Attorney-Approved Last Will and Testament Form

Last Will and Testament for Particular US States

Last Will and Testament Form Types

Form Preview Example

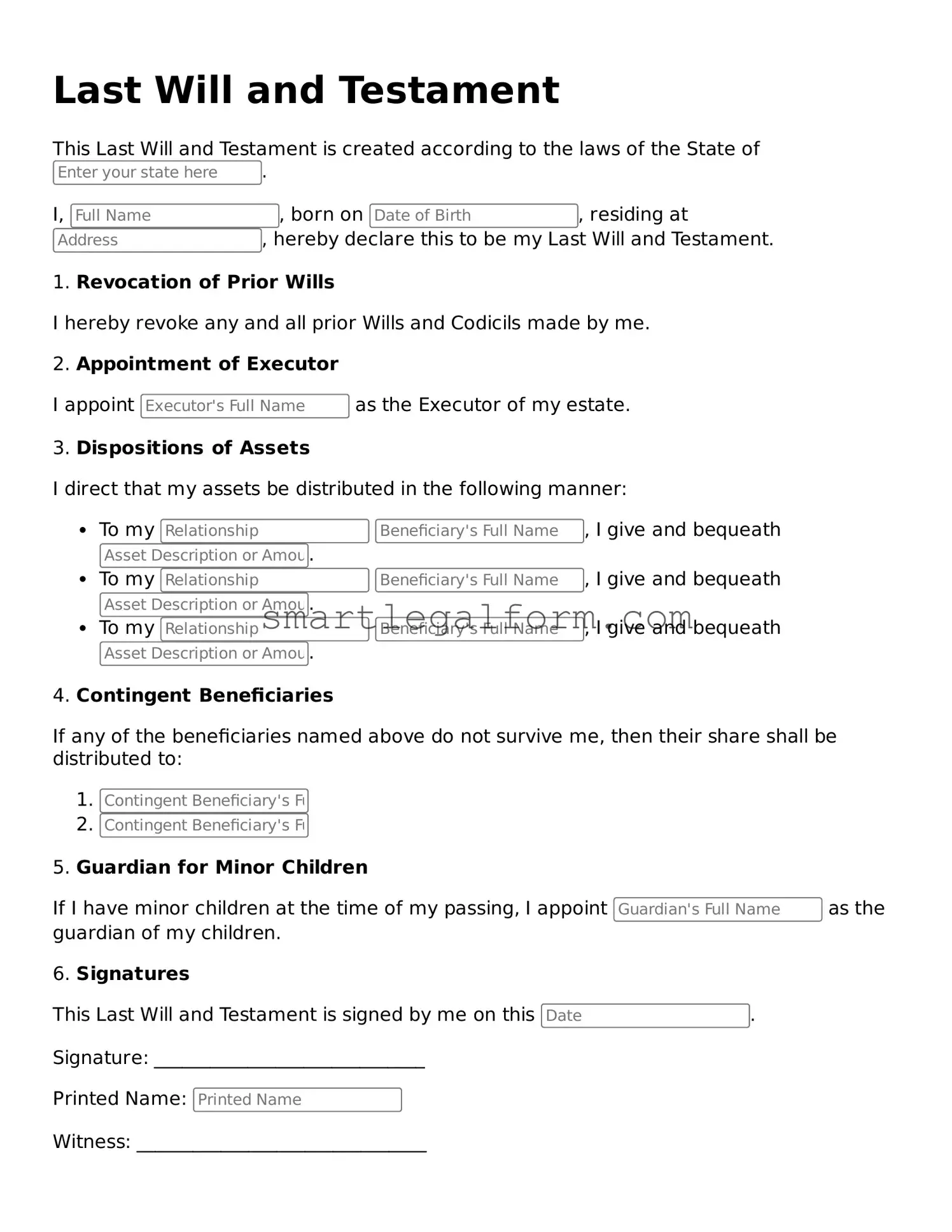

Last Will and Testament

This Last Will and Testament is created according to the laws of the State of .

I, , born on , residing at , hereby declare this to be my Last Will and Testament.

1. Revocation of Prior Wills

I hereby revoke any and all prior Wills and Codicils made by me.

2. Appointment of Executor

I appoint as the Executor of my estate.

3. Dispositions of Assets

I direct that my assets be distributed in the following manner:

- To my , I give and bequeath .

- To my , I give and bequeath .

- To my , I give and bequeath .

4. Contingent Beneficiaries

If any of the beneficiaries named above do not survive me, then their share shall be distributed to:

5. Guardian for Minor Children

If I have minor children at the time of my passing, I appoint as the guardian of my children.

6. Signatures

This Last Will and Testament is signed by me on this .

Signature: _____________________________

Printed Name:

Witness: _______________________________

Witness: _______________________________

Common mistakes

Creating a Last Will and Testament is a crucial step in ensuring that one's wishes are honored after death. However, many individuals make common mistakes that can lead to confusion or disputes among heirs. One frequent error is failing to properly identify beneficiaries. It is essential to provide full names and, if possible, relationships to avoid ambiguity. Without clear identification, disagreements may arise over who is entitled to inherit.

Another mistake involves not updating the will after major life changes. Events such as marriage, divorce, or the birth of a child can significantly impact one’s wishes regarding asset distribution. Neglecting to revise the will accordingly can result in unintended consequences, such as disinheriting a spouse or failing to include a new family member.

Additionally, some people overlook the importance of having witnesses. Most states require that a will be signed in the presence of at least two witnesses who are not beneficiaries. Failing to meet this requirement can lead to the will being deemed invalid. It is advisable to ensure that witnesses are present during the signing to avoid future legal challenges.

Inadequate detail about asset distribution is another common pitfall. A vague description of assets can create confusion and disputes among heirs. Specificity is key; clearly outline what each beneficiary will receive. This clarity helps to prevent misunderstandings and ensures that the testator’s intentions are honored.

Finally, many individuals neglect to consider the appointment of an executor. This person is responsible for managing the estate and ensuring that the will is executed according to the testator’s wishes. Choosing someone who is trustworthy and capable is vital. Without a competent executor, the process can become complicated, leading to delays and potential conflicts among beneficiaries.

Dos and Don'ts

When filling out a Last Will and Testament form, it's crucial to approach the task with care and attention to detail. Here are ten essential tips to guide you through the process.

- Do ensure that you are of sound mind and legal age when creating your will.

- Do clearly identify yourself and your beneficiaries in the document.

- Do specify how you want your assets distributed among your heirs.

- Do appoint an executor who will manage your estate after your passing.

- Do sign and date the will in the presence of witnesses, if required by your state.

- Don't use ambiguous language that could lead to confusion or misinterpretation.

- Don't forget to update your will after major life changes, such as marriage or divorce.

- Don't leave out important details, such as debts or specific bequests.

- Don't try to create a will without understanding the legal requirements in your state.

- Don't store your will in a location that is difficult for your executor to access.

Following these guidelines can help ensure that your wishes are honored and that your loved ones are taken care of after your passing. Take the time to review and complete your Last Will and Testament carefully.

Common Templates:

Single Status Certificate - Often notarized to ensure authenticity of the declaration.

Work Availability Form - This form allows employees to indicate their schedule preferences.

Goodwill Receipt - This document proves your donation to a worthy cause.

Similar forms

- Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they may be unable to communicate their wishes. Like a Last Will and Testament, it serves to express personal desires, but it focuses on healthcare decisions rather than the distribution of assets after death.

- Durable Power of Attorney: This document grants someone the authority to make financial or legal decisions on behalf of another person. Similar to a Last Will, it ensures that an individual's wishes are honored, but it operates during their lifetime, particularly in the event of incapacitation.

- Healthcare Proxy: A healthcare proxy allows an individual to designate someone to make medical decisions on their behalf if they become unable to do so. While a Last Will addresses posthumous matters, a healthcare proxy focuses on immediate medical care and preferences.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Both a trust and a Last Will serve to manage assets, but a trust can take effect during the grantor's lifetime, allowing for more immediate management of assets.

- Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes without drafting an entirely new Last Will and Testament. This document provides flexibility and ensures that the testator's current wishes are reflected.

- Letter of Instruction: This informal document provides guidance to loved ones regarding personal wishes, funeral arrangements, and the distribution of sentimental items. While not legally binding like a Last Will, it complements the will by offering additional context and clarity on the testator's intentions.

- Estate Plan: An estate plan encompasses a comprehensive strategy for managing an individual's assets and affairs during their lifetime and after death. It often includes a Last Will, trusts, and powers of attorney, ensuring a coordinated approach to fulfilling one's wishes.