Free IRS Schedule C 1040 Form

Form Preview Example

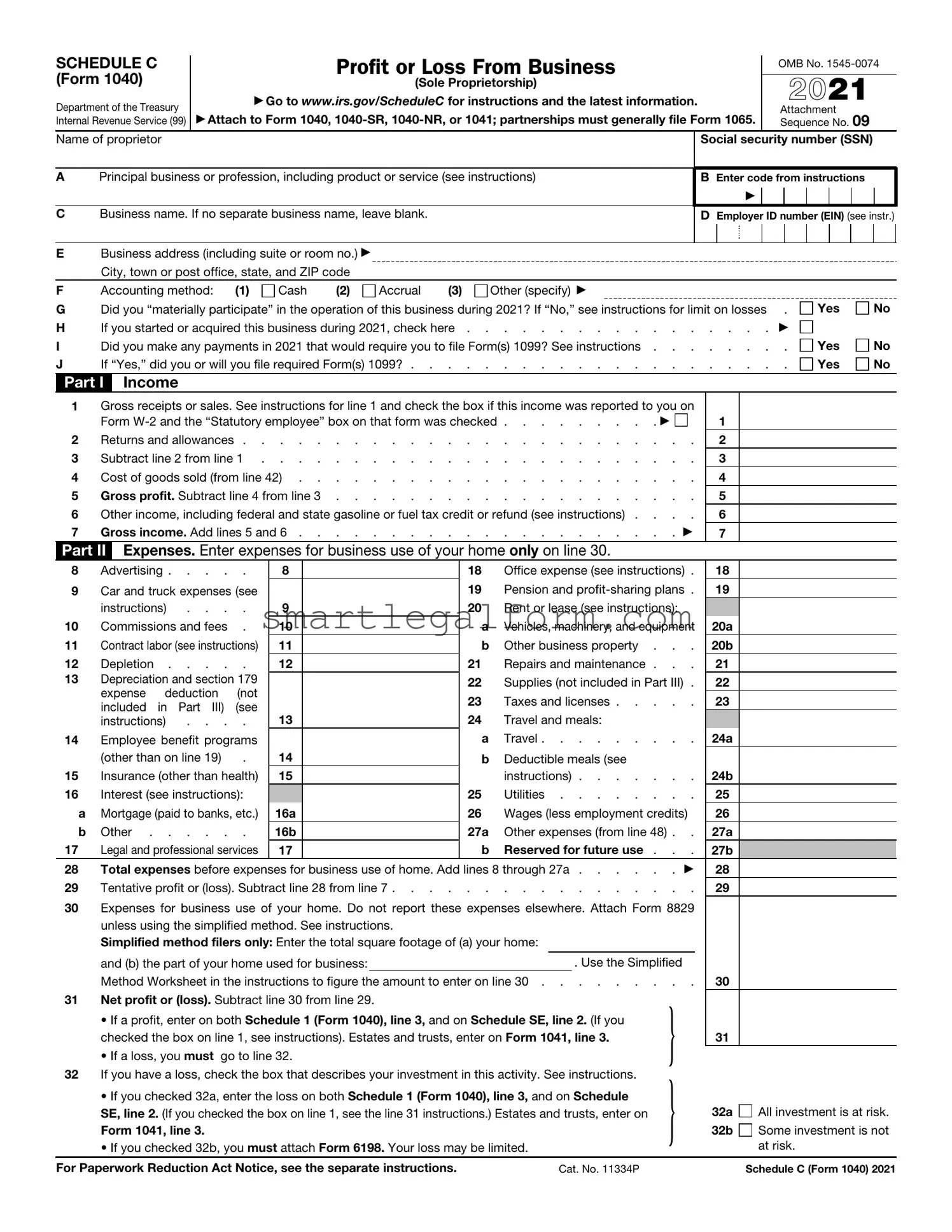

SCHEDULE C (Form 1040)

Department of the Treasury Internal Revenue Service (99)

Profit or Loss From Business

(Sole Proprietorship)

▶Go to www.irs.gov/ScheduleC for instructions and the latest information.

▶Attach to Form 1040,

OMB No.

2021

Attachment Sequence No. 09

Name of proprietor

APrincipal business or profession, including product or service (see instructions)

CBusiness name. If no separate business name, leave blank.

Social security number (SSN)

BEnter code from instructions

▶

DEmployer ID number (EIN) (see instr.)

EBusiness address (including suite or room no.) ▶

City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

|

Accrual |

(3) |

Other (specify) ▶ |

|

|

|

|

|

|

|

||||||

G |

Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on losses |

. |

Yes |

No |

|||||||||||||||||

H |

If you started or acquired this business during 2021, check here |

. . |

. . |

▶ |

|

|

|||||||||||||||

I |

Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions . . . |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

. . |

. . |

. |

Yes |

No |

|||||||||||||||

Part I |

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|

|

|

|||||||||||||||

|

Form |

. . . . . . . . . ▶ |

1 |

|

|

|

|

||||||||||||||

2 |

Returns and allowances |

2 |

|

|

|

|

|||||||||||||||

3 |

Subtract line 2 from line 1 |

3 |

|

|

|

|

|||||||||||||||

4 |

Cost of goods sold (from line 42) |

4 |

|

|

|

|

|||||||||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

5 |

|

|

|

|

|||||||||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|

|

|

|||||||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . . |

. ▶ |

7 |

|

|

|

|

|||||||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

|

|

|||||||||||||

8 |

Advertising |

8 |

|

|

|

|

|

|

18 |

Office expense (see instructions) . |

18 |

|

|

|

|

||||||

9 |

Car and truck expenses (see |

|

|

|

|

|

|

|

19 |

Pension and |

19 |

|

|

|

|

||||||

|

instructions) . . . . |

9 |

|

|

|

|

|

|

20 |

Rent or lease (see instructions): |

|

|

|

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

|

|

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

|

|

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

|

|

|

|

b |

Other business property . . . |

20b |

|

|

|

|

||||||

12 |

Depletion |

12 |

|

|

|

|

|

|

21 |

Repairs and maintenance . . . |

21 |

|

|

|

|

||||||

13 |

Depreciation and section 179 |

|

|

|

|

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

|

|

|

||||||

|

expense deduction |

(not |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|

|

|

|||||||

|

included in Part III) (see |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

instructions) . . . . |

13 |

|

|

|

|

|

|

24 |

Travel and meals: |

|

|

|

|

|

|

|

||||

14 |

Employee benefit programs |

|

|

|

|

|

|

|

a |

Travel |

24a |

|

|

|

|

||||||

|

(other than on line 19) |

. |

14 |

|

|

|

|

|

|

b |

Deductible meals (see |

|

|

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

|

|

|

|

instructions) |

24b |

|

|

|

|

||||||

16 |

Interest (see instructions): |

|

|

|

|

|

|

|

25 |

Utilities |

25 |

|

|

|

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

|

|

|

|

26 |

Wages (less employment credits) |

26 |

|

|

|

|

||||||

b |

Other |

16b |

|

|

|

|

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

|

|

|

||||||

17 |

Legal and professional services |

17 |

|

|

|

|

|

|

b |

Reserved for future use . . . |

27b |

|

|

|

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a |

. ▶ |

28 |

|

|

|

|

||||||||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

29 |

|

|

|

|

|||||||||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|

|

|

|||||||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

and (b) the part of your home used for business: |

|

|

|

|

|

|

|

. Use the Simplified |

|

|

|

|

|

|||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|

|

|

|||||||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

|

|

} |

|

|

|

|

|

|

||||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|

|

||||||||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

31 |

|

|

|

|

||||||||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

} |

|

|

|

|

|

|

|||||||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

|

|

|

|

||||||||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on |

|

32a |

All investment is at risk. |

|||||||||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

32b |

Some investment is not |

|||||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

at risk. |

|

|

||||||||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

Schedule C (Form 1040) 2021 |

||||||||||||||

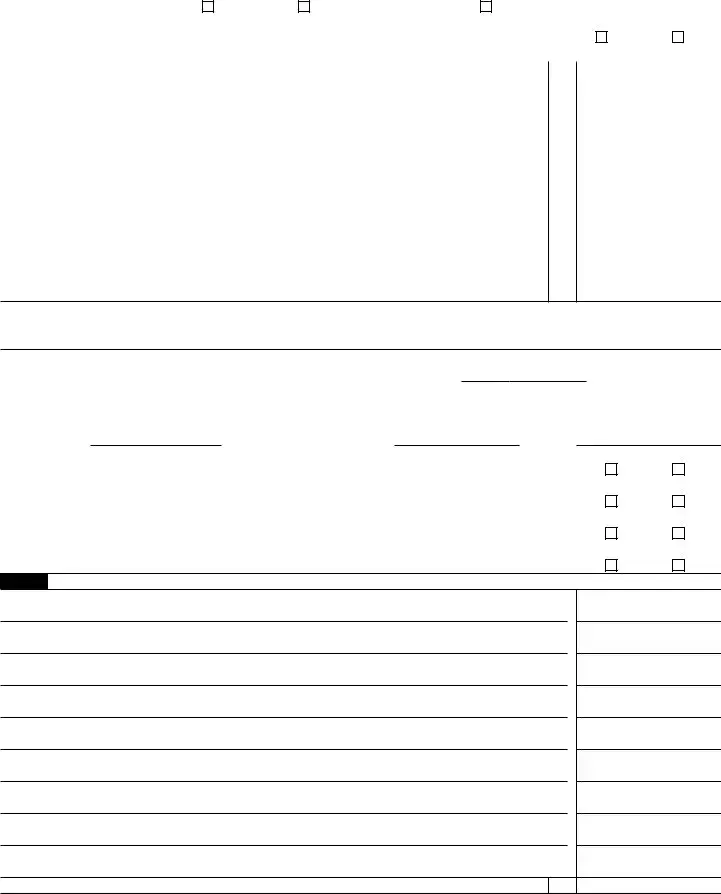

Schedule C (Form 1040) 2021 |

Page 2 |

|

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

36 |

Purchases less cost of items withdrawn for personal use |

36 |

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

38 |

Materials and supplies |

38 |

39 |

Other costs |

39 |

40 |

Add lines 35 through 39 |

40 |

41 |

Inventory at end of year |

41 |

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562.

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

44Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

45 |

Was your vehicle available for personal use during |

||

46 |

Do you (or your spouse) have another vehicle available for personal use? |

||

47a |

Do you have evidence to support your deduction? |

||

b |

If “Yes,” is the evidence written? |

||

Yes

Yes

Yes

Yes

No

No

No

No

Part V Other Expenses. List below business expenses not included on lines

48 |

Total other expenses. Enter here and on line 27a |

48

Schedule C (Form 1040) 2021

Common mistakes

Filling out the IRS Schedule C (Form 1040) can be a complex task, and mistakes can lead to significant issues, including delays in processing or even audits. One common error is failing to report all income. Individuals often overlook income from side jobs or freelance work. It is essential to include every source of revenue to ensure compliance with tax laws.

Another frequent mistake is misclassifying expenses. Many people do not understand the difference between direct and indirect expenses. This can lead to improper deductions. For example, mixing personal expenses with business expenses can raise red flags during an audit. Keeping detailed records and separating personal and business transactions is crucial.

Additionally, some individuals neglect to keep adequate documentation for their expenses. The IRS requires proof for deductions claimed on Schedule C. Without receipts or invoices, taxpayers may find themselves unable to substantiate their claims, resulting in denied deductions. Maintaining organized records throughout the year can alleviate this problem.

Many taxpayers also fail to consider the implications of self-employment taxes. While some may focus solely on income tax, self-employment tax can significantly impact overall tax liability. Understanding this tax is essential for accurate financial planning and avoiding surprises at tax time.

Improperly calculating net profit is another common mistake. This can occur when individuals do not accurately subtract expenses from income. An incorrect calculation can lead to overpayment or underpayment of taxes. Using accounting software or consulting a professional can help ensure accuracy.

Some people also overlook the importance of deadlines. Missing the filing deadline can result in penalties and interest charges. It is essential to be aware of important dates and to file on time to avoid unnecessary costs.

Finally, many individuals do not seek professional advice when needed. While it is possible to complete Schedule C independently, complex situations may require expert guidance. Consulting a tax professional can provide valuable insights and help avoid costly mistakes.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it’s essential to be thorough and accurate. Here are some key things to consider:

- Do keep detailed records of all income and expenses related to your business. This will help you provide accurate information on the form.

- Do report all sources of income, including cash payments. Every dollar counts when it comes to your tax obligations.

- Do take advantage of all allowable deductions. This can significantly reduce your taxable income.

- Do review the form for accuracy before submission. Double-checking can help prevent costly mistakes.

- Don't ignore the importance of categorizing your expenses correctly. Misclassifying can lead to issues with the IRS.

- Don't submit the form without signing it. An unsigned form is considered incomplete and may delay processing.

By following these guidelines, you can navigate the Schedule C form more effectively and ensure compliance with IRS requirements.

Other PDF Documents

Mortgage 1098 - Mortgage counseling options are available if needed.

Employers often rely on the Employment Application PDF form to gather critical information from potential hires efficiently, which can include details about their work experience and educational background. For those looking for a reliable template, you can find one at https://documentonline.org/blank-employment-application-pdf/, ensuring that the application process is smooth and professional for both applicants and employers.

Faa Form 8050-2 - It is highly recommended for individuals involved in buying or selling aircraft to use this standardized form.

Similar forms

The IRS Schedule C (Form 1040) is a vital document for self-employed individuals and small business owners. It reports income and expenses related to a business. Several other documents share similarities with Schedule C, each serving a unique purpose in the realm of taxation and business reporting. Below are six documents that resemble Schedule C in function and intent:

- Form 1065: This form is used by partnerships to report income, deductions, and other information. Like Schedule C, it captures the financial performance of the business but is specifically tailored for partnerships rather than sole proprietorships.

- Form 1120: Corporations use this form to report their income and expenses. Similar to Schedule C, it provides a comprehensive overview of the business's financial status, but it applies to corporate entities rather than individual owners.

- Form 1120S: This is the tax return for S corporations. It resembles Schedule C in that it reports income and deductions, but it is specifically for S corporations, which have different tax implications compared to sole proprietorships.

- Hold Harmless Agreement: In California, a Hold Harmless Agreement is essential for mitigating risks in various situations, ensuring all parties know their responsibilities and liabilities. For more information, you can visit TopTemplates.info.

- Schedule E: Used for reporting supplemental income and loss, Schedule E is similar to Schedule C in that it details income from rental properties, partnerships, and S corporations, but it focuses on passive income sources rather than active business income.

- Form 1040: The individual income tax return, Form 1040, is the overarching document that includes Schedule C. While Schedule C provides detailed business information, Form 1040 encompasses all personal income, deductions, and credits.

- Schedule F: This schedule is for farmers to report their farming income and expenses. It is similar to Schedule C in that it captures the financial details of a specific business type, focusing on agricultural operations.

Understanding these documents can help streamline the reporting process and ensure compliance with tax regulations.