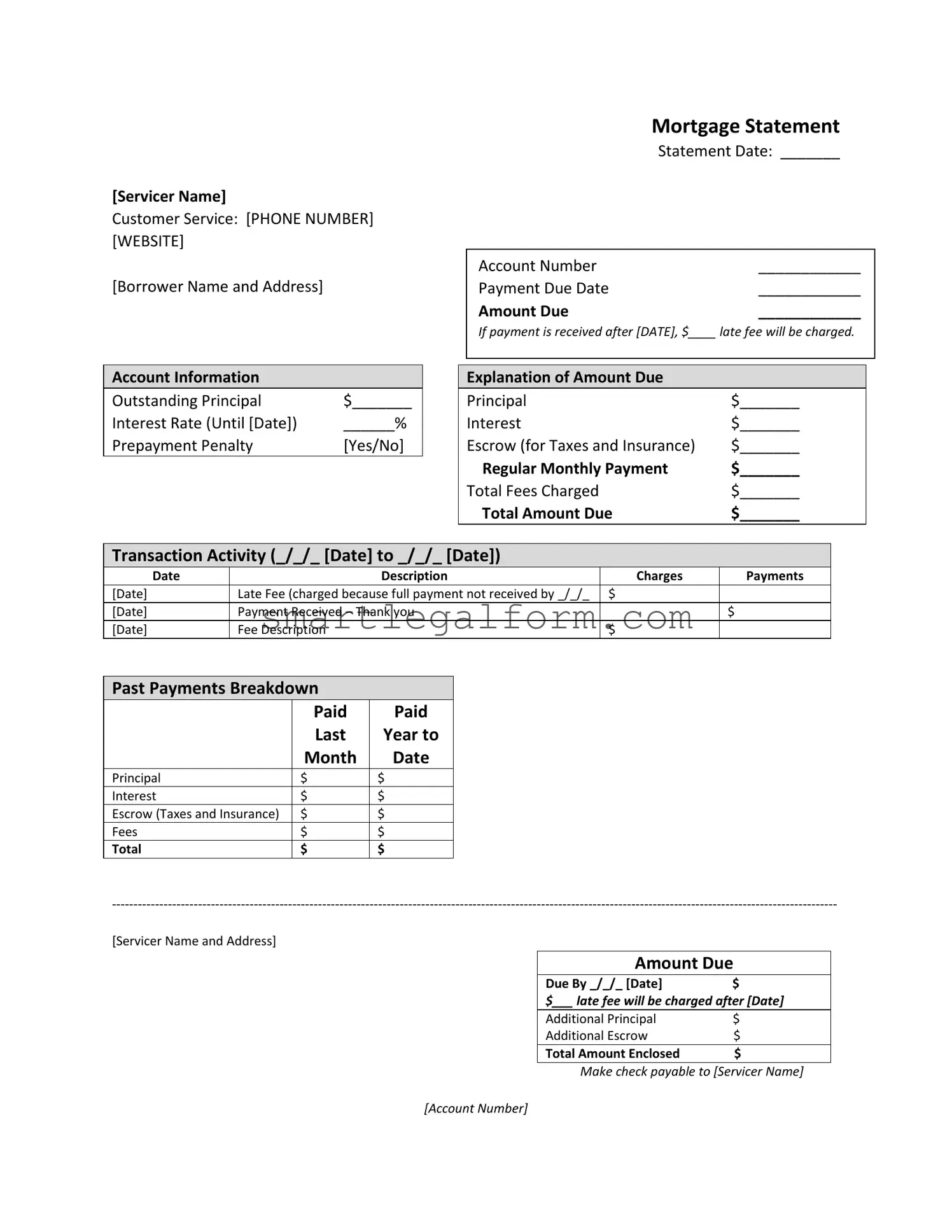

Free Mortgage Statement Form

Form Preview Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Common mistakes

Filling out the Mortgage Statement form can seem straightforward, but several common mistakes can lead to complications. One frequent error is failing to include the account number. This number is essential for the servicer to identify your account and process your payment correctly. Omitting it can result in delays or misapplied payments.

Another mistake is neglecting to check the payment due date. Many borrowers overlook this detail, which can lead to late payments and associated fees. It’s crucial to pay attention to the specified date to avoid unnecessary charges. Keeping a calendar reminder can help ensure timely payments.

Some individuals also forget to verify the amount due. Errors in this section can occur if the borrower does not account for recent payments or changes in fees. Always double-check the total amount before submitting to prevent underpayment or overpayment.

Another common issue arises with the escrow amount. Borrowers sometimes miscalculate this figure, which can impact their overall payment. The escrow portion covers taxes and insurance, and any discrepancies can lead to future complications or a shortage in funds when payments are due.

Lastly, many people fail to read the important messages included in the form, such as the section on partial payments. Understanding how partial payments are handled is vital to avoid confusion about how funds are applied to the mortgage. Ignoring this information can lead to unexpected issues, including the risk of foreclosure.

Dos and Don'ts

When filling out the Mortgage Statement form, it's important to follow certain guidelines to ensure accuracy and completeness. Here’s a list of things you should and shouldn’t do:

- Do write your name and address clearly at the top of the form.

- Don't leave any fields blank; fill in all required information.

- Do double-check your account number for accuracy.

- Don't forget to note the statement date and payment due date.

- Do clearly indicate the amount you are sending with your payment.

- Don't ignore the late fee details; be aware of the deadlines.

- Do review your transaction activity for any discrepancies.

- Don't overlook the importance of including your servicer's name on the check.

- Do keep a copy of the filled-out form for your records.

Other PDF Documents

Independent Contractor Pay Stub - Contains the date of payment and pay period covered.

Minor Travel Consent Letter - This form is a safeguard for both children and organizations.

When engaging in the sale of a vehicle, it is crucial for both the buyer and seller to utilize the appropriate documentation to ensure legal protection and clarity; one such resource is the Florida Motor Vehicle Bill of Sale form, which can be accessed at https://documentonline.org/blank-florida-motor-vehicle-bill-of-sale/. This form effectively outlines the specifics surrounding the transaction, ensuring that both parties are aware of their rights and obligations.

Create a Gift Certificate - A gift certificate offers the freedom to select something truly special.

Similar forms

- Billing Statement: Like a mortgage statement, a billing statement provides a summary of charges and payments due for a specific period. It details amounts owed, payment history, and any fees incurred, making it easy for customers to understand their financial obligations.

- Loan Statement: A loan statement outlines the details of a borrower’s loan, including outstanding balance, interest rate, and payment history. Similar to a mortgage statement, it helps borrowers track their progress in repaying the loan.

- Account Statement: An account statement summarizes transactions within a specific timeframe, showing deposits, withdrawals, and fees. Like a mortgage statement, it provides a clear overview of account activity, helping customers manage their finances effectively.

- Operating Agreement Form: For LLCs in Arizona, the comprehensive Arizona Operating Agreement essentials provide a necessary framework for managing company operations and responsibilities.

- Payment Reminder: A payment reminder notifies borrowers of upcoming due dates and amounts owed. It serves a similar purpose to a mortgage statement by prompting timely payments and reducing the risk of late fees.

- Escrow Statement: An escrow statement details the funds held in escrow for taxes and insurance. Much like a mortgage statement, it provides transparency regarding how funds are allocated and what is due, ensuring borrowers understand their financial responsibilities.

- Delinquency Notice: A delinquency notice alerts borrowers when they are behind on payments. Similar to a mortgage statement, it provides critical information about the status of the loan and the consequences of continued non-payment, encouraging borrowers to take action.