Free IRS 2553 Form

Form Preview Example

Note: Form 2553 begins on the next page.

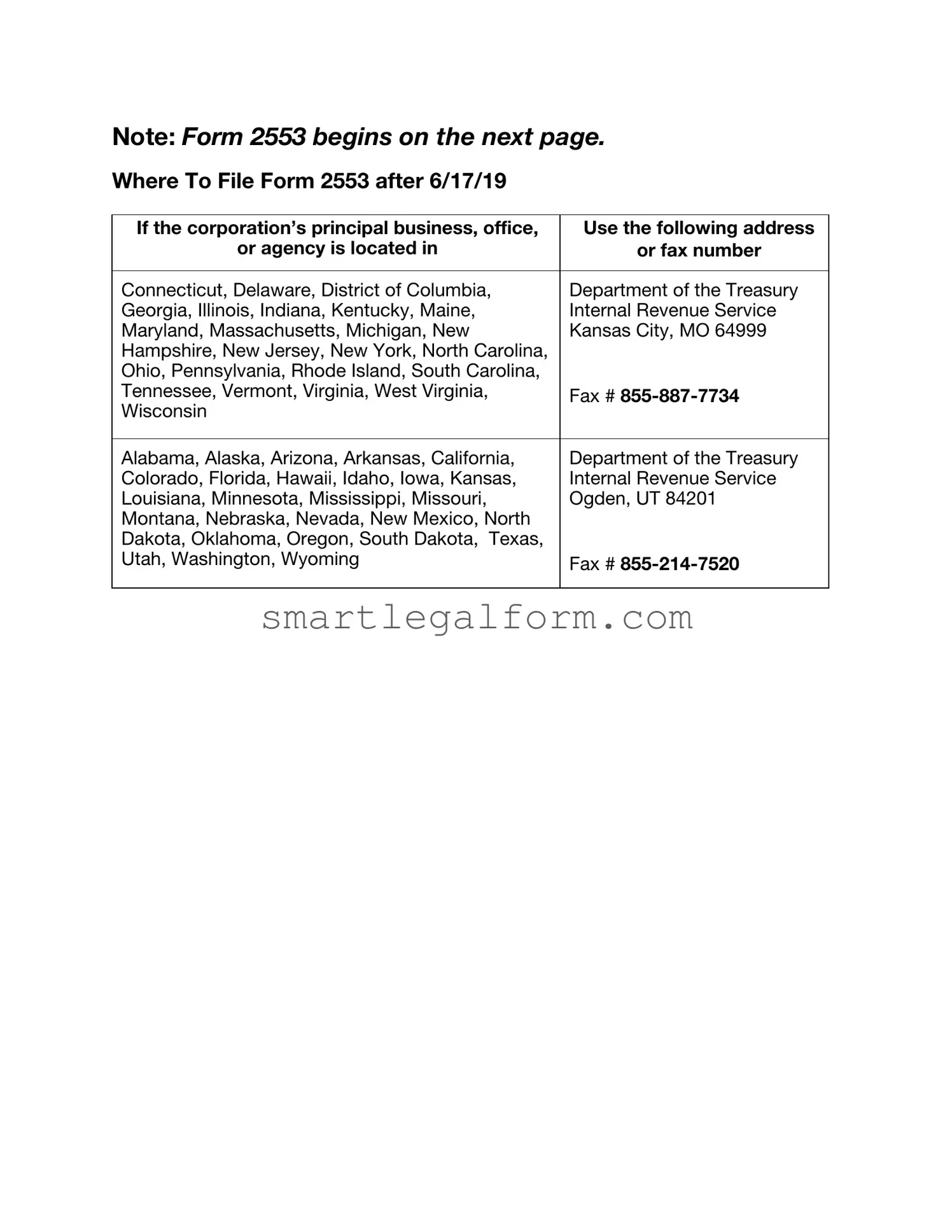

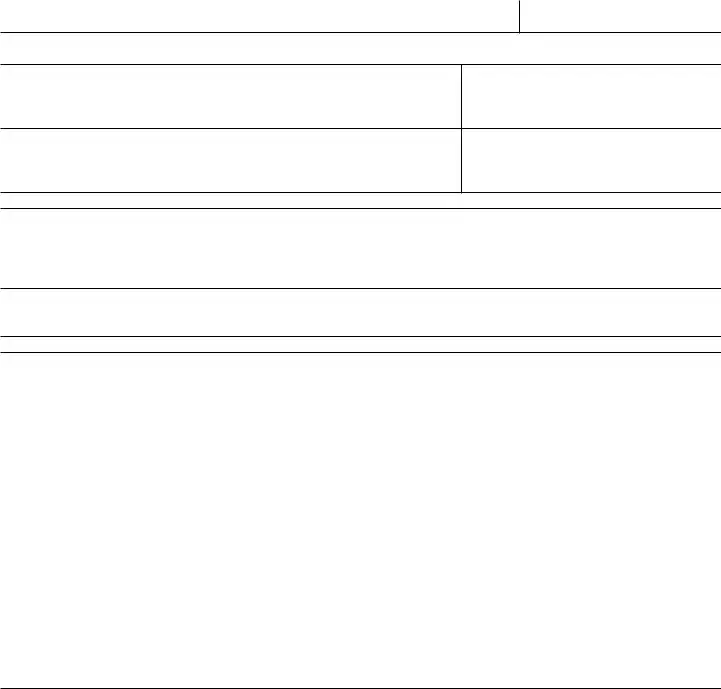

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, |

Use the following address |

or agency is located in |

or fax number |

|

|

Connecticut, Delaware, District of Columbia, |

Department of the Treasury |

Georgia, Illinois, Indiana, Kentucky, Maine, |

Internal Revenue Service |

Maryland, Massachusetts, Michigan, New |

Kansas City, MO 64999 |

Hampshire, New Jersey, New York, North Carolina, |

|

Ohio, Pennsylvania, Rhode Island, South Carolina, |

|

Tennessee, Vermont, Virginia, West Virginia, |

Fax # |

Wisconsin |

|

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

Department of the Treasury |

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Internal Revenue Service |

Louisiana, Minnesota, Mississippi, Missouri, |

Ogden, UT 84201 |

Montana, Nebraska, Nevada, New Mexico, North |

|

Dakota, Oklahoma, Oregon, South Dakota, Texas, |

|

Utah, Washington, Wyoming |

Fax # |

|

|

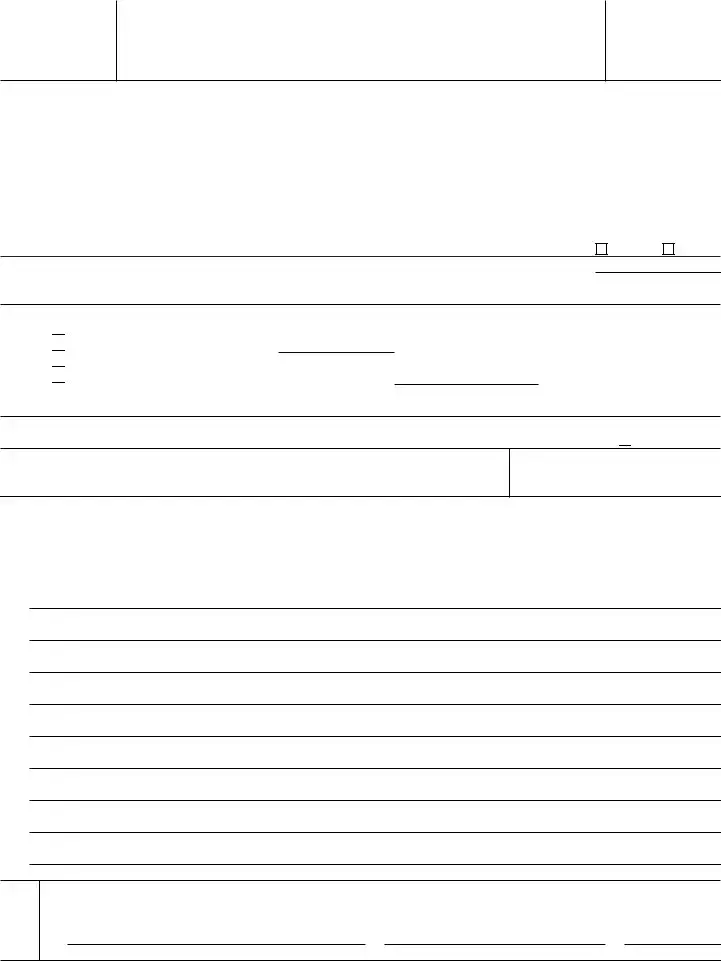

Form 2553

(Rev. December 2017)

Department of the Treasury Internal Revenue Service

Election by a Small Business Corporation

(Under section 1362 of the Internal Revenue Code)

(Including a late election filed pursuant to Rev. Proc.

▶You can fax this form to the IRS. See separate instructions.

▶Go to www.irs.gov/Form2553 for instructions and the latest information.

OMB No.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information have been provided.

Part I |

|

Election Information |

|

|

|

|

|

|

|

Name (see instructions) |

A Employer identification number |

||

Type |

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

B Date incorporated |

|

|||

or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City or town, state or province, country, and ZIP or foreign postal code |

C State of incorporation |

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

D |

Check |

the applicable box(es) if the corporation (entity), after applying for the EIN shown in A above, changed its |

name or |

address |

||

EElection is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the beginning date of a short tax year that begins on a date other than January 1.

FSelected tax year:

(1) Calendar year

Calendar year

(2) Fiscal year ending (month and day) ▶

Fiscal year ending (month and day) ▶

(3)

(4)

If box (2) or (4) is checked, complete Part II.

GIf more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

HName and title of officer or legal representative whom the IRS may call for more information

Telephone number of officer or legal representative

IIf this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its discovery. See instructions.

|

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my |

||

Sign knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. |

|||

Here |

▲Signature of officer |

|

|

|

Title |

Date |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 18629R |

Form 2553 (Rev. |

|

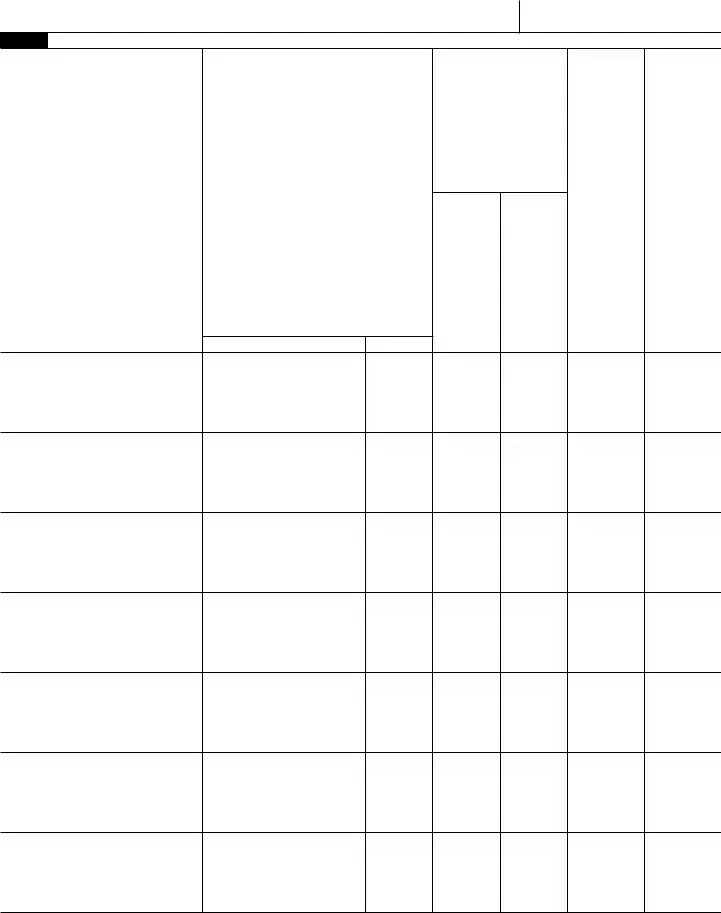

Form 2553 (Rev. |

Page 2 |

Name |

Employer identification number |

Part I Election Information (continued) Note: If you need more rows, use additional copies of page 2.

J

Name and address of each

shareholder or former shareholder required to consent to the election.

(see instructions)

K

Shareholder’s Consent Statement

Under penalties of perjury, I declare that I consent to the election of the

Signature |

Date |

L

Stock owned or

percentage of ownership

(see instructions)

Number of |

|

shares or |

|

percentage |

Date(s) |

of ownership |

acquired |

M |

|

Social security |

|

number or |

N |

employer |

Shareholder’s |

identification |

tax year ends |

number (see |

(month and |

instructions) |

day) |

Form 2553 (Rev.

Form 2553 (Rev. |

Page 3 |

|

Name |

|

Employer identification number |

|

|

|

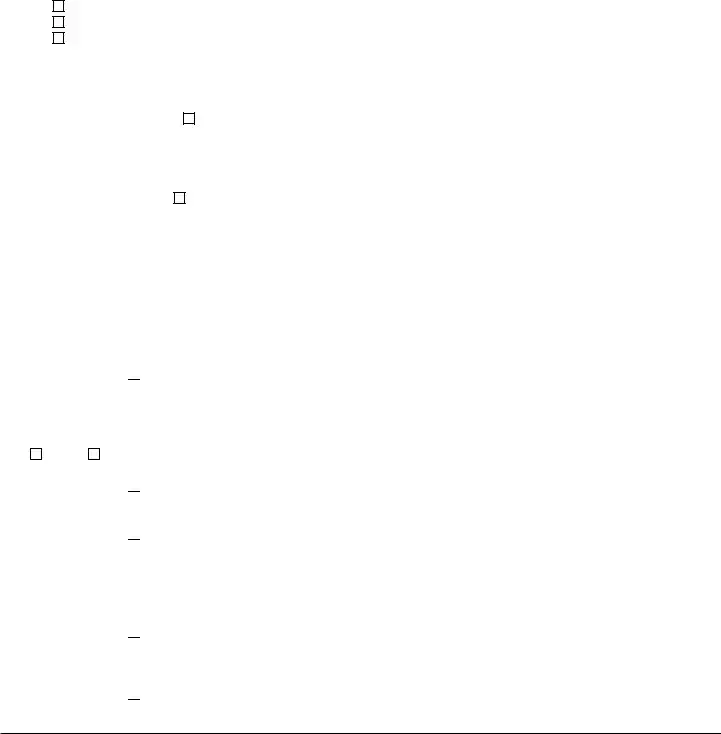

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

|

O Check the applicable box to indicate whether the corporation is: |

|

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a

QBusiness

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

Yes |

No |

2.Check here ▶

to show that the corporation intends to make a

to show that the corporation intends to make a

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

RSection 444

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Form 2553 (Rev.

Form 2553 (Rev. |

Page 4 |

Name |

Employer identification number |

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . ▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election |

|

Date |

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust after the date on which the corporation makes the S election.

Part IV Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective, relief for a late S corporation election must also include the following representations.

1The requesting entity is an eligible entity as defined in Regulations section

2The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section

4The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

bThe requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Form 2553 (Rev.

Common mistakes

Filling out the IRS Form 2553 can be a straightforward process, but many individuals make common mistakes that can delay their election for S Corporation status. One frequent error is not meeting the deadline. The form must be filed within 75 days of the beginning of the tax year. Missing this deadline can result in the loss of S Corporation status for that year.

Another mistake involves incorrect eligibility checks. To qualify for S Corporation status, a business must meet specific criteria, such as having no more than 100 shareholders and only one class of stock. Failing to confirm eligibility can lead to complications and potential disqualification.

Inaccurate information is also a common issue. Many people fill out the form with incorrect names, addresses, or Employer Identification Numbers (EIN). Such errors can cause significant delays in processing and may require resubmission of the form.

Some individuals neglect to provide all required signatures. The form must be signed by all shareholders who own stock at the time of filing. Omitting a signature can invalidate the election, leading to further complications.

Another mistake is not properly identifying the tax year. The IRS Form 2553 requires you to indicate the tax year for which the S Corporation election is being made. Choosing the wrong tax year can create confusion and may result in the rejection of the application.

Additionally, some filers fail to provide a valid reason for late filing if applicable. If the form is submitted after the deadline, you must explain why. Not including a reasonable cause can lead to rejection of the election.

Misunderstanding the implications of the election is also a frequent error. Some individuals do not fully grasp how S Corporation status affects taxation and shareholder distributions. This misunderstanding can lead to poor financial planning and unexpected tax liabilities.

Finally, many people overlook the importance of keeping a copy of the submitted form. Retaining a copy ensures that you have a record of what was filed, which can be crucial for future reference or in case of any disputes with the IRS.

Dos and Don'ts

When filling out the IRS Form 2553, which is used to elect S Corporation status, there are several important considerations to keep in mind. Below is a list of things you should and shouldn't do to ensure a smooth filing process.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do file the form within the required timeframe. Generally, this is 75 days from the start of the tax year.

- Do obtain the consent of all shareholders. Each shareholder must sign the form to indicate their agreement with the S Corporation election.

- Do keep a copy of the completed form for your records. This is important for future reference and compliance.

- Do consult the IRS instructions for Form 2553 if you have questions. Guidance is available to help clarify any uncertainties.

- Don't forget to check for any state-specific requirements. Some states have additional forms or regulations regarding S Corporation elections.

- Don't submit the form without the necessary signatures. Incomplete forms can lead to delays or rejection of your election.

- Don't wait until the last minute to file. Early submission helps avoid potential issues and gives you time to address any problems.

- Don't overlook the importance of maintaining S Corporation eligibility. Ensure that your business continues to meet all necessary criteria after the election.

- Don't assume that filing the form guarantees S Corporation status. The IRS must approve the election, so be prepared for possible follow-up.

Other PDF Documents

Creating a Lease Agreement - Provisions for prorated rent ensure fairness for tenants who move in or out mid-month.

Printable Five Wishes Document Pdf - Upon completion, Five Wishes becomes a vital resource for your family and healthcare providers during difficult times.

Where Can I Get the Disability Forms - The processing time for benefits after submitting the DE 2501 varies and can take weeks.

Similar forms

-

Form 1120S: This form is used by S corporations to report income, deductions, and credits. Like Form 2553, it is part of the process for S corporations, ensuring compliance with IRS regulations.

-

Form 1065: Partnerships use this form to report income, deductions, and other tax-related information. Similar to Form 2553, it is essential for tax classification and helps define the entity's tax responsibilities.

-

Form 941: Employers use this form to report payroll taxes withheld from employees. While Form 2553 focuses on entity classification, Form 941 deals with ongoing tax obligations related to employment.

-

Form 1040: This is the individual income tax return form. While Form 2553 is for business classification, Form 1040 is used by individuals to report their personal income and tax liabilities.