Free Louisiana act of donation Form

Form Preview Example

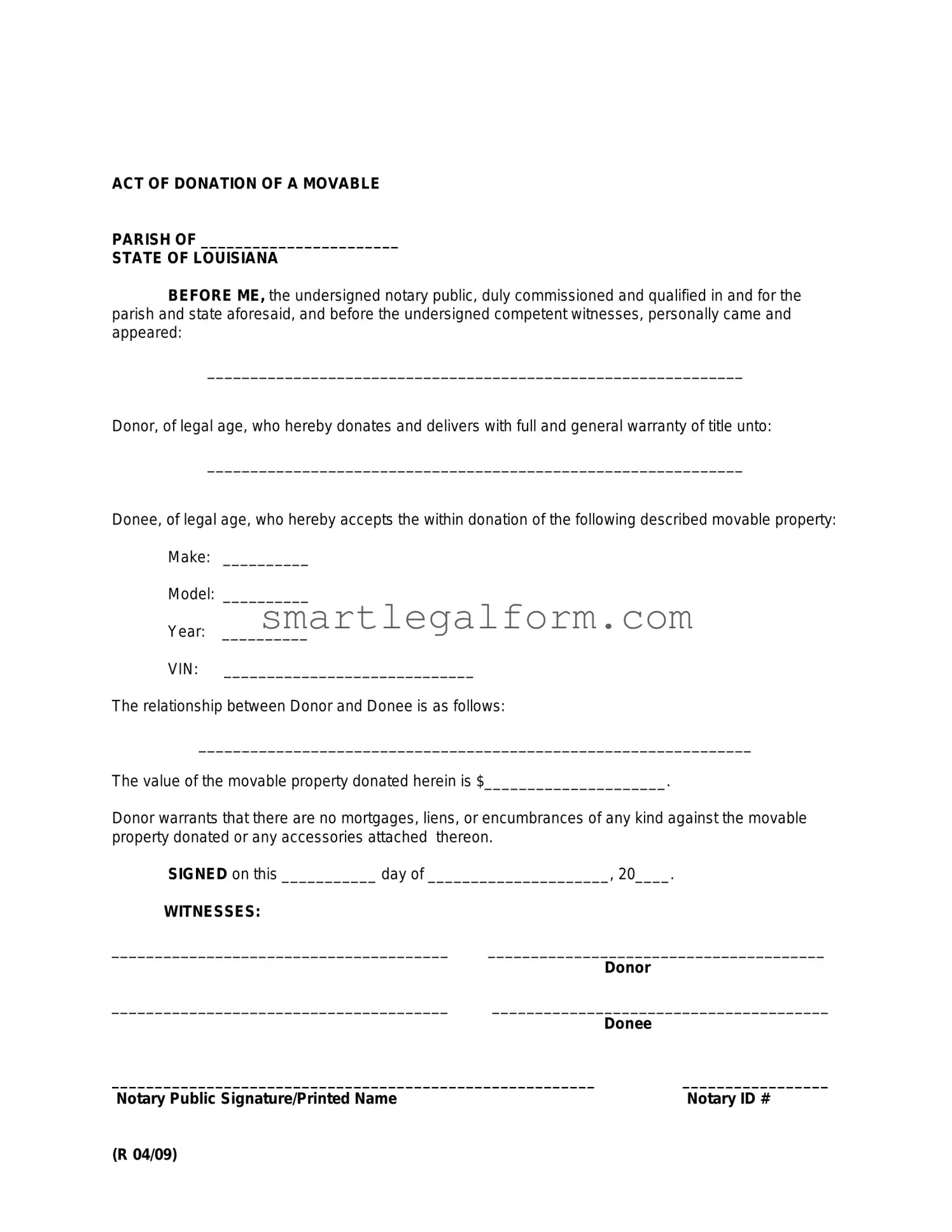

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Common mistakes

When filling out the Louisiana Act of Donation form, individuals often make several common mistakes that can lead to complications in the donation process. One frequent error is failing to provide accurate personal information. Donors must ensure that their names, addresses, and contact details are correct. Any discrepancies can cause delays in processing the donation.

Another mistake is neglecting to include a proper description of the property being donated. It is essential to specify the type of property clearly, whether it is real estate, personal belongings, or financial assets. Without a detailed description, the donation may not be legally recognized.

Some individuals overlook the requirement for signatures. Both the donor and the recipient must sign the form for it to be valid. Incomplete signatures can invalidate the entire document, leading to potential disputes later on.

Additionally, many people fail to date the form. A date is crucial as it establishes when the donation took effect. Without a date, there may be confusion regarding the timeline of the transfer, which can complicate matters for both parties involved.

Another common oversight is not having the document notarized. Louisiana law requires that the Act of Donation be notarized to be enforceable. Skipping this step can render the donation ineffective, leaving the donor's intentions unfulfilled.

People sometimes forget to consider the tax implications of their donation. Failing to consult with a tax professional can lead to unexpected tax liabilities for both the donor and the recipient. Understanding these implications is vital for effective financial planning.

Moreover, individuals may not provide adequate information about any liens or encumbrances on the property. It is essential to disclose any existing debts or claims against the property to avoid legal issues after the donation is completed.

Finally, some donors do not keep a copy of the completed form. Retaining a copy is important for personal records and may be necessary for future reference. Without documentation, proving the donation can become challenging.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do provide accurate information. Ensure all names, addresses, and property descriptions are correct.

- Do sign and date the form. A signature is required for the document to be valid.

- Don't leave any sections blank. Fill out all required fields to avoid delays.

- Don't use white-out or make alterations. If you need to correct something, cross it out and initial the change.

Other PDF Documents

Identification Card Online - Drivers may check their eligibility for a license based on their driving history.

In addition to understanding the legal implications of a Hold Harmless Agreement in California, it is essential for parties to access reliable templates and resources to ensure that their agreements are comprehensive and binding. For those looking for assistance in drafting such documents, a valuable resource can be found at TopTemplates.info, which provides templates tailored for various situations involving potential risks.

Parent Consent Letter for Travel - It is designed to ensure safety and compliance during travel.

Similar forms

The Louisiana act of donation form is a specific legal document used for transferring ownership of property without any exchange of money. Similar documents serve various purposes in property transfer and estate planning. Here are seven documents that share similarities with the Louisiana act of donation form:

- Gift Deed: This document also transfers property ownership as a gift. Like the act of donation, it does not involve payment and requires the consent of the donor.

- Last Will and Testament: A will can distribute property after death, similar to how the act of donation transfers ownership during a person's lifetime. Both documents require clear intent and legal formalities.

- Quitclaim Deed: This deed transfers any interest the grantor has in the property without guaranteeing that the title is clear. It is often used in family transactions, much like the act of donation.

- Trust Agreement: A trust can hold property for beneficiaries, similar to how an act of donation may designate future ownership. Both documents outline the terms of property management and transfer.

- Bill of Sale: This document is used to transfer ownership of personal property. Like the act of donation, it requires the consent of both parties, though it typically involves a sale rather than a gift.

- Power of Attorney: This document allows someone to make decisions on behalf of another person, including property transfers. It shares the intent of facilitating property management, similar to the act of donation.

Employee Handbook: To ensure clarity and understanding of workplace policies, refer to the comprehensive Employee Handbook resource which outlines essential rights and responsibilities for employees.

- Property Settlement Agreement: Often used in divorce proceedings, this agreement outlines how property will be divided. Like the act of donation, it formalizes the transfer of property ownership.

Understanding these documents can help clarify the various ways property can be transferred, whether as a gift, through a will, or in other legal arrangements.