Attorney-Approved Loan Agreement Form

Loan Agreement for Particular US States

Loan Agreement Form Types

Form Preview Example

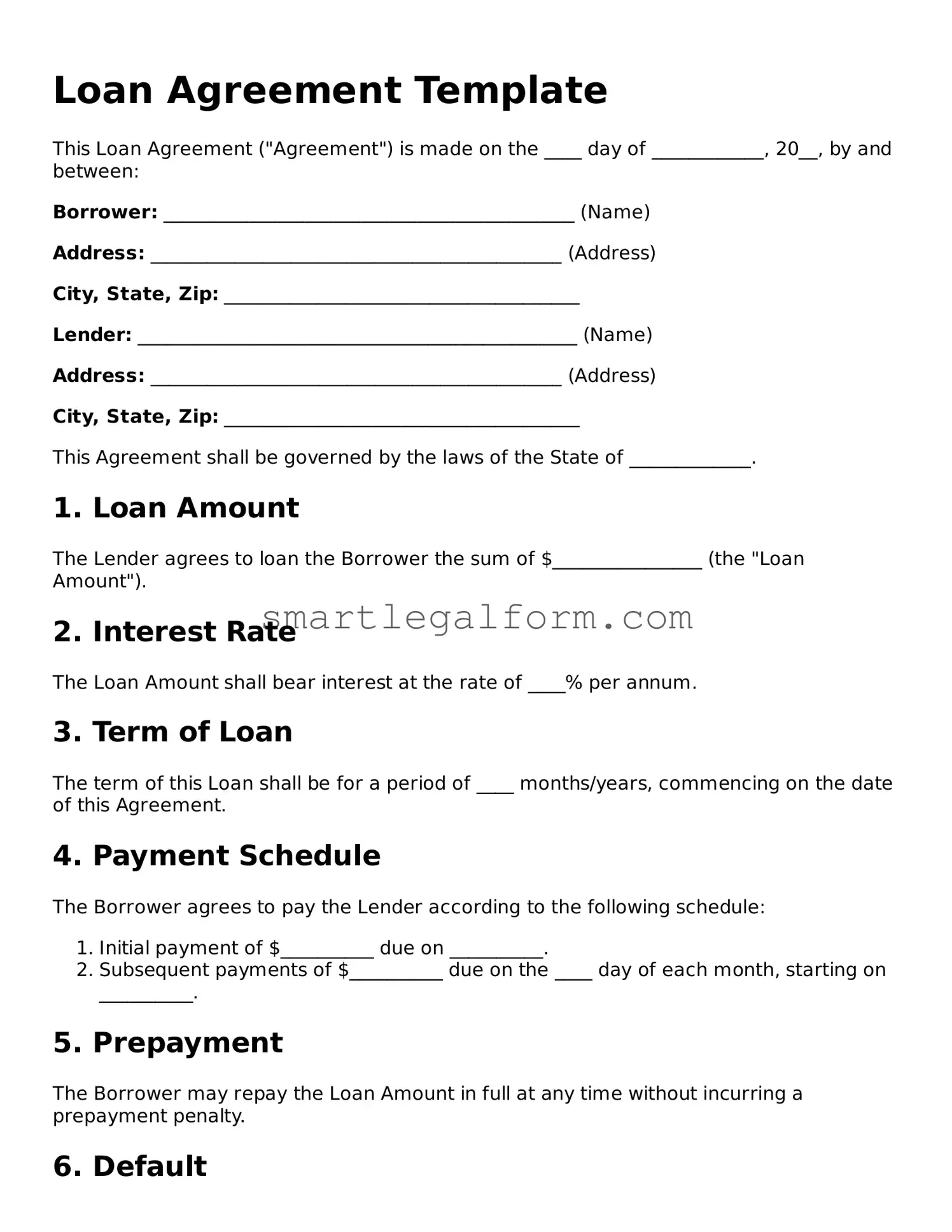

Loan Agreement Template

This Loan Agreement ("Agreement") is made on the ____ day of ____________, 20__, by and between:

Borrower: ____________________________________________ (Name)

Address: ____________________________________________ (Address)

City, State, Zip: ______________________________________

Lender: _______________________________________________ (Name)

Address: ____________________________________________ (Address)

City, State, Zip: ______________________________________

This Agreement shall be governed by the laws of the State of _____________.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of $________________ (the "Loan Amount").

2. Interest Rate

The Loan Amount shall bear interest at the rate of ____% per annum.

3. Term of Loan

The term of this Loan shall be for a period of ____ months/years, commencing on the date of this Agreement.

4. Payment Schedule

The Borrower agrees to pay the Lender according to the following schedule:

- Initial payment of $__________ due on __________.

- Subsequent payments of $__________ due on the ____ day of each month, starting on __________.

5. Prepayment

The Borrower may repay the Loan Amount in full at any time without incurring a prepayment penalty.

6. Default

If the Borrower fails to make any scheduled payment within ____ days of its due date, the Lender may declare the Loan Amount due and payable immediately.

7. Amendments

This Agreement may be amended only by a written agreement signed by both the Borrower and the Lender.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

9. Signatures

By signing below, both parties agree to the terms and conditions set forth in this Loan Agreement.

Borrower Signature: _______________________________ Date: __________

Lender Signature: _______________________________ Date: __________

Common mistakes

When filling out a Loan Agreement form, one common mistake is failing to provide accurate personal information. Borrowers often overlook the importance of entering their full legal name, current address, and contact details. Inaccuracies can lead to delays in processing the loan or even rejection of the application. Always double-check this information to ensure it matches your identification documents.

Another frequent error is misunderstanding the loan terms. Many individuals skip reading the fine print or gloss over the interest rates, repayment schedules, and any fees associated with the loan. This lack of attention can result in unexpected financial burdens later. Take the time to understand each term fully before signing the agreement.

Additionally, people sometimes underestimate their financial situation when filling out the form. They may overstate their income or fail to disclose existing debts. This misrepresentation can have serious consequences, including loan denial or legal repercussions. It’s crucial to provide a realistic picture of your financial health to avoid complications down the line.

Lastly, neglecting to ask questions is a mistake that many borrowers make. If something is unclear, it’s important to seek clarification from the lender. Ignoring uncertainties can lead to misunderstandings about obligations and rights under the agreement. Engaging in open communication can prevent issues and ensure that you are fully informed about your loan.

Dos and Don'ts

When filling out a Loan Agreement form, it’s essential to follow specific guidelines to ensure accuracy and clarity. Here’s a list of things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about your financial status.

- Do ask questions if you don’t understand any part of the agreement.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't rush through the process; take your time to ensure everything is correct.

Common Templates:

Affidavit Letter of Support Marriage Sample - While the format can vary, authenticity and honesty must remain the focus of the content.

Dd 214 - It may be used to facilitate various benefits, including housing assistance.

Similar forms

A Loan Agreement is a crucial document in the lending process, but it's not the only one of its kind. Here are six other documents that share similarities with a Loan Agreement:

- Promissory Note: This document outlines the borrower's promise to repay the loan. Like a Loan Agreement, it includes the loan amount, interest rate, and repayment terms, but it typically focuses more on the borrower's commitment rather than the broader terms of the loan.

- Mortgage Agreement: This is a specific type of loan agreement used in real estate transactions. It secures the loan with the property itself, detailing the rights and responsibilities of both the lender and borrower, similar to how a Loan Agreement outlines the terms of the loan.

- Security Agreement: This document establishes collateral for the loan, much like a Mortgage Agreement. It specifies what assets are being used to secure the loan, ensuring the lender has a claim to those assets if the borrower defaults.

- Loan Application: While not a binding agreement, this document collects essential information about the borrower and their financial situation. It sets the stage for the Loan Agreement by providing the lender with the necessary details to assess risk.

- Disclosure Statement: This document provides borrowers with important information about the terms of the loan, including fees and interest rates. It complements the Loan Agreement by ensuring transparency and helping borrowers understand what they are agreeing to.

- Forbearance Agreement: In situations where a borrower is struggling to make payments, this document outlines temporary relief measures. It shares similarities with a Loan Agreement in that it details the terms of the modified repayment plan, ensuring both parties are on the same page.